Apple Has a Decade-Long Lead in Wearables

Last week, Apple quietly unveiled one of the more remarkable pieces of technology that has been developed in the past few years. AssistiveTouch allows one to control an Apple Watch without actually touching the device. Instead, a series of hand and finger gestures can be used to control everything from answering a call to ending a workout. The video below showcasing AssistiveTouch is quite impressive:

Just two months prior, Facebook went on a big PR push to show the world how it was in early R&D stages of working on technology that can also use hand and finger movements to control future gadgets. AssistiveTouch is just the latest example of how Apple’s lead in wearables is still being underestimated. The evidence points to Apple having a wearables lead of not just a few years but more like a decade.

Apple Wearables by the Numbers

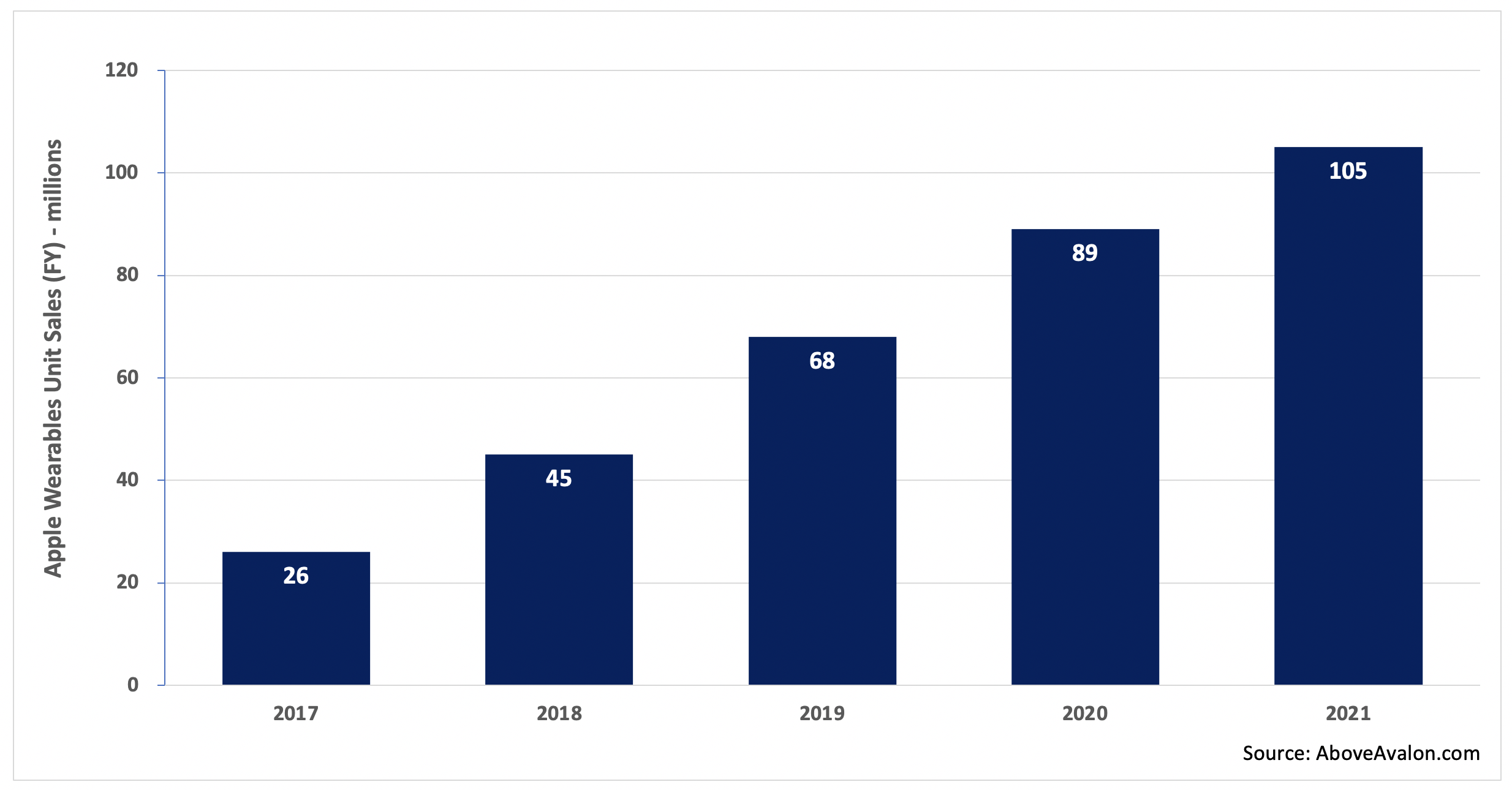

According to my estimate, Apple is on track to sell more than 100 million wearable devices in 2021. That total represents nearly 40% of the number of iPhones that will be sold during the same time period. Unit sales don’t tell the full story, however. On a new-user basis, Apple is seeing more people enter the wearables arena than buy a new iPhone for the first time.

