Apple Buys Satellite Capacity, Apple and Starlink, Apple’s Satellite Ambition (Daily Update)

Hello everyone.

Happy Thursday.

One quick update regarding Dark Sky, the popular paid iOS weather app acquired by Apple in 2020.

The app will be shut down on January 1st, 2023. The following message is now posted within the app:

Apple's acquisition set off a wave of worries and angst in weather app land. Check out the daily update from April 1st, 2020 for my detailed thoughts on the acquisition.

Since then, Apple announced that it was including Dark Sky’s tech within its own weather app while making the Dark Sky API available to third-party app developers via WeatherKit. This matched my expectations for what Apple would do. Dark Sky is looking like a very intelligent acquisition at what was likely a very attractive price.

Apple Buys Satellite Capacity

“Apple Inc on Wednesday selected Globalstar Inc as its partner for a feature that would allow iPhone 14 users to send emergency messages from remote locations.

The tech giant said it was dedicating $450 million from its advanced manufacturing fund toward satellite infrastructure to support the feature. GlobalStar will receive the majority of the funding, but the iPhone maker did not specify which other players will receive the rest and in what form.

While Apple will pay for 95% of the approved capital expenditure for the new Globalstar satellites needed to support the service, Globalstar said it would still need to raise additional debt to construct and deploy the satellites.

Globalstar, which makes low-earth orbit (LEO) satellites, said it had tapped investment bank Goldman Sachs & Co and expects to complete a financing in the fourth quarter of 2022.

LEO satellites operate 36 times closer to the earth than traditional ones and hence take less time to send and receive information, leading to faster broadband service even in remote areas."

According to Globalstar, which has dozens of LEO satellites and 24 ground stations, its deal with Apple is “transformational.”

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Thoughts on iPhone 14 and 14 Pro Pre-orders, Garmin Trolls Apple, Apple Watch Ultra Battery Life (Daily Update)

Hello everyone.

One clarification regarding iPhone 14 Plus. In yesterday’s update I wrote:

“The iPhone 14 Plus finds itself in a pricing canyon. It’s the third-most expensive iPhone, after iPhone 14 and iPhone SE. However, it’s just $100 less than the 6.1-inch iPhone 14 Pro.”

That should have said "It’s the third-least expensive flagship iPhone.” The broader point is unchanged - the iPhone 14 Plus finds itself in a weird spot within the iPhone line.

With that, let’s jump right in.

Thoughts on iPhone 14 and 14 Pro Pre-orders

Here is the current delivery dates for the iPhone 14 flagships (U.S.):

iPhone 14 (Sept 20 to 21) – available Sept 16th

iPhone 14 Plus (Oct 7) – available Oct 7th

iPhone 14 Pro (Oct 13 to 20) – available Sept 16th

iPhone 14 Pro Max (Oct 20 to 27) – available Sept 16th

Apple has embraced an underpromise and overdeliver mantra when it comes to delivery estimates for online orders. Delivery dates almost always end up being pulled forward. This may explain why delivery dates aren’t dependent on iPhone finish color or storage. Apple may be simply providing an estimated delivery range for each model that it is confident it will not just meet but exceed.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Deconstructing Apple’s “Far Out” Presentation (Part 2) - Daily Update

Hello everyone.

In today’s update, we will wrap up my Apple event review. As a recap, last Thursday we went over my initial impressions regarding event highlights. Yesterday, we talked about the Apple Watch in greater detail. We will now go over AirPods Pro, Fitness+, and iPhone.

Before we jump into today’s update, there is one additional observation from attending the Apple event that was worth sharing.

I couldn’t help but notice how Phil Schiller was walking around the product demo area for what seemed like an extended period.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Deconstructing Apple’s “Far Out” Presentation (Part 1) - Daily Update

Hello everyone.

Welcome to a new week.

We will continue my Apple event review. Last Thursday, we went over the event highlights that jumped out at me. Our attention will now shift to more granular topics.

In today’s update, we will focus primarily on Apple Watch. In tomorrow’s update, we will talk about iPhone, AirPods, and any other remaining topics that deserve to be talked about. Instead of just going through the laundry list of announcements, we will focus will on the why behind Apple's announcements.

Prioritization

Over on Apple's Events page, the company listed the following products/features unveiled at last week’s “Far Out” event:

iPhone 14 Pro (Dynamic Island / safety features / upgraded camera)

iPhone 14 (new Plus size model and better battery life / safety features / low-light photography)

AirPods Pro (ANC and adaptive transparency / personalized spatial audio / better battery life)

Apple Watch Ultra (rugged / capable)

Apple Watch Series 8 (“future of health” = advanced cycle tracking / Crash Detection / Workout app enhancements)

Apple Watch SE ("more capability and an even lower price")

Apple Fitness+ (will be available to all iPhone users)

For iPhone, cameras and processors were not positioned as the most important new features for this year’s flagships. Instead, additional screen real estate with the new Plus model and changes to Pro screens with Dynamic Island were the two big new features. Apple positioned

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Apple Event Highlights (Daily Update)

Hello everyone.

The plan is to go over some of the major highlights / takeaways from Apple’s “Far Out” event. We will focus on the details on Monday.

Let’s jump right in.

Attending the Event

This was the first full-blown in-person product unveiling that Apple has held in three years. WWDC was in some ways a trial run.

There were some changes from prior events.

Security was noticeably tighter with metal detectors in use for the first time (at least that I recall).

All visitors needed to submit a negative COVID test.

The presentation shown in Steve Jobs Theater was taped instead of taking live on stage.

The more interesting takeaway for me was how natural it felt to watch a taped presentation in Steve Jobs Theater. It felt just like any other prior event. Much of that was due to Apple’s taped presentations being superior to traditional onstage keynotes. Apple is able to do so much more from a production standpoint with taped presentations. Tim Cook went on stage at the beginning with a few words about how these events are ultimately about people coming together. There is much truth with that statement. Going forward, the taped presentation shown at Steve Jobs Theater format works. In many ways, it’s like a movie premiere.

About the Rumors

The Apple rumor beat has changed. Apple has seen success in going after leaks and security holes. Whatever remains doesn’t have the same kind of cohesiveness and punch as before.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Thoughts Heading Into Apple’s “Far Out” Event (Daily Update)

Hello everyone.

As a reminder, this email is meant for Tuesday. It’s being published early to avoid some scheduling conflicts.

Let’s jump right in.

Thoughts Heading Into Apple’s “Far Out” Event

My expectation is that Apple’s “Far Out” event on Wednesday will primarily be an iPhone and Apple Watch event. That means those two product categories will receive the bulk of the presentation time and post-event analysis.

Given Apple’s expanding ecosystem and the company’s efforts at maintaining robust update schedules for its product line, it’s not unreasonable to assume we will also receive an update or two regarding other Apple products and services.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Disney Considering Memberships, Apple One’s Strategic Value, More Details About Netflix’s Upcoming Ad Tier (Daily Update)

Hello everyone. Welcome to September.

