Above Avalon Podcast Episode 181: Let's Talk Apple Retail

When asked to identify Apple’s crown jewel, most will point to the iPhone or iPad. Apple’s retail operations probably wouldn’t be too high on many people’s lists. This is a mistake. In episode 181, Neil discusses Apple’s retail operations with a focus on where Apple Retail is headed and what changes are needed. Discussion topics include the three distinct phases that Apple Retail has experienced, the roles that Apple stores need to play going forward, and the three big bets that Apple is placing with its stores.

To listen to episode 181, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

RSS Feed (for your favorite podcast player)

The Future of Apple Retail

In recent weeks, there have been a number of intriguing developments in the retail space. Apple and Target announced a partnership that will bring mini Apple stores to 17 Targets. Last week, Disney announced it will close 20% of its stores. As a sign of just how much the pandemic impacted Apple’s brick and mortar retail, all U.S. stores are fully open for the first time in a year. While the Apple store celebrates its 20th anniversary this May, the pandemic causes many to question retail’s future amid changing consumer behavior. A close examination of Apple’s ecosystem shows both where the company’s retail operations are headed and what changes are needed.

A Crown Jewel

When asked to identify Apple’s crown jewel, most will point to the iPhone or iPad. Apple’s retail operations probably wouldn’t be too high on many people’s lists. This is a mistake. Along with Apple’s design-led culture and vertical integration strategy, the company’s direct retail operations have played a vital role in its expanding ecosystem.

