Is That a Case on Your iPhone? (AVALON Podcast Episode)

In the 26th episode of the AVALON podcast, Neil discussed the following topics/subjects:

What's on the Agenda (the bulk of the discussion modeled after Apple’s Monday morning meetings)

My iPhone 17 Pro Max (Cosmic Orange) impressions.

iPhone Air demo observations.

My revised iPhone Air sales expectations.

iPhone 17 sales mix.

Thoughts on iPhone unit sales.

Why we may be seeing the start of a multi-year uptrend for iPhone.

Lighting Round (two topics two minutes each)

Warner Bros. Discovery is up for sale.

Tesla thinking about adding CarPlay support to its vehicles.

Give Me a Break (something ridiculous that jumped out at me)

AI avatars of dead relatives.

Tell Me More (something intriguing that has my attention)

My Black Friday 2025 observations (shopping malls, LEGO, Barnes & Noble).

Listen to the first four minutes of the episode below:

Become a subscriber to continue listening to the 81-minute episode. Already an AVALON subscriber? The episode “Is That a Case on Your iPhone?” is in your podcast player.

Choose a monthly subscription or go with annual to save. (Charges can be expensed by your employer as the podcast is filled with analysis and research. If you need paid invoice receipts, go with the annual plan.)

Upon signup, you will receive a welcome email with directions for getting the podcast in your player. AVALON can be listened to in Apple Podcasts and various third-party podcast players including Pocket Casts, Overcast, and Castro.

If you currently subscribe to the Above Avalon Daily newsletter (great choice), with the Podcasts Package attached to your subscription, you get the AVALON podcast for FREE. This is one of the best deals available in the Above Avalon ecosystem.

If you subscribe to Above Avalon Daily without the Podcasts Package, no worries - you still receive a large 40% discount. Pay just an extra $6 per month (or $60 per year) for AVALON by filling out this form.

The Competitive Landscape Favors the iPhone, More on Elon Musk Suing Apple

Hello everyone. The highly anticipated remedies verdict in U.S. v. Google (available here) was released a few hours ago. Based on a quick look over the ruling, things look pretty good for Apple (and Google for that matter). We will dedicate tomorrow’s update to the topic.

For today’s and Thursday’s updates we will focus on a few topics that are on my mind ahead of Apple’s big event next week.

Let’s jump right in.

The Competitive Landscape Favors the iPhone

A week from today, Apple will host its largest event of the year when it comes to generating buzz and attention. WWDC is the largest event when thinking of number of Apple Park guests and overall operation (there’s many moving parts). And one can certainly argue new software is vitally important for the Apple ecosystem. However, the flagship iPhone event in September is able generate more press than any other Apple event. It’s a truly global affair as well. The iPhone is Apple’s best tool for grabbing new users around the world.

From a hardware perspective, attempts to somehow displace iPhone from its perch have not been successful. We can point to AI hardware startups underestimating consumers’ love for iPhone. Meanwhile, Apple peers are struggling to recreate the Apple playbook of vertical integration and ecosystem cohesion.

Become a member to continue reading today’s update. Already a member? Read the full update here.

An audio version of this update is available to members who have the podcast add-on attached to their membership.

Member Privileges and Benefits

Become an Above Avalon member and receive the following privileges and benefits:

Exclusive Analysis. Receive the Above Avalon Daily newsletter, widely-recognized as the leading daily newsletter dedicated to Apple. Now in its tenth year.

Archive Access. Access previous newsletters sent to members.

Member Forum Access. Access all channels in the Above Avalon forum in Discord.

Email Access. Receive timely responses from Neil to email inquiries.

Access to Add-ons. Customize a membership with the AVALON, Podcasts, Inside Orchard, and Financial Models add-ons.

Above Avalon Support. Play an active role in supporting Above Avalon as an independent voice and resource.

Previewing Apple’s 1Q25 Earnings, Apple 1Q25 Earnings Expectation Meters

Today's Above Avalon Daily email contains the following stories:

Previewing Apple’s 1Q25 Earnings

Apple 1Q25 Earnings Expectation Meters

My 1Q25 earnings preview looks slightly different as we bring back my expectation meters and a “cheat sheet” that can be utilized with Apple’s earnings release. In addition to my 1Q25 estimates, the email includes commentary regarding expectations heading into Apple’s earnings release.

Become a member to continue reading today’s update. Already a member? Read the full update here.

An audio version of this update is available to members who have the podcast add-on attached to their membership.

Member Privileges and Benefits

Become an Above Avalon member and receive the following privileges and benefits:

Exclusive Analysis. Receive the Above Avalon Daily newsletter, widely-recognized as the leading daily newsletter dedicated to Apple. Now in its tenth year.

Archive Access. Access previous newsletters sent to members.

