Apple's 3Q23 in Three Charts

Hello everyone. Welcome to Monday and a new week. We will continue our Apple 3Q23 review.

Given how the past few quarters for Apple have contained similar themes, we are going to try something different for this quarter's review. We will focus on three charts that sum up Apple's 3Q23. As we will see, there is quite a bit of consistency on display with each chart. (We will cover all of the granular takeaways from Apple's 3Q23 earnings call in tomorrow’s update.)

Before jumping into today’s update, one clarification regarding Friday’s update. When talking about Apple’s hardware margins, the commentary was garbled. That part of the update should have read:

Products (HW) gross margin: 35.4% (vs. my 35.7%). My iPhone gross margin estimate was a tad bit too optimistic. On a year-over-year basis, HW gross margins were up by 85 basis points.

Apple's 3Q23 in Three Charts

Gross Profit Resiliency

3Q23 results: $36B gross profit (up 1.5% from 3Q22)

There has been much attention placed on Apple’s gross margins (and rightly so). Gross margin is cost of goods subtracted from revenue. Based on management commentary, the company will come close to reporting a 11-year quarterly high for gross margin percentage 1Q24. Management provided a 44.0% to 45.0% range. Gross margin percentages don’t tell the full story though. Instead, we need to look at gross profit in absolute terms to obtain a cleaner assessment of Apple’s business.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Disney CEO Talks ESPN’s Future, Apple’s Sports Play, Apple Watch Ultra Reviews (Daily Update)

Hello everyone. Let's begin today's update in the live sports world.

Disney CEO Talks ESPN’s Future

Last week, Disney CEO Bob Chapek, who recently had his CEO contact extended by three years, sat down with CNBC’s David Faber to talk about ESPN and where live sports goes from here.

Here’s Chapek:

“We're hard at work in our offices, both on the east coast and the west coast, figuring out how we make it more friction-free sports environment for our viewers. And obviously, some of these things take the cooperation of a lot of the people in the ecosystem, whether they be the leagues, other broadcast partners, but we foresee a world where ESPN, even more than ever, is the pinnacle of all your broadcast needs and we’re excited to continue working on that and at some point, when we’re all fully backed, we’ll come back.”

Chapek referred to four broad working areas as to where Disney is focusing ESPN's energy:

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

The daily updates have become widely read and influential in the world of Apple and technology. They are unmatched in the marketplace in terms of comprehensive analysis and research on all things Apple. Members reside in 60 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists in the business.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

The Apple Watch Series 7 Is Great

Shortly after Apple’s virtual event last month concluded, some people wondered out loud if the Apple Watch Series 7 was a placeholder. The rumor hill was confident that Apple was going to extend the design language found with the iPhone and iPad by announcing an Apple Watch with flat edges. Instead, Apple unveiled an Apple Watch Series 7 display with curved edges. The apparent lack of other noteworthy features was then used by some as evidence of Apple rushing the Series 7 to unveil something in front of the holidays.

Nothing could be further from the truth.

For the past few days, I’ve been using an Apple Watch Series 7 (45mm - Aluminum Green). The best descriptive words regarding the Series 7 that come to mind are fun, fulfilling, and endearing. The Series 7’s targeted updates help to advance computing on the wrist while addressing some known friction points that had accompanied daily usage. There is nothing like the Apple Watch in the market, and Apple continues to run forward with a device ushering in a paradigm shift in computing.

The following are my initial impressions from using an Apple Watch Series 7.

Larger Screen. Apple Watch Series 7 marketing is anchored around the larger screen - and for good reason. Much to my surprise, reducing the display borders by 40% gives the Series 7 a completely different kind of Apple Watch experience. Instead of using the Series 7’s larger screen (20% larger than the Series 6) to include more text and information, Apple leveraged the additional screen real estate to make buttons and text larger. This was a smart decision. Instead of having Series 7 owners spend more time looking at their wrists, the larger screen makes it easier to quickly gather information and not get lost in the watch.

One way of describing the Apple Watch’s screen size changes over the years is that the Series 4 went after the low-hanging fruit. There was value found in simply fitting more stuff on a bigger screen. The Series 7 screen (50%+ larger than the Series 3) feels like the refinement step, focusing more on the finer things like larger font and click areas that end up having a larger impact on daily usage.

Larger Footprint. Apple Watch Series 7 has a slightly larger form factor than the Series 6 (45mm and 41mm vs 44mm and 40mm). The larger size on the wrist was not noticeable. The Series 7 Aluminum doesn’t feel heavier than the Series 6 either despite weighing 7% more. Weight becomes a bigger issue when moving to the Stainless Steel from Aluminum. As someone who has worn the Aluminum regularly for years, the Stainless Steel is too heavy for my taste. There will come a point at which the larger Apple Watch option starts to become unwieldy, but I don’t think we are at that point yet.

Apple Watch Series 6 (left) vs. Apple Watch Series 7 (right)

Setup. It took about 20 minutes to set up the Series 7 with an iPhone 13 Pro using Restore from Backup. Similar to how the iPhone setup process has become streamlined over the years, the days of needing to wait until the weekend to set up your new Apple Watch for fear of running into issues are over.

Brighter Screen. Similar to how the Series 7’s larger screen jumped out at me, the 70% brighter always-on screen was also noticeable. To the user’s eye, it pretty much seems like the Apple Watch screen has the same brightness regardless of one’s wrist position. With the Series 6, I found myself needing to tap the screen when in the “always-on” state and not in a direct line of sight because it wasn’t bright enough.

Color. Apple unveiled five new aluminum colors - Green, Blue, Product Red, Starlight, and Midnight. The green is very attractive, reminding me more of a greenish black. In certain light conditions, the Watch comes across as having a black case.

Battery Life. Apple has been following an “all day” battery life strategy for Apple Watch. Instead of removing Watch features to extend battery life to two to three days, Apple has strived to have Apple Watch battery life last as close to a full day as possible without the wearer needing a quick boost in the middle of the day. For the most part, Apple has been successful with that objective. Obviously, Apple Watch battery life is dependent on usage. Someone that goes heavy on workouts, podcast listening, and GPS will struggle getting through the whole day on a single charge. However, on average, the Apple Watch should last from a morning charge to getting ready for bed approximately 18 hours later.

In recent years, sleep tracking has complicated Apple’s battery goal for Apple Watch. It’s no longer enough for Apple Watch to last a full day. It also needs to last the subsequent night. Quick charge is Apple’s solution. In the amount of time someone takes to get ready for bed, an Apple Watch can get enough charge (~20%) to do six to eight hours of sleep tracking and then be ready for a longer (~45 minutes) charge in the morning.

Based on my rudimentary testing, the strategy holds true. Thanks to an updated charging architecture and fast-charging USB-C cable, I was able to charge the Apple Watch Series 7 from 0% to 82% in 45 minutes. That is favorable to Apple’s 80% battery charge in 45 minutes claim. As for Series 7 and Series 6 charging, I achieved 25% to 30% faster charging for the Series 7 using the same 20W USB-C power adapter for both the Series 7 and 6. Apple claims the Series 7 has “up to 33% faster charging” than the Series 6 when using a 20W USB-C power adapter with the Series 7 and a 5W USB power adapter with the Series 6.

In practice, does all of this battery life strategizing work for the average Apple Watch wearer? The short answer is “yes.” Most Apple Watch wearers will likely end up getting through the day and night on a single charge. A roughly 30 minute charge in the morning will then be enough to get through the following day. Of course, there is room for Apple to improve Apple Watch battery life. There will likely always be room for battery life improvement.

Full-Size Keyboard. Two words: scary good. I was impressed with Apple’s slide-to-text technology that relies on machine learning to predict what I’m typing. Heading into the Series 7, my view was that tapping or sliding on an Apple Watch screen to write messages or emails didn’t make much sense. Instead, dictation was the way forward. That idea hasn’t completely gone away for me. It’s still faster to dictate messages on the wrist instead of typing. However, using voice for dictation has its limitations, especially when it comes to privacy. It’s just not practical or useful to use voice to dictate messages when in meetings or public settings. By including a built-in full-size keyboard for the first time (third-party options were previously available), Apple has essentially given the Apple Watch a new user input.

In a related note, as discussed above, the larger touch areas made possible by the 20% larger screen really do make a difference. For example, it’s easier and more enjoyable using the calculator app.

