Newest Analysis

Above Avalon provides accurate and comprehensive analysis of Apple’s product, business, and financial strategy as well as its industry competitiveness.

The Above Avalon ecosystem consists of the following products:

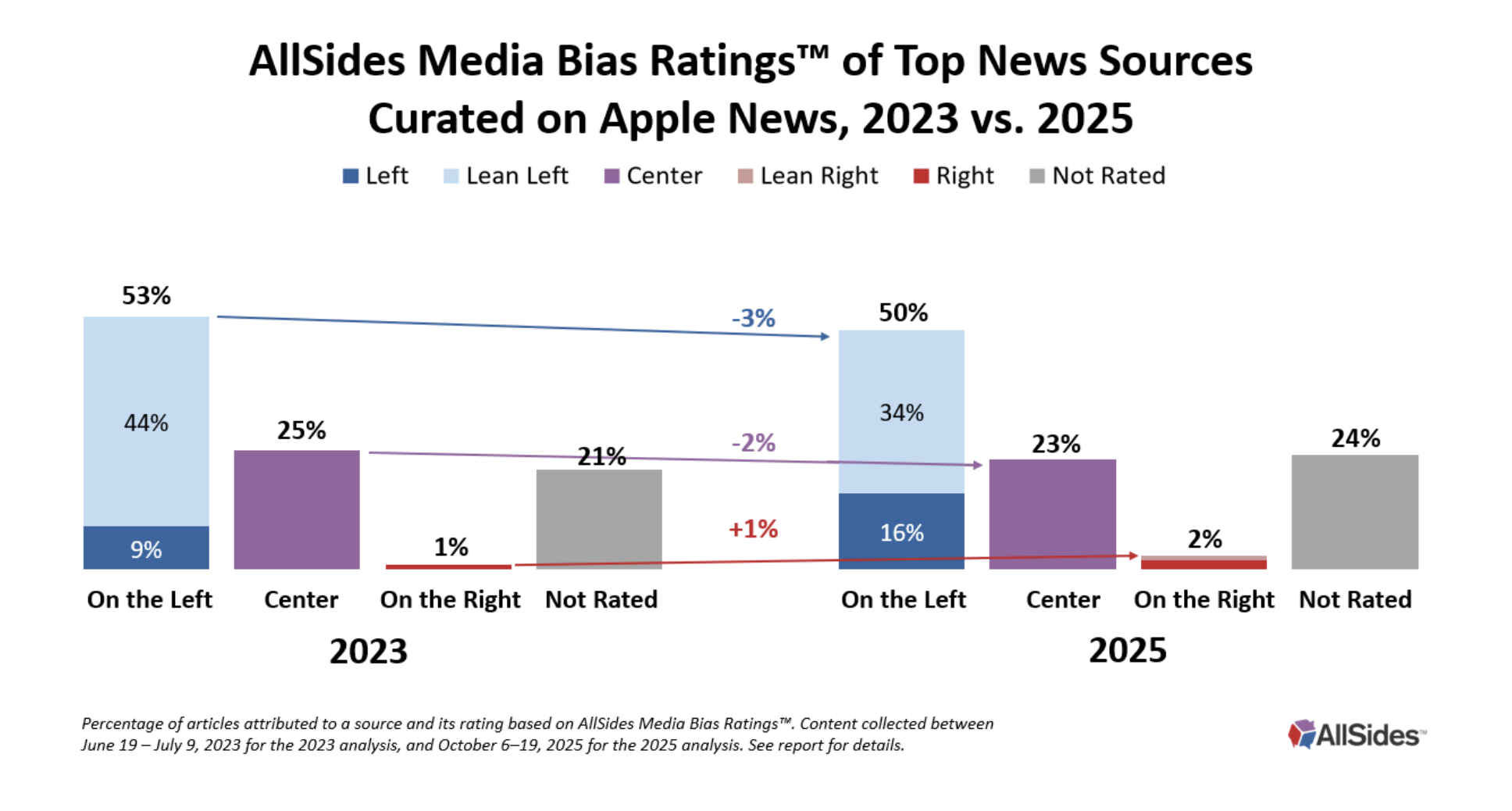

Above Avalon Daily, widely-recognized as the leading daily newsletter dedicated to Apple. Now in its tenth year with nearly 1,900 updates published to date.