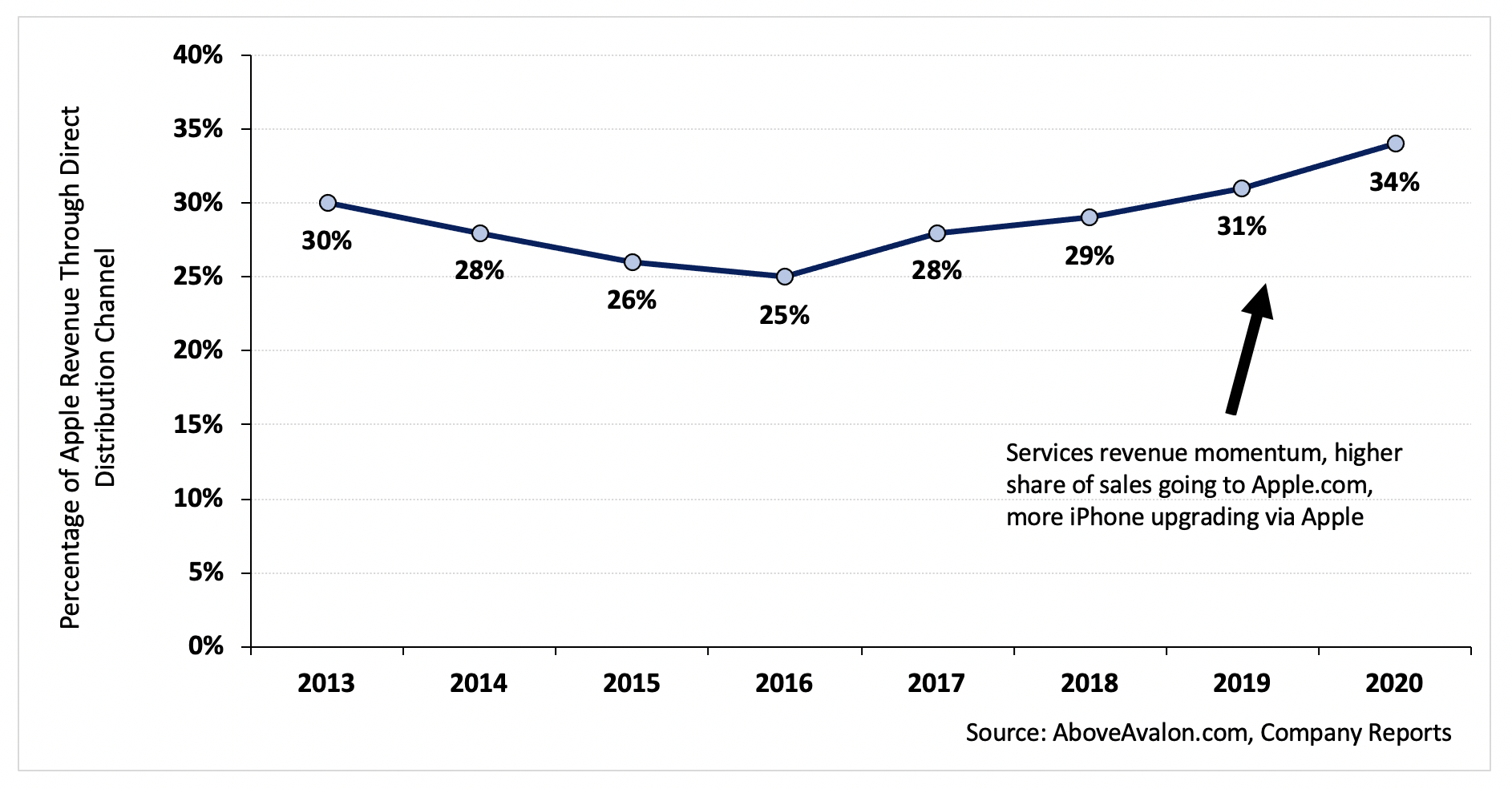

Apple discloses the percentage of sales going through its direct distribution, which includes its website, retail stores, and direct sales force. As shown in Exhibit 1, the percentage of sales going through Apple’s direct distribution has gradually increased in recent years. The increase in sales percentage has likely been boosted by services revenue, more sales going through Apple’s website, and more iPhone upgrading taking place through Apple.

Exhibit 1: Percentage of Apple Revenue Through Direct Distribution Channel

Note: Direct distribution channel includes Apple’s website, Apple stores, and direct sales force.

It’s difficult to gauge Apple retail’s importance by just looking at revenue. The figures do not show the significant role Apple stores play in allowing people to try and test the latest products, get questions answered, and seek product support. Nowhere is this seen more than with Apple’s wearables business. Store closures related to the pandemic have had a negative impact on Apple Watch and AirPods sales. While the product categories are still seeing revenue growth, the numbers would have been stronger with opened stores. Here’s Tim Cook explaining the situation on Apple’s 3Q20 earnings call:

“I think the [Apple] Watch in particular, like the iPhone, is more affected by store closures, because some people want to try on the Watch and see what it looks like, look at different band choices and those sorts of things. And so I think as stores closed, it puts more pressure on that.”

Apple Retail Store Phases

Apple opened its first retail store (shown in the video below) in Virginia on May 19th, 2001. Twenty years later, Apple now has 510 stores across 25 countries and territories.

When assessing how the Apple store has changed over the years, there have been three distinct phases:

Lifestyle Experience. In the beginning, Apple stores were locations to touch and see the Apple lifestyle experience. Since Apple only sold a few Mac models, the stores were designed around five core tenets: "Home" and "Pro" (containing Apple's products), solutions (music, movies, photos, and kids), accessories, software, and the Genius Bar. Another way of thinking about Apple stores was that they let people see what can be done with a Mac.

New Product Experience. As Apple's product line gradually expanded, the Apple Store turned into the best way for consumers to play with new products. Between 2010 and 2015, Apple’s installed base grew by 530 million people.

Customer Service / Product Support / Education. Starting around the mid-2010s, Apple stores embraced more of a customer service / product support feel as the number of users and devices continued to shoot higher. Between 2015 and 2020, Apple’s installed base grew by another 400 million people.