Putting the Series 7 Into Perspective. As someone who has worn an Apple Watch daily for the past six years, the Series 7 is up there with the Series 4 as being the most noteworthy upgrade to date. It’s that good. That may come off as surprising given the lack of new features found with the Series 7. However, quality always trumps quantity when it comes to new features. The primary reason for the Series 7 receiving such a high honor is that a larger screen plays a very big role in my day-to-day Apple Watch experience. The wrist is among some of the most valuable real estate for computing, and a larger Apple Watch screen takes advantage of that premium real estate.

At the same time, Apple’s ongoing dedication to Apple Watch’s rectangular design heritage is appreciated. Apple could certainly go in different directions with Apple Watch case design, but the company’s continued commitment to positioning Apple Watch as a general computing device ends up being met with a screen designed to display text and information. Apple’s focus on maintaining all-day battery life despite larger power requirements, like a brighter and larger screen, is also something that can’t be ignored.

One Final Thing About the Series 3. Apple continues to sell the Apple Watch Series 3 alongside the flagship Series 7. Apple is relying on a different strategy here than with the iPhone and iPad. By not keeping last year’s Apple Watch series around, Apple ended up creating a larger gap in feature set between models. The end result is more people opting for the latest and greatest. When comparing the Series 7 to the Series 3, it’s no surprise that the Series 7 will grab the majority of sales. Interestingly, the Apple Watch SE (basically a rebranded Series 4) wasn’t updated last month either. This will only serve to funnel additional sales to the Series 7.

There are a few reasons for Apple to keep the Series 3 in the lineup. Price is a big one. For some users, budget is the most important purchasing consideration. The Series 3 is just $199 in comparison to $399 for Series 7 GPS. The Series 3 also prevents a price umbrella from forming under the flagship model. With the Series 3 still available for sale, it’s difficult for an Apple Watch competitor to gain traction in the $150 to $200 range. Despite being four years old, the Series 3 can still hold its own relative to the competition. That just goes to show how far Apple is with its wearables strategy.

As someone who has used both the Series 3 and now Series 7, the difference between the two models is like day and night. It’s hard to imagine going from a Series 7 back to a Series 3. The $200 price gap comes across as small. The thing is, the Apple Watch is a new user story. Unlike the iPhone, Apple Watch sales are driven by customers buying their first Apple Watch. A Series 3 still beats a bare wrist.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

For additional discussion on this topic, check out the Above Avalon daily update from October 14th.

Above Avalon Podcast Episode 184: Let's Talk WWDC 2021

In episode 184, Neil discusses the big themes found with this year’s WWDC. The episode then takes a deep dive into watchOS direction and what Neil sees as missed opportunities for unleashing more of Apple Watch’s potential.

To listen to episode 184, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

RSS Feed (for your favorite podcast player)

Apple's Missed Opportunity at WWDC

For the third year in a row, Apple held an impressive WWDC (worldwide developers conference). The breadth of announcements across various product categories speaks to how Apple is successfully pulling away from the competition. No other company is able to match Apple’s ability to push so many distinct platforms forward yet simultaneously keep an eye on ecosystem cohesiveness. It was this ecosystem focus that ended up being one of the major takeaways from Apple’s WWDC 2021, as outlined in my WWDC review (available here for Above Avalon members).

With that said, it was hard to shake the feeling that Apple missed a big opportunity at this year’s WWDC to push its most personal product even further than it already has. There were three specific instances in which Apple had the chance to add functionality to the Apple Watch but instead chose to puts its focus on less robust alternatives. It is in Apple’s best interest to expand Apple Watch functionality in order for the device to handle an increasing number of tasks currently given to smartphones and tablets.

Focus

Along with unveiling revamped notifications, Apple announced a new initiative aimed at helping users avoid unwanted distractions. With Focus, users can now match their device usage to activities and mindset. Positioned as a type of enhanced Do Not Disturb, setting up a Focus gives users more control over how involved they can become with their devices at any given time. The features sure seem to be a direct result of Apple employees struggling with work from home directives over the past 15 months during the pandemic.

While some people will undoubtedly benefit from Focus, Apple missed a big opportunity to position the Apple Watch as a solution for iPhone information overload. Apple Watch wearers are already able to put down their other Apple devices but still feel connected by receiving important notifications or reminders. It was odd how Apple didn’t draw attention to such utility and look to add new controls to Apple Watch that allow us to engage with our other devices without becoming overwhelmed. Instead, Apple went so far as to imply the Apple Watch contributes to information overload. The entire Focus segment of the keynote came off as not fully thought out.

Smart Home

The smart home remains the Wild West. It is simply too early to declare winners or losers in the space. Companies are now reconfiguring their smart home strategies to focus on verticals seeing some kind of traction (security in the form of video cameras and video entertainment in the form of streaming video boxes and speakers).

During WWDC, Apple unveiled a few updates to its smart home strategy. One of the more strategic changes involves expanding Siri support to third-party smart home devices. Voice queries will be run through a homeowner’s HomePod or HomePod mini. While the feature may become popular with some users, Apple missed another opportunity to position the Apple Watch as a key differentiator when it comes to grabbing territory in the home.

At one point during the WWDC keynote, Apple’s Yah Cason said the following: “We believe Siri is most powerful when it’s available throughout your house.” Apple is right in making such a claim - a digital voice assistant is indeed more powerful and valuable when not confined to a stationary device. However, is having more stationary devices in the home the best solution for always having Siri nearby? Apple seemingly ignored how nearly 110 million of its users already have Siri always on them when at home by wearing an Apple Watch. Having Siri always available on one’s wrist via the Apple Watch means there is no need to worry about where a Siri-integrated device may be found in and outside the home. In addition, Apple Watch wearers have a screen to display Siri answers which is useful for things like weather queries, sports scores, and seeing how much time is left on a timer. Apple could be giving the Apple Watch a much larger role to play in its smart home strategy. We saw hints of this potential when Apple unveiled an updated Home app for Apple Watch. Much more could have been done.

Siri Watch Face Forgotten

For the third year in a row, Apple acted as if the Siri watch face didn’t exist. While Apple can technically use its fall event for unveiling new Apple Watch hardware to also announce updates to the Siri watch face, such a scenario doesn’t seem likely.

Unveiled at WWDC 2017, the Siri watch face pushes snippets of information and data to an Apple Watch wearer throughout the day. This information is contained in “cards” that change based on the time of day, location, and upcoming schedule. Apple announced a major update to the Siri watch face in 2018 when third-party cards and Siri shortcuts were made available. In a disconcerting development, Apple hasn’t announced any updates to the Siri watch face since.

Interestingly, despite no updates to the Siri watch face, Apple did bring similar functionality to the iPhone in 2020 via the Smart Stack widget. Even the design of the Focus app shares some functionality with the Siri watch face. Given these developments, the lack of updates to the actual Siri watch face ends up being that much more of a head scratcher.

Why?

It’s easy to write a blog post or record a podcast / video about how Apple is making a mistake and needs to adjust strategy. The value is found in understanding the “why” behind a particular Apple decision, which involves weighing both sides of a decision.

Why didn’t Apple push Apple Watch more when it came to reducing notification overload on iPhones and helping Apple users throughout the home? Why does Apple continue to ignore the Siri watch face?

There are two possible explanations for Apple’s actions:

1) Apple believes wrapping the Apple Watch around health makes the device an easier sell with consumers. Some of the biggest watchOS announcements unveiled at this year’s WWDC were once again related to health. This follows Apple’s multi-year strategy of adding health sensors to the Apple Watch. While Apple management knows that most Apple Watch wearers use the device for more than health monitoring, those other use cases are not used to anchor Apple Watch marketing. As seen with the following images from Apple’s Apple Watch webpage, it’s all about heath. Even fitness, which is more niche than health, takes a secondary position to health when it comes to selling Apple Watch.

There may be a “if it ain’t broke, don’t fix it” mentality at play with Apple Watch product marketing. Apple’s current Apple Watch strategy involving health (and fitness) seems to be connecting with customers as seen by Apple Watch unit sales (the following are my estimates):

2018: 22 million units

2019: 26 million

2020: 31 million

Accordingly, Apple may be bypassing certain features for watchOS that would fundamentally move the Apple Watch away from being an intelligent health companion device.

2) Apple is close to announcing its entry into face wearables. Apple may not want to spend years positioning Apple Watch as a certain kind of device only to have it be surpassed by a pair of lightweight smart glasses (AR / mixed reality). Instead, Apple is focused on pushing Apple Watch in a direction that it is confident will complement a pair of smart glasses. This results in Apple making a notable push on the health front from both a hardware (sensors) and software perspective while other functionality is kept on the back burner with the intention of having it show up in face wearables.