Member Forum Access. Access all channels in the Above Avalon forum in Discord.

Email Access. Receive timely responses from Neil to email inquiries.

Access to Add-ons. Customize a membership with the Podcast, Inside Orchard, and Financial Models add-ons.

Above Avalon Support. Play an active role in supporting Above Avalon as an independent voice and resource.

Addressing iPhone Pessimism

In today’s update, we will take a closer look at some of the iPhone pessimism that materialized following Apple’s “It’s Glowtime” event. Let’s jump right in.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. (Members: Daily Updates are accessible via the archive. If you haven’t logged into the archive before, fill out this form to receive an invite.)

Above Avalon Membership

Choose either a monthly or annual membership. Payment is hosted by MoonClerk and secured by Stripe. Apple Pay and other mobile payment options are accepted. After signup, use this link to update your payment information and membership status at any time. Contact me with any questions.

Contact me directly if you would like to purchase multiple subscriptions (five or more) for your team or company.

An audio version of the newsletter is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here. Special Inside Orchard bundle pricing is available for Above Avalon members. Additional membership customization is available via the Financial Models add-ons.

Deconstructing Apple’s Product Event (iPhone)

Hello everyone. We will conclude our Apple event review, focusing on the iPhone segment of the presentation.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. (Members: Daily Updates are accessible via the archive. If you haven’t logged into the archive before, fill out this form to receive an invite.)

Above Avalon Membership

Choose either a monthly or annual membership. Payment is hosted by MoonClerk and secured by Stripe. Apple Pay and other mobile payment options are accepted. After signup, use this link to update your payment information and membership status at any time. Contact me with any questions.

Contact me directly if you would like to purchase multiple subscriptions (five or more) for your team or company.

An audio version of the newsletter is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here. Special Inside Orchard bundle pricing is available for Above Avalon members. Additional membership customization is available via the Financial Models add-ons.

Apple Just Held Its Strongest September Event in Years

Hello everyone. Today’s update will go over my initial impressions from Apple’s “It’s Glowtime” event. The discussion will have more in the way of big picture takeaways. We will get to the specifics, including my thoughts on the features, on Wednesday and possibly Thursday.

Let’s jump right in.

Apple Just Held Its Strongest September Event in Years

Apple’s “It’s Glowtime” event was jam-packed with HW updates.

The Apple Watch Series 10 marked one of the more significant year-over-year improvements for a flagship Apple Watch in years. We will likely see a bump up in the non-Ultra to Ultra sales ratio.

All four iPhone flagships contained notable upgrades including A18 (for non-Pro models) / A18 Pro (for Pro models), Camera Control (touch-capacitive area with sensors and haptic motors), and improved battery life across the line.

The entire AirPods line saw updates for the first time since the line expanded to three models, with AirPods receiving a H2 chip along with fit and comfort enhancements, AirPods Pro becoming a clinical-grade Hearing Aid, and AirPods Max receiving its first change in its four-year life (USB-C and new colors).

Apple sneaked in a non-HW Apple Intelligence feature, Visual Intelligence, tied into Camera Control. Visual Intelligence provides iPhone users context for their surroundings.

After looking back at prior September events, it’s fair to say yesterday’s event was the strongest Apple September event since at least 2017 (iPhone X unveiling). That is not meant to belittle or

An Above Avalon membership is required to continue reading this update. Members can read the full update here. (Members: Daily Updates are accessible via the archive. If you haven’t logged into the archive before, fill out this form to receive an invite.)

Above Avalon Membership

Choose either a monthly or annual membership. Payment is hosted by MoonClerk and secured by Stripe. Apple Pay and other mobile payment options are accepted. After signup, use this link to update your payment information and membership status at any time. Contact me with any questions.

Contact me directly if you would like to purchase multiple subscriptions (five or more) for your team or company.

An audio version of the newsletter is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here. Special Inside Orchard bundle pricing is available for Above Avalon members. Additional membership customization is available via the Financial Models add-ons.

My 2Q24 Apple Estimates, Expectations for Apple's 3Q24 Guidance, My Updated Apple Earnings Model

Happy Wednesday. One quick thing before we get to the second half of my earnings preview.

Financial Models Add-on. As a reminder, members now have access to my iPhone, iPad, and Apple Watch installed base models with the Financial Models add-on. These models make it possible to estimate device unit sales, the number of devices in the wild over time, product upgrade cycle length, percent of device sales going to new users versus existing users by year and more. For those of you who purchased the Financial Models add-on, all installed base models have been updated ahead of earnings. You can access the models at any time by logging into your Above Avalon membership account here and going to the Digital Package tab (shown below). My earnings model has also been uploaded so that it will always be available in the same tab for easy access.