Exhibit 1: Apple Wearables Unit Sales (2017 to 2021)

Note: Apple wearables include Apple Watch, AirPods, and select Beats headphones.

On a revenue basis, Apple Watch, AirPods, and select Beats headphones are a $30 billion per year business. That would rank Apple wearables on a combined basis just shy of a Fortune 100 company. Assuming continued Apple Watch and AirPods momentum, along with Apple expanding its wearables platform by getting into face wearables (AR/VR headsets and glasses), Apple wearables will likely be able to generate up to $50 billion of revenue annually within a few years.

Exhibit 2: Apple Wearables Revenue (2017 to 2021)

Note: Apple wearables include Apple Watch, AirPods, and select Beats headphones.

Measuring Apple’s Lead

When Apple unveiled the iPhone in January 2007, Steve Jobs famously said that the iPhone was “literally five years ahead of any other mobile phone.” He ended up being mostly correct. It took the competition a number of years, and a whole lot of copying, to catch up with what Apple had just unveiled.

With wearables, my suspicion is Apple’s lead is longer than five years. There are three components to Apple’s wearables lead:

Custom silicon / technology / sensors (a four to five-year lead over the competition, and that is being generous to the competition)

Design-led product development processes that emphasizes the user experience (adds three years to Apple’s lead)

A broader ecosystem build-out in terms of a suite of wearables and services (adds two years to Apple’s lead)

Apple has at least a four-to-five year lead over the competition when thinking about just the technology powering its wearables. Everything from custom silicon and health monitoring sensors to audio and AR-focused technologies come together to set Apple apart from the competition. Only a select number of companies will likely be able to even compete with Apple on the technology front. Others will be forced to pursue partnerships.

Apple’s wearables lead extends beyond four to five years when taking into account attributes that set wearables apart from mobile devices. Succeeding on the technology front is not enough. Wearables need to be designed so that people want to be seen wearing them for extended periods of time. A smartwatch or wireless pair of headphones must also be able to work seamlessly with other devices and services. A competitor needs to have not only an answer for effectively competing with Apple Watch on the wearables front, but also answers for various services available on AirPods and Apple’s other devices. Looking ahead, Apple’s entry into face wearables will only make the hill to climb that much steeper for competitors trying to go after Apple Watch and AirPods.

For competitors, the intimidating part is that the pieces needed to compete effectively with Apple wearables are unable to be worked on concurrently (at the same time). A company needs to first spend the required years developing and researching the core technologies before turning its focus on ensuring the right kind of collaboration exists between engineering and design. Product sales will then need to materialize before a company has the means of leaning on an ecosystem to sell additional wearable devices.

Apple M&A

A different way of measuring Apple’s lead in wearables is to look at the company’s M&A activity. Apple has been busy buying tech and talent for its upcoming face wearables play for the past six years. In wearables land, the days of new products taking only two to three years to develop are over. The required technology and R&D required to get such devices off the ground require much more lead time.

Metaio - AR (2015)

SensoMotoric Instruments – AR glasses (2017)

Vrvana – AR / hand & positional tracking technology (2017)

Akonia Holographics – AR glasses (2018)

NextVR – content platform for wearables (2020)

Spaces – content platform for wearables (2020)

Examples of Apple’s Lead

There are a number of real-world examples demonstrating Apple’s significant lead in wearables.