As of now, my expectation is that Tuesday’s update will be published late on Monday (ET). It will be dedicated to going over my thoughts and expectations heading into Apple’s “Far out” product event.

Let’s jump into today’s update.

Disney Considering Memberships

Over at the WSJ, here are Jessica Toonkel and Sarah Krouse:

“Walt Disney Co. is exploring a membership program that could offer discounts or special perks to encourage customers to spend more on its streaming services, theme parks, resorts and merchandise, according to people familiar with the discussions.

The program would be somewhat akin to Amazon Prime, which offers advantages such as free shipping, discounts at Whole Foods and a complementary streaming video service for a monthly or annual fee, the people said. Internally, some executives have referred to Disney’s initiative as ‘Disney Prime,’ although that won’t be the name of the program, one of the people said.

Discussions at Disney are in the early stages. It couldn’t be learned how much the company would charge for membership and how long it would take to launch such a program.

By creating a membership program, Disney would be betting it could offer customers more value, prompting them to spend more on the company’s products and services, while providing Disney with a trove of information about their preferences.

The effort is supported by Disney Chief Executive Bob Chapek, who has been vocal both internally and publicly about the opportunity for Disney to do more to cross-sell to customers, the people familiar with the discussions said."

Disney provided a statement to the WSJ confirming that it is indeed exploring a membership program. The WSJ also claims that Disney has “studied” Apple One in terms of coming up with its own membership program.

My first reaction after reading this story this morning was “it’s about time.” My next thought was wondering if they would call it “Disney One” to signify having various Disney experiences available in one place.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Apple Gives Up Didi Board Seat, Snap Announces Major Pullback, Gauging Snap as an M&A Target (Daily Update)

Hello everyone. We will begin today’s news with a Didi update. It’s been a number of years since we last talked about the ridesharing company in China. The discussion will then turn to Snap.

Let’s jump right in.

Apple Gives Up Didi Board Seat

Over at Bloomberg, here are Lisa Du and Mark Gurman:

“An Apple Inc. executive has left the board of Didi Global Inc., as the Chinese ride-hailing company struggles to regain ground it lost during Beijing’s crackdown on the country’s internet sector.

Adrian Perica, Apple’s vice president of corporate development, has resigned from Didi’s board, according to a one-sentence release posted on Didi’s website this month. Didi didn’t respond to requests for comment. Apple declined to comment.

The departure of Perica, who also heads Apple’s mergers and acquisitions strategy, follows a tumultuous year for Didi. Since the company went ahead with a US initial public offering against Beijing’s wishes in June last year, Didi’s app has been pulled from China’s mobile stores, preventing meaningful growth and erasing more than 80% of its market value.”

Here’s a screenshot of what may be the shortest press release I’ve come across to date:

It took nearly a month for a U.S. publication to notice the resignation.

Perica joined Didi’s board in 2016 as part of Apple’s $1B investment in the company at a $26B valuation.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Roku Losing Flexibility, YouTube Quietly Unveils Podcast Homepage, Big Ten Passes Over Apple (Daily Update)

The following update was sent to members on August 30th.

Hello everyone.

One quick clarification and then a programming alert.

Clarification. Regarding yesterday’s discussion, Apple offers three months of TV+ with qualifying Apple hardware purchase. That is a promotion with specific language tied to availability and qualifications. Apple does not offer a blanket promotion in which Apple TV+ is given to free to all Apple device owners.

Programming Alert. Over at my other website, Inside Orchard, this week’s essay (Roku's Bad Bet) was focused on why I think Roku is experiencing fallout from one bad bet that it placed regarding its place in streaming. Inside Orchard is home to my perspective and ideas on the tech industry that don’t quite fit with Above Avalon. You can think of them as sibling sites. As a reminder, Above Avalon members can bundle an Inside Orchard subscription with their membership and receive a 50% discount in the process. Judging from the increasing percentage of members who have the bundle, it’s a pretty compelling offer.

In today’s update, we will begin with Roku. My focus is on the company’s most recent earnings report and a read-through to Apple.

Roku Losing Flexibility

Here’s Roku founder and CEO Anthony Wood in the company’s 2Q22 shareholder letter released at the end of July:

“In Q2, there was a significant slowdown in TV advertising spend due to the macro-economic environment, which pressured our platform revenue growth. Consumers began to moderate discretionary spend, and advertisers significantly curtailed spend in the ad scatter market (TV ads bought during the quarter). We expect these challenges to continue in the near term as economic concerns pressure markets worldwide. In response, we took steps in Q2 to significantly slow both operating expense and headcount growth.”

The macro environment is serving as a cover for what is likely underlying deterioration in Roku’s business model due to changing industry dynamics. Instead of going over various numbers and percentages tied to 2Q22, here are three key takeaways from Roku's earnings release that jumped out at me:

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

An Upcoming Flood of TV Content, Netflix Mulls Pricing for Ad Tier, Apple TV+ Pricing Strategy (Daily Update)

The following update was sent to members on August 29th.

Hello everyone. Let’s jump right into a new week of updates.

An Upcoming Flood of TV Content

“Since 2016, the veteran US television executive John Landgraf has been predicting the arrival of ‘peak TV’ — the moment when the number of new scripted shows reaches an all-time high.

The streaming boom has proved him wrong every time but he gamely made the prediction again this month, telling guests at the Television Critics Association press tour that 2022 would mark ‘the peak of the peak TV era’.

Landgraf, chair of Disney’s FX network, conceded that he could be wrong this time too. But there is little doubt that this autumn will present audiences with a flood of some of the most expensive television ever produced.”

It’s not good to be known as the prognosticator of peak TV. There is no question that streaming has led to the overall video pie getting larger. While we may see a temporary plateau in the number of scripted shows produced, betting on peak TV is basically betting against video. That’s not an attractive bet to me.

An offshoot to Landgraf’s “Peak TV” theory does intrigue me though.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Apple Sends Out Event Invites to Media, Peloton Is Imploding, A Peloton and Amazon Tie-up? (Daily Update)

The following update was sent to members on August 25th.

Hello everyone. Let’s jump right in.

Apple Sends Out Event Invites to Media

Yesterday, Apple sent out media invites for an in-person event at Steve Jobs Theater to be held on Wednesday, September 7th. It’s been three years since Apple last held a full-fledged in-person product event at Steve Jobs Theater.

Apple’s approach to WWDC was likely a test run for what is in store on September 7th. Apple will welcome press/media/analysts/VIPs/employees to Steve Jobs Theater to enjoy breakfast/refreshments. Guests will then be led to Steve Jobs Theater where Tim Cook will get on stage to welcome everyone. This will be directly followed by Apple playing a taped presentation. Afterwards, the press will be able to check out the new products in the demo area. Apple may even start the taped presentation a few minutes earlier for guests to encourage press liveblogging on social media.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Revisiting the HomePod Discontinuation, Sonos Earnings, Smart Speakers Getting Squeezed (Daily Update)

The following update was sent to members on August 24th.

