Apple Has a Decade-Long Lead in Wearables

Last week, Apple quietly unveiled one of the more remarkable pieces of technology that has been developed in the past few years. AssistiveTouch allows one to control an Apple Watch without actually touching the device. Instead, a series of hand and finger gestures can be used to control everything from answering a call to ending a workout. The video below showcasing AssistiveTouch is quite impressive:

Just two months prior, Facebook went on a big PR push to show the world how it was in early R&D stages of working on technology that can also use hand and finger movements to control future gadgets. AssistiveTouch is just the latest example of how Apple’s lead in wearables is still being underestimated. The evidence points to Apple having a wearables lead of not just a few years but more like a decade.

Apple Wearables by the Numbers

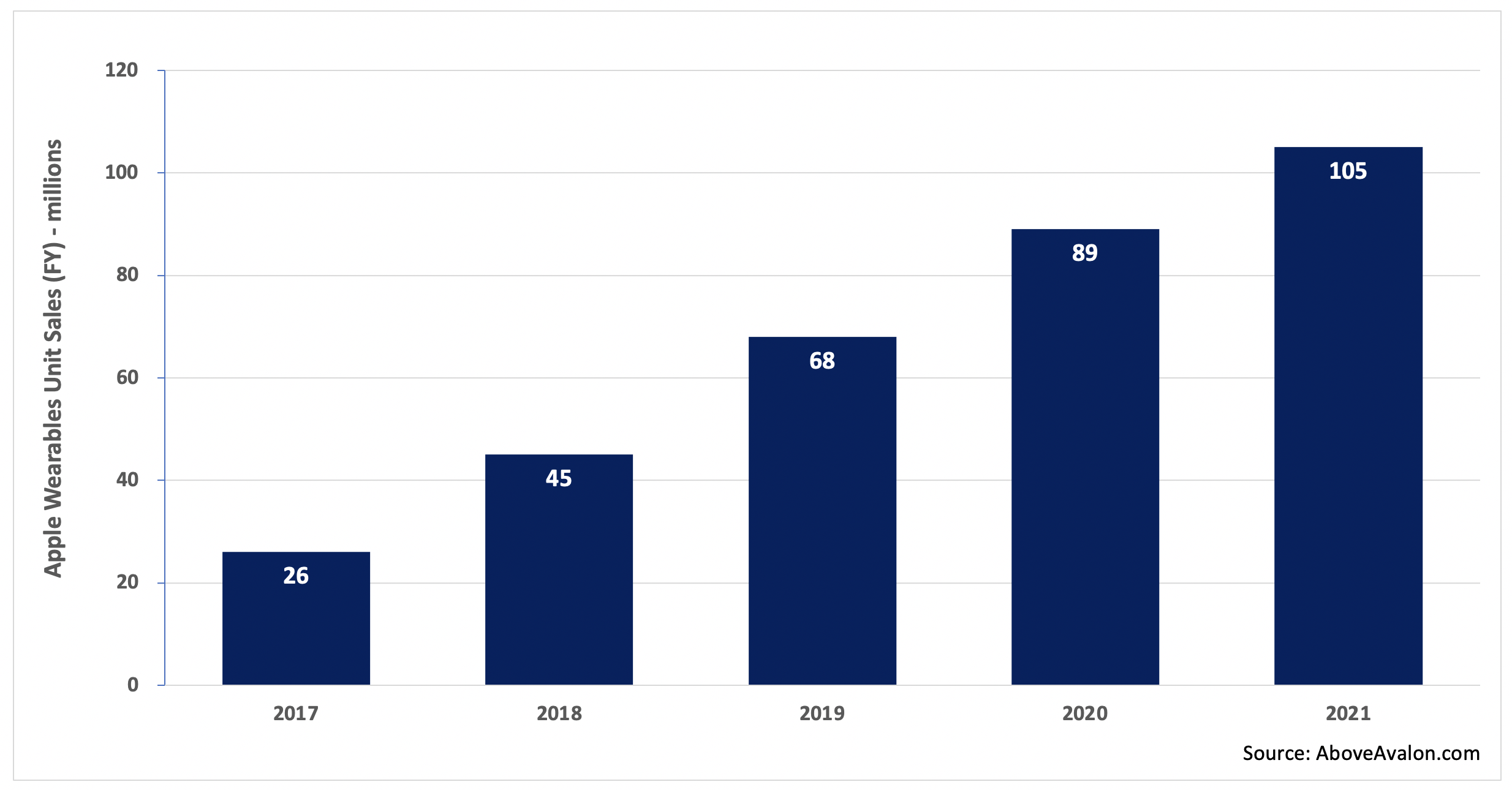

According to my estimate, Apple is on track to sell more than 100 million wearable devices in 2021. That total represents nearly 40% of the number of iPhones that will be sold during the same time period. Unit sales don’t tell the full story, however. On a new-user basis, Apple is seeing more people enter the wearables arena than buy a new iPhone for the first time.

