Taylor Swift is Backing Herself Into a Corner - Above Avalon Premium Week in Review

Along with periodic Above Avalon posts accessible to everyone, I write 10-12 stories a week about Apple sent exclusively to Above Avalon members via a daily email. The following story was sent to members on June 22nd. For more information and to sign-up, visit the membership page.

Taylor Swift is Backing Herself Into a Corner

Taylor Swift was able to capture much of the Sunday news cycle with a well-circulated Tumblr post with a passive aggressive "To Apple, Love Taylor" title. The seven paragraphs that made up the post can be summed up in three sentences:

"I'm sure you are aware that Apple Music will be offering a free 3 month trial to anyone who signs up for the service. I'm not sure you know that Apple Music will not be paying writers, producers, or artists for those three months. I find it to be shocking, disappointing, and completely unlike this historically progressive and generous company."

Eddy Cue responded within 17 hours saying via Twitter that Apple had changed its mind and will pay artists during the free trial period. Apparently, Apple will pay rights holders on per-stream basis, the details of which were not disclosed [Apple will pay 0.2 cents for each song streamed]. It would seem the rate will be less than the regular rate once the trial period ends. Regardless, the change in Apple's stance occurred very quickly. Does this mean everything is okay? Not quite.

Before I go any further, I think it's important to note that Taylor Swift knows exactly what she is doing. Beginning with her WSJ op-ed last year and her recent spat with Spotify where she removed her entire music catalog from the music streaming service, Swift has fully embraced the message that music needs to be valued appropriately. Not only does such positioning likely hold true to her beliefs, but it serves her well from a business sense.

Taylor Swift is arguably the biggest music act going today. She is one of the few that can sell out venues each night for months across the world. She has spent years developing her fan base and connects with them extremely well. Simply put, she can afford to take these kind of hard stances and use her music as a bargaining chip.

You will quickly discover that you can't go far talking about music without discussing record labels and the complicated structure where everything is done in such a way as to position the dollar as the ultimate goal. In many ways, Taylor Swift transcends all of this talk because of the power she holds. This means that any discussion involving Taylor Swift is often much more ideological than practical as we can ignore the record label.

At the end of the day, this Taylor Swift vs. Apple battle wasn't even about Apple. It's about valuing music. Swift previously battled Spotify. Yesterday, she called out Apple. Tomorrow, she will call out someone else. Apple is simply a symbol of what Swift is fighting for: raising awareness that the music industry is selling an art form that should be valued accordingly.

Swift's primary argument against Apple's 3 month tier was that such a feature does not value music appropriately. If you are a music artist and you release a new album from July to September, you would have received $0 from Apple Music and the 10s of millions of people trying the service out. While simplistic in thought, basically the entire music industry would have received $0 from Apple for those three months. When you say it like that, it is hard not to agree with Swift's argument, and I suspect that is why Apple changed its tune, deciding to pay artists during the trial period. Swift wasn't the only one to raise this issue in recent days, so it is possible that Apple was at least thinking about this topic for a few days and Swift was the final straw.

Even though Swift won this latest battle (Apple probably will face no long-term negative implications from this though), I still think Swift's long-term positioning in terms of valuing music is problematic. Swift is combining short-term goals with long-term ambitions. She is upset with any service or feature that doesn't value music correctly. She raises very valid (and convincing) arguments. However, when looking at the long-term, Swift is likely backing herself into a corner.

One theme that has developed in the music industry over the past decades, especially the last 10-15 years, is that technology is a formidable force. The music industry has not been able to figure out how to find sustainability with music streaming. There is pain in the streets. Taylor Swift, and a handful of other actors, are using what essentially boils down to aggressive negotiation tactics to force change (i.e. getting people to pay for music). In the near-term, Swift's exposure and power will increase. Her fans will like her even more. And she may very well win many battles (as she did vs. Apple).

However, look at what happened with Swift's battle with Spotify. The music streaming service's momentum in terms of user growth (the most important metric for Spotify) has shown no signs of slowing down after Swift pulled her music collection. In fact, one can argue Spotify gained exposure following Swift's very public battle with its free streaming tier. Here is where I think Swift will find some trouble. She will not be able to control technology. Even though she is the most popular music artist in the world today, that is not enough to shift what will be inevitable in terms of music and technology. She is trying to get everyone to play nicely, but no one person holds enough power to keep everyone in line. A stronger Spotify, including a more popular free streaming option, would seem to go against what Swift is advocating.

Look at how Kid Rock turned out in his opposition to paid downloads on iTunes. Technology, and the world, passed him over. The same will happen with Swift if she doesn't change her tune (which I think she will) over time, concerning how music should ultimately be valued.

Swift wants people to value music appropriately. Apple does too. Swift thinks the best way of doing that is to pay for music. I'm not sure Apple feels the same way long-term. Technology likely has other plans in mind (and I suspect Apple does too) in terms of how one can monetize music to ensure sustainability. Free music streaming isn't going away, regardless of how much Taylor Swift hates it.

In addition to the preceding story, Above Avalon members also received the following stories this past week:

- Apple Stock Buyback Primer (seven chapters)

- Apple's Cash Dilemma (Why Not Just Pay the Tax?)

- One Drawback of Holding $194 Billion of Cash

- The Symbolism Behind the Gold iPhone

- Google's Early Approach to Take On Apple Watch

- Calculating Apple Watch Band Profit

- Just Doing What's Right (Tim Cook and Eddy Cue edition)

- Improving iOS 9 Adoption is High Priority at Apple

To read these stories (accessible via email) and receive future stories containing Apple analysis, sign-up at the membership page. A weekly option is also available containing all of the week's articles in one email delivered at the end of the week. Above Avalon is supported 100 percent by its members. Thank for your continued support.

Wall Street Starting to Doubt Apple Watch - Above Avalon Premium Week in Review

Along with periodic Above Avalon posts accessible to everyone, I write 10-12 articles a week about Apple sent exclusively to Above Avalon members via a daily email. The following article was sent to members on June 17th. Please visit the membership page for more information and to sign-up.

Wall Street Starting to Doubt Apple Watch

One by one, sell-side analysts are starting to turn cold on Apple Watch, a product released seven weeks ago. Yesterday, Pacific Crest analyst Andy Hargreaves published a note saying his confidence in Apple Watch is declining as interest appears to be higher in the iPod than Apple Watch, judging by Google Trends, and something needs to be done or else Apple will struggle meeting Watch expectations. Here's Hargreaves:

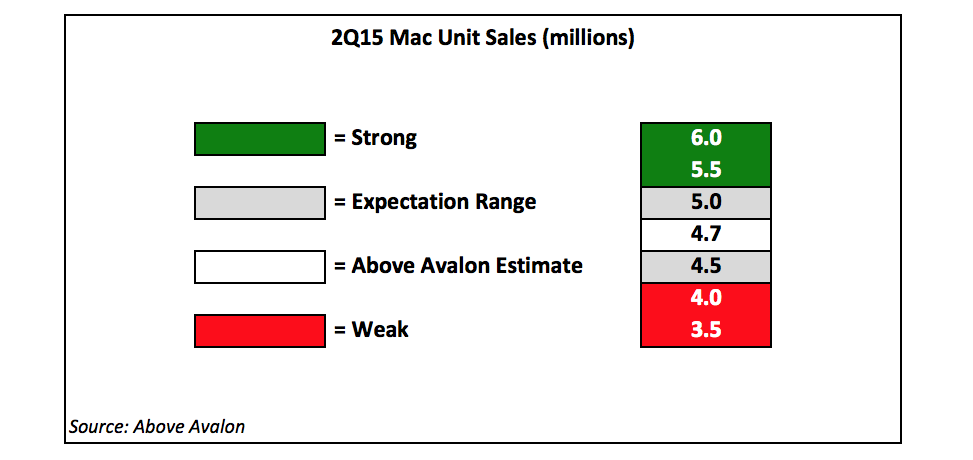

"Initial Apple Watch demand has been very strong and our most recent checks suggest Apple remains well positioned to produce enough units to meet or exceed our FQ3 unit estimate of 5.5 million and our F2015 unit estimate of 11 million. However, reviews of the device have been mixed, the fashion angle appears to be leaning a bit too much toward "calculator watch," and general consumer interest as measured by search volume is below the iPod (with an "o")...All of this suggests a dramatic increase in functionality is likely needed to grow unit sales and meet current expectations for F2016 unit volumes. Given Apple's developer community, this is clearly possible. However, our confidence is declining, which suggests risk to our F2016 unit estimate of 24 million is increasing."

