Above Avalon Podcast Episode 176: The Mac Earned a Diploma

The Mac is seeing momentum by being true to itself instead of trying to be something that it’s not. With a transition to Apple Silicon, the product category is now benefiting from lessons Apple learned from more popular devices aimed at the mass market. As the Above Avalon podcast enters its seventh season, episode 176 is dedicated to discussing the Mac’s Apple Silicon and what may come next for the Mac. Additional topics include the Apple Silicon transition being akin to a graduation for the Mac, the Apple Innovation Feedback Loop, and overlap between the iPad Pro and Mac portables.

To listen to episode 176, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

The Mac's Graduation

The iPad is seeing more than twice the number of new users as the Mac. Within two years, the number of people wearing an Apple Watch will equal the number of people owning a Mac. Approximately 90% of Apple users don’t use, and probably never will use, a Mac.

It’s tempting to look at the preceding statements and think that the Mac has lost its luster. However, 2020 was a record fiscal year for the Mac in terms of revenue and the number of new users was near a record high. How does one reconcile such different worlds? The Mac is seeing momentum by being true to itself instead of trying to be something that it’s not. With a transition to Apple Silicon, the product category is now benefiting from lessons Apple learned from more popular devices aimed at the mass market.

Apple Silicon Transition

This past June at WWDC, Apple unveiled the Mac’s multi-year transition to Apple Silicon. Last week, Apple’s “One More Thing” product event focused on the first wave of Mac hardware to take advantage of Apple Silicon. Three models saw updates:

13-inch MacBook Air

13-inch MacBook Pro

Mac mini

One of the more interesting takeaways from WWDC and last week’s event ended up being subtle. While Apple technically announced a Mac transition, the Mac ended up taking a back-row seat to the sheer power and capability found with Apple Silicon and Apple’s decade-long bet on designing its own chips.

A Graduation

The MacBook Air, Apple’s best-selling Mac, was included in the first wave of hardware transitioning to Apple Silicon. The well-known model had one of the more memorable unveilings in Apple history when it was pulled out of a manila envelope by Steve Jobs onstage at Macworld 2008.

The MacBook Air’s design was industry leading. Jony Ive and Apple’s industrial design group had utilized a new unibody architecture that was eventually brought to the entire Mac portable line. Twelve years later, the MacBook Air still feels refreshing.

While the MacBook Air’s thinness was the top feature in 2008, a MacBook Air powered by Apple Silicon is all about performance, longer battery life, and quietness. (The 12-inch MacBook that Apple unveiled in 2015 and discontinued four years later was ahead of its time.)

It is telling that Apple didn’t see the need to change the MacBook Air’s design despite the fact that it is being powered by Apple Silicon. This is evidence of the Apple Silicon transition being akin to the Mac graduating and entering a new phase in life.

A graduation is an acknowledgment of someone acquiring a certain amount of knowledge and experience. Such knowledge can then be used to solve future problems. A similar dynamic is found with Macs powered by Apple Silicon. The Mac now has a new toolset that it can rely on to tackle future problems.

Grand Unified Theory

Prior to this year’s WWDC, reaction in some tech circles was cool towards the idea of Apple transitioning the Mac to its own Silicon. Many were skeptical that Apple would want to face any risks and trouble that could be found with such a transition. Others figured the Mac wasn’t important enough to receive that kind of attention from Apple.

In reality, the Apple Silicon transition was always a question of when, not if. The transition would not only give Apple the kind of control over the Mac that it yearned for, but more importantly, Apple Silicon would open new doors to push the Mac forward in ways that simply weren’t possible with Intel.

With Apple Silicon, Apple took lessons learned from personal devices such as Apple Watches, iPhones, and iPads to help push less personal devices, like the Mac, forward. This is a core tenet of The Grand Unified Theory of Apple Products. We saw early iterations of this with Mac features such as the Touch Bar, Touch ID, and T1 / T2 chips. These additions were the clues that an eventual transition to Apple Silicon would take place.

What’s Next?

The Mac, having graduated thanks to Apple Silicon, is now in a much stronger position to navigate a world being overrun with iPhones, iPads, and an expanding line of wearable devices designed for different parts of the body (wrists, ears, and eventually eyes).