Exhibit 1: Apple Wearables Unit Sales (2017 to 2021)

Note: Apple wearables include Apple Watch, AirPods, and select Beats headphones.

On a revenue basis, Apple Watch, AirPods, and select Beats headphones are a $30 billion per year business. That would rank Apple wearables on a combined basis just shy of a Fortune 100 company. Assuming continued Apple Watch and AirPods momentum, along with Apple expanding its wearables platform by getting into face wearables (AR/VR headsets and glasses), Apple wearables will likely be able to generate up to $50 billion of revenue annually within a few years.

Exhibit 2: Apple Wearables Revenue (2017 to 2021)

Note: Apple wearables include Apple Watch, AirPods, and select Beats headphones.

Measuring Apple’s Lead

When Apple unveiled the iPhone in January 2007, Steve Jobs famously said that the iPhone was “literally five years ahead of any other mobile phone.” He ended up being mostly correct. It took the competition a number of years, and a whole lot of copying, to catch up with what Apple had just unveiled.

With wearables, my suspicion is Apple’s lead is longer than five years. There are three components to Apple’s wearables lead:

Custom silicon / technology / sensors (a four to five-year lead over the competition, and that is being generous to the competition)

Design-led product development processes that emphasizes the user experience (adds three years to Apple’s lead)

A broader ecosystem build-out in terms of a suite of wearables and services (adds two years to Apple’s lead)

Apple has at least a four-to-five year lead over the competition when thinking about just the technology powering its wearables. Everything from custom silicon and health monitoring sensors to audio and AR-focused technologies come together to set Apple apart from the competition. Only a select number of companies will likely be able to even compete with Apple on the technology front. Others will be forced to pursue partnerships.

Apple’s wearables lead extends beyond four to five years when taking into account attributes that set wearables apart from mobile devices. Succeeding on the technology front is not enough. Wearables need to be designed so that people want to be seen wearing them for extended periods of time. A smartwatch or wireless pair of headphones must also be able to work seamlessly with other devices and services. A competitor needs to have not only an answer for effectively competing with Apple Watch on the wearables front, but also answers for various services available on AirPods and Apple’s other devices. Looking ahead, Apple’s entry into face wearables will only make the hill to climb that much steeper for competitors trying to go after Apple Watch and AirPods.

For competitors, the intimidating part is that the pieces needed to compete effectively with Apple wearables are unable to be worked on concurrently (at the same time). A company needs to first spend the required years developing and researching the core technologies before turning its focus on ensuring the right kind of collaboration exists between engineering and design. Product sales will then need to materialize before a company has the means of leaning on an ecosystem to sell additional wearable devices.

Apple M&A

A different way of measuring Apple’s lead in wearables is to look at the company’s M&A activity. Apple has been busy buying tech and talent for its upcoming face wearables play for the past six years. In wearables land, the days of new products taking only two to three years to develop are over. The required technology and R&D required to get such devices off the ground require much more lead time.

Metaio - AR (2015)

SensoMotoric Instruments – AR glasses (2017)

Vrvana – AR / hand & positional tracking technology (2017)

Akonia Holographics – AR glasses (2018)

NextVR – content platform for wearables (2020)

Spaces – content platform for wearables (2020)

Examples of Apple’s Lead

There are a number of real-world examples demonstrating Apple’s significant lead in wearables.

AssistiveTouch vs. Facebook Reality Labs. Two months ago, Facebook gave the press a peek at how it is researching using a smartwatch-like device as an input method for a pair of AR glasses. The research, centered on electromyography, looked to be in the pretty early stages with many years needed before seeing the technology in a consumer-facing product. The video was intriguing as it showed research that was thought to be at the forefront of what is going on in technology R&D today. Apple then shocked everyone by unveiling AssistiveTouch for Apple Watch. Instead of showing a behind-the-scenes look at an R&D project, Apple unveiled a technology ready for users today. The technology, relying on a combination of sensors and technologies to turn the Apple Watch into a hand / finger gesture reader, was designed for those in need of additional accessibility. Of course, the technology can go on to have other use cases over time, such as controlling a pair of smart glasses like the ones Facebook is working on. AssistiveTouch does a good job of showing just how far ahead Apple is on the wearables R&D front.