I will comment on his Watch sales estimates shortly, but it's important to note what he is arguing: once early adopters buy the Watch, evidence in the form of Google Trends would suggest sales will slow. The focus isn't so much on Apple Watch sales for the current quarter or even next (those will probably be fine), but the follow-through as we move away from launch. Basically, the question being raised is will normal people buy the Watch?

Hargreaves is not the first analyst to raise Watch concerns. On Apple's last earnings quarter, Toni Sacconaghi of Sanford Bernstein took issue with Tim Cook's attitude and tone when discussing Apple Watch. Here's Sacconaghi:

"I just wanted to revisit the watch. Tim, I think you've said, when you were talking about your new products, you said we're 'very happy with the reception' and in response to a previous answer, you said, 'relative to demand, it's hard to gauge with no product in the stores.' I would say relative to other product launches, where your commentary around demand was characterized by superlative after superlative, that assessment feels very modest."

Tim responded, "I'm thrilled with it, Tony, so I don't want you to read anything I'm saying any way other than that. So I'm not sure how to say that any clearer than that." Sacconaghi recently visited with Tim Cook and Luca Maestri and once again he made note of their demeanor, saying their tone was "confident, though not ebullient."

All of this doubt should be expected as Apple chose not to disclose Apple Watch sales. That decision was likely not taken too lightly at Apple HQ. If management announced opening weekend sales, a can of worms would be opened where people would expect such disclosure at every turn and any slight deviation would be marked as a negative. Take a look at iPad to see what being aware that unit sales are declining year-over-year can do to a product's perception.

However, by not releasing sales numbers, doubt and worry are allowed to build as there is no concrete evidence to refute an analyst's analysis. Instead, some are left resorting to analyzing management's tone when talking about the Watch.

I suspect one of the driving reasons that led management to keep Apple Watch sales under wraps is that given the current environment, Apple doesn't need to release Watch sales numbers. With the iPhone selling so well and representing a large portion of operating income, I can see Apple looking at that and saying that there wouldn't be much benefit from releasing Watch sales numbers. When you are selling 50 million iPhones a quarter, announcing four million Apple Watch sales may be lost on many market observers. In addition, the less Watch disclosure, the harder it would be for competitors to respond.

The very little amount of data that we do have on Watch sales (primarily from Slice Intelligence, but also Apple revenue guidance for the current quarter) would suggest that Apple Watch sales look solid (4M so far), although the adoption rate may be a bit weaker than that of the initial iPad in 2010. Said another way, the Watch may indeed take a bit longer to catch on with people compared to how the world seemed to accept the iPad over night. Did Apple expect this and feel it was prudent to not release sales early on? It's possible. In a way, Apple would be somewhat hedging its bet just a bit.

Let's not forget, Apple has been big about disclosing sales numbers if they are strong. That's why I think this decision may be related to iPhone strength. Apple would have decided they weren't going to break out Watch sales numbers months ago. I suspect this is not a decision based on opening weekend sales strength or weakness.

Ultimately, Wall Street is all about expectations. Back in November 2014, my very first Watch sales estimate was for 20-30 million units to be sold in the first 12 months on the market. In March 2015, I fine-tuned my estimate to 28 million units in the first 12 months on the market. These numbers are important because they help frame how I look at the Watch and what would be "disappointing" results or "strong" numbers. Every analyst is different, and that is important to take into account when they issue research notes discussing the Watch. Looking back at Hargreaves' note, his 12-month Watch sales estimate looks to be pretty similar to mine across the board, so he's not overly optimistic or pessimistic.

If analysts' main concern is around Apple Watch sales in 2016, I have a feeling we may need to get used to this Apple Watch doubt. We are in the very early innings of this game, and there is no evidence yet to suggest the Watch has struck out.

In addition to the preceding article, Above Avalon members also received the following articles this past week:

- The Genius Move Behind the Phil Schiller Interview

- How to Discover Apple Watch Sales

- Apple is Playing Offense, not Defense

- New Productivity Features Hint at iPad's Future

- Fitbit Prices IPO Above Expectations

- Cablevision CEO Sees Cable Bundle Dying

- Apple's New Search APIs

- Apple Retail Store Renovations

- Apple Hiring News Editors

- Apple Correctly Killed Plans for Beats Wifi Speakers

To read these articles (accessible via email) and receive future articles containing Apple analysis, subscribe at the membership page. A weekly option is also available containing all of the week's articles in one email delivered at the end of the week. Above Avalon is supported 100 percent by its members. Thank for your continued support.

Apple's Cash Dilemma

With approximately $200 billion of cash on the balance sheet, Apple's financial strength has never been stronger. However, Apple has a growing dilemma on its hands concerning its cash and capital return program. Apple is unable to keep the pace of share buybacks and dividends in-line with its foreign cash generation. As a result, excess cash that is not needed to run Apple's business continues to build on the balance sheet. While labeling a company with $200 billion of cash as having a cash dilemma seems like hyperbole, Apple's valuation metrics will likely be negatively impacted in the coming years if Apple is unable to return this excess cash to shareholders.

Apple's Total Cash Continues to Increase

Apple currently has $194 billion of cash, cash equivalents, and marketable securities. Not only is this a record in terms of cash held by a single company, but it represents approximately 10% of all cash held on corporate balance sheets. Given Apple's business model, it does not need all of this cash to run its business. With an enterprise value of $583 billion, Apple would theoretically be able to repurchase 30% of itself using the cash on its balance sheet. In reality, things are much more complicated as most of this cash is not able to be used for share buyback because it is held offshore and would be liable for additional tax if returned to the U.S.

Exhibit 1: Apple's Total Cash, Cash Equivalents and Marketable Securities

Most of Apple's Cash is Held Offshore

Apple's foreign cash continues to comprise a growing portion of Apple's overall cash. In the eight years since the iPhone was released, Apple's foreign cash has grown to $171 billion from $7 billion and now accounts for 89% of Apple's total cash, up from 44% in 2007. With approximately 70% of annual revenue coming from outside the U.S., Apple's foreign cash will continue to grow at a much faster pace than its U.S. cash. Apple has been content with keeping foreign cash offshore in order to avoid paying additional tax if it was brought back to the U.S.

Exhibit 2: Apple's Total Cash, Cash Equivalents and Marketable Securities (Foreign vs. U.S.)

Apple has been using some of its foreign cash for organic growth initiatives, including component procurement, international retail and facility expansion, and clean energy initiatives. Even after all of these expenses, cash generation continues to exceed what management needs to run the business.

This past quarter, Apple sold more iPhones in China than in the U.S. for the first time. Rather than this being an isolated event, China will only become a bigger piece of the iPhone sales pie given social-economic trends and an untapped market of more than 600 million phone users. The end result is Apple's foreign cash generation will continue to vastly outpace U.S. cash generation.

Apple's U.S. Cash is Being Depleted

With foreign cash being kept offshore, Apple is forced to use its U.S. cash to fund the capital return program. As a result, Apple has a more "modest" $22 billion of cash available in the U.S., which reflects the impact of more than $40 billion of debt issuance over the past three years. Without issuing debt, Apple would only be able to rely on U.S. free cash flow generation of approximately $20-$25 billion a year to fund buyback and dividends. It is important to remember that Apple needs a certain level of available cash in the U.S. to take care of routine business expenses, not to mention have cash on hand to take advantage of M&A opportunities. It is not prudent to allow this cash total to fall too low, and management has shown the willingness to slow share buybacks instead of depleting U.S. cash reserves.