Based on my installed base estimates for various Apple product categories, as of the end of FY2020, it’s clear that the Mac hasn’t been for everyone:

There are 7x more people using iPhones than Macs. There are 2x more people using iPads than Macs. Some think that Apple Silicon will dramatically change these ratios by increasing the Mac’s addressable market. Caution is needed in running too far with such thinking.

The value found with Apple Silicon isn’t that it will turn the Mac into a fundamentally different product. We should not assume Macs will become touch-first devices. Apple already sells touch-first or touch-based computers; they are called iPhones and iPads.

For Apple, the goal isn’t to take fundamentally different product categories and form factors and converge them for no other reason than that they can. A far more challenging endeavor is to resist such calls from users, often the most loyal ones, and instead stay true to a form factor’s design.

When thinking about workflows, Apple’s iOS / iPadOS / macOS product lines are designed in such a way that some products do a better job of handling personal workflows than more demanding workflows. As shown in the following exhibit, macOS devices are designed to handle some of the most demanding workflows while iOS and iPadOS is geared toward handling more personal workflows. However, there is overlap between iPads running iPadOS and Mac portables running macOS when thinking about some workflows.

Since a MacBook Air and iPad Pro can handle some of the same workflows, some people think both devices will eventually merge into one another. The iPad Pro’s Magic Keyboard is positioned as a sign of this upcoming merge while touch-based Macs are said to be inevitable.

There are a few holes found in the logic of such thinking.

Even though Mac portables and iPads may handle many similar workflows, that doesn’t mean that both devices should lose their core identity. The iPad doesn’t move away from being a touch-based computer simply because a keyboard can be attached to it or an Apple Pencil can be used to take notes and sketch a drawing. A MacBook Pro doesn't embrace a touch-first interface just because Big Sur has similar elements to iOS and iPadOS.

Instead, we should expect Apple to take what makes the Mac special for 130 million people and accentuate those items, namely, a screen that tilts while always being attached to a dedicated keyboard. While both the screen and keyboard will likely see their fair share of changes in the future, including possibly sharing a foldable display, the dynamic found with using a keyboard permanently connected to a screen would remain.

While iPads would remain touch-first computers with a range of productivity accessories like dedicated keyboards, Macs powered by Apple Silicon could embrace multi-touch and foldable displays but in a dedicated area of the machine where one’s fingers are likely to always be found (think the area between the Touch Bar and the lower fifth of the screen). A good argument can be made that Apple should pursue flexible displays for Mac portables so that the entire area between the Touch Bar and vertical screen can be usable.

Such a product may seem underwhelming to some. The word “legacy” probably will come to mind for others. There is nothing inherently wrong with a product being classified as legacy as long as the product doesn’t jeopardize Apple’s ambition and efforts with new platforms and paradigm shifts. This risk was described in detail in the Above Avalon article titled “The Mac is Turning into Apple’s Achilles’ Heel.”

Apple management has spent the past few years trying to convince Mac users that the Mac’s future has never been brighter. Some pro users may end up disappointed with where Apple will, and won’t, take the Mac. However, it is a positive sign that Apple remains focused on pushing forward with new platforms aimed at lowering the barrier between technology and people while allowing the Mac to be true to itself.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members in both written and audio forms. To sign up and for more information on membership, visit the membership page.

Above Avalon Podcast Episode 175: iPhone at a Billion

According to Neil’s estimate, Apple surpassed the billion iPhone users milestone last month. With the iPhone upgrade cycle approaching a plateau of four to five years, Apple is well-positioned to report record iPhone unit sales. In episode 175, Neil discusses the current state of the iPhone business as it surpasses a billion users. Topic include: iPhone unit sales, iPhone sales mix broken out by iPhone upgrades and new users, the iPhone installed base, Apple’s top priorities for iPhone, peak iPhone, and more.

To listen to episode 175, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive future Above Avalon podcast episodes:

A Billion iPhone Users

A billion people now have iPhones. According to my estimate, Apple surpassed the billion iPhone users milestone last month. Thirteen years after going on sale, the iPhone remains the perennial most popular and best-selling smartphone. Competitors continue to either shamelessly copy iPhone or, at a minimum, be heavily influenced by the iPhone. Looking ahead, Apple’s top priorities for the iPhone include finding ways to keep the device at the center of people’s lives while at the same time recognizing the paradigm shift ushered in by wearables.

iPhone Sales

Over the past two years, iPhone sales have experienced notable gyrations. In early 2019, Apple saw material weakness in iPhone sales due to deteriorating economic conditions in China related to U.S. trade tensions. Although Tim Cook faced some skepticism when making such a claim, the observation was later proven to be legitimate as a number of other companies went on to describe a similar slowdown in demand.