Google I/O 2021. At its 2021 developers conference, Google showed signs of finally taking wrist wearables seriously by ditching Wear OS and partnering with Samsung on a new OS. While it is fair to be skeptical that the effort will end up being successful, the announcement was a marked change from prior Google I/Os when wearables were all but ignored. Diving a bit deeper into Google’s announcement, it’s easy to see how far behind Google truly is in wearables. The company doesn’t even have an OS capable of powering a smartwatch. This may be excusable if Apple Watch was just unveiled. However, last month marked Apple Watch’s sixth anniversary.

Snap Spectacles 4 / Microsoft HoloLens / Magic Leap. While we see a handful of companies release various kinds of prototype hardware for the face (AR/VR/mixed reality), nothing has stuck with consumers. The feeling in the air is that they all lack something – design thinking. This is an item that is not easy to recreate with most companies simply not structured to emphasis design. Many companies will need to rethink their face wearables strategies once Apple enters the market. None have viable answers for smartwatches or wireless headphones either, which make their face-focused efforts look incomplete.

How Did This Happen?

Apple’s lead in wearables wasn’t driven by any one factor or item. Instead, a series of events came together to give Apple an advantage.

Apple was early. One way to build a big lead against the competition is to get an early start. Wearables represent a paradigm shift in computing, and few companies other than Apple saw it coming. As for how Apple was able to see it so early, wearables are all about making technology more personal - a mission Apple has been on for decades. In a way, Apple was built to excel with wearables. Apple’s lack of fear in coming up with new products that may potentially impact sales of existing products also helped the company run wrist-first into wearables in the early 2010s.

Voice computing distraction. Even after Apple began to unveil its wearables strategy, many competitors balked at following the company. Competitors thought the actual paradigm shift materializing was found with voice computing. Most of these companies didn’t have the hardware expertise to do well with wearables out of the gate, so they pinned their hopes on voice assistants being piped through stationary speakers. Once the stationary smart speaker mirage became apparent, companies found themselves years behind Apple on the wearables front.

Wearables require design expertise. It’s not enough to just throw together some leftover smartphone components and ship wearables. People want to wear devices that they are OK with being seen in. This is one reason why so many companies have looked at Apple Watch for design cues. The lack of design talent and ability remains a major roadblock for many companies.

Ecosystem and technology advantage. Wearables are the ultimate ecosystem play. On the technology front, Apple was able to utilize lessons learned from mobile devices to push wearables forward. Not many companies are able to do the same. Consolidation in the smartphone space has left only a handful of companies even in a position to have a wearables and mobile ecosystem. The probability of there being a wave of smartwatch OEMs utilizing something akin to Android remains low.

No price and feature umbrellas under Apple. One reason Android found oxygen in the smartphone space is that Apple left a pretty wide price umbrella under the iPhone. In addition, Android positioned itself as giving users features that iPhone users may not have had access to. No such umbrellas exist in wearables. Entry-level AirPods sell for $159 and are often available for less at third-party retailers. Apple Watch is available starting at $199. It is very difficult for a hardware manufacturer to sell wearables for less than Apple and turn a profit. Meanwhile, companies that would look to make money in other ways, such as through data collection, are still stuck with the requirement of wearables needing to look good enough to be worn in public.

Six years after releasing the Apple Watch, it’s still not clear who is going to represent genuine competition for Apple in the wearables space. Apple’s success in wearables is finally being noticed by others, as seen by the growing number of companies selling products for the body (Amazon, Microsoft, Facebook, Google, Samsung, Huawei, Xiaomi, Garmin, and the list goes on). However, none are in as strong of a position as Apple was in a few years ago, let alone today. Apple’s wearables lead stands to grow further once the company enters face wearables. The next few years will likely dictate the power structure in wearables for the next 10 to 20 years. When it comes to competitors figuring out a way to slow Apple in wearables, it’s now or never.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

Apple Watch Momentum Is Building

In a few months, the number of people wearing an Apple Watch will surpass 100 million. While the tech press spent years infatuated with stationary smart speakers and the idea of voice-only interfaces, it was the Apple Watch and utility on the wrist that ushered in a new paradigm shift in computing. We are now seeing Apple leverage the growing number of Apple Watch wearers to build a formidable health platform. The Apple Watch is a runaway train with no company in a position to slow it down.