Exhibit 3: Apple's Cash, Cash Equivalents and Marketable Securities (U.S.)

The Dilemma

Apple's cash dilemma is straight-forward: Apple is generating cash internationally at a much faster rate than it is able to spend on stock repurchases and cash dividends in the U.S. As China continues to make up a larger portion of Apple's product sales, boosting total free cash flow, management is facing some limits as to the amount of available funds used for stock buyback and dividends. The following exhibit shows how the amount of free cash flow (red line) is expected to outpace the amount of cash spent on buyback and dividends (blue line) in the coming years. China is increasingly causing the red line to slope upward as time goes on while the blue line is being pinned as the U.S. is becoming a smaller piece of the overall cash generation pie. In an ideal world, there would no gap between the red and blue lines as most of Apple's free cash flow would be spent on buyback and dividends.

Exhibit 4: Apple's Cash Dilemma

Apple's Options

Management does not have many available options at its disposable for solving its cash dilemma.

- Lobby for U.S. Tax Law Changes/Holiday. The preferred option would be returning cash currently held offshore back to the U.S. in an environment with a lower tax rate (15% or less), or during a special tax holiday similar to 2004. Obviously, Apple would want a rate in the single-digits, but Washington politics may make any change to tax policy a long shot. If the tax rate was lowered, Apple would be able to bring back $140-$150 billion of foreign cash and then buy back up to 20% of itself in relative short-order through a public tender offer. At a forward price/earnings ratio of 12x and a free cash flow yield of 6%, Apple management likely views AAPL's current valuation as attractive for such a tender offer.

- Continue Issuing Debt to Fund Capital Return. Apple is currently using a combination of debt and U.S. free cash flow to fund share buyback and dividends. As Apple's foreign cash grows, Apple can continue to borrow additional debt. However, Apple's cash dilemma will not be solved as foreign cash generation will still likely outpace the rate of capital return even after considering a realistic amount of debt issuance each year. Eventually, Apple would be holding $400-$500 billion of cash, almost all of it offshore, and $150 billion of debt, all of which would have been spent on the capital return program. Apple would then need to manage its debt obligations, only straining its U.S. cash needs even more. Management may begin to cool to the idea of issuing significant amounts of debt if interest rates rise or if Apple's business slows, further making this option somewhat unsustainable in the long run.

- Do Nothing. Management could also slow debt issuance and simply spend less on share buyback. This option would be taken with balance sheet preservation in mind. If Apple slowed all buyback activity, both U.S. and foreign cash would increase and Apple would likely reach $400 billion of total cash in relative short-order. The risk to this option is Wall Street's reaction to Apple sitting on too much excess capital, a scenario that had begun to play out in 2011-2012, and some can argue, is still playing out today.

How is Holding too Much Cash a Dilemma?

Apple's market valuation is obtained in the marketplace at a price where AAPL buyers and sellers are willing to trade shares to each other. If there is greater demand for shares at a certain price, the price will rise until demand and supply are in equilibrium. Investors buying Apple shares are interested in owning a piece of the company's assets used to generate cash in the future. Since a company's value is obtained by discounting future cash flows and excess cash is not involved in future cash generation, the market is forced to include the cash in its Apple valuation. The end result is there is a high likelihood of either Apple's cash being valued incorrectly, or much more likely, Apple's underlying business being valued at a discount. This is the fundamental logic behind those that have been pushing Apple to use its excess cash to buy back more stock.

Unless foreign cash is brought back to the U.S. in order to boost the magnitude of share buyback, Apple's excess cash will continue to grow, and the valuation metric that the market is giving Apple will continue to be suppressed. This is one likely reason why Apple is trading at a 12x forward P/E multiple. Apple CFO Luca Maestri has quite the dilemma on his hands.

Receive my exclusive analysis and perspective about Apple in a daily email containing 2-3 stories (10-12 stories a week). For more information and to sign up, visit the membership page.

Members have access to the Above Avalon stock buyback primer which can be used to become familiar with Apple's share buyback.

Apple Is Playing Offense at WWDC

Apple is on the offensive. This is not a company content with standing by and letting Google, Facebook, Spotify and a handful of other third-parties take over critical elements of the user experience of approximately 500 million iPhone users. Instead of just swinging a sword and trying to compete with everyone indiscriminately, Apple is carefully positioning its resources and the overall iOS platform to stress value propositions at which Apple has historically excelled. These include personalization, emotion, and privacy. WWDC highlights how battles are being chosen meticulously as Apple's mission is clear: reducing its dependency on others. With the News app, Apple is trying to change users' habits in terms of how they get content. Apple Music is a test in how successful Apple will be once again in not just getting customers to pay for something that is free elsewhere, but rethinking the music industry. Siri and Spotlight are being positioned as Apple's method for rethinking search. Instead of sitting back and letting third-parties have all the fun, Apple wants more.

The Chess Game Heading into WWDC

Apple had the wind at its back headed into this year's WWDC. The iPhone 6 and 6 Plus have resonated with consumers across the world, especially in China, leading to more than 40% unit growth year-to-date in 2015. One metric that Tim Cook has reiterated on recent earnings conference calls is the Android switcher rate, or the percent of iPhone sales that can be attributed to former Android users. Recent Kantar data and Above Avalon estimates would suggest that approximately 20-25% of iPhone sales in 2015 have come from customers new to iOS, which totals to nearly 25-30 million users entering the iOS ecosystem for the first time.

The iOS platform has hit critical mass; it is large enough to sustain app innovation and developer interest. Nearly every major third-party consumer-facing technology company, including Google, Apple's primary competitor, have all but guaranteed support for the iOS platform, a noteworthy reversal from years of doubt and cynicism from those who warned Apple's smartphone 10% market share may eventually be outmatched by Android's massive reach. The problem with that logic turned out to be that Apple actually has 70%+ market share in the premium smartphone market which includes those who are very likely to use apps and services.

On top of that, Google and Facebook have business models that depend on obtaining data at scale, and Apple's highly engaged users are a prime target. It would be difficult, if not impossible, for Google and Facebook to ignore 500 million iPhone users.

Given the current environment, one would assume Apple is feeling pretty good. Executives could push out an iOS refinement update, watch iPhone sales roll in, and coast along until WWDC 2016. In reality, Apple is more nervous now than ever before.

This nervousness is not born from weakness, but rather strength. Apple is nervous about the unknown, the low probability event, the Black Swan that we can't even imagine. It is with this nervousness that Apple positioned certain new OS X and iOS 9 features as preemptive moves on the hypothetical chess board.

Apple wants to be in a position where it can counter the scenario of Google, Facebook, or another powerful third-party taking over such a large amount of the user experience that Apple's relationship with the user is harmed. People are spending an increasing amount of time on social networks while music streaming is taking over. Even though both of these activities are not directly hurting Apple's financials, it's clear management wants to be better positioned to respond to each trend.

While there are very few, if any, credible competitors that can truly ship software, services, and hardware at scale, it would be theoretically possible for a company to take user engagement on iOS and try to leverage it into a new direction using their own differentiated hardware. If Apple can position itself more strategically as a counter to third-party offerings, reducing its dependency on others, Apple could be in a better position to maintain the user experience and battle third-party apps and services in the future.

Fighting for Your Attention

Although Apple may be seeing success in terms of smartphone sales, a fierce battle has been occurring for our attention once we turn on our gadgets. Press and hold the iPhone home button and the battleground emerges: our home screen. Software and services companies are each angling for our attention. Tech pundits often say Facebook's greatest threat is Google. Instead, Facebook's greatest threat is our short attention span. Services that largely do similar things are increasingly fighting for mind share in the areas of messaging, email, photo storage, and entertainment. When considering that a service can benefit from a network effect, the battle is only intensified as the apps and services with the most users achieve the best quality, thereby making it that much easier to attract new users.