Hello everyone. A good way to get back into the swing of things is to talk more about HomePod. The discussion will include a look at the latest earnings report from Sonos and a broader theory of mine regarding smart speakers.

Let’s jump right in.

Revisiting the HomePod Discontinuation

The most recent Above Avalon Report was dedicated to Apple’s HomePod discontinuation, a decision that is still surrounded by many unanswered questions.

In a development that likely deserves its own report, we have seen Apple very recently go down the path of discontinuing a few products (iMac Pro / iPod). While each discontinuation has its own story and surrounding circumstances (the company did embrace a product strategy shift a few years back), the HomePod discontinuation stands out to me as being the most peculiar.

Member reactions to the report came in swiftly. Some agreed with my experience that the HomePod was a very impressive product – one of the most impressive Apple has shipped in years. Others raised concerns with how their HomePod(s) produced a feeling of “never [being] in control of the device.” Additional issues cited included connectivity problems, headaches with needing to restart and update the units, and just an overall uncharacteristic unevenness in experiences. That last item is interesting as the HomePod, in addition to the HomePod mini, are indeed different products when thinking of how they are designed to be used in communal settings while Apple Watch, AirPods, iPhone, etc. are designed for one-to-one settings.

One comment in particular though stood out to me.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

HomePod: The Discontinuation That Still Has Unanswered Questions (Above Avalon Report)

An examination of the run-up, decision, and fallout related to Apple’s most curious product discontinuation.

Written by Neil Cybart

In March 2021, Apple discontinued the original HomePod with the stated reason of focusing on the HomePod mini. The decision was a curious one, not only because Apple rarely discontinues products, but also the HomePod mini is an all-around inferior product in comparison to the HomePod.

More than a year later, all of the questions related to Apple’s decision to discontinue HomePod remain just as valid today. The HomePod was one of the more impressive products Apple had shipped in years. The stellar music listening experience obtained by pairing two HomePods together remains an eye-opening experience. It’s hard to imagine Apple executives have replaced original HomePods in their homes with HomePod minis.

HomePod may be up there as the most questionable product discontinuation in modern Apple. In its quest to say no much more often than yes, the HomePod may have fallen victim to Apple’s focus culture.

The Stationary Smart Speaker Market

In the late 2010s, we experienced a stationary smart speaker mirage. Companies were using smart speakers to take advantage of an awkward phase of technology in which there didn’t seem to be any clear direction as to where things were headed.

An Above Avalon membership is required to continue reading this report. Members can read the full report here. An audio version of this report is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Reports are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

Member Privileges and Benefits

Receive Exclusive Daily Updates. The cornerstone of Above Avalon membership is access to Neil’s exclusive daily updates about Apple. Updates are sent via email and go over current news and developments impacting Apple, its competitors, and the industries Apple plays in (or will play in). Approximately 200 daily updates are published throughout the year. Sample daily updates can be viewed here, here, and here.

Receive Exclusive Reports. Members have access to Neil’s reports, which are in-depth examinations of Apple's business, product, and financial strategy.

Access Private Podcasts. Members have the option of attaching a podcast add-on to their membership in order to receive the daily updates and reports in audio form.

Access Neil’s Earnings Model. Members have access to Neil’s working Apple earnings model (an Excel file that also works in Numbers). The model is fully functional and adjustable and provides the ability to alter earnings drivers.

Email Priority. Receive priority when it comes to having email questions and inquiries answered. Neil personally answers all inquiries, including customer service matters related to your membership.

Archive Access. Read 1,200+ daily updates and reports that have been previously sent to members. The Above Avalon member archive is unmatched in the marketplace in terms of the sheer amount of Apple analysis found in one location. The daily updates archive can be viewed here while the reports archive is available here.

Member Forum Access. Join other Above Avalon members in an active forum containing in-depth discussion and debate. Neil moderates and participates in the forum. The forum is run through Slack and can be accessed here.

Virtual Meet-ups. Talk with Neil about Apple and other related items in virtual meet-ups held via Slack throughout the year.

Above Avalon Support. Play an active role in supporting Above Avalon as an independent source of Apple analysis. Above Avalon is fully sustained by its members.

Apple FY3Q22 Earnings Recap

Two weeks ago, Apple reported a solid FY3Q22 (April to June) given the tough year-over-year compare and considerable FX headwind. In terms of good news, supply chain issues, component shortages, and COVID-related headwinds appear to have bottomed for Apple. When it comes to bad news, some parts of Apple’s business are getting hit by inflation and slowing economic growth more than others.

Here are Apple’s reported 3Q22 results versus my expectations with brief commentary for each item.

Revenue: $83.0 (vs. my $85.9B estimate). Results missed my estimate due to a larger than expected headwind from FX, a larger than expected supply shortage with Mac, and macro issues impacting Wearables, Home, and Accessories.

EPS: $1.20 (vs. my $1.25).

iPhone revenue: $40.7B (vs. my $39.9B). That’s a good iPhone revenue number that doesn’t raise any yellow or red flags to me.

Services revenue: $19.6B (vs. my $20.1B). Results missed primarily on a larger than expected headwind from FX.

Wearables / Home / Accessories revenue: $8.1B (vs. my $9.4B). This was a weak number which Apple attributed to a “cocktail of headwinds.”

Mac revenue: $7.4B (vs. my $8.9B). Apple experienced major issues with supply as the Mac was the product category impacted the most by COVID lockdowns closing factories in China.

iPad revenue: $7.2B (vs. my $7.6B). Apple experienced ongoing issues with iPad supply.

Overall gross margin: 43.3% (vs. my 43.3%)

Services gross margin: 71.5% (vs. my 72.0%)

Products (HW) gross margin: 34.5% (vs. my 34.5%)

Breaking down the $2.9B revenue miss to my estimate, there were two primary drivers:

$1.5B revenue miss due to Mac supply not being as good as thought.

$1.3B revenue miss due to weaker Wearables, Home, and Accessories.

Even though Apple missed my (elevated) expectations, the company reported a 3Q22 beat to consensus as revenue came in about $2B stronger than sell-side analysts were expecting. The beat was due to stronger iPhone revenue as most analysts were expecting something more like $36B to $38B of iPhone revenue (vs. the $40.7B reported figure). EPS came in $0.04 above consensus as Apple’s margins came in slightly better than consensus thought as well.

An Above Avalon membership is required to continue reading this article. Members can read the full article here.

The full article includes the following sections:

Apple’s 3Q22: The Key Numbers

iPhone Sales Resiliency

Apple Ecosystem Growth Slows

Reading Between the Lines of Apple’s 3Q22 Earnings Q&A With Analysts

Notes From Apple’s 3Q22 10-Q

Tracking Apple’s Paid Subscriptions

Apple's Share Buyback Update

My Revised Apple Financial Estimates

An audio version of the article is available to members who have the podcast add-on attached to their membership. More information about the add-on is found here.