The Financial Models add-on is designed to be a perfect companion for AAPL investors wanting to take a deep dive into Apple’s financials as well as Apple competitors and suppliers needing to better understand the marketplace dynamic. For pricing information and to purchase the add-on, check out this page.

My 2Q24 Apple Estimates

Here are my granular estimates for Apple’s 2Q24:

Revenue: $91.9B (consensus: $90.0B)

Overall gross margin: 46.9% (guidance: 46% to 47%)

Gross margin (HW): 37.4%

Gross margin (Services): 74.6%

EPS: $1.59 (consensus: $1.50)

iPhone revenue:

An Above Avalon membership is required to continue reading this update. Members can read the full update here. (Members: Daily Updates are accessible via the archive. If you haven’t logged into the archive before, fill out this form to receive an invite.)

Choose either a monthly or annual membership. Payment is hosted by MoonClerk and secured by Stripe. Apple Pay and other mobile payment options are accepted. After signup, use this link to update your payment information and membership status at any time. Contact me with any questions.

Contact me directly if you would like to purchase multiple subscriptions (five or more) for your team or company.

An audio version of the newsletter is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here. Special Inside Orchard bundle pricing is available for Above Avalon members. Additional membership customization is available via the Financial Models add-ons.

Thoughts on Apple Product Pricing, My iPhone and Apple Watch Sales Mix Estimates, U.S. Carriers Improve iPhone Promotions

In today’s update, we go over a few topics related to the new Apple Watches and iPhones. The discussion begins with Neil’s thoughts on new Apple Watch and iPhone pricing. We then turn to Neil’s estimates for unit sales mix by Apple Watch and iPhone model. The update concludes with U.S. carriers improving their iPhone promotions.

Hello everyone. Welcome to a new week. Let’s jump right in.

Thoughts on Apple Product Pricing

At last week's product event, no major changes to Apple’s product pricing strategy were announced. There were more than a few rumors suggesting iPhone Pro pricing was going up against the board. That did not occur. Generally, Apple pricing rumors should be discounted as Apple is able to keep pricing information under wraps.

Here is entry-level pricing for each Apple Watch collection:

Apple Watch Series SE: $249 (GPS) – did not receive any updates last week

Apple Watch Series 9: $399 (GPS)

Apple Watch Ultra 2: $799 (GPS + Cellular)

We will talk more about my sales mix expectations by Apple Watch model shortly. For now, it is important to point out how Apple is sticking with

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Apple 2Q23: By the Numbers, Apple Device Upgrading Slows, Apple's Emerging Markets Strength (Daily Update)

Today's special Friday edition of the Daily Update will be focused on reviewing Apple's earnings. The idea is to keep things broad and look at the big picture takeaways. We also examine how Apple’s results compared to Neil’s expectations.

Hello everyone. Welcome to a special edition Friday version of the daily update. We will begin going over Apple’s 2Q23 numbers and conference call.

For today, the focus will be on the key numbers and two big picture takeaways. The discussion will continue next week.

Let’s jump right in.

Apple 2Q23: By the Numbers

There were no major surprises found with Apple’s 2Q23 earnings. Device upgrading has slowed, although Apple continues to bring new users into the fold. While the iPhone, iPad, and Apple Watch look OK, AirPods continues to experience growth turbulence, while the Mac is trying to find sales stabilization. In an environment where gross margin integrity is being rewarded, Apple’s results will get attention.

Apple’s guidance for 3Q23 is close to what sell-side analysts were expecting, which likely will come as a disappointment to some. Looking under the hood, it looks like the U.S. macro environment is indeed sluggish, backing up conclusions from various Fortune 500 firms. Offsetting such disappointment, Apple continues to see strong momentum in emerging markets as the company takes share from Android.

Here are Apple’s reported 2Q23 results versus my expectations with brief commentary for each item.

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

My Apple 2Q23 Estimates, Expectations for Apple's Capital Management Changes, My Revised Apple Earnings Model (Daily Update)

Apple reports FY2Q23 earnings on Thursday. Today’s update contains the second half of Neil’s earnings preview. The first half is available here. The update begins with Neil’s granular financial estimates. The discussion includes qualitative explanations for each of Apple’s product categories. We then look at Neil’s expectations for what Apple will announce regarding its cash dividend and share repurchase authorization. We conclude with Neil’s updated Apple earnings model and how the model has changed over the past three months. Access to Neil’s Apple earnings model is a benefit associated with Above Avalon membership at no additional cost.

Hello everyone. Similar to previous quarters, with Apple releasing earnings tomorrow, Thursday’s update will be pushed out a day so that there is a special edition Friday version of the daily update.

Let’s jump into the second half of my earnings preview.