Whereas hardware manufacturers measure success by the 10s of millions of users, for software, success is now measured in 100s of millions. As more people spend more time on smartphones, the battle for our attention is only intensifying. It is for this reason that iOS is such an attractive proposition for companies craving reach and scale amongst premium users.

In the early days of the iPhone, it was common to see a smartphone with lots of apps, each possessing a specific duty or job role. I created separate folders for social apps and news. Today, I still open my social app folder every day, but now my news folder has become irrelevant as I get most of my news from Twitter. This type of fierce competition for my attention is still playing out in area of social platforms and media brands, but it's clear that given the finite amount of attention, there will be winners and losers.

With a suite of over 20 apps, Apple has relied on its vertical integration of shipping hardware, apps and services. In 2012, Apple jumped into maps. In 2014 Apple launched its health, fitness, and payments initiatives. And at this week's WWDC, Apple launched new News and Music apps, with rumors of a video service arriving sometime later this year or 2016. All of these services share one purpose: controlling our time and experience. They are meant to represent tasks or things that we do each day and to which Apple can add differentiation. One should not expect Apple to try to be the answer to everything, such as entering social media or other services that are inherently less fundamental to Apple's product line-up.

News

Apple's News app isn't so much a competitive jab at Facebook, but instead a hook for grabbing people's attention. Apple's description of the new app is quite clear: "News conveniently collects all the stories you want to read, from top news sources, based on topics you're most interested in - so you no longer need to move from app to app to stay informed." With News, Apple is trying to keep our attention just a little bit longer. Take a look at Facebook's Instant Articles and Snapchat's Discover to see what the war over attention is leading to. Technology companies are trying to shift commoditized news into a differentiated service meant to keep you within their properties.

This type of attention-holding strategy isn't new. In brick-and-mortar retail, Walmart includes various stores within its stores, such as vision centers, fast food restaurants, and medical clinics in an effort to get you inside a Walmart. Similarly, Facebook wants people to spend more time within its apps by offering additional services, like news.

I don't view Apple as necessarily trying to rethink news or put other companies out of business. Instead, it is looked at as a tool to enrich the iOS platform while maintaining a closer relationship with the user.

The risk in the strategy is that many users still have to go to Facebook, regardless of reading news. Going back to the Walmart analogy, it would be the equivalent of having to go to Walmart regardless of which medical clinic you visited. Chances are good you will end at the clinic inside Walmart rather than going across town to the stand-alone clinic. At the end of the day, the easiest path usually wins. It is for this reason that I think caution needs to be held before assuming News will be a runaway hit. Instead, I look at it as Apple moving a piece on the chess board, trying to gain a better competitive position in the future.

Apple Music

Apple's ambitions in music are underestimated. As Eddy Cue and Jimmy Iovine have made it very clear, Apple Music is not about music streaming, but rather a new music ecosystem meant to offer listeners across the world (100+ countries at launch) a place to not only access music, but become part of something bigger, interacting with musicians and receiving recommendations. Eddy Cue and Jimmy Iovine don't say it, but Apple Music is inherently built to keep your attention rather than just engage you in the physical act of listening to music. Technically speaking, Apple is now getting into content creation with its 24/7 radio station, Beats 1, as Zane Lowe will have a music show that contains interviews and other content.

Connect, which will serve as a venue for musicians to connect with their fans, while distinct enough from the Ping disaster, contains just enough social media to make people begin wondering if there may be a bit more that meets the eye, where Connect can become a musician's first stop for sharing content. It is important to point out that despite Apple introducing new features that undoubtedly chase people's attention, the company is not being hostile to third-parties. Connect allows sharing through Facebook and Twitter.

Apple Music is competing with the free streaming services of the world, including YouTube. While Apple may have indeed gotten people to pay for music once around (iTunes), it will be challenging for Apple to completely rethink the music industry without a free, ad-supported streaming option. Nevertheless, Apple is going to give it a try, positioning service and a new culture-defining internet radio option, as reasons customers will be willing to give Apple Music their attention and pay for something that can be gotten for free in the next app over.

Siri and Spotlight

We saw hints of Apple's ambitions in search last year, but this year's WWDC all but confirmed that Apple is quickly looking to distance itself from Google search.

Apple's intentions on reducing its dependence on third-parties is not just limited to apps and software. All of Apple's new announcements related to an improved Siri and Spotlight, not to mention a new search API, are meant to have us move past Google dependence. In the process, Apple is able to build on its relationship with the user and not necessarily collect troves of data. Apple feels very confident that it doesn't need all of your data to produce "magic" as Phil Schiller described it. In reality, what Apple is suggesting is that it can produce an enjoyable environment that doesn't let technology overwhelm the user, yet still position the iPhone as a personal assistant. Apple calls it "intelligence," which is appropriately quite different from the connotations surrounding Google's "machine-learning" initiatives.

Pushing Forward with iPad and Apple Watch Software

Apple’s mission hasn’t changed from its founding in the 1970s. As Jony Ive put it at the Condé Nast International Luxury Conference this past April, Apple has always been about making technology more personal. The primary way Apple will be able to continue going down that path is if they control our time and attention by selling gadgets filled with apps and services that we increasingly use to navigate the world.

Nowhere is this strategy more apparent than Apple’s current product line-up, pieces of glass ranging from the Apple Watch to the iMac. At every stage in between, each product possesses a different function or role. This is the primary reason why Tim Cook hasn’t sounded the alarm about the iPad despite the product losing all of its sales momentum. For Apple, the iPad still has a role in the world. It’s just that a greater number of people are able to get their jobs done using iPhones and Macs. At WWDC, Apple all but assured us that a larger 12.9-inch iPad Plus will be released in the future with Split View, Slide Over, and picture-in-picture video. An iPad Plus isn't meant to turn around the iPad line, but instead serve a particular set of needs that can be answered with a multi-touch Force Touch-enabled large display. Some of Apple's products are simply more popular than others, based on screen size and mobility. Success isn't determined by the number of unit sales, but instead how effective a product is in addressing a particular set of problems.

From Apple’s perspective, positioning the iPhone as a computer in our pocket is central to controlling our time because of how we are able to bring the iPhone mostly everywhere we go. Taking things further, in a quest to control even more of our time, what better way than to sell a computer that is literally on us? The Apple Watch is Apple's first personalized piece of technology that can be worn. The outlook for native apps able to tap into much of the advanced components found in the Watch only validates Tim Cook's claim that the wrist is indeed a very interesting place. The day is still early with wearables, but Apple isn't waiting to push the envelope on what can be done on the wrist.

WWDC 2016 and Beyond

When considering Apple’s future, take a look at your daily calendar and at the activities that take up significant portions of your day. Anything from sleeping, watching TV, and commuting to and from work likely represent areas of interest for Apple. Of course, management is quite selective and as Tim Cook mentioned last year, executives actually spend most of their day debating what not to do. Apple is built on a model of placing very few big bets that can change the world, not lots of little bets very likely to fail but not likely to have much long-lasting impact. Apple's offensive strategy was on display at this year's WWDC including additional Siri capability, new and updated apps meant to hold user's attention, and a new Music platform positioned to regain music mindshare. Such tactical maneuvering is indicative that Apple is not pausing despite its improved market positioning when compared to Android. Apple is playing offense.

If you enjoyed this article, you would love becoming an Above Avalon member. Receive exclusive analysis and perspective about Apple (10-12 articles a week delivered via a daily email). For more information and to become a member, visit the membership page.

Apple's Metaio Acquisition Could Be a Game Changer (Above Avalon Premium Sample)

Along with weekly Above Avalon posts accessible to everyone, I write 2-3 stories about Apple each day covering a range of topics delivered exclusively via email ($10/month or $100/year). The following story was included in the email sent on June 1, 2015. To sign up, visit the membership page.