AVALON, a weekly podcast about Apple unlike anything you have listened to before.

Inside Orchard, weekly essays and podcast episodes about technology.

Above Avalon Models, financial models for estimating Apple’s earnings and business strategy.

Subscribe to individual products (starting at just $10/month) or access everything via the Above Avalon Bundle ($35/month).

Above Avalon has subscribers and members from 65+ countries. They represent diverse backgrounds and occupations and range from Silicon Valley founders / executives and the largest Apple shareholders to hobbyists and students.

A daily email (Monday through Thursday) containing Apple analysis and perspective. Each update contains 2-3 stories (10-12 stories per week). An archive of previous daily emails can be found here. Sample updates can be read here, here, and here.

Sign up to receive the Above Avalon Daily newsletter using the payment forms below.

To listen to the updates as a podcast narrated by Neil Cybart, choose the subscription that includes the Podcasts Package (+$10 per month or +$100 per year). In addition to receiving the written updates as a podcast, the Podcasts Package also provides access to Neil’s weekly AVALON podcast for free (a $10/month or $100/year value).

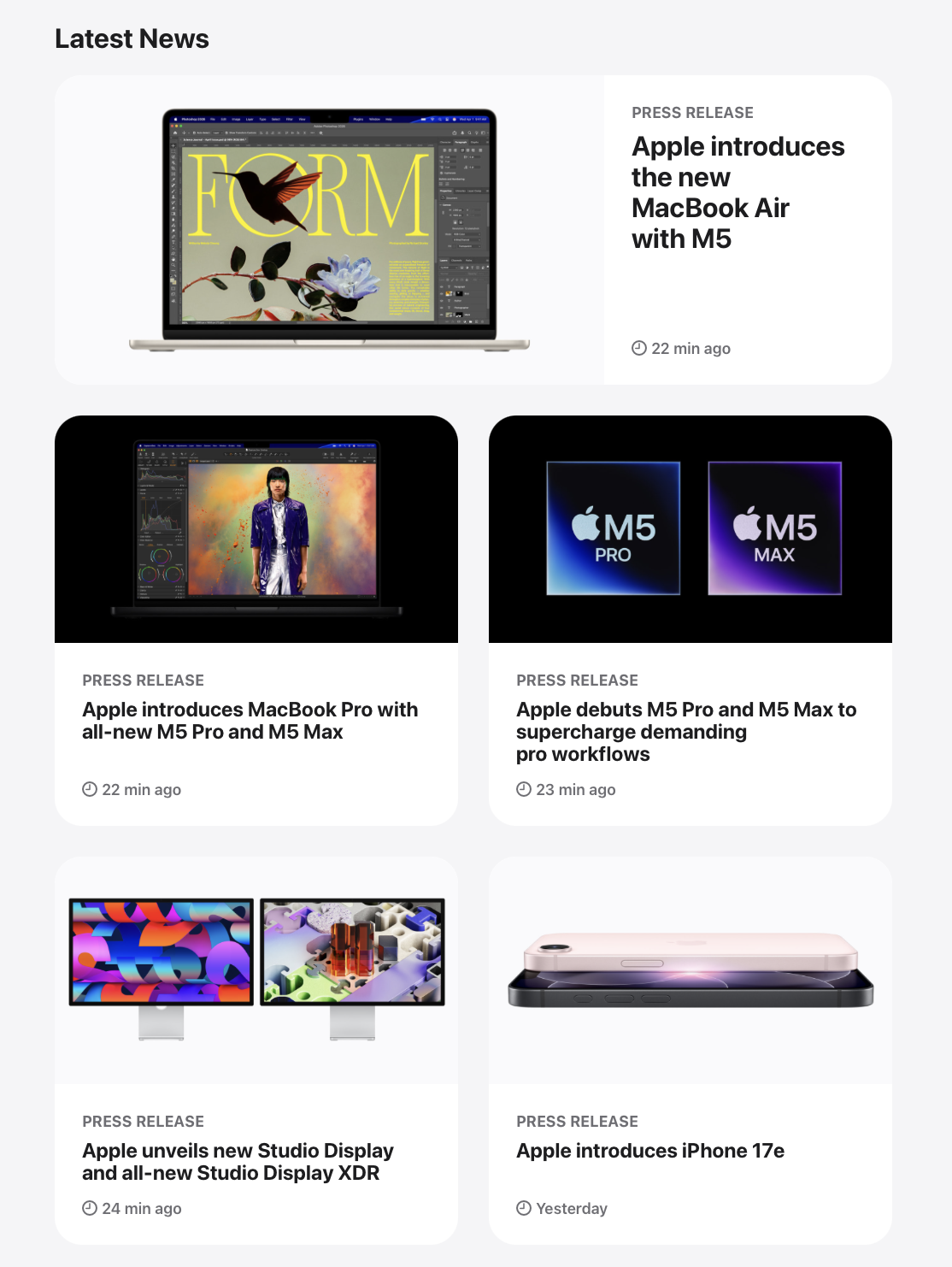

Newest Updates

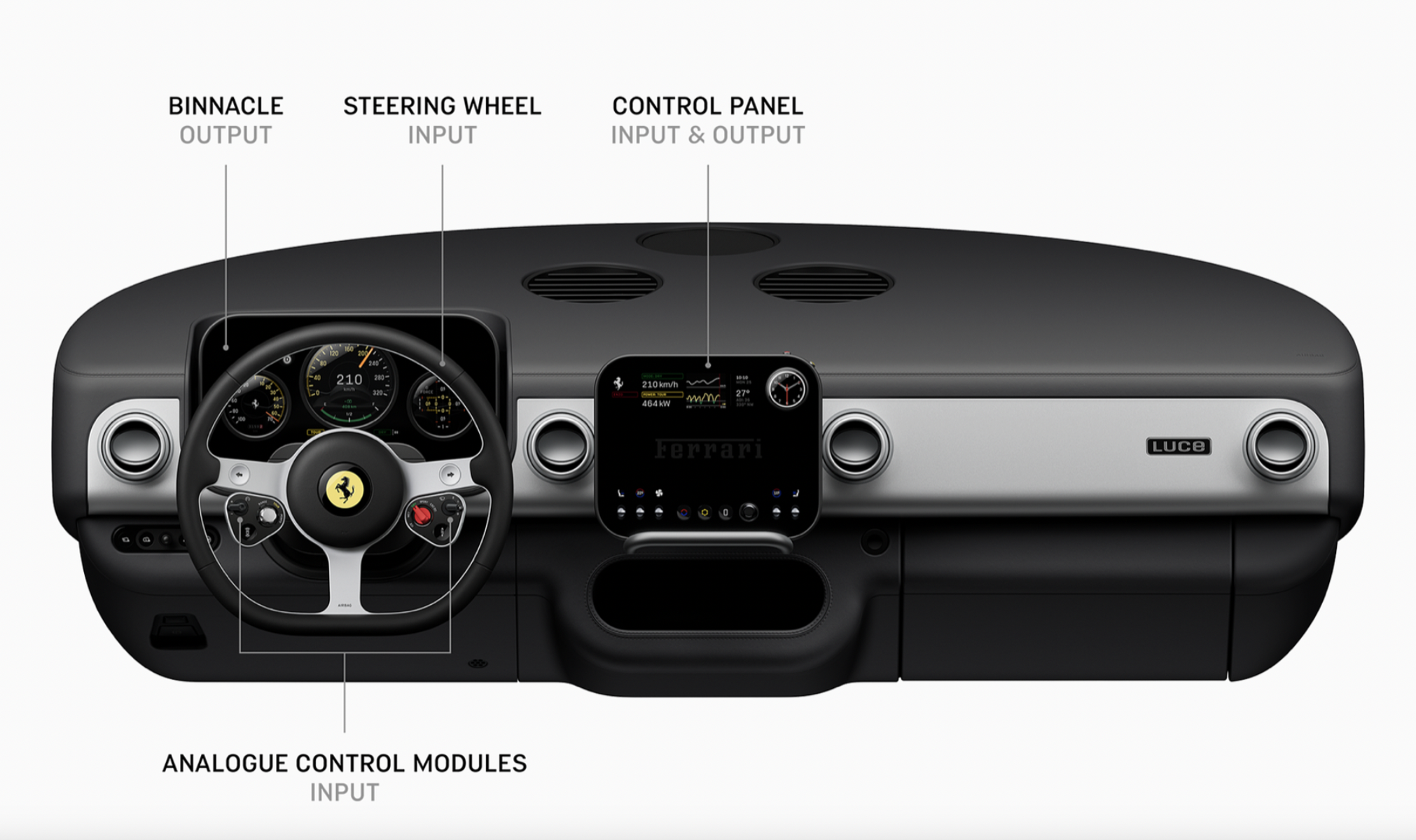

A podcast about Apple unlike anything you have listened to before. Join Neil Cybart every Tuesday for a journey through the world of Apple products - loosely modeled after Apple’s famous Monday morning meetings.