My Apple 2Q23 Estimates

Here are my granular estimates for Apple’s 2Q23:

Revenue: $95.7B (consensus: $93.0B)

Overall gross margin: 44.6% (guidance: 43.5% to 44.5%)

Gross margin (HW): 37.5%

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Selling Non-Pro iPhones, Revisiting iPhone Repairability, Less Frequent Upgrading Can Help Apple's User Monetization (Daily Update)

Hello everyone. Welcome to a new week. In today's update, we will cover a few topics related to the iPhone. The discussion begins with Apple’s strategy for selling non-pro iPhones. This leads us to revisiting the subject of iPhone repairability. We go over three primary implications of improved iPhone repairability. The discussion ends with an example of how Apple can turn less frequent device upgrading into improved user monetization over time. Let's jump right in.

Selling Non-Pro iPhones

Over at The Sydney Morning Herald, here is Tim Biggs:

“The latest line-up of iPhones has arguably the biggest gap ever between the standard models and the Pros. The phones have different displays, different features, different cameras and different processors.

If you ask Apple, it will say the two categories are designed with two different consumers in mind, each model having its own strengths. And if you take a look inside, you’ll see that the standard phone can’t simply be written off as a stripped-down Pro or a repackaged model from last year…

It can be hard to tell just from looking at the specs and exteriors where each ‘standard’ iPhone model sits in a hierarchy amid previous models and Pros, new and old. With Pros, it’s easy to assume they’re the biggest and best iPhones at the time of release, but with the standards there’s always an implicit question of what sacrifices are made to get to the lower price.

Richard Dinh, Apple’s longtime senior director of iPhone design, said the company didn’t really think of it like that.

‘We don’t always follow a recipe, as much as maybe our customers would like to predict what we’re going to go do next, but it always starts with the customer experience,’ he said, noting that a standard phone might have different goals for performance, weight, longevity and photography than the Pro models.

‘Sometimes we do draw from the Pros because they’re just incredible, and we’re bringing some of that hardware to a broader audience, and sometimes we go do something different.’”

In talking to The Sydney Morning Herald, one of Apple's goals was to draw attention to how less expensive flagship iPhone models aren’t just pro models that had features removed. Instead, non-pro iPhone models may in some years contain features that premium models lack. For the iPhone 14 and 14 Plus, such features include superior battery life (found with the Plus) and repairability (found with the 14).

An Above Avalon membership is required to continue reading this update. Members can read the full update here. An audio version of this update is available to members who have the podcast add-on attached to their membership. More information about the podcast add-on is found here.

(Members: Daily Updates are always accessible by logging into Slack. If you haven’t logged into Slack before, fill out this form to receive an invite.)

Above Avalon Membership

Payment is processed and secured by Stripe. Apple Pay and other mobile payment options are accepted. Special Inside Orchard bundle pricing is available for Above Avalon members.

More information about Above Avalon membership, including the full list of benefits and privileges, is available here.

Above Avalon Year in Review (2021)

Heading into 2021, Apple had just gone through one of the more tumultuous years in its existence. As discussed in last year’s Year in Review, the pandemic turned 2020 into a steady stream of unexpected challenges for Apple. Expectations that 2021 would be much smoother turned out to be optimistic. While society did largely open up halfway through the year, which allowed Apple’s retail apparatus to return to normal operations, Apple continued to face once-in-a-few-decades challenges when it came to the supply chain, product manufacturing, and navigating its 154,000 employees through a pandemic.

According to my estimate, Apple experienced $10 billion of unmet demand in 2021 as a result of supply chain issues. This total is on top of lingering demand issues associated with wearables that arose from the pandemic.

Despite the challenges, 2021 was a record year for Apple on a number of business fronts:

Apple sold 260M+ iPhones - a record high for a 12-month period.

Apple sold 25M Macs - a record high for a 12-month period.

The Apple Watch installed base surpassed 100 million people.

Articles

In 2021, I published 10 Above Avalon articles. In looking through the articles, which are accessible to all, there was one overarching theme: Apple’s ecosystem continues to gain strength and is ready for the next major product category launch (a mixed reality headset).

Here are a few of my favorite articles published in 2021 (in no particular order):

Apple Has a Decade-Long Lead in Wearables. AssistiveTouch allows one to control an Apple Watch without actually touching the device. A series of hand and finger gestures can be used to control everything from answering a call to ending a workout. The technology is just the latest example of how Apple’s lead in wearables is still being underestimated. The evidence points to Apple having a wearables lead of not just a few years, but more like a decade.

Apple Won the Share Buyback Debate. I receive many questions about Apple from Above Avalon readers, listeners, and members. In previous years, one topic has been far ahead of any other as a source of questions. Everyone wanted to know about Apple’s share buyback program. Something interesting happened in 2020. I received far fewer questions about Apple’s share buyback program. To be precise, I didn’t receive an incoming question about buyback in nine months - from when the stock market put in a bottom in April 2020 to the start of 2021. What explains such a dramatic change? The Apple share buyback debate ended, and Apple was declared the winner.