While most think Apple is asleep at the wheel, busy spending all of its cash on share buybacks, evidence continues to add up that Apple is planning for the future. News broke late last week that Apple bought Metaio. Even though Apple confirmed the deal by providing the typical PR response about buying small companies from time to time, signs point to this Metaio acquisition being a bit different. There is evidence to suggest this is a big deal in terms of implications on future products and services.

Metaio is a leader in augmented reality (AR) and co-founders Thomas Alt and Peter Meier are considered some of the industry's pioneers. Even though Metaio is called a "start-up," the company has been around for over a decade and actually had its founding as a research initiative from VW back in 2000. In one keynote, Alt introduced Metaio with "we've been around forever." Metaio even organized the biggest AR conference each year. Simply put, I have a hard time seeing Metaio selling to Apple without something significant coming from this. That theory is also supported by Apple's track record with M&A where they typically buy companies and technology with a clear goal in mind, often to plug a hole in product strategy.

Last year, Thomas Alt gave a talk that touched on a few reasons why I suspect he may have went on to sell to Apple. 1) monetization remains hard in the field 2) it is becoming increasingly more difficult with the resources Metaio had to track unknown, or outdoor environments, and not just a closed, indoor environment. Said another way, Metaio may have run its course as an independent company and needed a bigger partner to reach its future goals, including the much bigger mission of getting the AR industry off the ground.

The impressive thing about Metaio is the entire vertical chain of products that they offer from Metaio SDK/Creator/Cloud and Junaio (an AR browser across platforms). The company has 140,000+ developers (many of which aren't happy with this sudden news of an acquisition), 1000+ B2B customers including eight automakers, 130 employees, and a patent and IP portfolio.

What can AR be used for? Metaio had previously marketed itself to industrial clients for the following use cases: digital manuals, training education, monitoring, accessories and spare parts (think cars), customer service, inspection, and remote maintenance.

AR has a very basic premise: interact with the world. The problem I have had with many AR use cases (and increasingly much of the hardware developed for AR) is that it is very obtrusive and distorts reality to such a degree that I think side effects are created. If there is a way to position AR as a way of actually improving reality and not just adding more noise, I can see Apple moving forward with such initiatives.

It is very easy to see that Metaio has been heavily involved in the auto market and the concept of the augmented city. There are many interesting possibilities around this use case, building off of AR's primary value of helping to navigate the world. Add this acquisition to Apple's Primesense acquisition (which one of Metaio's co-founders had previously classified as interesting), and I think the concepts of both indoor (and outdoor) mapping where depth and mobility are present start to head in the direction Apple may be headed.

Metaio's developer tools and prior discussion around AR's biggest road block being the lack of relevant content would suggest that Apple may look to bring developers into the fold which would not only give AR a big shot in the arm, but support Metaio's vision of getting AR off the ground.

One theme that is apparent these past few months: there are a growing number of signs that Apple is building and planning for future (unannounced) initiatives. This acquisition firmly places Apple in the augmented reality game, and I suspect the end goal is much bigger than just gaming and other gimmicky demos.

In addition to the preceding post, Above Avalon members received the following articles this past week (100 percent related to Apple). To read these stories and to receive future stories via email, sign-up at the membership page.

- Tim Cook's Stance on Privacy Isn't Actually About Your Data

- The Chess Game Heading into WWDC

- Odds of Apple Replacing Google as Default Search in Safari Going Up

- Apple Music is Sounding More Interesting

- A Closer Look at Apple's Services Business Segment

- New iPhone Ads

- iPhone Sales Share - April Update

- Jay Blahnik Touting Apple's Health Strategy

- Next Phase of Apple Watch Retail

- Google I/O

- IBM Loves MacBooks

The Apple vs. Google Battle Has Changed

The biggest takeaway from Google I/O 2015 was how different Apple and Google are approaching mobile, each guided by their own mission statement and strategy. After years of fierce competition for smartphone market share, the battle between the two companies has changed. Google's ambitions include connecting the next billion users and obtaining scale across its suite of services which requires supporting an iPhone user base quickly moving towards 500 million users. Apple's ambitions are aimed at making technology more personal and lessening its dependency on Google, its primary competitor. The next battle in mobile has begun and it may be just as fierce as the initial rounds. The battle is moving beyond the smartphone and is now based on which platform is more successful in occupying a user's time with the best experience.

Since the iPhone launch in 2007, the Apple vs. Google battle has not remained constant, instead going through distinct stages, beginning with an arms-race for market share, followed by an Android OEM consolidation phase led by Samsung, and now the large screen iPhone renaissance ushering in the current phase where the battle is moving beyond the smartphone.

Battling over Daily Activations (2009-2011)

The early days of the smartphone war were all about market share. The daily beat of the tech press was focused on which mobile operating system was doing better in terms of sales. Google, and Andy Rubin especially, prided themselves on periodically announcing Android daily activations. One of the rare times Steve Jobs was on an Apple earnings conference call with analysts occurred in 4Q10 to put some cold water on Android activations news. The mission was clear: promote iOS as a platform worth developing apps for. Here was Jobs:

"Last week, Eric Schmidt reiterated that they are activating 200,000 Android devices per day. And have around 90,000 apps in their App Store. For comparison, Apple has activated around 275,000 iOS devices per day on average for the past 30 days with a peak of almost 300,000 iOS devices per day on a few of those days. And Apple has 300,000 apps on its App Store.

Unfortunately, there is no solid data on how many Android phones are shipped each quarter. We hope that manufacturers will soon start reporting the number of Android handsets they ship each quarter. But today that just isn't the case."

The battle was not only fought in the marketplace and press, but also in the court room as Apple began setting up its patent litigation offense against various hardware companies using Android to compete with Apple. Apple's goal with litigation wasn't about the money, but rather pride and to slow competitors down in the marketplace. Market share was everything in the early days of the smartphone race.

Samsung's Reign (2012-2013)

The 2012-2013 time frame was interesting for Apple as Samsung was able to make very strong inroads within the Android ecosystem, capitalizing on the lack of a large-screen iPhone in the high-end of the market and lack of proper competition in the low-end. While there was never much in the way of widespread defections of iOS users fleeing to Samsung, the ability for one hardware manufacturer with such immense distribution network to grab so much power within the Android ecosystem was alarming to Apple. The battle was aired on TV in the form of a very successful line of Samsung commercials mocking Apple customers, not to mention continued battles in the courtroom.

As evidence of how seriously Apple took the Samsung threat, in 2012, Phil Schiller tried to preempt Samsung's big Galaxy S4 keynote in NYC by talking with the WSJ the day prior in order to discredit Android and provide some counter balance to the overwhelmingly positive press coverage given to Samsung. Schiller went on to say:

"Android is often given as a free replacement for a feature phone and the experience isn't as good as an iPhone...When you take an Android device out of the box, you have to sign up to nine accounts with different vendors to get the experience iOS comes with."

It is important to note how Apple positioned Samsung as merely the preferred hardware competitor at the moment. Google, not Samsung, was the ultimate long-term threat as Apple saw that Samsung was gaining market share purely on the back of Android. Without Android, Samsung phones would not be viable competition for the iPhone.

The New Battle

Apple now finds itself with an iPhone user base approaching 500 million users, and strong market positions in key geographic territories including the U.S. (40% sales share), U.K (40% share), and China (25% share). Any concerns related to iOS being crowded out by Android OEMs in a repeat of the Windows era have likely been put to bed. Apple's iOS platform now has critical mass, or the ability to entice developers and third-parties, including Google, Facebook, and Twitter, to support iOS users.

One of the clearest themes from Google I/O 2015 was that Google needs iOS and its 475 million highly-engaged iPhone users for Google's business model to succeed. Looking ahead a few years and assuming continued 10-20% iPhone unit sales growth, it will be nearly impossible for a third-party with a business model dependent on achieving scale to ignore what has the potential to be a 600-700 million user ecosystem (if not larger).

While one can make an argument that Google made a strategic misstep by limiting Google Maps on iOS a few years ago, which ended up pushing Apple into developing its own maps initiative, hindsight is 20/20. Google may have thought it was worth taking the bet at that time as iOS was a very different, and weaker, platform in 2012 than today.