A Different Approach

Just as it’s easy to say that Apple is doing something wrong, the claim is worthless if counter suggestions aren’t given. If Apple needs to make a change with Apple Watch, what should that change be?

One issue that is starting to become noticeable is Apple not expanding Apple Watch’s functionality fast enough. Using health to anchor Apple Watch marketing may indeed be a good way for Apple to grab new Apple Watch users. For some, the Apple Watch makes for a great health / fitness companion and nothing more. Those users should be able to continue using Apple Watch for health monitoring without needing to mess or deal with extraneous software or features.

However, Apple is not pushing Apple Watch enough from the perspective of being an iPhone alternative. The Siri watch face is a bridge to the future and yet all signs point to few people using the face. The lack of updates certainly hasn't helped in improving adoption. There are signs of deeper issues at play. According to Apple, Photos is the most popular watch face. That may seem innocent enough. However, Apple Watch watch faces were once positioned as apps. This turned to watch face complications. Why then are Apple Watch wearers using the most simplistic and data-free watch faces such as Photos? This may be a sign that Apple needs to reexamine the concept of watch faces as apps. Users likely don’t want to interact with various complications or even watch faces. This doesn’t mean that users do not want additional functionality from Apple Watch. A more likely answer is that users like the ease and simplicity found with the Photos watch face. (With this, they are still able to receive all of their notifications, messages, and alerts).

Instead of pushing increasingly complicated Watch faces, legacy watch faces, or bringing a version of multitasking to Apple Watch, the additional functionality given to Apple Watch would materialize in the form of machine learning pushing more information and context to the wearer throughout the day. The only information one would need to see on their wrist would be based on one’s:

Daily habit (provide the upcoming weather each morning at the same time given prior habits, give driving time information to the local coffee shop frequented each morning).

Current activity (push news alerts while seated at the coffee shop).

Location (suggest items that may be of importance to the wearer’s current location).

Schedule ( provide information that is relevant to an upcoming meeting, reminder, or event).

Notice how all of those items involve action verbs - provide, give, push, and suggest. That is Apple Watch’s future - an intelligent assistant that helps people get through their day.

With an Apple Watch installed base quickly approaching 125 million people, even if only a portion of Apple Watch users are interested in this additional functionality, we are still looking at tens of millions of people, and that number will prove to be conservative over time. It’s not enough to anchor watchOS releases around new health features, a new portrait photos watch face, and GIF support in messages.

The Apple Watch already has the pieces required for handling additional functionality:

An always-on screen with superb line of sight for the wearer.

A smart digital assistant that increasingly knows more about the wearer’s past, current, and future activity. (This is where having an ecosystem of devices that is also home to the digital assistant will help.)

A developer base that is increasingly embracing Apple Watch and watchOS.

As for the idea that an eventual Apple Glasses launch should dictate how Apple positions the Apple Watch in 2021, a pair of lightweight glasses from Apple is likely still a few years away. It’s odd for Apple to put the Apple Watch on the proverbial ice when it comes to non-health initiatives in response to a product that is still years away. Even in a world with Apple Glasses, it is not a given that Apple Watch will even be a competitor. Glasses may not be the best form factor to push information to the wearer throughout the day, even if it’s through peripheral vision. Instead, Apple Glasses would be aimed at helping the wearer navigate the world while the Apple Watch would be more of a digital assistant / monitor focused on providing granular information throughout the day. Also, the Apple Watch is well-positioned to help power a pair of Apple Glasses given the amount of real estate available on the wrist for storing technology and sensors.

Giving the Siri watch face a much-needed reboot in watchOS 9 would be a great start at unleashing a new layer of Apple Watch functionality. Such a reboot can be wrapped around a series of new Watch faces that amount to pushing different kinds of information to the user throughout the day while retaining much of the simplicity found with the Photos face. Apple can increase the number of available cards in the Siri watch face and push card development as a key priority for watch developers interested in getting in front of users. In addition, a more concentrated focus on selling Siri on your wrist and enhanced notifications control will go a long way. This could set Apple up for eventually including a front-facing camera on Apple Watch for FaceTime calls (with software that auto-centers the subject so that one can’t tell you are using an Apple Watch to make calls).

One lesson from this year’s WWDC is that Apple isn’t just pushing individual product categories forward but rather using devices and services to push an ecosystem forward. For a product like Apple Watch, Apple’s goal should be positioning the device as both taking advantage of its unique design attributes while also helping to add value to other Apple devices. The Apple Watch is the most popular watch in the world. It’s time for Apple to begin unleashing more of Apple Watch’s potential.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

For additional discussion on this topic, check out the Above Avalon daily update from June 24th.

Apple Has a Decade-Long Lead in Wearables

Last week, Apple quietly unveiled one of the more remarkable pieces of technology that has been developed in the past few years. AssistiveTouch allows one to control an Apple Watch without actually touching the device. Instead, a series of hand and finger gestures can be used to control everything from answering a call to ending a workout. The video below showcasing AssistiveTouch is quite impressive:

Just two months prior, Facebook went on a big PR push to show the world how it was in early R&D stages of working on technology that can also use hand and finger movements to control future gadgets. AssistiveTouch is just the latest example of how Apple’s lead in wearables is still being underestimated. The evidence points to Apple having a wearables lead of not just a few years but more like a decade.

Apple Wearables by the Numbers

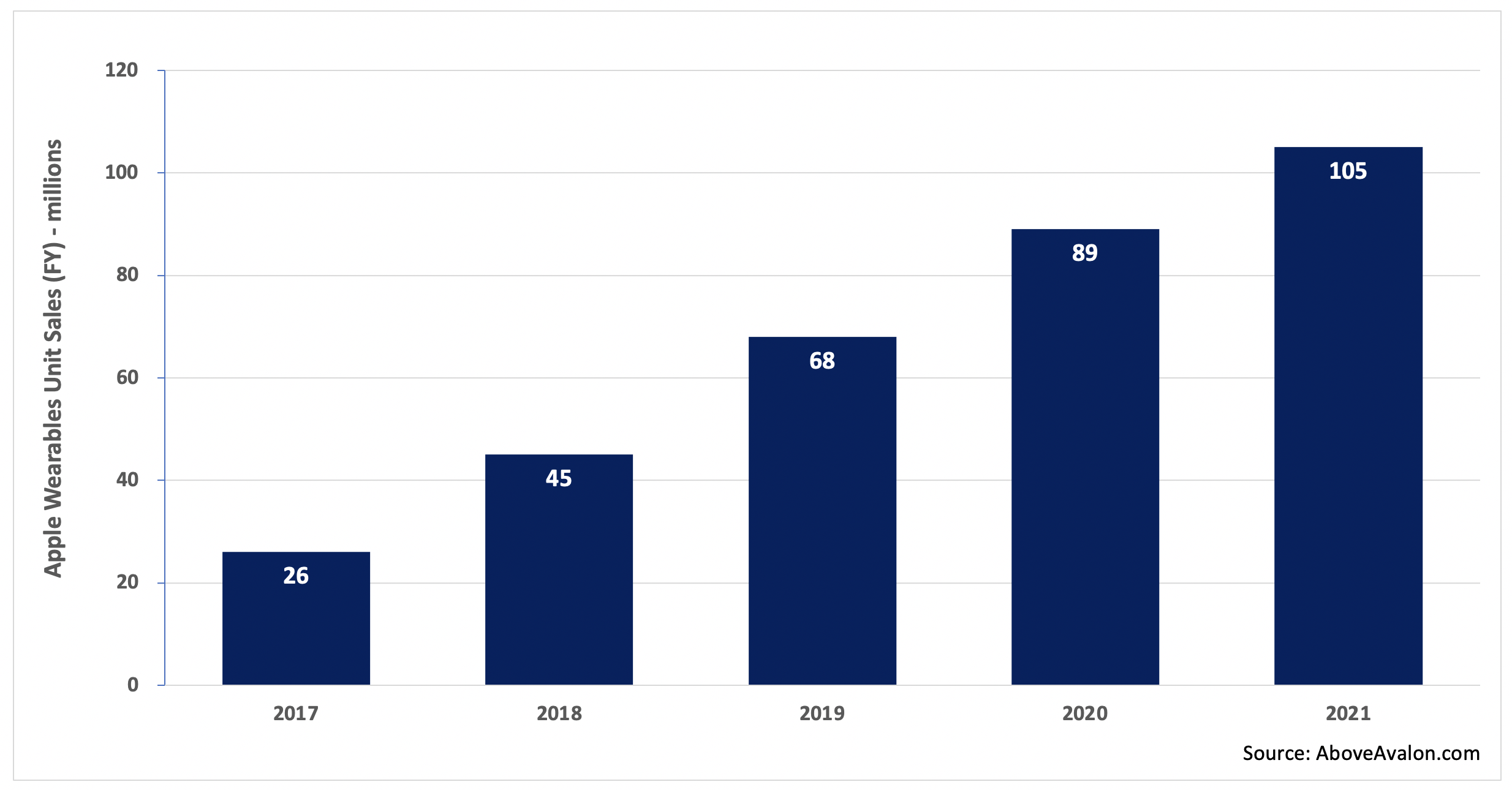

According to my estimate, Apple is on track to sell more than 100 million wearable devices in 2021. That total represents nearly 40% of the number of iPhones that will be sold during the same time period. Unit sales don’t tell the full story, however. On a new-user basis, Apple is seeing more people enter the wearables arena than buy a new iPhone for the first time.