As shown in Exhibit 1, iPhone unit sales on a trailing twelve months basis dropped by about 12% in early 2019 from a 218 million annual pace to a 191 million pace. The iPhone business went on to experience a gradual improvement in sell-through (i.e. customer) demand during the second half of 2019 and the beginning of 2020 before the pandemic hit. iPhone unit sales are back above a 200 million annual pace and are currently 13% below the unit sales high experienced in 2015.

Exhibit 1: iPhone Unit Sales (TTM Basis)

At a glance, Exhibit 1 would suggest that the iPhone business has lost some of the shine it had in the mid-2010s. However, this would be a misreading of the situation. On its own, unit sales don’t tell us the full story about the iPhone business. This is the primary reason behind Apple’s decision in late 2018 to stop providing unit sales data on a quarterly basis. Wall Street was incorrectly using unit sales as a crutch for shoddy analysis.

Flat to down iPhone unit sales do not automatically mean iPhone business fundamentals have deteriorated. Instead, a longer upgrade cycle can be a leading factor behind declining unit sales. In addition, unit sales don’t say anything about customer loyalty and satisfaction rates, which are crucial when it comes to a customer’s decision to continue using a product.

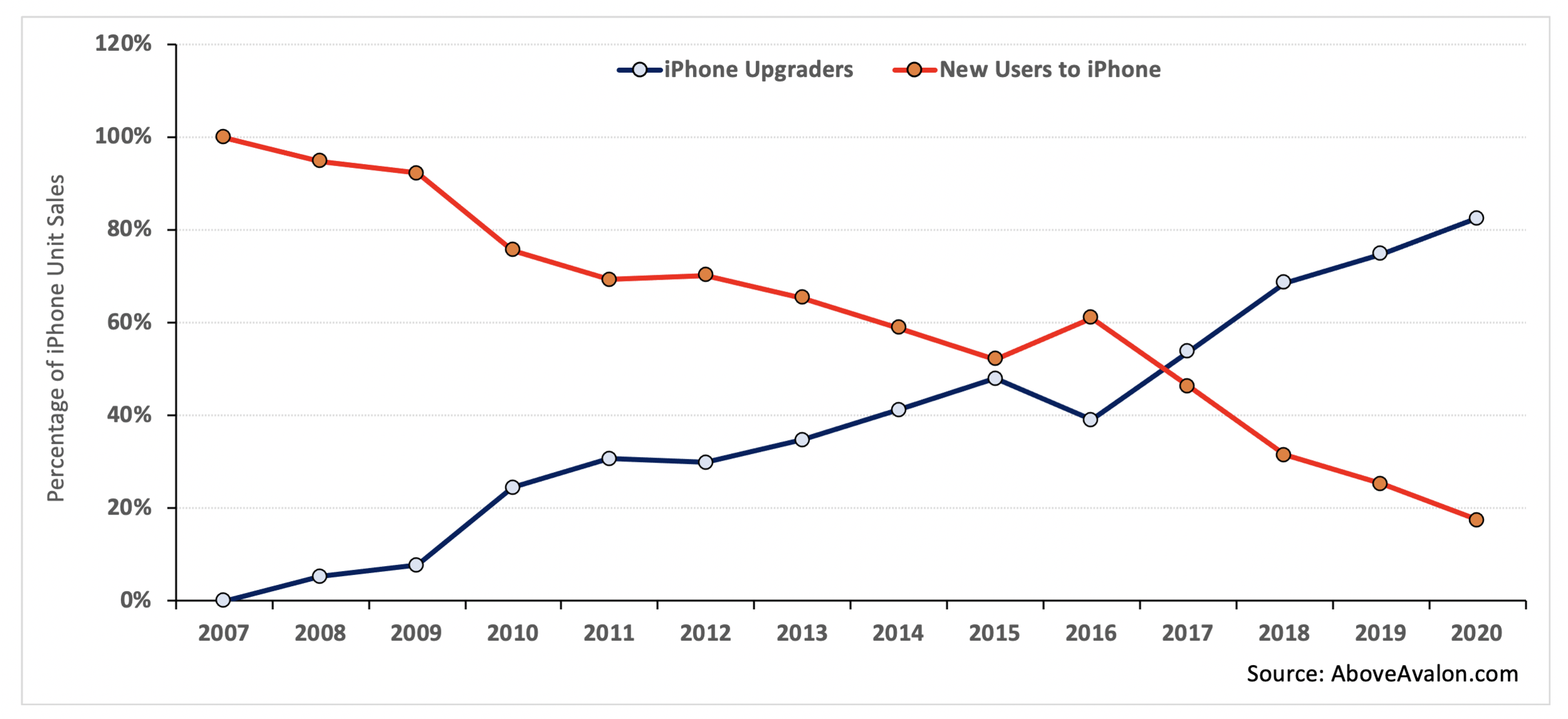

In order to reach more valuable insights regarding the iPhone business, Exhibit 2 takes unit sales data from Exhibit 1 and adds granularity. Instead of looking at sales just in terms of the number of units shipped from a factory, Exhibit 2 takes into account who bought iPhones: customers upgrading to a new iPhone or customers buying their first new iPhone. The data is derived from my iPhone installed base model that tracks when customers entered the installed base and then monitors upgrading patterns.

Exhibit 2: iPhone Unit Sales Mix (iPhone Upgraders vs. New Users to iPhone)

The iPhone business has turned into an upgrading business. While Apple is still bringing in 20M to 30M new iPhone users each year, the percentage of overall iPhone sales going to new users has steadily declined. For FY2020, iPhone sales to new users will likely have accounted for less than 20% of overall iPhone sales - an all-time low.

iPhone Installed Base

While quarterly iPhone unit sales contain an inherent amount of volatility, installed base totals do a better job of monitoring iPhone fundamentals over the long run. The iPhone installed base is defined as the total number of people using an iPhone (both new and used iPhones). A shrinking iPhone installed base would raise a number of warning signs for Apple as it would suggest people have been switching to Android. A growing iPhone installed base would suggest Apple continues to see new users embrace the iPhone for the first time.

Two variables are needed to estimate and track the iPhone installed base:

The number of people who purchase (and continue to use) a new iPhone from Apple or a third-party retailer.