Above Avalon Membership

Become a member by using the following signup forms (starting at $20 per month or $200 per year).

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

Apple's WWDC 2022 (Daily Updates Recap)

Earlier this month, I flew out to Cupertino to attend Apple’s in-person WWDC event.

The best way of describing the event at Apple Park was Apple getting back into the swing of hosting in-person events. Excluding the masks and hand sanitizer stations, it felt like a usual in-person Apple event. There was a waiting area for press, hundreds of Apple Retail greeters with an infectiously-positive mood, and a product demo area for the media following the keynote.

My estimate is there were 200 to 250 members of the press and media in attendance, including some international press. That’s a smaller crowd that usual. As for developers, there were approximately 1,000. In terms of Apple employees, my best count was that 2,000, possibly even as many as 2,500, watched the keynote.

The event also served as Apple’s first “open house” for its massive circular ring building at Apple Park. All prior Apple Park events for the press took place at Steve Jobs Theater which is located on the other side of Apple Park. For those events, Apple was careful not to have any visitors stray to other parts of the campus.

The Ring at Apple Park (Above Avalon)

The keynote viewing area, as shown below, was intelligently thought out. Apple opened the giant glass walls found in the employee cafeteria to create an indoor / outdoor venue. This served as an adequate solution for getting a lot of people out of the sun. As for those who were baking in the sun, they were given more comfortable, beach-style chairs in return. For the first time, the best seats in the house at an Apple keynote were in the middle of the audience, seated in the shade.

Inside The Ring at Apple Park (Above Avalon)

Interestingly, Apple began airing the taped keynote three minutes earlier than the public streaming. The delay seemed intentional, possibly as a way to encourage live blogging / tweeting since there didn’t seem to be any other reason for starting it early. The largest screen that Apple relied on to show the presentation was shockingly good – the clearest big screen I have ever come across, while the sound system made it seem like I was in an indoor event.

As for why Apple went through the trouble of having ~1,000 developers come on campus despite having an all-virtual WWDC with labs and sessions occurring online, the company missed the community aspect that had become a WWDC tradition. There are clear benefits found with having a virtual WWDC, such as a significant increase in accessibility. However, the face-to-face interactions and social elements that developers experience have been sorely missed the past two years.

My suspicion is that Apple will rely on the event structure again, including in September with the upcoming product event. Apple likely hopes it will be able to host the event inside Steve Jobs Theater. All-in-all, the format worked well, with meticulous planning and preparation throughout. Apple has gotten really good at putting on these massive events. More importantly, an event structure reminiscent of a movie premiere offers a good combination of virtual benefits such as the well-polished taped presentation with animated transitions that can never be replicated in real time and in-person perks like a product demo area.

An Ecosystem Event

WWDC is all about software updates with new hardware sprinkled in from time to time. As Tim Cook put it when concluding the keynote: “[W]e pushed our software platforms forward in some incredible new ways. Introducing features and capabilities that will enable our developers to do amazing work and provide our users with exciting new experiences."

A different way of thinking about WWDC is that it’s Apple’s annual ecosystem event – the one time each year when Apple shows how it is pushing its entire ecosystem forward.

An Above Avalon membership is required to continue reading this article. Members can read the full article here.

The full article includes the following sections:

Attending the Event

An Ecosystem Event

iOS 16 Takeaways

The New MacBook Air

The iPadOS vs. macOS Debate

The Big Surprise Found With Apple Pay Later

Revisiting Apple’s Credit Kudos Acquisition

CarPlay Mistruths

My Full Notes from the Keynote

Winners and Losers From WWDC 2022

An audio version of the article is available to members who have the podcast add-on attached to their membership. More information about the add-on is found here.

Above Avalon Membership

Become a member by using the following signup forms ($20 per month or $200 per year).

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

Member Privileges and Benefits

Receive Exclusive Daily Updates. The cornerstone of Above Avalon membership is access to Neil’s exclusive daily updates about Apple. Updates are sent via email and go over current news and developments impacting Apple, its competitors, and the industries Apple plays in (or will play in). Approximately 200 daily updates are published throughout the year. Sample daily updates can be viewed here, here, and here.

Receive Exclusive Reports. Members have access to Neil’s reports, which are in-depth examinations of Apple's business, product, and financial strategy.

Access Private Podcasts. Members have the option of attaching a podcast add-on to their membership in order to receive the daily updates and reports in audio form.

Access Neil’s Earnings Model. Members have access to Neil’s working Apple earnings model (an Excel file that also works in Numbers). The model is fully functional and adjustable and provides the ability to alter earnings drivers.

Email Priority. Receive priority when it comes to having email questions and inquiries answered. Neil personally answers all inquiries, including customer service matters related to your membership.

Archive Access. Read 1,200+ daily updates and reports that have been previously sent to members. The Above Avalon member archive is unmatched in the marketplace in terms of the sheer amount of Apple analysis found in one location. The daily updates archive can be viewed here while the reports archive is available here.

Member Forum Access. Join other Above Avalon members in an active forum containing in-depth discussion and debate. Neil moderates and participates in the forum. The forum is run through Slack and can be accessed here.

Virtual Meet-ups. Talk with Neil about Apple and other related items in virtual meet-ups held via Slack throughout the year.

Above Avalon Support. Play an active role in supporting Above Avalon as an independent source of Apple analysis. Above Avalon is fully sustained by its members.

The iPhone Mini (Above Avalon Report)

An analysis of Apple’s iPhone mini strategy including the model’s lukewarm reception with consumers and difficult time competing against the iPhone SE.

Written by Neil Cybart

The iPhone business is booming. Unit sales are estimated to be at record highs (~270 million units per year) while average selling prices remain at healthy levels ($750+). No Android alternative comes close to matching the iPhone’s success. A major contributor to the iPhone’s success over the years, both in terms of sales and installed base growth, has been Apple’s intelligent approach at diversifying the iPhone line based on feature set and price. Selling a range of iPhone models, including the iPhone mini, has played a key role in Apple reaching a larger customer base.

History

Apple’s iPhone model expansion strategy started relatively straightforward and early on.

An Above Avalon membership is required to continue reading this report. Members can read the full report here. An audio version of this report is available to members who have the podcast add-on attached to their membership. More information about the add-on is found here.

(Members: Reports are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

Member Privileges and Benefits

Receive Exclusive Daily Updates. The cornerstone of Above Avalon membership is access to Neil’s exclusive daily updates about Apple. Updates are sent via email and go over current news and developments impacting Apple, its competitors, and the industries Apple plays in (or will play in). Approximately 200 daily updates are published throughout the year. Sample daily updates can be viewed here, here, and here.

Receive Exclusive Reports. Members have access to Neil’s reports, which are in-depth examinations of Apple's business, product, and financial strategy.

Access Private Podcasts. Members have the option of attaching a podcast add-on to their membership in order to receive the daily updates and reports in audio form.