Head of Retail Succession

As head of Apple Retail from 2014 to 2019, Angela Ahrendts took over an operation that wasn’t too far away from collapse. The division had been leaderless for two years, and stores were feeling major strain under Apple’s ecosystem growth. Complaints of stores being too chaotic grew louder by the month. Average store traffic was declining. Things got so bad, many began to suggest Apple drop its unique retail thinking and embrace traditional ideas like cash registers and queues in an attempt to reduce the store craziness. After quickly admitting it had made a mistake hiring John Browett to lead retail, Apple went back to the drawing board and eventually landed on Ahrendts, a rising executive in the retail space that had transformed Burberry, to lead its retail stores.

Judging from reaction to her surprise Apple departure announced in early 2019, Ahrendts’ five-year tenure at Apple was massively misunderstood. One of her not-so-publicized achievements was modernizing Apple’s retail backend so that Apple’s website, online store, and in-store experience weren’t disconnected.

A more public objective for Ahrendts was managing a massive Apple store remodeling plan overseen by Jony Ive and Apple’s design team in addition to Foster + Partners. The store redesign included Apple moving away from its smaller store footprints, embracing more open spaces centered around “forums and “video walls,” and expanding the Genius Bar concept to handle more customers. Another goal for Ahrendts was defining Apple’s retail culture.

By choosing Deirdre O’Brien to be Ahrendts’ successor, Apple gave a pretty clear signal that it wanted to keep employee culture and morale at the center of its near-term retail strategy. Instead of new objectives in terms of the backend or store expansion plans, forward changes to retail operations would be more focused. Of course, the pandemic changed those plans in a very big way.

Store of the Future

It’s easy to say that brick-and-mortar retailers need to rethink the store concept and embrace experiences to compete with e-commerce. In practice, such a strategy is incredibly difficult, and few retailers will be able to pull it off. Microsoft thought adding Xbox consoles would turn its stores into experience centers. It didn’t work. The company made the right decision to get out of retail – it just took a pandemic for the company to reach that decision.

Disney’s recent announcement that it will close 20% of its stores is the latest sign that turning stores into experience centers may make for a good presentation but be extremely difficult to pull off. Disney stores aren’t turned into experience centers by just having some TVs play Disney+ while Mickey and Minnie stroll around the store. The company is likely coming to the realization that its customers prefer consuming Disney stories in the comfort of their own home rather than inside a store at the mall. For those who want Disney stories outside the home, vacations to Disney theme parks are in order. Similarly, Nike knows its experiences are going to be found not in mall stores, but with people using their products at home, at gyms, and outdoors.

Where does this leave Apple and its long-term strategy for brick-and-mortar stores? When assessing Apple’s current ecosystem and where the company needs to go in the future, Apple stores need to play three vital roles:

Brand Embassies. With the Apple installed base now exceeding 1 billion users, 87% of the world’s population doesn’t use any Apple products. Apple stores need to serve as the initial point of contact with the Apple brand for these 87% of people. Having control over someone’s first impression with the Apple brand plays a key role in that person’s likelihood of entering the ecosystem. There are two ways for Apple to reach the 87% of people who don’t own any Apple products – go to them by opening stores in India, China, Brazil, Africa, etc., or have them come to Apple as they visit the world’s largest cities for business and pleasure. As we will discuss shortly, the latter will likely be the option Apple chooses. Upward social mobility will be a defining social-economic trend for decades to come.

Ecosystem Support. Given how everyone is at a different stage when it comes to involvement with the Apple ecosystem, there is a strong need for Apple stores to represent different things to different people. After leaving Apple, Ahrendts commented that roughly a third of Apple store visitors were there to buy products, a third were there to get service for their Apple products, and a third were there to learn about the latest gadgets and attend Today at Apple sessions. Focusing Apple stores on just one of those tasks won’t work.

Distribution Hubs. It is essential that Apple remain a realist with the way shopping habits are evolving. Convenience determines where retail is headed. Using Apple stores as distribution hubs for same day or 2-hour delivery will prove valuable. Ordering a product online from Apple’s website and using an app to track the product being brought to you from the local Apple store via courier is up there with using Uber or Lyft for the first time. The experience makes you look at retail stores differently.