The number of people who are using an iPhone obtained via the gray market. These iPhones have either been passed down through families and friends or resold to new users via a web of retailers and distributors.

By combining the two groups, one is able to derive estimates for the total number of iPhones in the wild. Although Apple does not disclose this installed base figure on a quarterly basis, the company did mention that the iPhone installed base surpassed 900M devices by the end of FY1Q19. As shown in Exhibit 3, which displays my estimates for the Apple installed base over the years, the iPhone installed base has grown each year since launch and recently surpassed a billion people.

(The methodology used to reach my iPhone installed base estimates is available here for Above Avalon members.)

Exhibit 3: iPhone Installed Base (total number of iPhone users in the wild)

In recent years, the pace of growth in the iPhone installed base has slowed. Much of this slower growth is due to high smartphone penetration and Apple having already successfully targeted the premium end of the smartphone market. With that said, Apple is still bringing in approximately 20M to 30M new iPhone users per year. These users are prime candidates for moving deeper into the Apple ecosystem by purchasing other Apple devices and services. Strong growth trends seen with iCloud storage, Apple’s content distribution services, Apple Watch, AirPods, and even iPad / Mac are made possible by hundreds of millions of people moving beyond just an iPhone to own additional Apple services and devices.

iPhone Priorities

Looking ahead, Apple has three primary priorities, or goals, for the iPhone:

Push camera technology boundaries.

Increase the value found with iPhone ownership.

Increase the number of roles handled by the iPhone.

Cameras. When thinking about the iPhone feature that will lead the way over the next five to ten years, more powerful cameras are high on the list. For the past few years, camera improvements and upgrades have been positioned as the top feature found with new flagship iPhones. A similar trend has been found with every major smartphone manufacturer. This has led to a type of camera arms race as each company tries to convince consumers that they have the best camera.

The primary reason Apple and its peers are betting so big on cameras is that they are convinced consumers will find value in smarter “eyes" - cameras that increasingly move into 3D rendering and AR realms. Advances in computational photography are also leveraged to make it easier for people to take really great photos.

While a bet on the camera will turn out to be a good one for Apple, the move doesn’t lack risk. As Apple pushes camera technology forward, many existing iPhone users are content with the iPhone camera they already own. This will manifest itself in no discernible bump in iPhone upgrading simply due to camera upgrades and advancements.