Access Neil’s Earnings Model. Members have access to Neil’s working Apple earnings model (an Excel file that also works in Numbers). The model is fully functional and adjustable and provides the ability to alter earnings drivers.

Email Priority. Receive priority when it comes to having email questions and inquiries answered. Neil personally answers all inquiries, including customer service matters related to your membership.

Archive Access. Read 1,200+ daily updates and reports that have been previously sent to members. The Above Avalon member archive is unmatched in the marketplace in terms of the sheer amount of Apple analysis found in one location. The daily updates archive can be viewed here while the reports archive is available here.

Member Forum Access. Join other Above Avalon members in an active forum containing in-depth discussion and debate. Neil moderates and participates in the forum. The forum is run through Slack and can be accessed here.

Virtual Meet-ups. Talk with Neil about Apple and other related items in virtual meet-ups held via Slack throughout the year.

Above Avalon Support. Play an active role in supporting Above Avalon as an independent source of Apple analysis. Above Avalon is fully sustained by its members.

Introducing New and Improved Above Avalon Reports

In 2018, I unveiled Above Avalon Reports as a way to go deeper into Apple topics for Above Avalon members. Reports were designed to have a long shelf life and be used as reference material that members can periodically turn to. Five reports were published to date, and each received very positive member feedback. The top request has been more reports.

I’m excited to unveil Above Avalon Reports 2.0, which both addresses some improvements to the reports format and introduces a few new concepts. The updates include:

A leveraging of the daily updates back catalog. Since 2015, more than 1,200 daily updates have been published. That amounts to approximately 35 books worth of analysis and perspective. It’s an incredible back catalog that has proven to have a long shelf life. However, the back catalog can be overwhelming to navigate. Reports are going to tackle this problem by purposely covering core topics that we have talked about in prior updates over the course of months and maybe even years. A few sample topics that fall under this bucket will include AAPL valuation trends, Apple’s TV strategy, gauging Apple Watch competition, Project Titan 101, and Mixed Reality 101.

More approachable (i.e. shorter) and frequent reports. With the initial round of reports, word count and publication date became arbitrary targets. Going forward, reports will be as long as they need to be in order to properly cover a topic. This will result in more frequent reports as well.

The tackling of new topics. In addition to covering topics that we have previously discussed in the updates, reports will also include topics that wouldn’t make as much sense for the daily updates format. These reports will likely be narrower in focus and shorter in length.

Easier-to-find reports. Daily updates have their own dedicated Slack channel. Reports will now get the same. Reports will also be featured more prominently on AboveAvalon.com. This will make it easier for members to access reports while potential members are made aware of what members have access to.

Accessible to All Members

It was important to me to keep Above Avalon Reports accessible to all members. Accordingly, reports will remain free for Above Avalon members.

The daily updates are a great way to discuss current news and developments impacting Apple, its competitors, and the industries Apple plays in (or will play in). Reports will be a great way to showcase my analysis and research on all things Apple that may not necessarily have a connection to the current news cycle. While I think the daily updates will remain the cornerstone of Above Avalon membership, my expectation is that some members will look at Reports as the gem found with an Above Avalon membership.

Become a member by using the following signup forms ($20 per month or $200 per year).

Payment is hosted and secured by MoonClerk and Stripe. Apple Pay is accepted. You will receive a confirmation email that includes a link allowing you to update your payment information and membership status at any time.

New Private Podcast for Reports

Something new that I am introducing is the option to receive Above Avalon Reports in audio form via a new private podcast. Once a written report has been sent out to all members via email, I will also be releasing an audio version of the report. This audio version will involve me reading through the report as well as explaining and talking through charts, exhibits, and tables. Each report will represent an episode of a new podcast that I am appropriately calling “Above Avalon Reports”. My expectation is that I will also record behind-the-scenes episodes that go over my research and perspective that didn’t make the final cut for publication.

This new private podcast will be made available to Above Avalon members who have attached the podcast add-on to their membership. This means the podcast add-on will now provide members access to two private podcasts:

Above Avalon Reports (for the reports)

The podcast add-on (just $10 per month or $100 per year) offers approachability and accessibility for members looking to customize their membership to their liking. Listen to daily updates and reports around the house, on a walk, or in the car. Receive more than 40 hours of audio per year while gaining access to a back catalog of 60 additional hours of analysis.

Transistor is handling the behind-the-scenes mechanics for distributing the private podcasts so that they can be listened to in various podcast players including Apple Podcasts and Overcast. The set-up process is very simple:

Upon purchasing the podcast add-on, you will receive an email (from “Neil Cybart via Transistor”) that directs you to a signup page listing various podcast players that can be used to listen to the podcast. Open the page on an iPhone, and you will see various iOS podcast players. Open the page on a Mac, and you will see options for listening to the podcast on a Mac.

After you select your preferred podcast player, new Above Avalon Reports episodes will automatically appear in your podcast feed as they are published.

That’s it. There is no need to create a separate login, password, or Transistor profile. In the vast majority of cases, there is no need to even copy or paste a link or RSS feed.

To become a member and have the podcast add-on attached to your membership, use the following signup forms:

Payment is hosted and secured by MoonClerk and Stripe. Apple Pay is accepted. You will receive a confirmation email that includes a link allowing you to update your payment information and membership status at any time.

If you are already an Above Avalon member, fill out this form to get the podcast add-on.

Big Picture

A growing number of sites that rely on paid subscription or membership business models are making their best material free and then treating membership features like exclusive posts and newsletters as “extras.” I’ve been building Above Avalon to be something different. Over the past few years, nearly all of my time and effort has been dedicated to exclusive analysis for members. In the coming weeks, I make a more deliberate effort to show non-members the value and content found with Above Avalon membership. A surprising number of people who read and listen to Above Avalon are still not aware I publish daily updates.

A big thank you to those of you who have supported Above Avalon membership and recommended it to others. Word of mouth has remained a vital growth driver for membership over the years. Above Avalon membership was launched seven years ago last month - May 13th, 2015!

- Neil

Apple Is in a League of Its Own

During Apple’s “Peek Performance” event held last month, the company announced not only a brand new Mac category with the Mac Studio, but also iPhone SE and iPad Air updates that will be well-received in the marketplace. Management fit so much into its 57-minute event, Apple’s entry into live sports was given just 65 seconds.

The primary takeaway from Apple’s event wasn’t found with any particular product. Instead, it was the sheer breadth of product unveilings that caught my attention. Over the past 18 months, Apple has held seven jam-packed product unveilings that have included a collection of new hardware, software, and services. Apple’s peers would be thrilled to hold just one of these presentations every year or two. There is no other company in the same league as Apple when it comes to maintaining and updating such a wide and comprehensive ecosystem of devices and services. The pace of Apple’s new product unveilings has played a role in the company pulling away from the competition.