Mirages and Head Fakes

We are coming off of a weird stretch for the tech industry. As smartphone sales growth slowed in the mid-2010s, companies, analysts, and pundits began to search for the next big thing. The search landed on stationary smart speakers and voice interfaces.

Companies who weren’t able to leverage the smartphone revolution with their own hardware placed massive bets on digital voice assistants that would supposedly usher in the end of the smartphone era. These digital voice assistants would be delivered to consumers via cheap stationary speakers placed in the home. Massive PR campaigns were launched that attempted to convince people about this post-smartphone future. Unfortunately for these companies, glowing press coverage cannot hide a product category’s fundamental design shortcomings.

At nearly every turn, Apple was said to be missing the voice train because of a dependency on iPhone revenue. Management was said to suffer from tunnel vision while the company’s approach to privacy was positioned as a long-term headwind that would lead to inferior results in AI relative to the competition. Simply put, Apple was viewed as losing control of where technology was headed following the mobile revolution.

There were glaring signs that narratives surrounding smart speakers and Apple lacking a coherent strategy for the future were off the mark. In November 2017, I wrote the following in an article titled, “A Stationary Smart Speaker Mirage”:

“On the surface, Amazon Echo sales point to a burgeoning product category. A 15M+ annual sales pace for a product category that is only three years old is quite the accomplishment. This has led to prognostications of stationary smart speakers representing a new paradigm in technology. However, relying too much on Echo sales will lead to incomplete or faulty conclusions. The image portrayed by Echo sales isn't what it seems. In fact, it is only a matter of time before it becomes clear the stationary home speaker is shaping up to be one of the largest head fakes in tech. We are already starting to see early signs of disappointment begin to appear…

I don’t think stationary smart speakers represent the future of computing. Instead, companies are using smart speakers to take advantage of an awkward phase of technology in which there doesn’t seem to be any clear direction as to where things are headed. Consumers are buying cheap smart speakers powered by digital voice assistants without having any strong convictions regarding how such voice assistants should or can be used. The major takeaway from customer surveys regarding smart speaker usage is that there isn’t any clear trend. If anything, smart speakers are being used for rudimentary tasks that can just as easily be done with digital voice assistants found on smartwatches or smartphones. This environment paints a very different picture of the current health of the smart speaker market. The narrative in the press is simply too rosy and optimistic.

Ultimately, smart speakers end up competing with a seemingly unlikely product category: wearables.”

Three years later, I wouldn’t change one thing found in the preceding three paragraphs. The smart speaker bubble popped less than 12 months after publishing that article. The product category no longer has a buzz factor, and despite the hopes of Amazon and Google, people are not using stationary speakers for much else besides listening to music and rudimentary tasks like setting kitchen timers.

The primary problem found with voice is that it’s not a great medium for transferring a lot of data, information, and context. As a result, companies like Amazon have needed to dial back their grandiose vision for voice-first and voice-only paradigms. Last week’s Amazon hardware event highlighted a growing bet on screens – a complete reversal from the second half of the 2010s.

Betting on the Wrist

As companies who missed the smartphone boat were placing bets on stationary speakers, Apple was placing a dramatically different bet on a small device with a screen. This device wouldn’t be stationary but instead push the definition of mobile by being worn on the wrist.

Jony Ive, who is credited with leading Apple’s push into wrist wearables, referred to the wrist as “the obvious and right place” for a different kind of computer.

When Apple unveiled the Apple Watch in 2014, wearable computing on the wrist was more of a promise than anything else. Apple created an entirely new industry – something that isn’t found much in the traditional Apple playbook.

After years of deep skepticism and cynicism, consensus reaction towards Apple Watch has changed and is now positive. Much of this is due to the fact that it’s impossible to miss Apple Watches appearing on wrists around the world. According to my estimates, approximately 35% of iPhone users in the U.S. now wear an Apple Watch. This is a shockingly high percentage for a five-year-old product category, and it says a lot about how Apple’s intuition about the wrist was right.

Apple Watch Installed Base

The number of people wearing an Apple Watch continues to steadily increase. According to my estimate, there were 81 million people wearing an Apple Watch as of the end of June. According to Apple, 75% of Apple Watch sales are going to first-time customers. This means that 23 million people will have bought their first Apple Watch in 2020. To put that number in context, there are about 25 million people wearing a Fitbit. The Apple Watch installed base is increasing by the size of Fitbit’s overall installed base every 12 months. Exhibit 1 highlights the change in the Apple Watch installed base over the years.

Exhibit 1: Apple Watch Installed Base (number of people wearing an Apple Watch)

(The calculations and methodology used to reach my Apple Watch installed base estimates is available here for Above Avalon members.)