Another factor behind betting big on iPhone camera technology is that the smartphone form factor remains conducive to bringing powerful cameras to the mass market. While a “selfie” camera may make sense on the wrist with Apple Watch, it is difficult to see the wrist as a good place for cameras used to capture memories. There is similar hesitation found with the idea of putting such powerful cameras on the face in the form of AR glasses. Therefore, it makes sense that the device held in our hands and stored in our pockets will likely contain the most powerful camera in our lives.

iPhone Value. A major development regarding the iPhone that continues to fly under the radar is the improving value proposition found with owing and using an iPhone. By improving iPhone durability and longevity, Apple ends up strengthening the iPhone’s value proposition via higher resale values. If a new iPhone can be recirculated to additional users, the gray market will be strengthened and consumers will find more attractive payment terms and options at time of purchase.

An increasing number of iPhone users think about iPhone pricing in terms of monthly payments rather than lump sum. Attractive trade-in offers and payment plans with built-in upgrades only serve to improve the iPhone’s value proposition.

iPhone Roles. Tim Cook kicked off Apple’s “Hi, Speed” product event earlier this month by referring to the iPhone as the product we use the most, every day. He went on to say that the iPhone has never been more indispensable than it is now.

It is in Apple’s best interest to have the iPhone take over an increasing number of roles once given to laptops and desktops in addition to handling entirely new roles. By increasing our dependency on iPhone today, Apple ends up being in a better position to sell various wearable form factors tomorrow. Wearables are designed to not only handle entirely new tasks, but also take over tasks given to the iPhone.

Peak iPhone?

In FY2015, Apple sold 231 million iPhones. There continues to be a debate regarding whether or not Apple experienced “peak iPhone,” never exceeding that 231 million unit sales total in a 12-month stretch.

As a general rule, one needs to approach “peak” sales claims very carefully with Apple products. It may be tempting to look at unit sales data and conclude that a lower sales trend won’t reverse. However, weaker sales may not be the result of a change in market fundamentals such as a permanently reduced addressable market or less capable product. Instead, lower sales may simply reflect a slowdown in upgrading.

Odds are increasing that Apple has not experienced peak iPhone. As shown in Exhibit 4, my FY2021 iPhone unit sales estimate stands at 240M units, 4% higher than Apple’s previous iPhone sales record. My estimate does not assume a mega upgrade cycle kicked off by 5G iPhones. With the iPhone installed base having surpassed a billion users and continuing to expand by 20M to 30M people each year, Apple is in a good position to grow iPhone unit sales as the iPhone upgrade cycle plateaus between four and five years. This is where iPhone’s strong resale value enters the picture with consumers embracing various upgrading plans and options made possible by a well-functioning gray market.

Exhibit 4: iPhone Unit Sales (TTM Basis) - Includes Above Avalon FY2021 Estimates

New User Generation

The iPhone was the largest contributor to Apple growing its overall installed base from 125 million people in 2010 to more than a billion in 2020. Looking ahead, it’s fair to wonder if the iPhone will remain Apple’s primary new user funnel for the next billion users.

A strong case can be made that Apple will continue to rely on the iPhone for new user generation in the near term. While flagship iPhone pricing is aimed at the premium segment of the market, the gray market continues to play its role in expanding the iPhone’s reach to lower price segments.

Apple is also getting that much closer to launching its face wearables strategy. Requiring early versions of face wearables (AR / VR glasses) to work with an iPhone is logical when thinking about the limited amount of space for technology found with a pair of thin and light glasses.

Over time, we can’t ignore the new user growth potential found with Apple wearables. Apple Watch remains on its march to full independency from the iPhone. A truly independent Apple Watch would expand the product’s address market by threefold. AirPods are similarly well-positioned for appealing to Android users around the world. This brings us to India. The country will likely play a crucial role in Apple’s strategy of bringing hundreds of millions of new people into the ecosystem. As wearables make technology more personal, the product category’s addressable market will only expand.

While the iPhone may have been responsible for Apple getting to a billion users, wearables have a decent shot of getting Apple to two billion users.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members in both written and audio forms. To sign up and for more information on membership, visit the membership page.