The Apple vs. Google battle has now moved beyond the smartphone. Walk into a carrier store and given the choice between an iPhone or Android-powered smartphone (the two most likely options), Google's services will be found on each. In addition, the prices between an iPhone and high-end Android-powered phone will be roughly the same. While Google may be excelling at machine learning-based cloud initiatives, it is not being positioned as a factor for buying an Android phone instead of an iPhone. Given the limited distribution behind Nexus devices, it is difficult to have much confidence in that line of Android hardware representing a viable alternative for most consumers.

Instead, the smartphone buying decision is likely related more to the other pieces of glass either being worn (smartwatches), in one's purse or backpack (tablets), or at home and on the work desk (desktops/laptops). Extend the exercise further to incorporate third-party devices in the home and driveway, and the entire iOS or Android ecosystem is becoming the much bigger deciding factor for what will be your next smartphone.

Apple's Strategy

Apple wants to be at the intersection of technology and liberal arts. Producing personalized technology experiences will require Apple to maintain control over the variables that come together to create experiences for the user. A key component will be owning critical technologies and services that may otherwise rely or require scale in future initiatives. A prime example would be avoiding the debacle over maps where functionality was limited by a third-party. In the future, mapping will likely be a required core competency for personal transport ambitions. If iOS represents a minority share of the automobile market, such a market position may pose a competitive risk in terms of relying on third-partners for map data.

The same thinking applies to Apple controlling the experience for providing content like movies and music to consumers. Notice how Apple doesn't need to own or produce the content in order to accomplish its goal. Instead, being the broker between the content owner and the consumer provides Apple room to add something new to the experience. Apple could then extend this experience to Android to further entice people to make the switch to iOS (as is planned with Apple Music).

Another way Apple can maintain its consumer experience is to embrace the emotion and feeling found with luxury. As seen with the Apple Watch, relying on materials and looks as the primary differentiation between a $400 and $17,000 device produces certain emotions that would be hard to match on Android or a competing platform where the virtues of luxury don't exist.

Google's Strategy

Google's ambition for its cloud-based services is increasingly competing more with Facebook than Apple as Google's business model is based on solving technological problems by accessing the world's data. Google wants all smartphone users to use its products, regardless if on Android or iOS. Similarly, Facebook is after the same data. Just like how Facebook unbundled its core app into a suite of apps, Google seems to be following a similar path, transforming into a suite of services and apps. Google wants to be at the intersection of technology and computer science. Judging by its engineering talent, I don't think anyone doubts Google will continue to push the envelope with such initiatives.

Going Forward

Google I/O made it clear that Google needs Apple and iOS. To ignore such a vibrant base of highly-engaged users, especially when other companies like Facebook enjoy a prominent place in the platform, would be highly destructive to Google's ambitions. On the other hand, Apple also needs Google as its services remain very popular among iOS users. However, judging from Apple's prior actions and mission statement to personalize technology, I would expect Apple will continue to try to minimize its dependence on Google as such a situation represents a long-term threat to Apple's mission.

Similar to how the Nexus experience provides the closest thing to pure Android, I suspect Apple wants to continue down the path of being in a position to ship an iPhone and suite of apps and services that make it possible to live within the Apple ecosystem without much interference from Google. While most consumers will end up settling somewhere in the middle, using both Apple and Google products and services, it is this quest to control the entire user experience that ultimately validates the competition between Apple and Google as genuine.

The probability of a world where Android excels as a direct result of iOS faltering is becoming more remote as time goes on. Instead, Google is becoming more reliant on a healthy iOS platform, which improves the chances of iOS continuing to grow and gain additional power. Meanwhile, the Android platform continues to become splintered and less effective at Google's mission of positioning services in such a way as to reach scale.

The primary question is now focused on how successful Apple will be in loosening its dependency on Google services. There are signs that we may see a more aggressive stance from Apple towards replacing many Google services with homegrown alternatives. This motivation will likely come to represent the driving factor for the continued battle between the two companies. While we may see skirmishes from time to time over individual features and services, the much bigger battle is clear: Apple and Google are built on a fundamentally different view of the world and each will now fight to occupy a user's time with the best experience. The battle has moved beyond the smartphone.

Want to read more posts like this? I write an exclusive daily email about Apple (10-12 stories a week). For more information and to subscribe, visit the membership page.

Apple Watch is Making Luxury Watchmakers Uncomfortable - Above Avalon Premium Weekly Recap

The following post is the sample story used to demonstrate the type of stories sent daily to Above Avalon Premium Members. The following story was sent on May 25th, 2015.

Apple Watch is Making Luxury Watchmakers Uncomfortable

The luxury watch industry still can't understand why someone would buy an Apple Watch.

Here's Alexander Schmiedt, managing director for watches at Montblanc, speaking with Bloomberg: "Our products should have very long life cycles. In modern technologies the life cycle is exactly the opposite. It may be the hottest thing today, and in one year it's already outdated, and in two years you're made fun of for still using it."

Montblanc will be selling a $390 "e-Strap," a stainless steel display designed to be attached to the watch band and worn on the underside of the wrist. Functionality is pretty limited compared to something like Apple Watch.

And here's Johann Rupert, owner of Montblanc: "I love Apple, but just when I've gone and set everything up for an iPhone 5, the iPhone 6 is coming out and the cords change. That is not to say the Apple Watch is not a great product. I predict it will do very well, but I don't think that customers are going to be ecstatic to throw away watches in one to two years when the technology is obsolete."

I thought those two quotes summed up the luxury watch industry's reaction to Apple Watch pretty well. Jean-Claude Biver of TAG Heuer has said something similar, unsure how to compete with something that isn't timeless. It's not that technology is foreign to luxury watchmakers, but I suspect software and the fast-pace of change found in technology are creating headaches. An iPhone 5 doesn't become obsolete in two years on its own, but rather a legitimately better device in the market helps to make it obsolete. The same dynamic is not found in the watch market.

Such uneasiness towards Apple Watch originates from the changing value proposition found in the luxury watch industry. With Apple Watch, consumers can begin valuing utility on the wrist. A luxury watch's timelessness was something that you were required to value if you wanted high-end jewelry for the wrist.

I suspect we are entering an era where people are still going to want the jewelry aspect found in their old watch, including the craftsmanship, but no longer place the same kind of value on a device's timelessness. For an industry built on timelessness, you can start to see how the Apple Watch spells trouble.

The other common reaction that I'm seeing related to Apple Watch is that the product increases awareness for other timepieces and wearables, almost like the Apple Watch is a gateway drug for "real" watches. I'm not so sure about that. After using Apple Watch, I don't have a greater appreciation for wearables or traditional luxury watches. If anything, the feeling is less. I just don't look at the Apple Watch as a watch.

If I craved something that looked more refined or polished, I could just upgrade from the Sport to Watch collection or change watch bands, and that type of reasoning is why I think Apple will actually keep the innovation and updates pretty vibrant for the higher-end Watch models. The Watch and Edition collections will likely account for 80% of Apple Watch profits despite only accounting for 20% of sales.

Consensus already assumes the low-end luxury Watch market (watches selling in the $200-$1000) is in trouble, but very few people will go on record and discuss how the overall watch market, including watches sold at higher prices, is in trouble because of devices that add utility to the wrist. The problem may not necessarily be that their current customers will run out and buy an Apple Watch, but that young professionals end up valuing utility over the traits the luxury watch market have traditionally marketed.

If new money stops flowing to the luxury watch market, the environment will become very difficult.

Receive my exclusive analysis and perspective about Apple throughout the week (2-3 stories a day, 10-12 stories a week). For more information and to sign up, visit the membership page.