Ecosystem Strength

It's easy to look at Apple’s quarterly earnings and reach conclusions about the company’s ecosystem strength. Apple’s financials, although strong, don’t tell the full story. With nearly 80% of Apple’s revenue attributable to hardware, the company’s financials remain heavily influenced by upgrading trends. Revenue, operating income, and cash flow metrics undersell how Apple is performing in the marketplace from a new user perspective.

The following new user estimates are obtained by combining Apple management commentary with my own product unit sales assumptions:

To get to the heart of what Apple is doing and how the company is executing so well, we have to go back to 2017 and 2018. Apple began to follow a new strategy that amounted to pushing all of its product category forward at the same time. Previously, Apple had been following a product strategy that can be thought of as a pull system. The company was most aggressive with the products capable of making technology more relevant and personal.

One way of conceptualizing this strategy is to think of Apple product categories being attached to a rope in order of which makes technology more personal via new workflows and processes for getting work done. As Apple management pulled on the rope, the Apple Watch and iPhone received much of the attention while the Mac increasingly resembled dead weight. Similarly, the iPad had hit a rough patch.

Apple is now utilizing a push system in which every major product category is being pushed forward simultaneously. As a result, the iPad, and in particular the Mac, has received more priority. We have also since seen Apple become more aggressive with expanding the number of SKUs available and giving consumers more price and feature options.

At the core of Apple’s product strategy shift was a doubling down on autonomy within its product development process. The Apple machine is operating at such speed and scale, it’s not realistic to think one person can control or run the machine. Apple wouldn’t be able to push its entire product line forward simultaneously if every decision had to go through one gatekeeper. Instead, the Apple machine was designed to take on a certain level of autonomy in order to instill Apple’s values in all employees. Designers of various disciplines have been given greater say over the user experience.

Floundering Competition

As product strategy changes were underway within Apple, the competition began to flounder. A growing number of bad product bets were placed, peaking with the ultimate misdirection in tech of the past decade: voice computing and the stationary smart speaker mirage. The subsequent embrace of stationary screens positioned on kitchen countertops has seen limited adoption. Foldable smartphone sales have not been impressive. Apple competitors are now struggling to capture consumers’ attention and money with routine annual smartphone updates.

We are at the point when tough questions have to be asked about Apple’s competition, or lack thereof. What company can realistically give Apple a run for its money? The number of paid subscriptions across Apple’s platform is increasing by 170 million per year. Google wants to compete in some hardware verticals that Apple plays in, but it’s fair to question Google management’s commitment. At times, their heart just doesn’t seem in it. Amazon and Microsoft have stronger motivations to do well in hardware, but their lack of design thinking is hard to miss. Meta would win the award for strongest public commitment to hardware, but the company’s culture and heritage don’t seem to mesh well with what it takes to do well in hardware. Snap, Spotify, Sonos, and the long list of smaller companies dabbling in hardware all lack the ecosystems to truly go up against Apple toe to toe.

When thinking of competition outside the U.S., a growing number of consumers are looking for entry points into comprehensive (and premium) ecosystems. Apple is selling both the all-around best smartphone in the market and tools and services designed to live both below and above the smartphone. Android switching rates are increasing while Apple entices hundreds of millions of iPhone-only users to move deeper into the ecosystem.

A risk that any company in Apple’s position will face is complacency. With most of its product categories, Apple’s largest competitor ends up being itself. The fact that Apple’s ecosystem updates are accelerating rather than declining as the competition breaks apart is a potential sign of Apple decoupling itself from the “competition drives us” mantra that is found in Silicon Valley. There is a deeper drive within Apple – a feeling that if Apple doesn’t create it, no one else will - that is driving teams forward.

Check out the daily update from April 5th for additional discussion on this topic.

Receive Neil’s analysis and perspective on Apple throughout the week via exclusive daily updates. The updates, which have become widely read and influential in the world of Apple, provide timely analysis of news impacting Apple and its competitors. Neil also publishes exclusive reports on Apple business, product, and financial strategy. The daily updates and reports are available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

Above Avalon Year in Review (2021)

Heading into 2021, Apple had just gone through one of the more tumultuous years in its existence. As discussed in last year’s Year in Review, the pandemic turned 2020 into a steady stream of unexpected challenges for Apple. Expectations that 2021 would be much smoother turned out to be optimistic. While society did largely open up halfway through the year, which allowed Apple’s retail apparatus to return to normal operations, Apple continued to face once-in-a-few-decades challenges when it came to the supply chain, product manufacturing, and navigating its 154,000 employees through a pandemic.

According to my estimate, Apple experienced $10 billion of unmet demand in 2021 as a result of supply chain issues. This total is on top of lingering demand issues associated with wearables that arose from the pandemic.

Despite the challenges, 2021 was a record year for Apple on a number of business fronts:

Apple sold 260M+ iPhones - a record high for a 12-month period.

Apple sold 25M Macs - a record high for a 12-month period.

The Apple Watch installed base surpassed 100 million people.

Articles

In 2021, I published 10 Above Avalon articles. In looking through the articles, which are accessible to all, there was one overarching theme: Apple’s ecosystem continues to gain strength and is ready for the next major product category launch (a mixed reality headset).

Here are a few of my favorite articles published in 2021 (in no particular order):

Apple Has a Decade-Long Lead in Wearables. AssistiveTouch allows one to control an Apple Watch without actually touching the device. A series of hand and finger gestures can be used to control everything from answering a call to ending a workout. The technology is just the latest example of how Apple’s lead in wearables is still being underestimated. The evidence points to Apple having a wearables lead of not just a few years, but more like a decade.

Apple Won the Share Buyback Debate. I receive many questions about Apple from Above Avalon readers, listeners, and members. In previous years, one topic has been far ahead of any other as a source of questions. Everyone wanted to know about Apple’s share buyback program. Something interesting happened in 2020. I received far fewer questions about Apple’s share buyback program. To be precise, I didn’t receive an incoming question about buyback in nine months - from when the stock market put in a bottom in April 2020 to the start of 2021. What explains such a dramatic change? The Apple share buyback debate ended, and Apple was declared the winner.

Apple’s Extremely Quiet Year for M&A. While going through Apple’s 10-K for FY2021, one number jumped out at me. It wasn’t the record iPhone sales, strong margins, or phenomenal free cash flow. Instead, it was the lack of cash spent on M&A. In 2021, Apple spent just $33 million on business acquisitions (M&A). That’s a record low for Apple with Tim Cook as CEO. It’s a number that deserves further investigation as Apple’s M&A strategy and philosophy play a big role in how Apple was able to get to where it is today.

The five most popular Above Avalon articles in 2021, as measured by page views, were:

Podcast Episodes

There were 11 episodes of the Above Avalon podcast recorded and published in 2021, totaling 4.5 hours. The podcast episodes that correspond to my favorite articles are found below:

Charts and Exhibits

The following charts and exhibits found in Above Avalon articles published in 2021 were among my favorites.