Above Avalon Podcast Episode 174: Apple Watch Is a Runaway Train

While the tech press spent years infatuated with stationary smart speakers and the idea of voice-only interfaces, it was the Apple Watch and utility on the wrist that ushered in a new paradigm shift in computing. In episode 174, Neil discusses how Apple Watch momentum is building. The product category resembles a runaway train as no company is in a position to slow it down. Additional topics include the stationary smart speaker mirage, Neil’s Apple Watch installed base estimates, how Apple Watch derives its momentum, and Apple’s health platform.

To listen to episode 174, go here.

The complete Above Avalon podcast episode archive is available here.

Subscribe to receive the latest Above Avalon podcast episode:

Apple Watch Momentum Is Building

In a few months, the number of people wearing an Apple Watch will surpass 100 million. While the tech press spent years infatuated with stationary smart speakers and the idea of voice-only interfaces, it was the Apple Watch and utility on the wrist that ushered in a new paradigm shift in computing. We are now seeing Apple leverage the growing number of Apple Watch wearers to build a formidable health platform. The Apple Watch is a runaway train with no company in a position to slow it down.

Mirages and Head Fakes

We are coming off of a weird stretch for the tech industry. As smartphone sales growth slowed in the mid-2010s, companies, analysts, and pundits began to search for the next big thing. The search landed on stationary smart speakers and voice interfaces.

Companies who weren’t able to leverage the smartphone revolution with their own hardware placed massive bets on digital voice assistants that would supposedly usher in the end of the smartphone era. These digital voice assistants would be delivered to consumers via cheap stationary speakers placed in the home. Massive PR campaigns were launched that attempted to convince people about this post-smartphone future. Unfortunately for these companies, glowing press coverage cannot hide a product category’s fundamental design shortcomings.

At nearly every turn, Apple was said to be missing the voice train because of a dependency on iPhone revenue. Management was said to suffer from tunnel vision while the company’s approach to privacy was positioned as a long-term headwind that would lead to inferior results in AI relative to the competition. Simply put, Apple was viewed as losing control of where technology was headed following the mobile revolution.

There were glaring signs that narratives surrounding smart speakers and Apple lacking a coherent strategy for the future were off the mark. In November 2017, I wrote the following in an article titled, “A Stationary Smart Speaker Mirage”:

“On the surface, Amazon Echo sales point to a burgeoning product category. A 15M+ annual sales pace for a product category that is only three years old is quite the accomplishment. This has led to prognostications of stationary smart speakers representing a new paradigm in technology. However, relying too much on Echo sales will lead to incomplete or faulty conclusions. The image portrayed by Echo sales isn't what it seems. In fact, it is only a matter of time before it becomes clear the stationary home speaker is shaping up to be one of the largest head fakes in tech. We are already starting to see early signs of disappointment begin to appear…

I don’t think stationary smart speakers represent the future of computing. Instead, companies are using smart speakers to take advantage of an awkward phase of technology in which there doesn’t seem to be any clear direction as to where things are headed. Consumers are buying cheap smart speakers powered by digital voice assistants without having any strong convictions regarding how such voice assistants should or can be used. The major takeaway from customer surveys regarding smart speaker usage is that there isn’t any clear trend. If anything, smart speakers are being used for rudimentary tasks that can just as easily be done with digital voice assistants found on smartwatches or smartphones. This environment paints a very different picture of the current health of the smart speaker market. The narrative in the press is simply too rosy and optimistic.

Ultimately, smart speakers end up competing with a seemingly unlikely product category: wearables.”

Three years later, I wouldn’t change one thing found in the preceding three paragraphs. The smart speaker bubble popped less than 12 months after publishing that article. The product category no longer has a buzz factor, and despite the hopes of Amazon and Google, people are not using stationary speakers for much else besides listening to music and rudimentary tasks like setting kitchen timers.

The primary problem found with voice is that it’s not a great medium for transferring a lot of data, information, and context. As a result, companies like Amazon have needed to dial back their grandiose vision for voice-first and voice-only paradigms. Last week’s Amazon hardware event highlighted a growing bet on screens – a complete reversal from the second half of the 2010s.

Betting on the Wrist

As companies who missed the smartphone boat were placing bets on stationary speakers, Apple was placing a dramatically different bet on a small device with a screen. This device wouldn’t be stationary but instead push the definition of mobile by being worn on the wrist.

Jony Ive, who is credited with leading Apple’s push into wrist wearables, referred to the wrist as “the obvious and right place” for a different kind of computer.