Deriving Power

From where is Apple Watch deriving its momentum? The answer is found in The Grand Unified Theory of Apple Products.

One of the core tenets of my theory is that an Apple product category's design is tied to the role it is meant to play relative to other Apple products. The Apple Watch is designed to handle a growing number of tasks once given to the iPhone. Meanwhile, the iPhone is designed to handle a growing number of tasks given to the iPad. One can continue this exercise to cover all of Apple's major product categories.

Apple Watch is not an iPhone replacement because there are things done on an iPhone that can't be done on an Apple Watch. This ends up being a feature, not a bug. The Apple Watch’s design then allows the product to handle entirely new tasks that can’t be handled on an iPhone. This latter attribute goes a long way in explaining how Apple Watch has helped usher in a new paradigm shift in computing. Apple Watch wearers are able to interact with technology differently.

(More on The Grand Unified Theory of Apple Products is found in the Above Avalon Report, “Product Vision: How Apple Thinks About the World,” available here for Above Avalon members.)

A Health Platform

In January 2019, Tim Cook surprised many by saying Apple will be remembered more for its contributions to health than for any other reason. Here’s Cook:

“I believe, if you zoom out into the future, and you look back, and you ask the question, ‘What was Apple’s greatest contribution to mankind?’ it will be about health.”

Many assumed that Cook’s comment hinted at Apple unveiling a portfolio of medical-grade devices that would go through the FDA approval process. Such thinking was based on a fundamental misunderstanding of Apple’s ambition and approach to product development.

Apple’s health strategy is based on leveraging hardware, software, and services to rethink the way we approach health. This means Apple wasn’t going to just launch a depository for our health data – something that is needed but which ultimately falls short of being truly revolutionary. In addition, Apple wasn’t going to just offer health and fitness services that amount to counting steps or keeping track of miles run.

By the time Cook gave his bullish comment about health, Apple had already placed its big bet on health four years earlier by unveiling the Apple Watch. In what ended up being one of Apple’s best decisions, the company avoided going the route of medical-grade devices requiring government agency approval to reach consumers. Instead, Apple framed its health platform as a new-age computer that ultimately is an iPhone alternative.

Health monitoring is one of the key new tasks that the Apple Watch, not iPhone, handles. To be more precise, Apple Watch is handling the following four health-related items:

Proactive monitoring (i.e. heart rate and blood oxygen)

Well-being assistance (i.e. sleep monitoring including the runup to sleep)

Fitness and activity tracking (i.e. Activity and Workout apps)

Fitness and health activity (i.e. Apple Fitness+)

With Apple Fitness+, Apple didn’t just release a virtual fitness class service. Instead, Apple Fitness+ is an Apple Watch service. In some ways, Apple Fitness+ reminds me of Apple TV+. A future in which Fitness+ workouts are available on third-party gym equipment displays including on treadmills and stationary bikes is not a stretch. In addition, classes from other companies such as Nike could further elevate Apple Fitness+.

Competition

If the Apple Watch is a runaway train, there is no obvious candidate in a position to stop or even slow the train. While other companies are slowly waking up and seeing the momentum found with Apple Watch, there is still much indifference, mystery, and misunderstanding as to why people are buying wearables. Too many companies still think of wearables as glorified smartphone accessories. Such thinking makes it impossible for competitors to see how Apple Watch is ushering in a paradigm shift in computing by making technology more personal in a way that other devices have failed to accomplish or replicate.

One of the main takeaways from Apple’s product event earlier this month is how Apple is its own toughest competitor. The Apple Watch’s most legitimate competition is found with older Apple Watches and non-consumption (i.e. empty wrists). While this introduces its own set of risks and challenges, there is still no genuine Apple Watch competition from other companies after six years. This is an indication of the power found in controlling your own hardware, software, and services in order to get more out of technology without having technology take over people’s lives.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members in both written and audio forms. To sign up and for more information on membership, visit the membership page.

For additional discussion on this topic, check out the Above Avalon daily update from October 1st.

Above Avalon Podcast Episode 170: Pulling Away From the Competition

In episode 170, Neil examines how Apple is pulling away from the competition to a degree that we haven’t ever seen before. Given how we are just now entering the wearables era, implications of this shift will be measured in the coming decades, not years. Additional topics include WWDC 2020, Apple’s revised product strategy, the competitive landscape, and Apple’s lead in wearables.

To listen to episode 170, go here.

The complete Above Avalon podcast episode archive is available here.