Retail Store Count

As shown in the following exhibit, Apple’s retail store count has plateaued at 510 stores despite continued growth in the installed base. Instead of creating large-scale store expansion plans involving dozens of new stores, Apple has been opening a few stores in a handful of the world’s top cities. The strategy was driven by Ahrendts’ bet on cities not countries, which came from her roots in high-end fashion.

Exhibit 2: Apple Retail Store Count

Source Link (2015 to 2019): 9to5Mac

There are a few key risks found with Apple changing course and pursuing a major expansion in its store count.

Store Size. It’s not practical for Apple to become like a mobile carrier and open thousands of smaller stores in shopping plazas throughout the U.S. or other countries. Such a store expansion strategy would amount to Apple stores being nothing more than sales kiosks which would go against the two first roles (discussed above) that Apple stores will need to play.

Locations. Apple has consistently gone after the most prized (and expensive) real estate in up-and-coming cities. The amount of cash that Apple spends on its retail stores would make any retailer blush. The strategy isn’t for the faint of heart, and nearly all retailers would stay away from the strategy as it can quickly lead to financial ruin. A major store expansion phase that involves locating stores in less optimal locations can raise the endeavor’s financial risk.

Employees. Apple has approximately 70,000 retail employees. Expanding its store footprint to fit the size of its ecosystem would require multiple times the number of employees. Such an expansion in employee count would present a completely different beast for Apple executives to oversee.

Logistics. With 510 stores, Apple is able to keep its retail footprint nimble while quickly responding to product launches and new initiatives. Trying to accomplish such feats with a store footprint that is multiple times the size would present its own unique set of challenges.

While it may not make sense for Apple to grow its store count in a big way from current levels, there are many Apple customers that can benefit from having physical stores in which to try products and get service. For Apple, an alternative to expanding its own store count is to continue partnering with third-party retailers to sell products, service devices, and accomplish other traditional retail tasks like offering different delivery options. By relying on third-party retail partnerships, Apple can establish more points of contact with customers and not worry about the long list of risks and problems found with operating its own stores.

Two weeks ago, Apple announced a partnership with Target to open mini Apple Stores in 17 locations. Some may worry that Apple is going down the wrong path with these partnerships. Apple’s initial move into retail 20 years ago was driven by shortcomings found with needing to go through others to reach customers. Wouldn’t similar shortcomings develop by going through third-party retailers to reach customers?

There is one big difference between the retail landscape of the 1990s and that of today: Apple now has the most powerful device ecosystem in the world. Apple no longer needs to fear having their products get lost in a sea of beige at an electronics store. Retail store employees are no longer incentivized to convince people to buy competing products. Instead, some of the world’s largest retailers are now placing big bets on Apple, hoping some of the company’s brand power will rub off on their own operations and financials.

Retail Bets

The bets Apple ended up placing with its retail stores didn’t end up having to do with selling iPhones and wearables or hosting educational classes. Instead, Apple stores are bets on three big themes:

Cities. Apple is betting that we will want to visit and live in the world’s top cities. This explains the store growth strategy being focused on cities, not countries.

People. Apple is betting that Apple store employees will remain the best ambassadors of the brand, introducing Apple to billions of new people. Having O’Brien, who also oversees Apple’s “People” team, be in charge of retail is an outward recognition of the key role given to Apple retail employees.

Experiences. Apple is betting that humans will continue to seek out premium experiences.

Apple Marina Bay Sands - Singapore. Source: Apple.

The Apple store of the future doesn’t have a specific layout or look. Instead, it ends up being an idea: evolution. We know retail isn’t going to remain static going forward. The way we buy products will continue to change as technology becomes closely intertwined with commerce. Apple’s retail apparatus, both online and brick and mortar, will only remain relevant in the future if it is built and designed to embrace change.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

For additional discussion on this topic, check out the Above Avalon daily update from March 11th.