iPhone Hysteria

With 2018 quickly coming to a close, a look back at the past 12 months leads to an interesting observation regarding Apple. On one hand, the company had a remarkably strong year when it came to pushing the Apple ecosystem forward. Every major product category was updated, with especially strong updates to Apple Watch and iPad Pro. iOS 12 experienced a successful launch, followed by strong adoption.

However, Apple had an awful year when it came to perception and media coverage. The first half of the year was all about iPhone X demand coming in weaker-than-expected. The past two months have been focused almost entirely on weak demand for iPhone XR, XS, and XS Max.

We are in the midst of an iPhone hysteria phase that has reached an inflection point. Attention is being given to data points that are not good indicators of the underlying strength of the iPhone business. Meanwhile, little to no attention is being given to the items that are genuine risks and concerns facing iPhone. We are now starting to see this hysteria and pessimism spill into how the rest of Apple’s business is perceived.

The iPhone Matters

If there is one widely-held opinion about the iPhone, it would be that the product still matters to Apple. The iPhone is directly responsible for 60% of Apple’s revenue and 65% of Apple’s gross profit. However, those percentages ignore the role the iPhone plays in driving Services and wearables revenue.

According to my estimates, approximately 80% of Apple’s Services business is in some way tied to the iPhone. Revenue drivers such as the App Store, iCloud, licensing, and AppleCare are closely tied to either iPhone sales or the broader iPhone installed base. With wearables, Apple Watch still requires an iPhone to set up. Taking into account the preceding items, the iPhone is responsible for more like 75% of Apple revenue and 85% of gross profit.

Dissecting iPhone Pessimism

The difference in opinion when it comes to iPhone is found with how best to analyze the business. In addition, there is disagreement as to Apple’s iPhone pricing strategy and where the iPhone fits within Apple’s broader product strategy.

There was quite a bit of iPhone pessimism in 2018. Pundits, analysts, and reporters concentrated on a specific narrative. Instead of focusing on the usual risk factors given for iPhone, such as competition from Android manufacturers or lower profit margins, attention was given to the lack of unit sales growth and higher pricing. Apple’s decision to no longer disclose iPhone, iPad, and Mac unit sales only added fuel to the fire.

The following quotes were pulled from articles published since Apple reported 4Q18 earnings last month.

WSJ:

“[Apple’s 4Q18 earnings] offered affirmation for two main pillars of Apple’s current strategy: promoting its software-and-services business and raising prices on its flagship iPhones to compensate for slower growth in unit sales.”

Bloomberg:

“The iPhone maker is transitioning from a business driven by the number of devices it ships into one that leans on pricier products and more sales of software and services to drive revenue.”

Business Insider:

“As Apple also alluded to this year when it decided to no longer announce unit sales in its earnings reports, growth across its most popular product lines, like the iPhone, is beginning to slow down. Price hikes help compensate for less business.”

On the surface, the preceding quotes may sound rational. Raising iPhone prices to offset slowing unit sales may pass the smell test for casual observers. Arguing that Apple is promoting services to offset slowing hardware sales probably won’t raise many eyebrows.

However, each quote shows a fundamental misunderstanding of Apple’s business model and the rationale behind management’s decision to push higher iPhone prices.

The common thread found in each quote is that slowing iPhone sales have led Apple management to desperately seek out revenue growth elsewhere. As a result, Apple is said to be making questionable product and strategy decisions. Higher iPhone prices are positioned as nothing more than an attempt to squeeze more money from existing iPhone users. Some people are going so far as to draw a parallel between Apple’s current iPhone pricing strategy and the company’s disastrous Mac strategy from the 1990s, which played a role in nearly bankrupting the company.

Meanwhile, Apple services are positioned as nothing more than a lever Apple is pulling to squeeze extra money from iPhone users. How Apple uses services to add value to its hardware and become a stronger content distributor is given little to no attention.

Things are Overdone

The sheer level of pessimism facing iPhone has hit an inflection point. Things have simply become too negative. The infatuation with quarterly iPhone unit sales is leading many observers to reach incorrect assumptions about business fundamentals.

Quarterly unit sales data have been telling us less about the iPhone business for years. Here were annual iPhone sales over the past four years:

2015: 231M units

2016: 212M

2017: 217M

2018: 218M

Given how iPhone unit sales have gone nowhere for years, things may not look too great on the surface. However, dive deeper, and iPhone business fundamentals look completely different.