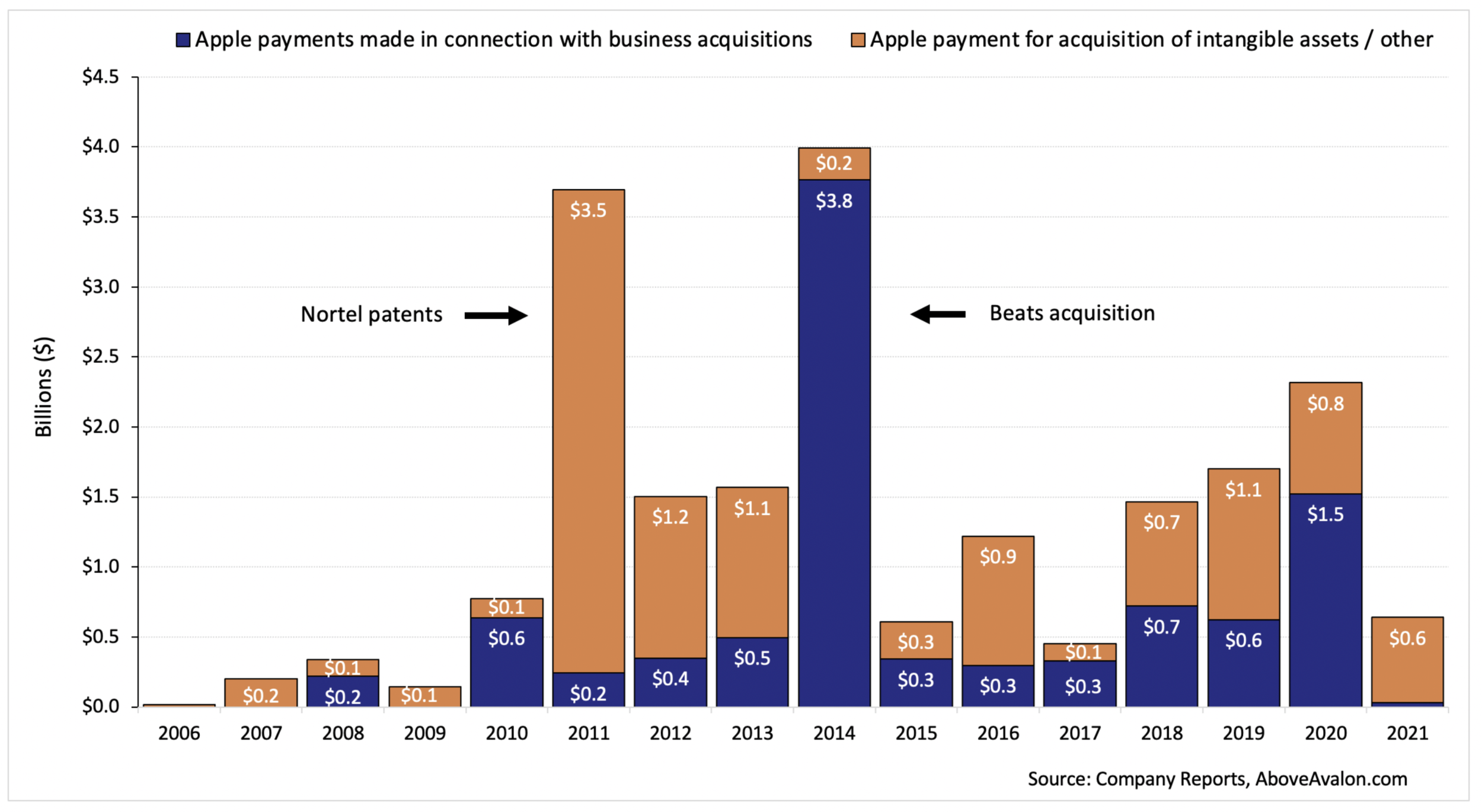

Apple’s Extremely Quiet Year for M&A. While going through Apple’s 10-K for FY2021, one number jumped out at me. It wasn’t the record iPhone sales, strong margins, or phenomenal free cash flow. Instead, it was the lack of cash spent on M&A. In 2021, Apple spent just $33 million on business acquisitions (M&A). That’s a record low for Apple with Tim Cook as CEO. It’s a number that deserves further investigation as Apple’s M&A strategy and philosophy play a big role in how Apple was able to get to where it is today.

The five most popular Above Avalon articles in 2021, as measured by page views, were:

Podcast Episodes

There were 11 episodes of the Above Avalon podcast recorded and published in 2021, totaling 4.5 hours. The podcast episodes that correspond to my favorite articles are found below:

Charts and Exhibits

The following charts and exhibits found in Above Avalon articles published in 2021 were among my favorites.