Exhibit 1: Apple Wearables Unit Sales (2017 to 2021)

Note: Apple wearables include Apple Watch, AirPods, and select Beats headphones.

On a revenue basis, Apple Watch, AirPods, and select Beats headphones are a $30 billion per year business. That would rank Apple wearables on a combined basis just shy of a Fortune 100 company. Assuming continued Apple Watch and AirPods momentum, along with Apple expanding its wearables platform by getting into face wearables (AR/VR headsets and glasses), Apple wearables will likely be able to generate up to $50 billion of revenue annually within a few years.

Exhibit 2: Apple Wearables Revenue (2017 to 2021)

Note: Apple wearables include Apple Watch, AirPods, and select Beats headphones.

Measuring Apple’s Lead

When Apple unveiled the iPhone in January 2007, Steve Jobs famously said that the iPhone was “literally five years ahead of any other mobile phone.” He ended up being mostly correct. It took the competition a number of years, and a whole lot of copying, to catch up with what Apple had just unveiled.

With wearables, my suspicion is Apple’s lead is longer than five years. There are three components to Apple’s wearables lead:

Custom silicon / technology / sensors (a four to five-year lead over the competition, and that is being generous to the competition)

Design-led product development processes that emphasizes the user experience (adds three years to Apple’s lead)

A broader ecosystem build-out in terms of a suite of wearables and services (adds two years to Apple’s lead)

Apple has at least a four-to-five year lead over the competition when thinking about just the technology powering its wearables. Everything from custom silicon and health monitoring sensors to audio and AR-focused technologies come together to set Apple apart from the competition. Only a select number of companies will likely be able to even compete with Apple on the technology front. Others will be forced to pursue partnerships.

Apple’s wearables lead extends beyond four to five years when taking into account attributes that set wearables apart from mobile devices. Succeeding on the technology front is not enough. Wearables need to be designed so that people want to be seen wearing them for extended periods of time. A smartwatch or wireless pair of headphones must also be able to work seamlessly with other devices and services. A competitor needs to have not only an answer for effectively competing with Apple Watch on the wearables front, but also answers for various services available on AirPods and Apple’s other devices. Looking ahead, Apple’s entry into face wearables will only make the hill to climb that much steeper for competitors trying to go after Apple Watch and AirPods.

For competitors, the intimidating part is that the pieces needed to compete effectively with Apple wearables are unable to be worked on concurrently (at the same time). A company needs to first spend the required years developing and researching the core technologies before turning its focus on ensuring the right kind of collaboration exists between engineering and design. Product sales will then need to materialize before a company has the means of leaning on an ecosystem to sell additional wearable devices.

Apple M&A

A different way of measuring Apple’s lead in wearables is to look at the company’s M&A activity. Apple has been busy buying tech and talent for its upcoming face wearables play for the past six years. In wearables land, the days of new products taking only two to three years to develop are over. The required technology and R&D required to get such devices off the ground require much more lead time.

Metaio - AR (2015)

SensoMotoric Instruments – AR glasses (2017)

Vrvana – AR / hand & positional tracking technology (2017)

Akonia Holographics – AR glasses (2018)

NextVR – content platform for wearables (2020)

Spaces – content platform for wearables (2020)

Examples of Apple’s Lead

There are a number of real-world examples demonstrating Apple’s significant lead in wearables.

AssistiveTouch vs. Facebook Reality Labs. Two months ago, Facebook gave the press a peek at how it is researching using a smartwatch-like device as an input method for a pair of AR glasses. The research, centered on electromyography, looked to be in the pretty early stages with many years needed before seeing the technology in a consumer-facing product. The video was intriguing as it showed research that was thought to be at the forefront of what is going on in technology R&D today. Apple then shocked everyone by unveiling AssistiveTouch for Apple Watch. Instead of showing a behind-the-scenes look at an R&D project, Apple unveiled a technology ready for users today. The technology, relying on a combination of sensors and technologies to turn the Apple Watch into a hand / finger gesture reader, was designed for those in need of additional accessibility. Of course, the technology can go on to have other use cases over time, such as controlling a pair of smart glasses like the ones Facebook is working on. AssistiveTouch does a good job of showing just how far ahead Apple is on the wearables R&D front.

Google I/O 2021. At its 2021 developers conference, Google showed signs of finally taking wrist wearables seriously by ditching Wear OS and partnering with Samsung on a new OS. While it is fair to be skeptical that the effort will end up being successful, the announcement was a marked change from prior Google I/Os when wearables were all but ignored. Diving a bit deeper into Google’s announcement, it’s easy to see how far behind Google truly is in wearables. The company doesn’t even have an OS capable of powering a smartwatch. This may be excusable if Apple Watch was just unveiled. However, last month marked Apple Watch’s sixth anniversary.

Snap Spectacles 4 / Microsoft HoloLens / Magic Leap. While we see a handful of companies release various kinds of prototype hardware for the face (AR/VR/mixed reality), nothing has stuck with consumers. The feeling in the air is that they all lack something – design thinking. This is an item that is not easy to recreate with most companies simply not structured to emphasis design. Many companies will need to rethink their face wearables strategies once Apple enters the market. None have viable answers for smartwatches or wireless headphones either, which make their face-focused efforts look incomplete.

How Did This Happen?

Apple’s lead in wearables wasn’t driven by any one factor or item. Instead, a series of events came together to give Apple an advantage.

Apple was early. One way to build a big lead against the competition is to get an early start. Wearables represent a paradigm shift in computing, and few companies other than Apple saw it coming. As for how Apple was able to see it so early, wearables are all about making technology more personal - a mission Apple has been on for decades. In a way, Apple was built to excel with wearables. Apple’s lack of fear in coming up with new products that may potentially impact sales of existing products also helped the company run wrist-first into wearables in the early 2010s.

Voice computing distraction. Even after Apple began to unveil its wearables strategy, many competitors balked at following the company. Competitors thought the actual paradigm shift materializing was found with voice computing. Most of these companies didn’t have the hardware expertise to do well with wearables out of the gate, so they pinned their hopes on voice assistants being piped through stationary speakers. Once the stationary smart speaker mirage became apparent, companies found themselves years behind Apple on the wearables front.

Wearables require design expertise. It’s not enough to just throw together some leftover smartphone components and ship wearables. People want to wear devices that they are OK with being seen in. This is one reason why so many companies have looked at Apple Watch for design cues. The lack of design talent and ability remains a major roadblock for many companies.

Ecosystem and technology advantage. Wearables are the ultimate ecosystem play. On the technology front, Apple was able to utilize lessons learned from mobile devices to push wearables forward. Not many companies are able to do the same. Consolidation in the smartphone space has left only a handful of companies even in a position to have a wearables and mobile ecosystem. The probability of there being a wave of smartwatch OEMs utilizing something akin to Android remains low.

No price and feature umbrellas under Apple. One reason Android found oxygen in the smartphone space is that Apple left a pretty wide price umbrella under the iPhone. In addition, Android positioned itself as giving users features that iPhone users may not have had access to. No such umbrellas exist in wearables. Entry-level AirPods sell for $159 and are often available for less at third-party retailers. Apple Watch is available starting at $199. It is very difficult for a hardware manufacturer to sell wearables for less than Apple and turn a profit. Meanwhile, companies that would look to make money in other ways, such as through data collection, are still stuck with the requirement of wearables needing to look good enough to be worn in public.