When Apple unveiled the Apple Watch in 2014, wearable computing on the wrist was more of a promise than anything else. Apple created an entirely new industry – something that isn’t found much in the traditional Apple playbook.

After years of deep skepticism and cynicism, consensus reaction towards Apple Watch has changed and is now positive. Much of this is due to the fact that it’s impossible to miss Apple Watches appearing on wrists around the world. According to my estimates, approximately 35% of iPhone users in the U.S. now wear an Apple Watch. This is a shockingly high percentage for a five-year-old product category, and it says a lot about how Apple’s intuition about the wrist was right.

Apple Watch Installed Base

The number of people wearing an Apple Watch continues to steadily increase. According to my estimate, there were 81 million people wearing an Apple Watch as of the end of June. According to Apple, 75% of Apple Watch sales are going to first-time customers. This means that 23 million people will have bought their first Apple Watch in 2020. To put that number in context, there are about 25 million people wearing a Fitbit. The Apple Watch installed base is increasing by the size of Fitbit’s overall installed base every 12 months. Exhibit 1 highlights the change in the Apple Watch installed base over the years.

Exhibit 1: Apple Watch Installed Base (number of people wearing an Apple Watch)

(The calculations and methodology used to reach my Apple Watch installed base estimates is available here for Above Avalon members.)

Deriving Power

From where is Apple Watch deriving its momentum? The answer is found in The Grand Unified Theory of Apple Products.

One of the core tenets of my theory is that an Apple product category's design is tied to the role it is meant to play relative to other Apple products. The Apple Watch is designed to handle a growing number of tasks once given to the iPhone. Meanwhile, the iPhone is designed to handle a growing number of tasks given to the iPad. One can continue this exercise to cover all of Apple's major product categories.

Apple Watch is not an iPhone replacement because there are things done on an iPhone that can't be done on an Apple Watch. This ends up being a feature, not a bug. The Apple Watch’s design then allows the product to handle entirely new tasks that can’t be handled on an iPhone. This latter attribute goes a long way in explaining how Apple Watch has helped usher in a new paradigm shift in computing. Apple Watch wearers are able to interact with technology differently.

(More on The Grand Unified Theory of Apple Products is found in the Above Avalon Report, “Product Vision: How Apple Thinks About the World,” available here for Above Avalon members.)

A Health Platform

In January 2019, Tim Cook surprised many by saying Apple will be remembered more for its contributions to health than for any other reason. Here’s Cook:

“I believe, if you zoom out into the future, and you look back, and you ask the question, ‘What was Apple’s greatest contribution to mankind?’ it will be about health.”

Many assumed that Cook’s comment hinted at Apple unveiling a portfolio of medical-grade devices that would go through the FDA approval process. Such thinking was based on a fundamental misunderstanding of Apple’s ambition and approach to product development.

Apple’s health strategy is based on leveraging hardware, software, and services to rethink the way we approach health. This means Apple wasn’t going to just launch a depository for our health data – something that is needed but which ultimately falls short of being truly revolutionary. In addition, Apple wasn’t going to just offer health and fitness services that amount to counting steps or keeping track of miles run.

By the time Cook gave his bullish comment about health, Apple had already placed its big bet on health four years earlier by unveiling the Apple Watch. In what ended up being one of Apple’s best decisions, the company avoided going the route of medical-grade devices requiring government agency approval to reach consumers. Instead, Apple framed its health platform as a new-age computer that ultimately is an iPhone alternative.

Health monitoring is one of the key new tasks that the Apple Watch, not iPhone, handles. To be more precise, Apple Watch is handling the following four health-related items:

Proactive monitoring (i.e. heart rate and blood oxygen)

Well-being assistance (i.e. sleep monitoring including the runup to sleep)

Fitness and activity tracking (i.e. Activity and Workout apps)

Fitness and health activity (i.e. Apple Fitness+)

With Apple Fitness+, Apple didn’t just release a virtual fitness class service. Instead, Apple Fitness+ is an Apple Watch service. In some ways, Apple Fitness+ reminds me of Apple TV+. A future in which Fitness+ workouts are available on third-party gym equipment displays including on treadmills and stationary bikes is not a stretch. In addition, classes from other companies such as Nike could further elevate Apple Fitness+.