Apple Wearables Unit Sales (2017 to 2021) - from Apple Has a Decade-Long Lead in Wearables

According to my estimate, Apple is on track to sell 105 million wearable devices in 2021. That total represents 40% of the number of iPhones sold during the same time period. Unit sales don’t tell the full story, however. On a new-user basis, Apple is seeing more people enter the wearables arena than buy a new iPhone for the first time.

Note: Apple wearables include Apple Watch, AirPods, and select Beats headphones.

Percentage of Apple Revenue Through Direct Distribution Channel - from The Future of Apple Retail

The percentage of sales going through Apple’s direct distribution has gradually increased in recent years. The increase in sales percentage has likely been boosted by services revenue, more sales going through Apple’s website, and more iPhone upgrading taking place through Apple.

Note: Direct distribution channel includes Apple’s website, Apple stores, and direct sales force.

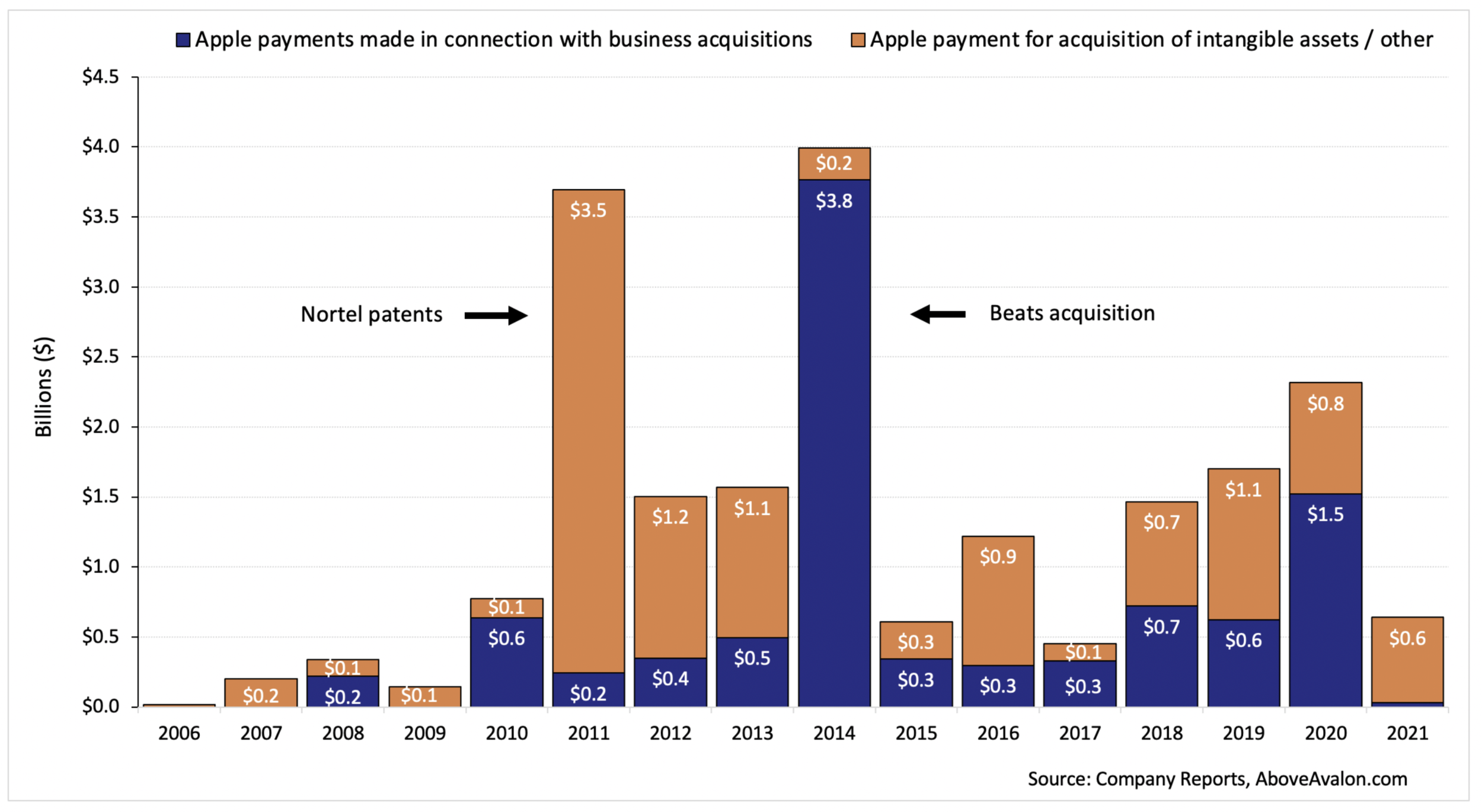

Apple M&A (Cash Payments) - from Apple’s Extremely Quiet Year for M&A

Since 2006, Apple has spent $20.6 billion on M&A with about half of the total tied to “business acquisitions.” The median is $1 billion per year. However, in 2021, Apple spent just $33 million on business acquisitions. That is the lowest amount since 2009 when Steve Jobs was still Apple CEO.

Daily Updates

In 2021, I published 182 Above Avalon Daily Updates that were available exclusively to Above Avalon members. With each update coming in at approximately 2,000 words, 182 updates are equivalent to five books. This continues to be an industry-leading number when it comes to the amount of Apple business and strategy analysis published.

When looking over the topics discussed in this year’s daily updates, a few sub themes become apparent:

Project Titan Moving Forward

Along with mixed reality and AR, transportation is one of the largest areas of opportunity when thinking of future Apple products and services. The year turned out to be the busiest one yet when it came to Project Titan news as Apple began to seek supply chain and manufacturing partners.

Hyundai Confirms Talks With Apple, Apple Considering Car Factory in Georgia, Making Sense of Apple and Hyundai News (Jan 12, 2021)

Apple Car and the Last Mile, Revisiting an Apple Campus Shuttle Service, Thursday Q&A (Feb 4, 2021)

Apple’s Kevin Lynch Joins Project Titan, Apple Car Implications, Apple Watch Implications (Jul 19, 2021)

Doug Field Leaves Apple for Ford, Project Titan’s Trajectory and Leadership, Silicon Valley vs. Detroit (Sep 8, 2021)

Kevin Lynch Tapped to Lead Project Titan, Disillusionment in the Auto Space Is Setting In, Ted Lasso Wins Big at the Emmys (Sep 20, 2021)

Changes in Paid Video Streaming Land

Given the rush of new players into the paid video streaming space in 2020, there was quite a bit of movement in 2021. AT&T’s decision to spin off WarnerMedia was an industry-shaking event. As the months went on, it became clear that many content distribution services were experiencing something equivalent to a pandemic air pocket as subscriber trends became noisy. Netflix and Roku ran into friction while the true new kid on the block (Apple TV+) regained momentum with new shows and movies coming online in the back half of the year.