Six years after releasing the Apple Watch, it’s still not clear who is going to represent genuine competition for Apple in the wearables space. Apple’s success in wearables is finally being noticed by others, as seen by the growing number of companies selling products for the body (Amazon, Microsoft, Facebook, Google, Samsung, Huawei, Xiaomi, Garmin, and the list goes on). However, none are in as strong of a position as Apple was in a few years ago, let alone today. Apple’s wearables lead stands to grow further once the company enters face wearables. The next few years will likely dictate the power structure in wearables for the next 10 to 20 years. When it comes to competitors figuring out a way to slow Apple in wearables, it’s now or never.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

Above Avalon Podcast Episode 180: 100 Million Wrists

According to Neil’s estimate, 100 million people now wear an Apple Watch. This means that approximately 10% of iPhone users wear an Apple Watch. In episode 180, Neil discusses these installed base and adoption figures as part of a larger discussion regarding Apple Watch’s sales momentum, growth potential, and roles in Apple’s ecosystem

To listen to episode 180, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

RSS Feed (for your favorite podcast player)

Apple Watch Is Now Worn on 100 Million Wrists

More than 100 million people wear an Apple Watch. Based on my estimates, Apple surpassed the important adoption milestone this past December. The Apple Watch has already helped usher in a new paradigm shift in computing, and Apple is still only getting started with what is possible on the wrist. New services designed specifically for Apple Watch (such as Fitness+) are being released. The wrist’s utility continues to be unveiled thanks to new hardware and software features revolving around health monitoring.

The Numbers

It took five-and-a-half years for the Apple Watch installed base to surpass 100 million people. As shown in Exhibit 1, the installed base’s growth trajectory has not been constant or steady over the years. Instead, the number of people entering the Apple Watch installed base continues to accelerate. The 30 million new people that began wearing an Apple Watch in 2020 nearly exceeded the number of new Apple Watch wearers in 2015, 2016, and 2017 combined.

Exhibit 1: Apple Watch Installed Base

The next exhibit takes a look at Apple Watch adoption as a percentage of the iPhone installed base. Since an iPhone is required to set up an Apple Watch, the iPhone installed base is a good proxy for the size of Apple Watch’s addressable market. There are a few exceptions to this such as Family Setup, which allows family members who don’t have iPhones to get set up with their own Apple ID and cellular Apple Watch.

Exhibit 2: Apple Watch Adoption Percentage (Global)

As of the end of 2020, approximately 10% of iPhone users were wearing an Apple Watch. This is a high percentage given the diverse technological wants and needs of those in the iPhone installed base.

Since the U.S. has been an Apple Watch stronghold for years, adoption in the country has trended materially high in comparison to global figures. At the end of 2020, approximately 35% of iPhone users in the U.S. were wearing an Apple Watch. This is a shockingly strong adoption rate that should serve as a wake-up call to Apple competitors interested in the wearables space. Apple Watch turned Fitbit from a household name as the wearables industry leader into a company that will eventually be viewed as an asterisk when the wearables story is retold to future generations.

(The calculations and methodology used to reach my Apple Watch installed base estimates is available here for Above Avalon members.)

Installed Base Comparisons

At 100 million users, the Apple Watch is Apple’s fourth-largest product installed base behind the iPhone, iPad, and Mac. At the current sales trajectory, the Apple Watch installed base will surpass the Mac installed base in 2022. Surpassing the iPad installed base will take longer and likely be measured in a number of years based on the current sales trajectory.

Growth Potential

While Apple Watch adoption figures point to a product gaining acceptance and appeal around the world, the same numbers also speak to the product’s sales growth potential. There is nothing stopping Apple Watch from grabbing much higher adoption over time. Stronger adoption will serve as an Apple Watch sales growth engine for years.

Running with a few simple calculations, if 35% of iPhone users around the world one day wear an Apple Watch, the same adoption percentage found in the U.S., the Apple Watch installed base would exceed 350 million people. That’s 2.5x larger than the current installed base.

Of course, a 35% adoption figure when looking at the iPhone installed base may end up selling the Apple Watch far short. There is nothing preventing Apple Watch from being worn by an even higher percentage of iPhone users. More importantly, the Apple Watch’s future is one of true independency from the iPhone. Opening the Apple Watch up to non-iPhone users would expand Apple Watch’s addressable market by 2.5x overnight. A 10% adoption figure among all smartphone users around the world would amount to 350 million people wearing an Apple Watch.

What’s Driving Adoption?

As for the factors behind Apple Watch’s steady growth in adoption, there are four primary ones:

Wearables Fundamentals. Leveraging new form factors and design (how we use the products), wearables are able to make technology more personal. People are attracted to Apple Watch’s ability to handle some tasks currently given to more powerful devices like iPhones and iPads as well as entirely new tasks. Given its design, there is nothing inherently found in wearables that limits its addressable market to the point of making it smaller than that of mobile devices. Instead, wearables are one of the rare product categories that can have an even larger addressable market than smartphones - a difficult feat given such high smartphone adoption figures.

Wrist’s Appeal. Everything from a great line of sight for displaying snippets of text and data, to an opportunity to successfully monitor activity and vital signs makes the wrist a valuable space for bringing utility to the body. By selling intangibles like prestige and wealth on the wrist, the Swiss watch industry ended up missing the wrist’s true value. Wrist real estate was being underpriced, and Apple capitalized on the mispricing with Apple Watch.

The Cool Factor. People want to be seen wearing an Apple Watch. The Apple Watch brand has evolved to become cool yet approachable. The device has wide appeal across gender, age, occupation, and social status. Apple Watch wearers are able to add customization to the wrist through various Watch band, case, and face / complications combinations. Thanks to Apple Watch’s comfortable bands, it’s easy to wear the device all day, every day.

Apple Ecosystem. One of the Apple Watch’s secrets to success is how it ends up being just one part of a much larger Apple ecosystem - an ecosystem that is unmatched in the industry. The ability to work seamlessly with other Apple wearables like AirPods as well as other devices ranging from iPhones to HomePods gives Apple Watch additional appeal and staying power in our lives. The ability to consume Apple Watch Services like Fitness+ on other Apple products helps to solidify Apple Watch’s positioning within the ecosystem.

Future Roles

When assessing Apple Watch’s future roles within Apple’s product line, three in particular jump out:

Identity Checker. Wrist detection allows the Apple Watch to maintain one’s identification chain as long as it remains in contact with the wearer’s skin. This is something that is difficult and cumbersome for other Apple devices to handle since they aren’t likely to be physically in contact with our bodies throughout the day. We already see Apple embrace this functionality by allowing Apple Watch to unlock Macs and most recently, iPhones. Going forward, the Apple Watch’s ability to serve as an identity checker can end up being used throughout our day as we interact with different devices, rooms, and objects.

Digital Health Purveyor. The Apple Watch is able to seamlessly monitor our health and alert us to things that we should know without overwhelming us with lots of data and information. This gives the Apple Watch a key role in our lives that would be difficult for other devices to handle.

Support Device for Face Wearables. While the face is home to some of the most valuable real estate on our bodies, it’s not an ideal place for storing a lot of technology. In order for face wearables to go mainstream, devices as light, thin, and comfortable as a regular pair of glasses are needed. Not surprisingly, this is proving to be a difficult engineering problem to solve. The Apple Watch allows technology required for computing on the face to be placed in a far more convenient location on the body.

A Successful Bridge

Back in early 2018, I called the Apple Watch a bridge to the future - a device that was still very much based on our current user interface repertoire but beginning to lay the groundwork for the future when it comes to greater reliance on voice, audio, and digital identity. At the time, in the Above Avalon article, “Apple Watch Is a Bridge to the Future,” I wrote the following:

“Apple has a vision for how we will use the combination of voice and screens in the future. Unlike Amazon and Google, who are desperately trying to position voice as a way to leapfrog over the current smartphone/tablet and app paradigm, Apple is approaching things from a different angle. Instead of betting on a voice interface that may push some information to a stationary screen, Apple is betting on mobile screens that are home to a digital assistant. Apple is placing a bet that consumers will want the familiarity of a touch screen to transition to a future of greater AI and digital assistants. In addition, Apple thinks user manipulation via screen (fingers, hands, and eyes) will remain a crucial part of the computing experience for the foreseeable future.”