Apple Wearables Unit Sales (2017 to 2021) - from Apple Has a Decade-Long Lead in Wearables

According to my estimate, Apple is on track to sell 105 million wearable devices in 2021. That total represents 40% of the number of iPhones sold during the same time period. Unit sales don’t tell the full story, however. On a new-user basis, Apple is seeing more people enter the wearables arena than buy a new iPhone for the first time.

Note: Apple wearables include Apple Watch, AirPods, and select Beats headphones.

Percentage of Apple Revenue Through Direct Distribution Channel - from The Future of Apple Retail

The percentage of sales going through Apple’s direct distribution has gradually increased in recent years. The increase in sales percentage has likely been boosted by services revenue, more sales going through Apple’s website, and more iPhone upgrading taking place through Apple.

Note: Direct distribution channel includes Apple’s website, Apple stores, and direct sales force.

Apple M&A (Cash Payments) - from Apple’s Extremely Quiet Year for M&A

Since 2006, Apple has spent $20.6 billion on M&A with about half of the total tied to “business acquisitions.” The median is $1 billion per year. However, in 2021, Apple spent just $33 million on business acquisitions. That is the lowest amount since 2009 when Steve Jobs was still Apple CEO.

Daily Updates

In 2021, I published 182 Above Avalon Daily Updates that were available exclusively to Above Avalon members. With each update coming in at approximately 2,000 words, 182 updates are equivalent to five books. This continues to be an industry-leading number when it comes to the amount of Apple business and strategy analysis published.

When looking over the topics discussed in this year’s daily updates, a few sub themes become apparent:

Project Titan Moving Forward

Along with mixed reality and AR, transportation is one of the largest areas of opportunity when thinking of future Apple products and services. The year turned out to be the busiest one yet when it came to Project Titan news as Apple began to seek supply chain and manufacturing partners.

Hyundai Confirms Talks With Apple, Apple Considering Car Factory in Georgia, Making Sense of Apple and Hyundai News (Jan 12, 2021)

Apple Car and the Last Mile, Revisiting an Apple Campus Shuttle Service, Thursday Q&A (Feb 4, 2021)

Apple’s Kevin Lynch Joins Project Titan, Apple Car Implications, Apple Watch Implications (Jul 19, 2021)

Doug Field Leaves Apple for Ford, Project Titan’s Trajectory and Leadership, Silicon Valley vs. Detroit (Sep 8, 2021)

Kevin Lynch Tapped to Lead Project Titan, Disillusionment in the Auto Space Is Setting In, Ted Lasso Wins Big at the Emmys (Sep 20, 2021)

Changes in Paid Video Streaming Land

Given the rush of new players into the paid video streaming space in 2020, there was quite a bit of movement in 2021. AT&T’s decision to spin off WarnerMedia was an industry-shaking event. As the months went on, it became clear that many content distribution services were experiencing something equivalent to a pandemic air pocket as subscriber trends became noisy. Netflix and Roku ran into friction while the true new kid on the block (Apple TV+) regained momentum with new shows and movies coming online in the back half of the year.

AT&T to Spin Off WarnerMedia, HBO Max’s Future, Apple Implications May 17, 2021

WarnerDiscovery and Apple M&A, Ranking Paid Video Streaming Leaders, Netflix Contemplating Move into Gaming May 26, 2021

The App Store’s Day in U.S. Court

The well-publicized Epic Games vs. Apple trial resulted in a resounding legal victory for Apple. It ended up being difficult to grasp just how poor of a job Epic Games did in trying to paint Apple as a monopoly. While the court did order Apple to change its anti-steering provision in the U.S., Apple won a stay by a court of appeals. The outcome with the highest probability is for the anti-steering provision to remain as is which would signal Apple’s very strong legal footing as it pertains to the App Store.

Epic Games vs. Apple, Epic's Arguments Against Apple, Epic’s Motivation Apr 27, 2021

Thoughts on the Epic Games vs. Apple Ruling Sep 13, 2021

When looking at my daily updates published in 2021, selecting a few favorites out of 196 updates was not easy. The following updates stood out to me (in no particular order):

Warren Buffett’s Annual Letter, Apple Isn’t Buffett’s Token “Tech” Stock, Apple, Buffett, and Buyback. We kick off today’s update with my thoughts on Warren Buffett’s 2020 letter to Berkshire Hathaway shareholders. Berkshire is Apple’s largest individual shareholder. The discussion then turns to why I don’t agree with those claiming Apple is Buffett’s token tech stock. We conclude by looking at share buyback and how the capital return mechanism leads to a wealth transfer event. (Mar 2, 2021)