The Jony Ive Promotion

Apple announced on Monday that Jony Ive will be promoted to Chief Design Officer, relinquishing his day-to-day managerial duties to Richard Howarth and Alan Dye. Reaction to the news has been mixed, with some thinking this announcement is the beginning of the end for Jony at Apple. I disagree. I look at this news as paving a sustainable path for Jony Ive to continue guiding Apple. In the process, we also now know the future leaders of Apple's design efforts. When we understand how Apple turns ideas into products, it becomes clear that Jony's new role is the closest thing yet to the unofficial role Steve Jobs held at Apple. We are in the midst of Jony Ive's Apple.

A Well-Planned and Intelligent Promotion

When Scott Forstall was removed from his position as VP of iOS software at the end of 2012, Tim Cook positioned the move as an effort to increase collaboration. In reality, much of the resulting executive shuffling was done with the near-term in mind. Apple was kicking off the Apple Watch project, and iOS needed a rethinking. Along with maintaining his leadership over the Industrial Design team, Jony was given leadership over Human Interface, which is not a trivial amount of additional responsibility and more importantly, time. While everything over the next two years appeared to go relatively smoothly (Apple software critics would disagree with that assertion), the managerial duties were likely taking their toll on Jony.

In the well-read The New Yorker Jony Ive profile published in February, Ian Parker made it seem like Jony was absolutely exhausted from the Apple Watch development. I just don't think Jony's job responsibilities and workload were sustainable. Here's Parker:

"[Jony] was a few days from starting a three-week vacation, the longest of his career. The past year had been 'the most difficult' he'd experienced since joining Apple, he said later that day, explaining that the weariness I'd sometimes seen wasn't typical. Since our previous meeting, he'd had pneumonia. 'I just brunt myself into not being very well,' he said. He had discouraged the thought that Newson's appointment portended his own eventual departure, although when I spoke to [Laurene] Powell Jobs she wondered if 'there might be a way where there's a slightly different structure that's a little more sustainable and sustaining.'"

Evidence would suggest that Jony's promotion was a long-time in the making and not due to some recent event or sudden decision. Not only is the Apple Watch launch now in the rear-view mirror, but both Howarth and Dye had been positioned in the press going as far back as late 2014. This move is made from a position of strength. Ultimately, promoting Jony to Chief Design Officer is a long-term solution to positioning Jony in a spot where he can do what he does best: make complicated technology more personal.

Titles Are Overrated

While the Chief Design Officer title may cause some to scratch their head with bewilderment as to what it means or doesn't mean, it is important to not get too caught up trying to match Apple corporate titles with importance and job duties. I've long felt Jony is the most powerful person at Apple, despite him not having the CEO title next to his name. As SVP of Design, I think Jony's current title went a long way in seemingly minimizing his influence at Apple. Jony was merely one of eight other SVPs, a comparison that likely was far from the truth.

I look at the title of Chief Design Officer as mostly ceremonial, not indicative of any less willingness by Jony to continue working on future Apple products. Tim Cook couldn't be more clear when explaining Jony's new role:

"Design is one of the most important ways we communicate with our customers, and our reputation for world-class design differentiates Apple from every other company in the world. As Chief Design Officer, Jony will remain responsible for all of our design, focusing entirely on current design projects, new ideas and future initiatives. On July 1, he will hand off his day-to-day managerial responsibilities of ID and UI to Richard Howarth, our new vice president of Industrial Design, and Alan Dye, our new vice president of User Interface Design."

Those job duties not only sound awfully similar to the role Jony has been doing for years as SVP of Design, but they sound incredibly ambitious, effectively giving Jony reign across Apple.

I suspect one issue that many pundits are having when analyzing this news is they are getting too caught up with titles, assuming Chief Design Officer is codeword for "Chairman" or something similar which does indeed have a connotation of transitioning more to a part-time or supervisory role. Similar to how Steve Jobs held the CEO title while Tim Cook performed most of the CEO duties, I think Jony Ive got a new fancy title for no other reason than to show recognition and appreciation for his past accomplishments.

New Leaders Add Clarity

While most were preoccupied with Jony's new job role, Tim Cook added a large amount of known to the sensitive subject of succession planning by announcing two new leaders in Apple design (Richard Howarth, VP of Industrial Design, and Alan Dye, VP of User Interface Design). As Jony's public profile increased over the years, the murmur of "Who will replace Jony?" grew louder and louder. While Wall Street has historically had a weak spot when it comes to valuing Apple design and understanding Jony's importance to the company, the greater level of clarity and certainty when dealing with a company's succession planning, the better.

There is not much public information about Howarth and Dye other than they have been at Apple for years (Howarth for 20 years). Both were successful in prior Apple projects, earning their dues and subsequent promotions. Upper mobility is not common at Apple, so I tend to think Tim Cook and Jony Ive must have really been impressed with these two gentlemen.

Apple's industrial design team should be considered more of a family than a collection of co-workers. The 19 industrial designers aren't at Apple for the money or fame. If they were, they would have left years ago. Instead, they believe in and care about solving problems and making great things. They work very well together, judging by the lack of turnover, and they have seen much success turning raw ideas into finished products. Such an environment and background leads me to think these new managerial appointments won't likely usher in a round of corporate politics and changing group dynamics. It certainly is something to watch for, however, with company departures as the clearest evidence of such a situation occurring.

Leading vs. Managing

With Howarth and Dye serving as Jony's two lieutenants in terms of managing day-to-day aspects of Apple design, what would such a dynamic look like and where would Jony fit into the picture? I consider Jony's new role to be much more about leadership while Howarth and Dye handle the more corporate side of things - the actual management of teams. The amount of additional time and attention that Jony can spend on entirely new projects, while leaning on his two right hands to make sure that schedules are being met and projects are receiving all of the resources they need, goes a long way in describing Apple's strategy over the next few years.

I see an environment in which Jony's potential can be unleashed even more now than the world has already seen. Similar to how Steve Jobs was known to head down to Jony's design lab to hang out, I suspect in some ways, Jony wants to do the same - check out of the day-to-day executive grind and lose himself in research and design elements on whatever topic or subject he choses. By being positioned in more of a leadership role than a managerial role, Jony could maybe be more like Jony.

Future Design Projects and Marc Newson

In his Telegraph article, Stephen Fry briefly mentions what Jony Ive will be up to once his promotion takes place: "Jony will travel more, he told me. Among other things, he will bring his energies to bear - as he has already since their inception - on the Apple Stores that are proliferating around the world. The company's retail spaces have been one of their most extraordinary success."

Take a look at Jony's travel itinerary the past few months, and it is no surprise that he will indeed be traveling more. While Fry positions Apple Retail stores as a likely focus for Jony, the truth is he could end up traveling to various countries, meeting and working with different people or simply researching different aspects of the world. While this may represent a change from what some may be used to at Apple, since when was change automatically a bad thing?

Apple's product road map will likely revolve around two major trends: wearables and personal transport initiatives (not to mention iPhones, iPads, Macs). I look at Jony's new role, along with Marc Newson's recent hire as a London-based member of Apple's design team, as the clearest sign yet that these two gentlemen have some big things planned for the future. Here's Marc Newson in a Telegraph article from 2014:

"[T]he world of automobiles I just find completely heinous...I have old cars but I rarely drive them anywhere. I must confess we do have a Peugeot people-carrier thing that I really hate going in. But car design, is driven by marketing, by people that are not designers. And it's just a completely sort of myopic approach...One of biggest sources of inspiration as a designer is basically looking at things and hating them. I have other designer friends who feel the same way, like Jony Ive."

I recently began to lay out the rationale for why Apple will enter the automobile industry and I do think this Jony Ive promotion is a way for projects like an Apple electric car to go forward, not to mention rethinking the Apple Store experience to better match this new product roadmap.

Moving Closer to the "Steve Jobs" Role

Not only will Steve Jobs never be replaced, but Apple should never think that someone needs to fill the role that Steve Jobs held. Steve had specific strengths and weaknesses that make any comparison to someone else illogical. Instead, I think the much more appropriate way of thinking about this subject is to ask who would be the best person to make sure that Apple's culture remains alive and well while ideas are allowed to mature from raw form to finished product, virtues that Steve Jobs oversaw.