No sponsorship reads. No wasting your time. Just Neil and unique perspective. Subscribe using the payment forms below.

Receive 40% off AVALON by bundling an AVALON subscription with an Above Avalon Daily newsletter subscription.

Newest AVALON Podcast Episodes

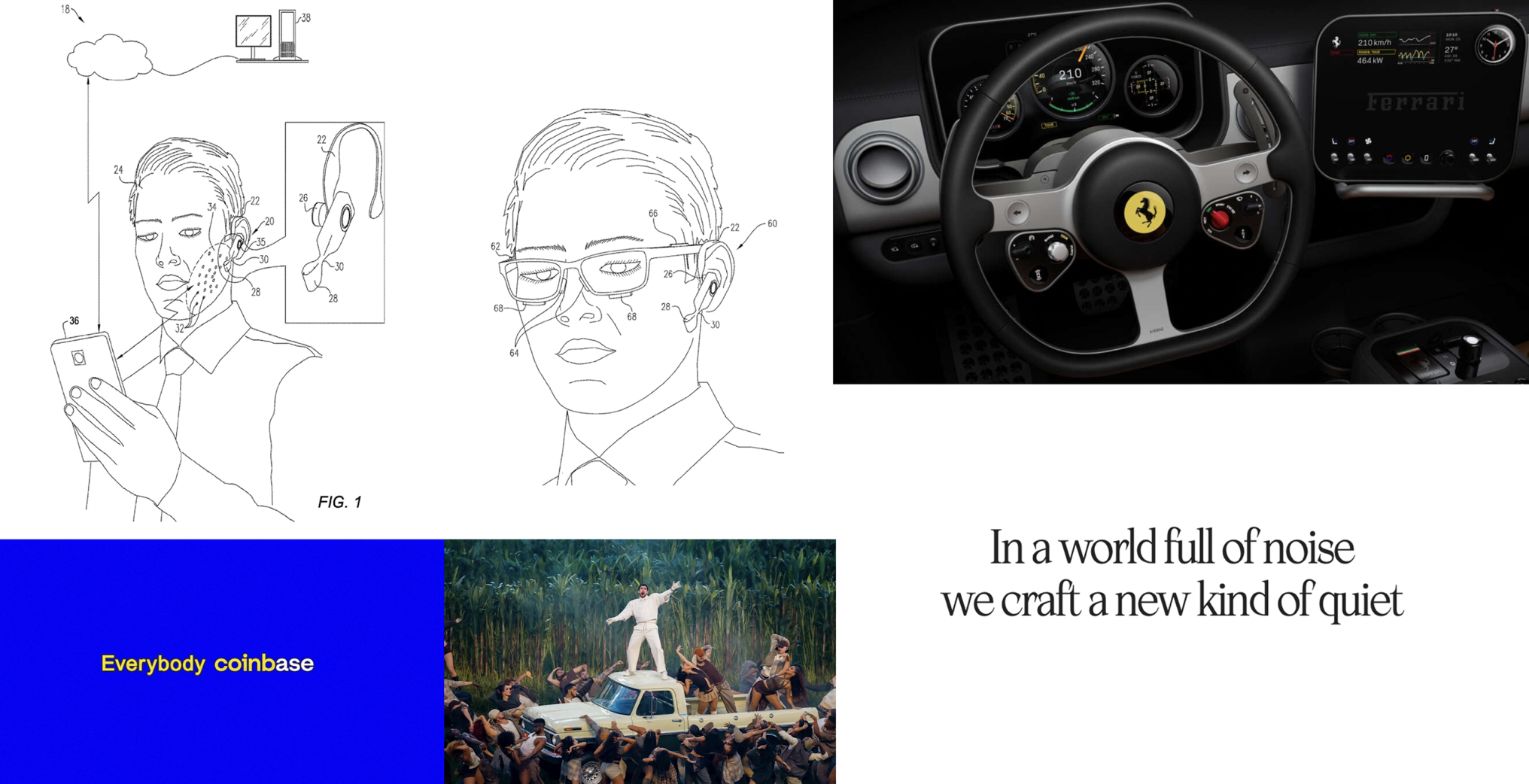

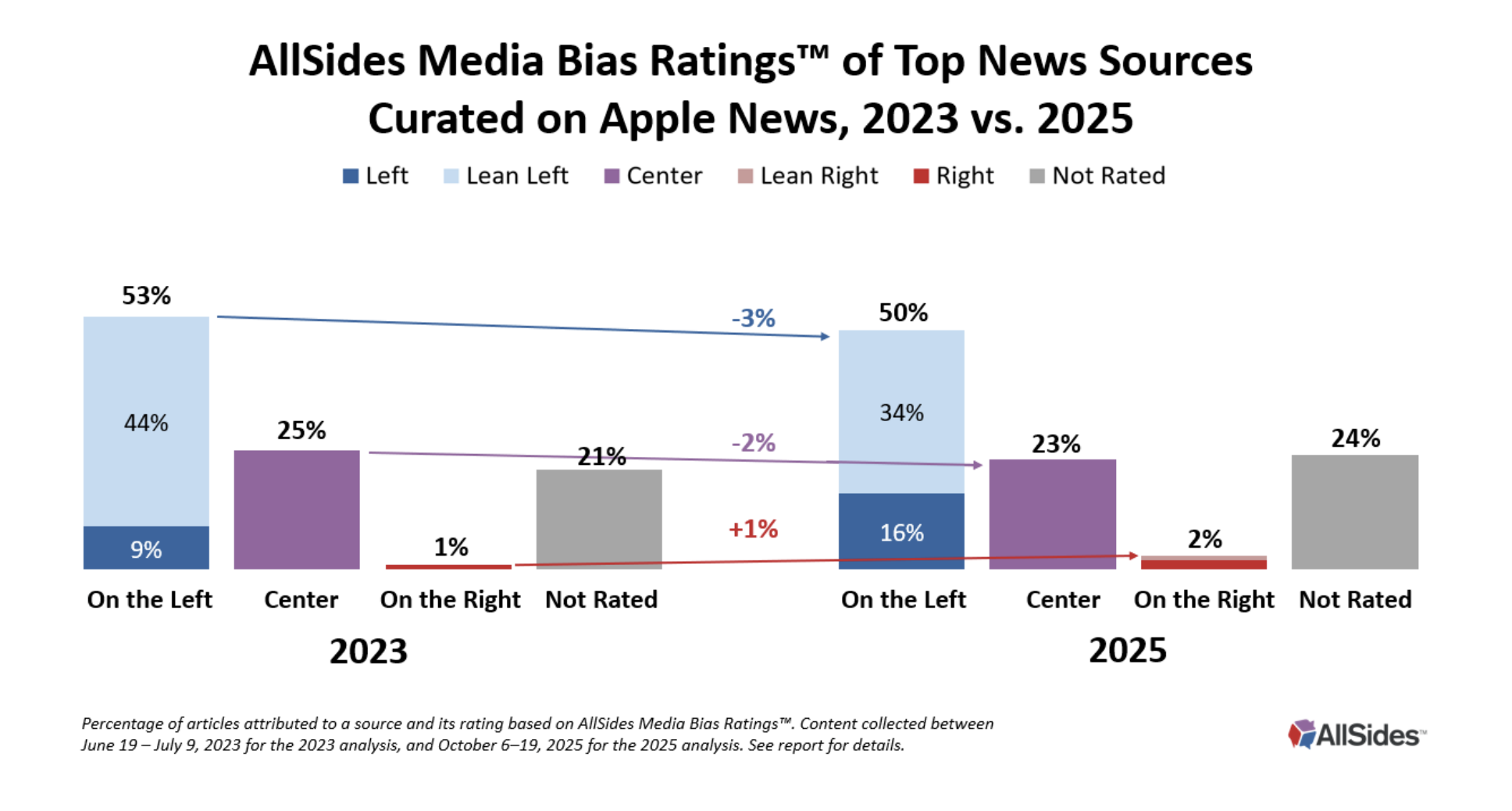

In 2021, Neil launched InsideOrchard.com to serve as a home for his broader views on technology and society that go beyond Apple. An Inside Orchard subscription includes access to Neil’s exclusive essays and podcast episodes. Essays are written for everyone from executives and investors to hobbyists and students.