AssistiveTouch vs. Facebook Reality Labs. Two months ago, Facebook gave the press a peek at how it is researching using a smartwatch-like device as an input method for a pair of AR glasses. The research, centered on electromyography, looked to be in the pretty early stages with many years needed before seeing the technology in a consumer-facing product. The video was intriguing as it showed research that was thought to be at the forefront of what is going on in technology R&D today. Apple then shocked everyone by unveiling AssistiveTouch for Apple Watch. Instead of showing a behind-the-scenes look at an R&D project, Apple unveiled a technology ready for users today. The technology, relying on a combination of sensors and technologies to turn the Apple Watch into a hand / finger gesture reader, was designed for those in need of additional accessibility. Of course, the technology can go on to have other use cases over time, such as controlling a pair of smart glasses like the ones Facebook is working on. AssistiveTouch does a good job of showing just how far ahead Apple is on the wearables R&D front.

Google I/O 2021. At its 2021 developers conference, Google showed signs of finally taking wrist wearables seriously by ditching Wear OS and partnering with Samsung on a new OS. While it is fair to be skeptical that the effort will end up being successful, the announcement was a marked change from prior Google I/Os when wearables were all but ignored. Diving a bit deeper into Google’s announcement, it’s easy to see how far behind Google truly is in wearables. The company doesn’t even have an OS capable of powering a smartwatch. This may be excusable if Apple Watch was just unveiled. However, last month marked Apple Watch’s sixth anniversary.

Snap Spectacles 4 / Microsoft HoloLens / Magic Leap. While we see a handful of companies release various kinds of prototype hardware for the face (AR/VR/mixed reality), nothing has stuck with consumers. The feeling in the air is that they all lack something – design thinking. This is an item that is not easy to recreate with most companies simply not structured to emphasis design. Many companies will need to rethink their face wearables strategies once Apple enters the market. None have viable answers for smartwatches or wireless headphones either, which make their face-focused efforts look incomplete.

How Did This Happen?

Apple’s lead in wearables wasn’t driven by any one factor or item. Instead, a series of events came together to give Apple an advantage.

Apple was early. One way to build a big lead against the competition is to get an early start. Wearables represent a paradigm shift in computing, and few companies other than Apple saw it coming. As for how Apple was able to see it so early, wearables are all about making technology more personal - a mission Apple has been on for decades. In a way, Apple was built to excel with wearables. Apple’s lack of fear in coming up with new products that may potentially impact sales of existing products also helped the company run wrist-first into wearables in the early 2010s.

Voice computing distraction. Even after Apple began to unveil its wearables strategy, many competitors balked at following the company. Competitors thought the actual paradigm shift materializing was found with voice computing. Most of these companies didn’t have the hardware expertise to do well with wearables out of the gate, so they pinned their hopes on voice assistants being piped through stationary speakers. Once the stationary smart speaker mirage became apparent, companies found themselves years behind Apple on the wearables front.

Wearables require design expertise. It’s not enough to just throw together some leftover smartphone components and ship wearables. People want to wear devices that they are OK with being seen in. This is one reason why so many companies have looked at Apple Watch for design cues. The lack of design talent and ability remains a major roadblock for many companies.

Ecosystem and technology advantage. Wearables are the ultimate ecosystem play. On the technology front, Apple was able to utilize lessons learned from mobile devices to push wearables forward. Not many companies are able to do the same. Consolidation in the smartphone space has left only a handful of companies even in a position to have a wearables and mobile ecosystem. The probability of there being a wave of smartwatch OEMs utilizing something akin to Android remains low.

No price and feature umbrellas under Apple. One reason Android found oxygen in the smartphone space is that Apple left a pretty wide price umbrella under the iPhone. In addition, Android positioned itself as giving users features that iPhone users may not have had access to. No such umbrellas exist in wearables. Entry-level AirPods sell for $159 and are often available for less at third-party retailers. Apple Watch is available starting at $199. It is very difficult for a hardware manufacturer to sell wearables for less than Apple and turn a profit. Meanwhile, companies that would look to make money in other ways, such as through data collection, are still stuck with the requirement of wearables needing to look good enough to be worn in public.

Six years after releasing the Apple Watch, it’s still not clear who is going to represent genuine competition for Apple in the wearables space. Apple’s success in wearables is finally being noticed by others, as seen by the growing number of companies selling products for the body (Amazon, Microsoft, Facebook, Google, Samsung, Huawei, Xiaomi, Garmin, and the list goes on). However, none are in as strong of a position as Apple was in a few years ago, let alone today. Apple’s wearables lead stands to grow further once the company enters face wearables. The next few years will likely dictate the power structure in wearables for the next 10 to 20 years. When it comes to competitors figuring out a way to slow Apple in wearables, it’s now or never.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.