Three years later, I wouldn’t change a word in that paragraph. This scenario has materialized. In addition, the fact that Apple Watch is not a futuristic device struggling to handle tasks that we currently have has given the device a good portion of its appeal and momentum over the past five years. With Apple Watch now worn on more than 100 million wrists, Apple can turn to the next Apple Watch adoption goal: 200 million wrists.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (3 stories per day, 12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

For additional discussion on this topic, check out the Above Avalon daily update from January 16th.

The Rise of Smaller Displays

Apple is a design company selling tools capable of improving people’s lives. Approximately 80% of those tools include a display. Apple is shipping about 300 million displays per year, from iPhones and iPads to Macs and Apple Watches. With Apple running as fast it can towards AR glasses, the number of displays that the company ships will only increase over the next five to ten years. While the pandemic is pushing people to embrace larger displays like iPads and Macs, the momentum found with smaller displays is still flying under the radar.

Display Spectrum

Back in 2017, I published the following chart that tracks Apple device unit sales by display size. The exercise involved breaking out iPhone, iPad, and Mac unit sales by model - something that Apple has never done itself but which the company provided enough clues for me to do on my own and have confidence in the estimates.

Exhibit 1: Apple Device Sales Mix by Display Size (2016 data)

Since Apple offers a finite number of display choices, Exhibit 2 turns the sales data from Exhibit 1 into a broader statement about preferred display size.

Exhibit 2: Apple Device Sales Mix by Display Size (2016 data - Smoothed Line)

The motivation in pursuing such an exercise was to place context around the number of large displays Apple was selling in the form of MacBooks and iMacs. Fast forward three years, and it’s time to revisit the topic. With the significant amount of change occurring in Apple’s product line since 2016, there is value in going through a similar exercise regarding display size preference with 2020 unit sales in mind. While Apple’s financial disclosures haven’t gotten better over the past four years - if anything, the disclosures have gotten worse - I am still confident in my ability to derive unit sales estimates for all of Apple’s products.

Exhibit 3: Apple Device Sales Mix by Display Size (2020 data)

Exhibit 4: Apple Device Sales Mix by Display Size (2016 data - Smoothed Line)

(All of my granular estimates and modeling that went into Exhibits 3 and 4 is available to Above Avalon members in the daily update published on December 7th found here.)

As seen in Exhibits 3 and 4, there is bifurcation in Apple display size popularity. The most in-demand displays fall into two (broad) categories:

Displays large enough for consuming lots of video and other forms of content that can still be comfortably held in a hand or stored in a pocket.

Displays small enough to be worn on the body (Apple Watch) and products lacking a display altogether (AirPods).

It hasn’t been difficult to miss Apple’s gradual move to larger iPhone displays over the years. The 6.7-inch iPhone 12 Pro Max is getting close to the maximum size for an iPhone display, at least when thinking about the current form factor. Such a reality has undoubtedly played a role in some smartphone manufacturers betting heavily on foldable displays for smartphones. Such a bet boils down to believing consumers will want larger smartphone screens to the point of being OK with tradeoffs in terms of device thickness and weight. Move beyond the iPhone and display popularity plummets as the iPad and Mac sell at a fraction of the pace. There are small sales peaks found at 10.2 inches, the size of the lowest-cost iPad, and 13.3 inches, the size of the MacBook Air and entry-level MacBook Pro.

With hundreds of millions of people embracing 4.7-inch to 6.7-inch displays via iPhone, the claim that consumers are embracing larger screens over time contains some validity. Many are now wondering if similar moves to larger displays will take over the iPad and Mac lines. However, focusing too much on large displays will make it easy to miss what is happening at the other end of the spectrum. The rise of wearables has given an incredible amount of momentum to small displays and devices lacking a display altogether.

Implications

There are four key implications arising from this display bifurcation observation.

Apple’s ecosystem naturally supports the idea of multi-device ownership.

As devices are given more roles and workflows to handle, there is a natural tendency for screen sizes to increase without changing the overall form factor much.

Power and value are flowing to smaller displays that are capable of making technology more personal.

Devices relying on voice as an input make more sense when paired seamlessly with devices with displays.

It is worth going over each in greater detail.

1) Apple’s ecosystem is characterized by hundreds of millions of iPhone-only users buying additional Apple products and services. This is a result of industry-leading customer satisfaction rates and subsequently very strong brand loyalty. However, there are more fundamental themes underpinning this trend. By controlling hardware, software, and services, Apple is able to sell a range of products that seamlessly work together. These tools don’t serve as replacements for one another but rather as alternatives. This leads to consumers being able to use multiple Apple devices aimed at handling different workflows in their unique way. Such a dynamic supports the idea of multi-device ownership over time with those additional Apple devices likely containing smaller displays or no displays at all.

2) Apple has given the iPad, iPhone, and Apple Watch larger displays over time. For the iPad, the 12.9-inch / 11-inch iPad Pro and 10.9-inch iPad Air are larger than the initial 9.7-inch iPad and subsequent 7.9-inch iPad mini. The 3.5-inch display found with the first few iPhone models looks downright tiny next to iPhone 12 flagships. Even the Apple Watch was given a larger display after being sold for three years. These moves may seem to be unnoteworthy reactionary outcomes to competitors and market forces. However, the move to larger displays over time ends up being connected to the product category handling more workflows over time. iPhones have become “TVs” for hundreds of millions of people. Today’s iPad Pro flagships are geared toward content creation. Apple Watch faces are being given more complications in order to provide additional new-age app interactions to wearers.

3) The two product categories seeing the strongest unit sales momentum have either the smallest displays Apple has shipped (Apple Watch) or no displays at all (AirPods). As wearables usher in a paradigm shift in computing by altering the way we use technology, new form factors designed to be worn on or in the body for extended periods of time are playing a role in helping to make technology more personal. This leads to an observation that may not be so obvious: Smaller displays require new user inputs and interfaces that force new ways of handling existing workflows while supporting entirely new workflows. Said another way, smaller displays end up playing a vital role in lowering the barriers between technology and humans.

4) The reason stationary smart speakers were one of the biggest tech head fakes of the 2010s is that consensus incorrectly assumed the future was voice and just voice. The idea of voice as a user input being enhanced by the presence of a display was skipped over. Jump ahead a few years and the HomePod is arguably made better by having nearby displays either simply around us (iPhones) or on us (Apple Watch). Some of the magic found with AirPods involves the seamless integration with various displays, especially the Apple Watch display. Voice just isn’t an efficient medium for transferring a lot of data and context. Relying on displays for such context makes it possible for devices without displays to shine by being allowed to do what they do best - either provide superior sound (HomePod) or convenient sound (AirPods).

Bet on Smaller Displays

One takeaway from the pandemic has been that social distancing in the form of distance learning and working from home has fueled momentum for some of the largest displays in Apple’s product line. The iPad is setting multi-year highs for unit sales and revenue. The Mac registered an all-time revenue record last quarter. There are a few reasons behind this momentum that include families needing newer (and faster) machines and employers funding work-from-home upgrades.

Instead of looking at this development as the start of a new era for large displays, the momentum found with larger displays shifts focus away from the actual revolution taking place with smaller displays.

Apple is on track to sell approximately 150M devices in FY2021 that either lack a display or contain a display that is less than two inches (5 cm). We are still in the early innings of this revolution. Looking ahead at AR glasses, Apple will eventually sell devices containing two small displays for the first time. Relying on conservative adoption estimates, Apple will sell hundreds of millions of devices per year that contain either small displays or no displays at all. We are seeing the rise of smaller displays, and the secret to witnessing it is knowing where to look.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

A Billion iPhone Users

A billion people now have iPhones. According to my estimate, Apple surpassed the billion iPhone users milestone last month. Thirteen years after going on sale, the iPhone remains the perennial most popular and best-selling smartphone. Competitors continue to either shamelessly copy iPhone or, at a minimum, be heavily influenced by the iPhone. Looking ahead, Apple’s top priorities for the iPhone include finding ways to keep the device at the center of people’s lives while at the same time recognizing the paradigm shift ushered in by wearables.

iPhone Sales

Over the past two years, iPhone sales have experienced notable gyrations. In early 2019, Apple saw material weakness in iPhone sales due to deteriorating economic conditions in China related to U.S. trade tensions. Although Tim Cook faced some skepticism when making such a claim, the observation was later proven to be legitimate as a number of other companies went on to describe a similar slowdown in demand.