Inside Orchard essays revolve around the following topics:

Industry analysis.

Company / business model analysis.

Technology’s impact on societal and consumer trends.

Subscribe using the payment forms below.

Bundle an Inside Orchard subscription with the Above Avalon Daily newsletter and pay just $5/month or $50/year for Inside Orchard. That’s 50% off regular pricing. Subscribe to two of the leading sources of analysis and perspective in the technology industry for just $25/month or $250/year.

Newest Inside Orchard Essays

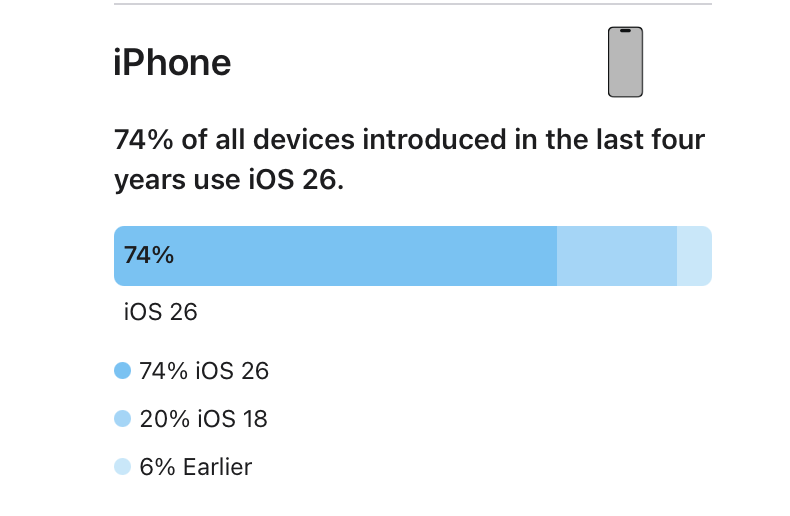

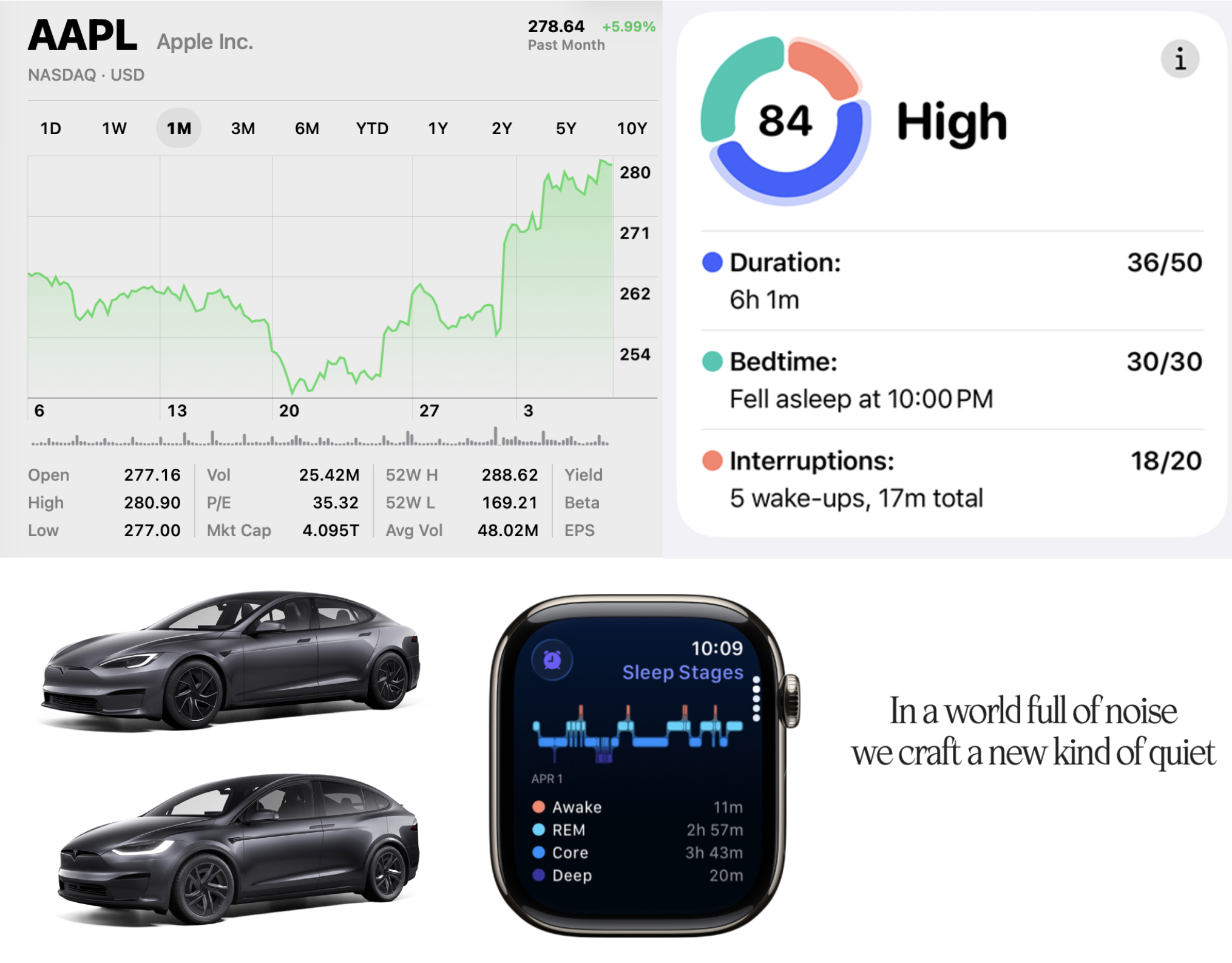

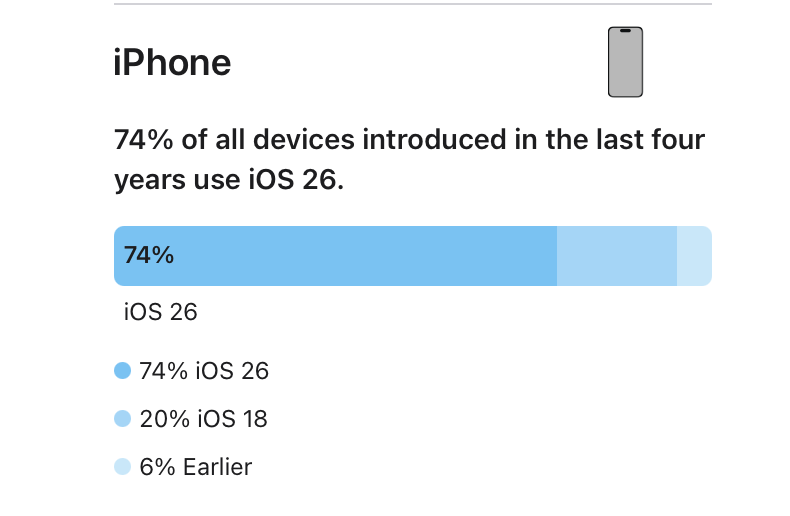

Designed for anyone with a deep interest in Apple’s financials and product strategy, Above Avalon Models is a digital package that offers access to Neil Cybart’s Apple earnings model and three of Neil’s Apple installed base models (iPhone, iPad, and Apple Watch).

The models are built in Excel but also usable in Numbers. While the models include Neil’s estimates and assumptions, all inputs can be adjusted to reflect your own assumptions. Members also have the ability to reach out to Neil with questions about the models.

The models, which have been built over the course of years, make it possible to estimate:

Device unit sales.

The number of devices in the wild over time.

Percent of device sales going to new users vs. existing users by year.

Product upgrade cycle length.

The upgrade path that users take.