AT&T to Spin Off WarnerMedia, HBO Max’s Future, Apple Implications May 17, 2021

WarnerDiscovery and Apple M&A, Ranking Paid Video Streaming Leaders, Netflix Contemplating Move into Gaming May 26, 2021

The App Store’s Day in U.S. Court

The well-publicized Epic Games vs. Apple trial resulted in a resounding legal victory for Apple. It ended up being difficult to grasp just how poor of a job Epic Games did in trying to paint Apple as a monopoly. While the court did order Apple to change its anti-steering provision in the U.S., Apple won a stay by a court of appeals. The outcome with the highest probability is for the anti-steering provision to remain as is which would signal Apple’s very strong legal footing as it pertains to the App Store.

Epic Games vs. Apple, Epic's Arguments Against Apple, Epic’s Motivation Apr 27, 2021

Thoughts on the Epic Games vs. Apple Ruling Sep 13, 2021

When looking at my daily updates published in 2021, selecting a few favorites out of 196 updates was not easy. The following updates stood out to me (in no particular order):

Warren Buffett’s Annual Letter, Apple Isn’t Buffett’s Token “Tech” Stock, Apple, Buffett, and Buyback. We kick off today’s update with my thoughts on Warren Buffett’s 2020 letter to Berkshire Hathaway shareholders. Berkshire is Apple’s largest individual shareholder. The discussion then turns to why I don’t agree with those claiming Apple is Buffett’s token tech stock. We conclude by looking at share buyback and how the capital return mechanism leads to a wealth transfer event. (Mar 2, 2021)

Peloton Recalls All of Its Treadmills, The At-Home Fitness Revolution Needs a Reset, Apple, Fitness Machines, and Gyms. Today’s update will be focused on the at-home fitness industry. It’s a market that Apple moved deeper into a few months ago with Apple Fitness+. A good argument can be made that at-home fitness impacts other Apple devices as well especially Apple Watch and Apple TV. We kick things off with my thoughts on Peloton recalling all of its treadmills. The discussion then turns to why I think the at-home fitness industry needs a reset. The update concludes with how fitness equipment safety, or the lack thereof, impacts Apple and why I continue to think there will be a role for gyms to play in the future. (May 6, 2021)

Tesla Buys Bitcoin, Apple and Bitcoin, Apple and Crypto Exchanges. Today’s update will be focused on bitcoin. We begin with news of Tesla buying $1.5B of bitcoin. We then turn to my thoughts on whether or not Apple should follow Tesla into bitcoin. The update concludes with a closer look at RBC Capital Market’s suggestion that Apple should move into cryptocurrency exchanges. We go over why I don’t think the firm’s analysis passes the small test. (Feb 10, 2021)

Apple’s Services Journey, A Different Way of Thinking of Apple One, Apple Services Evolution. For the first time in what feels like a long time, the Apple news cycle is taking a breather. This provides us with an opportunity to pursue some original topics. We kick off today’s update with my thoughts on the narrative surrounding Apple’s Services business. Things are starting to change. The discussion then turns to how I think about Apple’s Apple One bundle and how reframing Apple One leads to some interesting questions and ideas as it pertains to the competition. The update concludes with my thoughts on the future factors determining where Apple Services are headed. (Jul 13, 2021)

Niantic CEO Pours Cold Water on the Metaverse, Meta Buys Within, The Mistake People Are Making With the Metaverse. We kick things off with my thoughts on Niantic CEO John Hanke’s interview with The Verge’s Nilay Patel on his Decoder podcast. Hanke discussed some of the more intriguing topics and concepts found in the AR/VR/metaverse space. The discussion then turns to Meta (Facebook) buying Within. We go over two items that jumped out at me about the acquisition. The update concludes with the mistake that I see consensus making when it comes to metaverse analysis. (Dec 16, 2021)

The Amazon Event, Amazon’s Play for Neighborhoods, Amazon Astro. Today’s update will be focused on Amazon’s product event. We kick things off with my thoughts regarding Amazon’s product strategy involving ambient intelligence. The discussion then turns to Ring’s outsized presence throughout Amazon’s presentation. We go over Amazon’s play for neighborhoods and what is at stake. The update concludes with a closer look at the Amazon Astro. (Sep 29, 2021)

Here are the five most popular daily updates published in 2021 based on page views to AboveAvalon.com. There is naturally a tendency for updates published earlier in the year to outrank more recent updates.

Apple Designer Eugene Whang Left Apple, Apple Industrial Design Turnover, Spotify’s WSJ Op-Ed Against Apple (May 19, 2021)

Peloton Acquires Wearables Company, Peloton vs. Apple Watch, Facebook Talks Up Smartwatch as AR Controller (Mar 23, 2021)

Tesla’s Bitcoin Problem, Apple and Bitcoin Mining, Introducing My FY2022 Estimates for Apple (Feb 11, 2021)

Target to Open Mini Apple Stores, Apple’s Retail Store Growth Strategy, Thursday Q&A (Feb 25, 2021)

Apple Contemplating Apple Watch Explorer Model, Thinking About the Apple Watch Line, Apple Watch Partnerships (Mar 29, 2021)

Just 13% of the daily updates published in 2021 are highlighted in this article. The full archive consisting of all 182 daily updates is available here. Above Avalon membership is required to access the updates.

Daily Podcast

This was the first full year for the Above Avalon Daily podcast, the private podcast available to members who attached the podcast add-on to their membership. A total of 182 episodes were published, totaling nearly 40 hours of audio. The podcast allows members to consume the daily updates in new and different ways while around the house, on a walk, or in the car. Since launch, reception of the daily podcast has exceeded my expectations with very positive listener feedback. More information on the daily podcast, including a few sample episodes, is found here. Once an Above Avalon member signs up for the daily podcast, all prior episodes become available for listening in podcast players that support private podcasts.

Inside Orchard (Launched in 2021)

In March, I launched InsideOrchard.com as a home to my unique perspective on technology and its impact on society. Over the past nine months, 40 essays and corresponding podcast episodes were published. Although distinct from the analysis and discussion found with Above Avalon, the two sites can be thought of as siblings. A bundle consisting of both an Above Avalon membership and Inside Orchard subscription, with an accompanying price discount, was purchased by a good percentage of the Above Avalon member base.

Here’s to 2022

A big thank you goes out to readers, listeners, and members for making 2021 another successful year for Above Avalon. Have a safe and relaxing Christmas, holiday season, and New Year. See you in 2022. - Neil

Above Avalon Podcast Episode 188: Apple Closed Its M&A Wallet

(Episode 188 was published on November 20th.)

While going through Apple’s recently-filed 10-K for FY2021, one number jumped out at me. It wasn’t the record iPhone sales, strong margins, or phenomenal free cash flow. Instead, it was the lack of cash spent on M&A. In episode 188, we discuss the key takeaway found with Apple spending just $33 million on business acquisitions (M&A) in FY2021. The discussion includes Neil’s thinking as to what may be behind the multi-year low for M&A and an overview of Apple’s M&A strategy.

To listen to episode 188, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

RSS Feed (for your favorite podcast player)