In announcing Jony's promotion, Tim Cook talked about how Jony would have less managerial responsibilities. Typically, one would assume a promotion goes the other way around, leading to more oversight over teams. In reality, I suspect Jony's promotion involves overlooking Apple's mission much more closely, with more flexibility than ever before. Jony Ive will still be Jony Ive, but I think this promotion positions him much more closely to the role Steve Jobs had: making sure the product always comes first.

Receive my analysis and perspective on Apple throughout the week via exclusive daily emails (2-3 stories a day, 10-12 stories a week). To sign up, visit the membership page.

Analyzing the iPhone User Base - Above Avalon Premium Recap

The following article was sent to Above Avalon members on May 19th, 2015.

Analyzing the iPhone User Base

One data point that I find increasingly important to keep track of is the current iPhone user base. This information isn't just useful when talking about the iPhone upgrade cycle, but it becomes critical when referring to adoption rates for services such as Apple Pay, and soon, Apple Music, and Apple's video streaming service.

Apple is actually somewhat good about disclosing financial information, or at least the right kind of data to reach educated estimates about most pieces of its business. You just need to have all the pieces of the puzzle in hand.

Last month, Tim Cook said on Apple's earnings call that 20% of the "active [iPhone] installed base" had upgraded to the iPhone 6 and 6 Plus. This data point compares to Cook's commentary back in January that approximately 13-14% of the iPhone installed base had upgraded (his exact quote was "mid-teens" or "barely in the teens").

Since we know Apple sold 61 million iPhones last quarter, we make an assumption as to what percent of the total were iPhone 6 and 6 Plus. I have long felt that 80% of total iPhone sales is a fair estimate for the newest iPhone model(s) on the market. Therefore, I estimate approximately 48 million iPhone 6 and 6 Plus units were sold January through March.

Running basic arithmetic with that 48 million number and Tim Cook's comments about the installed base, I get an iPhone installed base of approximately 475 million users. Is this an exact number? No. Is this a good estimate of roughly the number of people with an iPhone (all models)? Yes.

With this estimate in hand, we can start to break out the iPhone base by model. iPhone 6 has been outselling 6 Plus by approximately 2.5x, while both have been outselling the iPhone 5s and 5c by nearly 4-to-1. Taking into account these ratios, I suspect the current iPhone user base breakout looks something like:

iPhone 6: 85 million users

iPhone 6 Plus: 35 million users

Older (5s, 5c, 5, 4s): 355 million users

Total: 475 million users

That 355 million user base of iPhone 5s and older phones represents the key number to look at when determining the prime market for iPhone owners looking to upgrade to a new iPhone this coming fall. But 355 million is still a very big number. Using Fiksu data and adjusting for its U.S. and Eurocentric tendencies, my best estimate of the current iPhone user base is:

iPhone 6: 85 million users

iPhone 6 Plus: 35 million users

iPhone 5s: 125 million users

iPhone 5c: 50 million users

iPhone 5: 80 million users

iPhone 4s: 60 million users

iPhone 4 and earlier: 40 million users

Total: 475 million users

There is a lot that can reached by using that data, but I struggle seeing how someone can look at that breakout and not think similarly to Tim Cook when he says there is still a significant number of iPhone users in the market for an iPhone upgrade. Then take into account Apple's growing presence in China, and you can start to see how Apple can realistically sell more than 250 million iPhones in FY2016 (they are on track to sell 230 million in FY2015).

Bonus: One easy way to come up with a quick geographical mix of iPhone sales? If the number of iPhones sold in Greater China now outpaces the U.S., we know the U.S. has represented a consistent 35-40% of total Apple sales. That would suggest iPhone sales mix is something like: Greater China 37%, U.S. 35%, Other 28%.

In addition to the preceding post, Above Avalon members received the following articles this past week (100 percent related to Apple):

- Apple and Uber Well-Positioned to Lead Automobile Industry

- Apple and Auto Industry M&A

- Icahn Invests in Lyft

- Carl Icahn is Still on Tim Cook's Side

- Spotify Wants Your Time

- Apple Television Plans Put On Ice

- Weak Apple Watch Demand?

- Android Switchers

- Verizon/AOL vs. Apple

- Clinkle Turned Down Apple's Acquisition Offer?

- Apple Buys a GPS Company

- Tony Fadell is Concerned about Wearables Battery Life

Become a member ($10/month or $100/year) to read these stories and 2-3 new stories each day via an exclusive email (10-12 stories/week). A weekly email option is also available. In the process, you will also be supporting Above Avalon and receiving priority email access. Your support is greatly appreciated. For more information and to sign-up, check out the membership page.

Uber, Not Tesla, Will Be Apple's Competition in the Automobile Industry

We are quickly approaching a pivotal moment in Apple's history as technology and mobile are on a collision course with the automobile. While most would conclude Elon Musk's Tesla and a few of the strongest automakers are the leading contenders of this new automobile era, Apple and Uber are the two companies best positioned to rule the new era of the automobile.

The Auto Industry Is Ripe for Change

Timing is everything. A few years too early and even the best product will fail to catch on with the consumer, while a few years too late and the best product will likely have already shipped. We are quickly moving towards a period where the auto industry is positioned for change.

Many are still not convinced Apple will enter the automobile industry because of doubt Apple can come up with a product that leapfrogs the best-ranked vehicle on the road today: Tesla's Model S. The problem with that thinking is that "better," when thinking about the future automobile, won't be defined by performance such as battery range, speed or acceleration. Instead, the primary innovation that will hit the auto industry will be shifting dynamics in which power moves from traditional auto manufacturers and car dealerships to technology companies that empower the consumer. Convenience and personalization will outweigh traditional performance metrics.

To rethink the automobile, one has to attack the current industry structure. Apple has had prior success with rethinking the way industries operate. The iPod, despite a revolutionary input method, did not become a mass-market success until Apple convinced the music industry to move to a $0.99 per song download model for long-term survival. The iPhone's biggest innovation may have been shifting the balance of power in the mobile phone industry from the carriers to Apple, something few analysts and pundits thought was possible. At the end of the day, Apple was able to position its products as the catalysts of change. This same type of "breakthrough" moment will occur in the automobile industry. Owning the manufacturing infrastructure capable of producing millions of cars will shift from a source of power to a liability. Instead, the power in the automobile industry will be found by the company owning the mobile ecosystem that empowers the consumer.

While many think Tesla is pushing the envelope in terms of altering the automobile industry, a closer analysis would reveal that Tesla is actually largely residing within the same structure, facing identical limitations to any other automaker, especially in terms of capital requirements and growth. Instead, companies like Uber are not only positioned to wreak havoc in the auto industry, but they are already causing much change. Uber isn't just a ridesharing app, but an aggregated demand phenomenon. Said another way, Uber is using the smartphone to match demand and supply for automobiles efficiently and cheaply. Uber is not alone as Lyft, its closest competitor, has seen some levels of success as well.

Many assume Uber will be the best taxi service in the world, but there are more important underlying trends taking place in the auto market. The automobile's value proposition is changing and few current automakers will be able to respond and remain relevant. Apple's ability to build experiences around style and a thriving ecosystem and Uber's ability to shift power back to the consumer represent the changes that will shake up the auto market the most since the Model T's introduction in the early 1900s.

Using the Model T to Determine the Future

Henry Ford had a very simple goal with the Model T: set the world free. Up to then, personal transportation was for the rich and privileged, which severely limited society's potential. The Model T was cheap, reliable, and utilitarian. These attributes were seen just by looking at the vehicle and its high-quality parts and high ground clearance to navigate a world with very few paved roads. Ford sold the Model T for the equivalent of what is around $5,000-$10,000 in today's dollars (the average price for a new car today is $33,000), a byproduct of pricing the automobile low to stoke demand, thereby making it cheaper to produce through economies of scale.

1917 Ford Model T Photo courtesy (Boldride).