Despite a lack of iPhone unit sales growth since 2015, Apple has added nearly 300M people to the iPhone installed base during the same time period, including 80M in 2018 alone. Strong growth in the iPhone installed base has been completely hidden by flat unit sales trends. Given high loyalty and satisfaction within the installed base, these users will very likely upgrade to a new iPhone at some point in the future. In addition, these users are more likely to subscribe to and pay for various Apple services and even purchase additional Apple products including Apple Watch and AirPods.

Despite declining iPhone unit sales over the past four years, Apple has generated approximately $250B of gross profit from iPhone sales during the same time period. A portion of this profit is funding Apple’s R&D initiatives, including the products designed to eventually take value away from iPhone. Apple is also plowing some of this profit into M&A and capital expenditures such as new stores and data centers. The remaining cash is going to fund Apple’s capital return program.

iPhone pricing was one of the more controversial topics over the past year. While consensus continues to view Apple’s march to higher pricing as a mistake directly responsible for unit sales weakness, few are taking into account the impact of the iPhone gray market. The gray market is handling a growing amount of iPhone demand at the low end. This development is giving Apple the freedom to become more aggressive at the high end. In addition, iPhone trade-in values remain robust, reducing the actual cost of iPhone ownership. A very good argument can be made that the iPhone, even at $1,000, is underpriced when considering the role it plays in nearly a billion lives.

When it comes to gauging demand for higher-priced iPhones, Apple has sold approximately 75M iPhones priced at $999 or higher over the past year. The idea of Apple selling 75M computers starting at $1,000 each in just 12 months would have been unimaginable as recently as a year ago.

Genuine Risks and Concerns

The problem with iPhone hysteria is that due to infatuation with unit sales and higher pricing, genuine concerns and risks facing the iPhone are ignored. Attention is being placed on the wrong items.

There are three genuine concerns found with the iPhone business.

Users switching from iPhone to Android.

Users leaving the Apple ecosystem.

Simpler, non-Apple devices handling use cases formerly given to iPhone.

None of those concerns can be monitored by simply looking at iPhone unit sales or ASP trends. Despite reporting flat to negative iPhone unit sales, Apple is still bringing new users into the installed base. This gives us confidence that the first concern is being kept in check. Strong loyalty and high satisfaction end up playing much larger roles in determining the health of the iPhone business than the quarterly fluctuation in iPhone unit sales.

Meanwhile, strong sales momentum found with Apple wearables and services, along with steady iPad and Mac sales, tell us that the Apple ecosystem continues to gain strength. This will have an impact when it comes to users deciding which smartphone to buy when it’s time to upgrade. Declining iPhone unit sales trends simply aren’t useful for determining if users are moving away from Apple.

However, the biggest risk facing iPhone is the inevitable competition from simpler, more personal devices. These devices will eventually be positioned as smartphone alternatives, handling some tasks formerly given to the iPhone.

While there are early signs of iPhone users being content with their current iPhone, as seen with the slowing upgrade rate, Apple appears to have expected such a development given the company’s focus on wearables. Apple Watch is rapidly becoming an iPhone alternative, handling a growing number of use cases formerly given to iPhone in addition to possessing entirely new use cases. This development means products like Apple Watch need to be part of the iPhone discussion. In reality, few people are even talking about Apple’s wearables platform.

The Road Ahead

It is certainly possible, maybe even likely at this point, that Apple will report a decline in iPhone unit sales in 2019. (Above Avalon members have access to my Apple earnings model, including my iPhone estimates.) Demand for flagship iPhones may indeed be coming in weaker than Apple management expected. (Forecasting iPhone demand is incredibly difficult.) However, such developments do not mean that the iPhone business is imploding or even in dire straits.

There are changes taking place in the iPhone business. The business is maturing. However, the largest change is something unable to be seen by just looking at unit sales or ASP. In recent years, the iPhone’s role within the Apple universe has been evolving.

In the beginning, the iPhone was the vessel for introducing Apple to nearly a billion users. While the iPod was Apple’s first genius mass-market item, the iPhone redefined the definition of mass-market for Apple. Years of mobile carrier expansion, which served as a natural tailwind for iPhone unit sales, ended back in 2015. The iPhone business is not going back to that high growth era.