As shown in Exhibit 1, iPhone unit sales on a trailing twelve months basis dropped by about 12% in early 2019 from a 218 million annual pace to a 191 million pace. The iPhone business went on to experience a gradual improvement in sell-through (i.e. customer) demand during the second half of 2019 and the beginning of 2020 before the pandemic hit. iPhone unit sales are back above a 200 million annual pace and are currently 13% below the unit sales high experienced in 2015.

Exhibit 1: iPhone Unit Sales (TTM Basis)

At a glance, Exhibit 1 would suggest that the iPhone business has lost some of the shine it had in the mid-2010s. However, this would be a misreading of the situation. On its own, unit sales don’t tell us the full story about the iPhone business. This is the primary reason behind Apple’s decision in late 2018 to stop providing unit sales data on a quarterly basis. Wall Street was incorrectly using unit sales as a crutch for shoddy analysis.

Flat to down iPhone unit sales do not automatically mean iPhone business fundamentals have deteriorated. Instead, a longer upgrade cycle can be a leading factor behind declining unit sales. In addition, unit sales don’t say anything about customer loyalty and satisfaction rates, which are crucial when it comes to a customer’s decision to continue using a product.

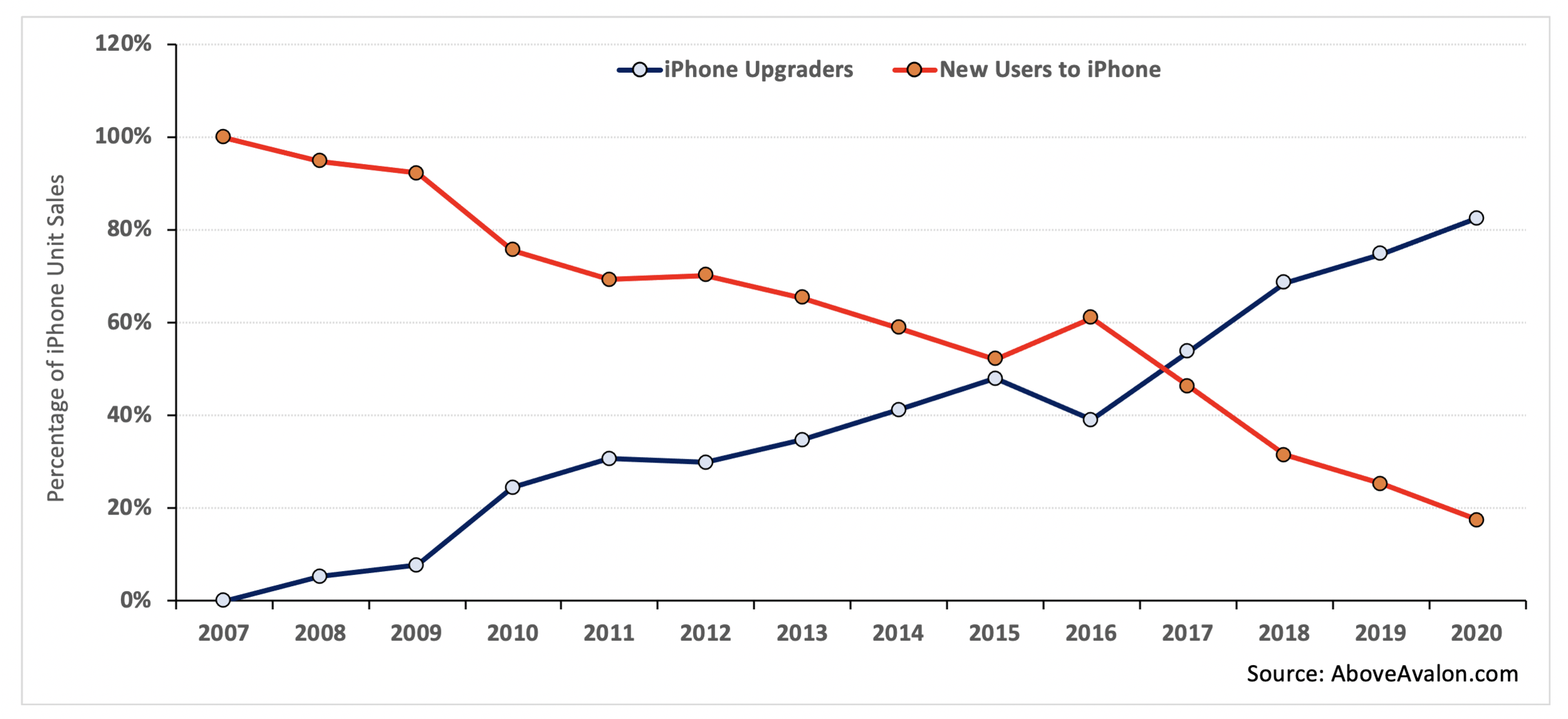

In order to reach more valuable insights regarding the iPhone business, Exhibit 2 takes unit sales data from Exhibit 1 and adds granularity. Instead of looking at sales just in terms of the number of units shipped from a factory, Exhibit 2 takes into account who bought iPhones: customers upgrading to a new iPhone or customers buying their first new iPhone. The data is derived from my iPhone installed base model that tracks when customers entered the installed base and then monitors upgrading patterns.

Exhibit 2: iPhone Unit Sales Mix (iPhone Upgraders vs. New Users to iPhone)

The iPhone business has turned into an upgrading business. While Apple is still bringing in 20M to 30M new iPhone users each year, the percentage of overall iPhone sales going to new users has steadily declined. For FY2020, iPhone sales to new users will likely have accounted for less than 20% of overall iPhone sales - an all-time low.

iPhone Installed Base

While quarterly iPhone unit sales contain an inherent amount of volatility, installed base totals do a better job of monitoring iPhone fundamentals over the long run. The iPhone installed base is defined as the total number of people using an iPhone (both new and used iPhones). A shrinking iPhone installed base would raise a number of warning signs for Apple as it would suggest people have been switching to Android. A growing iPhone installed base would suggest Apple continues to see new users embrace the iPhone for the first time.

Two variables are needed to estimate and track the iPhone installed base:

The number of people who purchase (and continue to use) a new iPhone from Apple or a third-party retailer.

The number of people who are using an iPhone obtained via the gray market. These iPhones have either been passed down through families and friends or resold to new users via a web of retailers and distributors.

By combining the two groups, one is able to derive estimates for the total number of iPhones in the wild. Although Apple does not disclose this installed base figure on a quarterly basis, the company did mention that the iPhone installed base surpassed 900M devices by the end of FY1Q19. As shown in Exhibit 3, which displays my estimates for the Apple installed base over the years, the iPhone installed base has grown each year since launch and recently surpassed a billion people.

(The methodology used to reach my iPhone installed base estimates is available here for Above Avalon members.)

Exhibit 3: iPhone Installed Base (total number of iPhone users in the wild)

In recent years, the pace of growth in the iPhone installed base has slowed. Much of this slower growth is due to high smartphone penetration and Apple having already successfully targeted the premium end of the smartphone market. With that said, Apple is still bringing in approximately 20M to 30M new iPhone users per year. These users are prime candidates for moving deeper into the Apple ecosystem by purchasing other Apple devices and services. Strong growth trends seen with iCloud storage, Apple’s content distribution services, Apple Watch, AirPods, and even iPad / Mac are made possible by hundreds of millions of people moving beyond just an iPhone to own additional Apple services and devices.

iPhone Priorities

Looking ahead, Apple has three primary priorities, or goals, for the iPhone:

Push camera technology boundaries.

Increase the value found with iPhone ownership.

Increase the number of roles handled by the iPhone.

Cameras. When thinking about the iPhone feature that will lead the way over the next five to ten years, more powerful cameras are high on the list. For the past few years, camera improvements and upgrades have been positioned as the top feature found with new flagship iPhones. A similar trend has been found with every major smartphone manufacturer. This has led to a type of camera arms race as each company tries to convince consumers that they have the best camera.

The primary reason Apple and its peers are betting so big on cameras is that they are convinced consumers will find value in smarter “eyes" - cameras that increasingly move into 3D rendering and AR realms. Advances in computational photography are also leveraged to make it easier for people to take really great photos.

While a bet on the camera will turn out to be a good one for Apple, the move doesn’t lack risk. As Apple pushes camera technology forward, many existing iPhone users are content with the iPhone camera they already own. This will manifest itself in no discernible bump in iPhone upgrading simply due to camera upgrades and advancements.