And more…

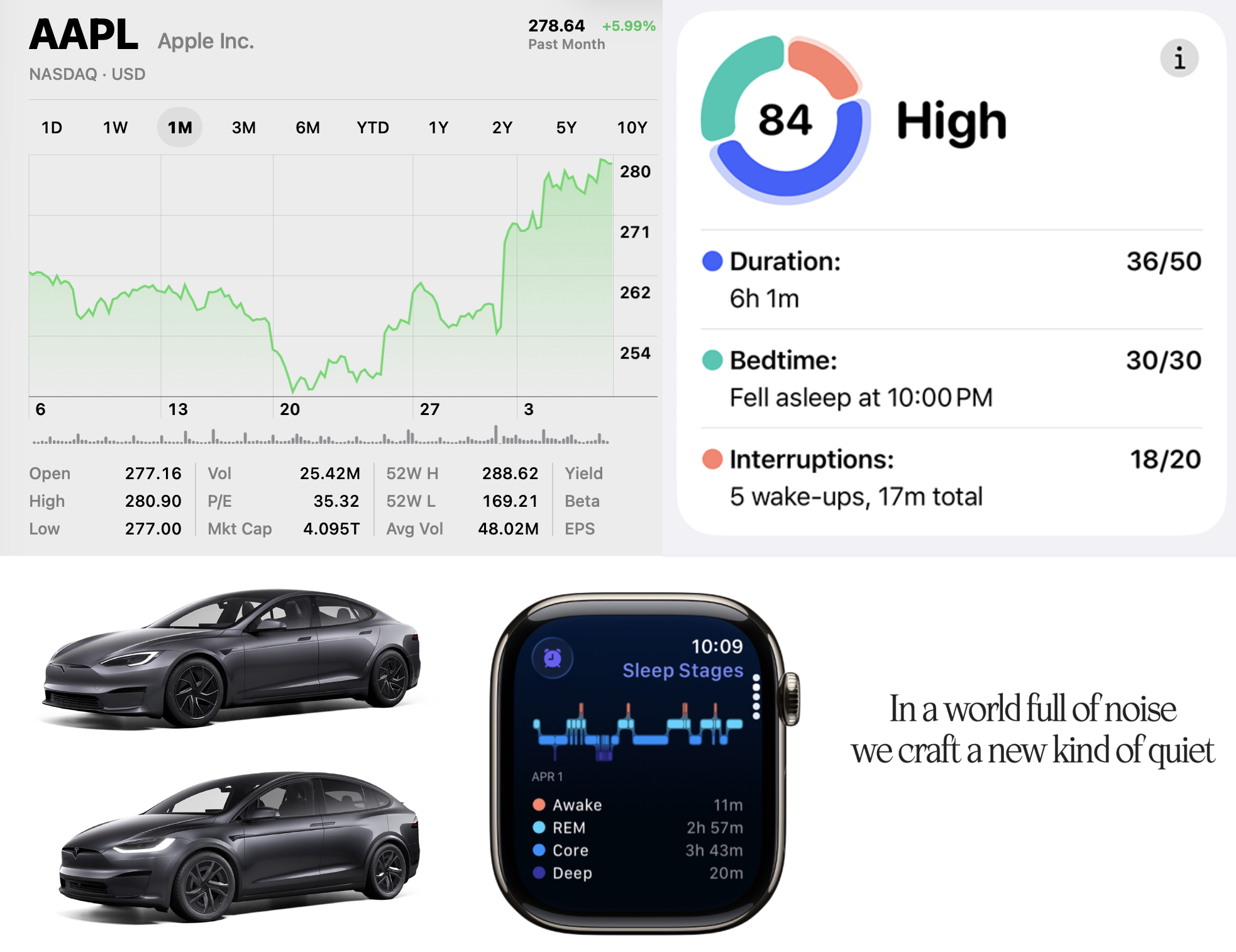

The preceding metrics will be of interest to everyone from AAPL investors modeling Apple’s financials to Apple competitors and suppliers needing to better understand the marketplace.

To purchase Above Avalon Models, subscribe using the following signup form:

Bundle Above Avalon Models with the Above Avalon Daily newsletter and get AVALON, the Above Avalon Daily podcast, and Inside Orchard for free. That’s nearly 30% off regular pricing. Subscribe to everything Neil has to offer via Above Avalon ULTRA.

Once payment has gone through, you will receive an email containing a personalized link to the installed base models. This personalized link tied to your membership will remain active as long as the add-on is attached to your membership. You will also be able to access the models via the Above Avalon payer portal (accessed via "Login" over at AboveAvalon.com). A “Digital Package” tab will appear that will bring you to your personalized download page. There are no new logins or passwords required.