Peloton Recalls All of Its Treadmills, The At-Home Fitness Revolution Needs a Reset, Apple, Fitness Machines, and Gyms. Today’s update will be focused on the at-home fitness industry. It’s a market that Apple moved deeper into a few months ago with Apple Fitness+. A good argument can be made that at-home fitness impacts other Apple devices as well especially Apple Watch and Apple TV. We kick things off with my thoughts on Peloton recalling all of its treadmills. The discussion then turns to why I think the at-home fitness industry needs a reset. The update concludes with how fitness equipment safety, or the lack thereof, impacts Apple and why I continue to think there will be a role for gyms to play in the future. (May 6, 2021)

Tesla Buys Bitcoin, Apple and Bitcoin, Apple and Crypto Exchanges. Today’s update will be focused on bitcoin. We begin with news of Tesla buying $1.5B of bitcoin. We then turn to my thoughts on whether or not Apple should follow Tesla into bitcoin. The update concludes with a closer look at RBC Capital Market’s suggestion that Apple should move into cryptocurrency exchanges. We go over why I don’t think the firm’s analysis passes the small test. (Feb 10, 2021)

Apple’s Services Journey, A Different Way of Thinking of Apple One, Apple Services Evolution. For the first time in what feels like a long time, the Apple news cycle is taking a breather. This provides us with an opportunity to pursue some original topics. We kick off today’s update with my thoughts on the narrative surrounding Apple’s Services business. Things are starting to change. The discussion then turns to how I think about Apple’s Apple One bundle and how reframing Apple One leads to some interesting questions and ideas as it pertains to the competition. The update concludes with my thoughts on the future factors determining where Apple Services are headed. (Jul 13, 2021)

Niantic CEO Pours Cold Water on the Metaverse, Meta Buys Within, The Mistake People Are Making With the Metaverse. We kick things off with my thoughts on Niantic CEO John Hanke’s interview with The Verge’s Nilay Patel on his Decoder podcast. Hanke discussed some of the more intriguing topics and concepts found in the AR/VR/metaverse space. The discussion then turns to Meta (Facebook) buying Within. We go over two items that jumped out at me about the acquisition. The update concludes with the mistake that I see consensus making when it comes to metaverse analysis. (Dec 16, 2021)

The Amazon Event, Amazon’s Play for Neighborhoods, Amazon Astro. Today’s update will be focused on Amazon’s product event. We kick things off with my thoughts regarding Amazon’s product strategy involving ambient intelligence. The discussion then turns to Ring’s outsized presence throughout Amazon’s presentation. We go over Amazon’s play for neighborhoods and what is at stake. The update concludes with a closer look at the Amazon Astro. (Sep 29, 2021)

Here are the five most popular daily updates published in 2021 based on page views to AboveAvalon.com. There is naturally a tendency for updates published earlier in the year to outrank more recent updates.

Apple Designer Eugene Whang Left Apple, Apple Industrial Design Turnover, Spotify’s WSJ Op-Ed Against Apple (May 19, 2021)

Peloton Acquires Wearables Company, Peloton vs. Apple Watch, Facebook Talks Up Smartwatch as AR Controller (Mar 23, 2021)

Tesla’s Bitcoin Problem, Apple and Bitcoin Mining, Introducing My FY2022 Estimates for Apple (Feb 11, 2021)

Target to Open Mini Apple Stores, Apple’s Retail Store Growth Strategy, Thursday Q&A (Feb 25, 2021)

Apple Contemplating Apple Watch Explorer Model, Thinking About the Apple Watch Line, Apple Watch Partnerships (Mar 29, 2021)

Just 13% of the daily updates published in 2021 are highlighted in this article. The full archive consisting of all 182 daily updates is available here. Above Avalon membership is required to access the updates.

Daily Podcast

This was the first full year for the Above Avalon Daily podcast, the private podcast available to members who attached the podcast add-on to their membership. A total of 182 episodes were published, totaling nearly 40 hours of audio. The podcast allows members to consume the daily updates in new and different ways while around the house, on a walk, or in the car. Since launch, reception of the daily podcast has exceeded my expectations with very positive listener feedback. More information on the daily podcast, including a few sample episodes, is found here. Once an Above Avalon member signs up for the daily podcast, all prior episodes become available for listening in podcast players that support private podcasts.

Inside Orchard (Launched in 2021)

In March, I launched InsideOrchard.com as a home to my unique perspective on technology and its impact on society. Over the past nine months, 40 essays and corresponding podcast episodes were published. Although distinct from the analysis and discussion found with Above Avalon, the two sites can be thought of as siblings. A bundle consisting of both an Above Avalon membership and Inside Orchard subscription, with an accompanying price discount, was purchased by a good percentage of the Above Avalon member base.