Another factor behind betting big on iPhone camera technology is that the smartphone form factor remains conducive to bringing powerful cameras to the mass market. While a “selfie” camera may make sense on the wrist with Apple Watch, it is difficult to see the wrist as a good place for cameras used to capture memories. There is similar hesitation found with the idea of putting such powerful cameras on the face in the form of AR glasses. Therefore, it makes sense that the device held in our hands and stored in our pockets will likely contain the most powerful camera in our lives.

iPhone Value. A major development regarding the iPhone that continues to fly under the radar is the improving value proposition found with owing and using an iPhone. By improving iPhone durability and longevity, Apple ends up strengthening the iPhone’s value proposition via higher resale values. If a new iPhone can be recirculated to additional users, the gray market will be strengthened and consumers will find more attractive payment terms and options at time of purchase.

An increasing number of iPhone users think about iPhone pricing in terms of monthly payments rather than lump sum. Attractive trade-in offers and payment plans with built-in upgrades only serve to improve the iPhone’s value proposition.

iPhone Roles. Tim Cook kicked off Apple’s “Hi, Speed” product event earlier this month by referring to the iPhone as the product we use the most, every day. He went on to say that the iPhone has never been more indispensable than it is now.

It is in Apple’s best interest to have the iPhone take over an increasing number of roles once given to laptops and desktops in addition to handling entirely new roles. By increasing our dependency on iPhone today, Apple ends up being in a better position to sell various wearable form factors tomorrow. Wearables are designed to not only handle entirely new tasks, but also take over tasks given to the iPhone.

Peak iPhone?

In FY2015, Apple sold 231 million iPhones. There continues to be a debate regarding whether or not Apple experienced “peak iPhone,” never exceeding that 231 million unit sales total in a 12-month stretch.

As a general rule, one needs to approach “peak” sales claims very carefully with Apple products. It may be tempting to look at unit sales data and conclude that a lower sales trend won’t reverse. However, weaker sales may not be the result of a change in market fundamentals such as a permanently reduced addressable market or less capable product. Instead, lower sales may simply reflect a slowdown in upgrading.

Odds are increasing that Apple has not experienced peak iPhone. As shown in Exhibit 4, my FY2021 iPhone unit sales estimate stands at 240M units, 4% higher than Apple’s previous iPhone sales record. My estimate does not assume a mega upgrade cycle kicked off by 5G iPhones. With the iPhone installed base having surpassed a billion users and continuing to expand by 20M to 30M people each year, Apple is in a good position to grow iPhone unit sales as the iPhone upgrade cycle plateaus between four and five years. This is where iPhone’s strong resale value enters the picture with consumers embracing various upgrading plans and options made possible by a well-functioning gray market.

Exhibit 4: iPhone Unit Sales (TTM Basis) - Includes Above Avalon FY2021 Estimates

New User Generation

The iPhone was the largest contributor to Apple growing its overall installed base from 125 million people in 2010 to more than a billion in 2020. Looking ahead, it’s fair to wonder if the iPhone will remain Apple’s primary new user funnel for the next billion users.

A strong case can be made that Apple will continue to rely on the iPhone for new user generation in the near term. While flagship iPhone pricing is aimed at the premium segment of the market, the gray market continues to play its role in expanding the iPhone’s reach to lower price segments.

Apple is also getting that much closer to launching its face wearables strategy. Requiring early versions of face wearables (AR / VR glasses) to work with an iPhone is logical when thinking about the limited amount of space for technology found with a pair of thin and light glasses.

Over time, we can’t ignore the new user growth potential found with Apple wearables. Apple Watch remains on its march to full independency from the iPhone. A truly independent Apple Watch would expand the product’s address market by threefold. AirPods are similarly well-positioned for appealing to Android users around the world. This brings us to India. The country will likely play a crucial role in Apple’s strategy of bringing hundreds of millions of new people into the ecosystem. As wearables make technology more personal, the product category’s addressable market will only expand.

While the iPhone may have been responsible for Apple getting to a billion users, wearables have a decent shot of getting Apple to two billion users.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members in both written and audio forms. To sign up and for more information on membership, visit the membership page.

Apple Watch Momentum Is Building

In a few months, the number of people wearing an Apple Watch will surpass 100 million. While the tech press spent years infatuated with stationary smart speakers and the idea of voice-only interfaces, it was the Apple Watch and utility on the wrist that ushered in a new paradigm shift in computing. We are now seeing Apple leverage the growing number of Apple Watch wearers to build a formidable health platform. The Apple Watch is a runaway train with no company in a position to slow it down.

Mirages and Head Fakes

We are coming off of a weird stretch for the tech industry. As smartphone sales growth slowed in the mid-2010s, companies, analysts, and pundits began to search for the next big thing. The search landed on stationary smart speakers and voice interfaces.

Companies who weren’t able to leverage the smartphone revolution with their own hardware placed massive bets on digital voice assistants that would supposedly usher in the end of the smartphone era. These digital voice assistants would be delivered to consumers via cheap stationary speakers placed in the home. Massive PR campaigns were launched that attempted to convince people about this post-smartphone future. Unfortunately for these companies, glowing press coverage cannot hide a product category’s fundamental design shortcomings.

At nearly every turn, Apple was said to be missing the voice train because of a dependency on iPhone revenue. Management was said to suffer from tunnel vision while the company’s approach to privacy was positioned as a long-term headwind that would lead to inferior results in AI relative to the competition. Simply put, Apple was viewed as losing control of where technology was headed following the mobile revolution.

There were glaring signs that narratives surrounding smart speakers and Apple lacking a coherent strategy for the future were off the mark. In November 2017, I wrote the following in an article titled, “A Stationary Smart Speaker Mirage”:

“On the surface, Amazon Echo sales point to a burgeoning product category. A 15M+ annual sales pace for a product category that is only three years old is quite the accomplishment. This has led to prognostications of stationary smart speakers representing a new paradigm in technology. However, relying too much on Echo sales will lead to incomplete or faulty conclusions. The image portrayed by Echo sales isn't what it seems. In fact, it is only a matter of time before it becomes clear the stationary home speaker is shaping up to be one of the largest head fakes in tech. We are already starting to see early signs of disappointment begin to appear…

I don’t think stationary smart speakers represent the future of computing. Instead, companies are using smart speakers to take advantage of an awkward phase of technology in which there doesn’t seem to be any clear direction as to where things are headed. Consumers are buying cheap smart speakers powered by digital voice assistants without having any strong convictions regarding how such voice assistants should or can be used. The major takeaway from customer surveys regarding smart speaker usage is that there isn’t any clear trend. If anything, smart speakers are being used for rudimentary tasks that can just as easily be done with digital voice assistants found on smartwatches or smartphones. This environment paints a very different picture of the current health of the smart speaker market. The narrative in the press is simply too rosy and optimistic.

Ultimately, smart speakers end up competing with a seemingly unlikely product category: wearables.”

Three years later, I wouldn’t change one thing found in the preceding three paragraphs. The smart speaker bubble popped less than 12 months after publishing that article. The product category no longer has a buzz factor, and despite the hopes of Amazon and Google, people are not using stationary speakers for much else besides listening to music and rudimentary tasks like setting kitchen timers.

The primary problem found with voice is that it’s not a great medium for transferring a lot of data, information, and context. As a result, companies like Amazon have needed to dial back their grandiose vision for voice-first and voice-only paradigms. Last week’s Amazon hardware event highlighted a growing bet on screens – a complete reversal from the second half of the 2010s.

Betting on the Wrist

As companies who missed the smartphone boat were placing bets on stationary speakers, Apple was placing a dramatically different bet on a small device with a screen. This device wouldn’t be stationary but instead push the definition of mobile by being worn on the wrist.

Jony Ive, who is credited with leading Apple’s push into wrist wearables, referred to the wrist as “the obvious and right place” for a different kind of computer.

When Apple unveiled the Apple Watch in 2014, wearable computing on the wrist was more of a promise than anything else. Apple created an entirely new industry – something that isn’t found much in the traditional Apple playbook.

After years of deep skepticism and cynicism, consensus reaction towards Apple Watch has changed and is now positive. Much of this is due to the fact that it’s impossible to miss Apple Watches appearing on wrists around the world. According to my estimates, approximately 35% of iPhone users in the U.S. now wear an Apple Watch. This is a shockingly high percentage for a five-year-old product category, and it says a lot about how Apple’s intuition about the wrist was right.

Apple Watch Installed Base