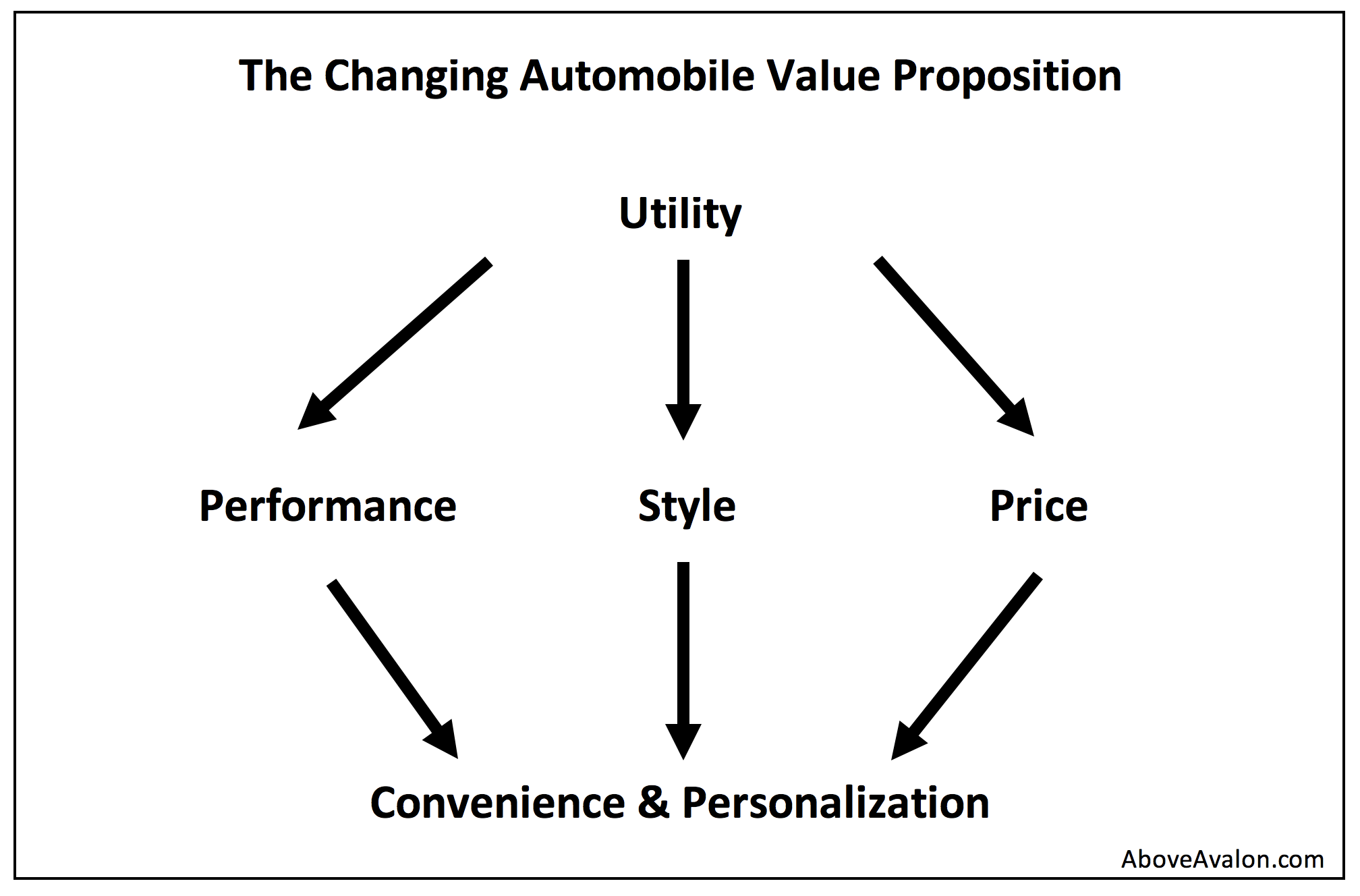

While the iPhone remains the most effective tool for bringing new users into the Apple ecosystem, something that will continue even if unit sales decline in any given year, the iPhone is now becoming a stepping stone in getting Apple’s wearables platform off the ground. The Apple Watch still requires an iPhone to set up. It won’t be surprising if Apple’s upcoming smart glasses require an iPhone to set up. It’s not that the iPhone is the hub and wearable devices are the spokes of an Apple "wheel.” Instead, the iPhone is being used to promote more personal devices that will one day surpass the iPhone in terms of utility and value.

There will come a time when the iPhone business is in big trouble. One day, the value we place on wearable devices, such as AR glasses and smartwatches, will surpass the value we give to smartphones. However, that day has not arrived quite yet.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.