Here’s to 2022

A big thank you goes out to readers, listeners, and members for making 2021 another successful year for Above Avalon. Have a safe and relaxing Christmas, holiday season, and New Year. See you in 2022. - Neil

Apple 4Q19 Earnings Expectation Meters

There is increased attention around Apple’s 4Q19 results. Apple shares are up 19% since the company reported 3Q19 results back on July 30th. Since the start of the year, AAPL shares are up 58% while the S&P 500 is up 21%. For a trillion dollar market cap company, such outperformance is noteworthy.

Apple’s strong stock performance has led to questions regarding what management will have to announce on Wednesday to meet or exceed expectations. At the same time, Apple’s 4Q19 results have the potential of containing some noise as Apple works through its flagship iPhone and Apple Watch launch. For example, the iPhone was not in demand / supply equilibrium by quarters end.

The following table contains my overall estimates for Apple’s 4Q19. My expectation is for Apple to report strong 4Q19 results and 1Q20 revenue guidance.

A detailed discussion of these estimates, including the methodology and perspective behind the numbers, is found in my Apple 4Q19 earnings preview available here. Above Avalon membership is required to read my earnings preview.

Each quarter, I publish expectation meters ahead of Apple's earnings release. Expectation meters turn single-point financial estimates into more useful ranges that aid in judging Apple's business performance. In each expectation meter, the white shaded area reflects my official single-point estimate. The gray shaded area represents a result that is considered near my estimate. A result that falls within this gray area signifies that the product or variable being measured is pretty much performing as expected. A result that falls in the green shaded area denotes strong performance and the possibility of me needing to raise my expectations for that particular item going forward. Vice versa, a result falling in the red shaded area denotes the possibility of needing to reduce my expectations going forward.

Over the years, the expectation meters have evolved with Apple’s changing business and financial disclosures. Ahead of Apple’s 4Q19 earnings, I am publishing three expectation meters:

Products vs. Services Revenue

iPhone vs. non-iPhone Revenue

1Q20 Revenue Guidance

Products vs. Services

Apple breaks out revenue into two categories: products (i.e. hardware) and services. The iPhone likely weighed on Apple’s 4Q19 products revenue due to both declining unit sales and a lower average selling price (ASP). The end result is products revenue that will show little to no growth. Partially offsetting lackluster growth in products, Apple’s Services revenue is expected to grow in the vicinity of 15%. This dynamic will likely improve in FY2020 as both products and services will once again contribute to Apple revenue growth.

iPhone vs. Non-iPhone

Another way of thinking about Apple’s business is to allocate the company’s various products and services into two buckets: iPhone and non-iPhone. Last quarter, Apple’s non-iPhone business registered more revenue than the iPhone business for the first time since 2012. It is unlikely that this dynamic will repeat itself in 4Q19 as the iPhone business gains revenue momentum due to the flagship iPhone launch.

Guidance

Consensus expects Apple to report $86B of revenue in 1Q20. That seems on the light side. My estimate is for Apple to announce 1Q20 revenue guidance in the range of $88B to $91B. Apple has to report more than $88.3B of revenue in 1Q20 to reach a new all-time record for quarterly revenue.

Apple has two tailwinds for issuing strong 1Q20 revenue guidance:

Apple is facing one of the easier year-over-year quarterly compares in years given the demand implosion in China seen in November and December 2018. This will make it that much easier for Apple to report revenue growth in 1Q20.

The environment is conducive to both Apple Watch and AirPods selling well during the 2019 holiday shopping season. Apple not only faces a lack of genuine smartwatch or wireless headphone competition, but also has strong product lines with attractive entry-level pricing available.

On the flip side, one headwind worth monitoring is declining iPhone ASP. Apple cut pricing of its lowest-priced flagship iPhone by $50. In addition, Apple remains aggressive with pricing outside the U.S.

Despite Apple’s strong stock price outperformance so far this year, the company continues to have the lowest forward valuation multiples among the Wall Street giants. A good argument can be made that Apple’s strong stock price outperformance in 2019 hasn’t been driven by expectations of strong 4Q19 numbers or even solid 1Q20 guidance. Instead, the marketplace may be betting on improved visibility around Apple’s financials through FY2021. The environment is becoming more hospitable for iPhone revenue growth to return in FY2020. At the same time, Apple wearables continue to gain momentum. There is then growing smoke around the idea of Apple potentially having a busy first half of CY2020 from a new product perspective.

My working Apple earnings model as well as my granular 4Q19 estimates including unit sales, ASP, and margin expectations, are available here. Above Avalon membership is required to read my full 4,000-word earnings preview. Access to my model is available to members at no additional cost.

My Apple earnings review will be made available exclusively to Above Avalon members. To have the review sent directly to your inbox once published, sign up at the membership page.