Competition

If the Apple Watch is a runaway train, there is no obvious candidate in a position to stop or even slow the train. While other companies are slowly waking up and seeing the momentum found with Apple Watch, there is still much indifference, mystery, and misunderstanding as to why people are buying wearables. Too many companies still think of wearables as glorified smartphone accessories. Such thinking makes it impossible for competitors to see how Apple Watch is ushering in a paradigm shift in computing by making technology more personal in a way that other devices have failed to accomplish or replicate.

One of the main takeaways from Apple’s product event earlier this month is how Apple is its own toughest competitor. The Apple Watch’s most legitimate competition is found with older Apple Watches and non-consumption (i.e. empty wrists). While this introduces its own set of risks and challenges, there is still no genuine Apple Watch competition from other companies after six years. This is an indication of the power found in controlling your own hardware, software, and services in order to get more out of technology without having technology take over people’s lives.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members in both written and audio forms. To sign up and for more information on membership, visit the membership page.

For additional discussion on this topic, check out the Above Avalon daily update from October 1st.

Above Avalon Podcast Episode 173: Let's Talk App Store

As Apple pulls away from the competition, the App Store is considered the best (and last) chance for competitors to reshape the mobile industry to their liking. In episode 173, Neil examines how competitors are waging a guerrilla war against Apple and the App Store. The discussion then turns to Neil unveiling a new podcast called Above Avalon Daily.

To listen to episode 173, go here.

The complete Above Avalon podcast episode archive is available here.

Attacking the App Store

Apple competitors have turned to guerrilla warfare tactics to wage a battle against Apple and the App Store. Based on what is being written and said about the App Store, one would think we have an entered a tech dystopia in which 27 million iOS developers and a billion Apple users are being taken advantage of by Tim Cook and his allegiance to Wall Street.

What had been valid criticism aimed at the App Store has descended into calls to burn everything down and replace it with anti-consumer and anti-developer alternatives. The writing is on the wall. Apple is pulling away from the competition, and the App Store is considered the best (and last) chance for competitors to reshape the mobile industry to their liking.

App Store

We have never seen anything like the App Store, a curated marketplace where a billion users can access 1.7 million apps. Apple established an easy, safe, private, and convenient way for consumers to personalize nearly 1.3 billion iPhones and iPads with third-party applications. Approximately 500 million people visit the App Store each week - a remarkable figure that speaks to how the App Store continues to connect with consumers on a global basis. In FY2019, App Store revenue was an estimated $53 billion. Apple’s share of that revenue came out to an estimated $14 billion. (Apple generates much less when it comes to App Store profit.)

Some have tried to say that there was a viable, safe, cost efficient, and overall compelling form of software distribution to the mass market prior to the existence of the App Store. There’s one problem with such a claim: The mass market didn’t consume software prior to the App Store. In 2008, the year the App Store launched, only 20% of people even had access to the internet.

There are a number of reasons why the iPhone installed base is eight times larger than the Mac installed base, and the App Store is high on the list.

Evolving Criticism

The App Store is not perfect. A small, but vocal, segment of the iOS developer community (now 27 million strong) has spent years raising concerns and issues regarding the App Store, and in particular, app review and the way Apple enforces App Store guidelines.

However, over the past 18 months, App Store criticism began to take on a dramatically different look and feel as multi-nationals entered the fray. In just the past few months, Facebook, Microsoft, Airbnb, and Epic Games have raised concerns about the App Store.

Spotify was one of the early App Store opponents. The company took what now looks like a delicate approach to raising specific issues with the App Store and what it deemed to be anticompetitive behavior on Apple’s part. While the company was grasping at straws with most of its claims, a few concerns had merit.

Microsoft decided to go behind Apple’s back to secretly get U.S. lawmakers to investigate the App Store on monopolistic grounds. Airbnb ran to the New York Times to air its grievance about wanting a special deal from Apple so it didn’t need to follow long-standing App Store guidelines.

However, it was Epic Games’ attack against Apple that marked a turning point in App Store criticism. Epic relied on a different kind of strategy:

Breaking App Store guidelines willingly and blatantly. We have never seen a company actually take pride in breaking App Store guidelines. Epic made sure everyone knew it was breaking App Store rules by offering a virtual currency as an in-app purchase without going through Apple payment.

Leveraging users and press to its advantage. Instead of making the battle be between two companies, Epic weaponized its user and fan base in an attempt to wage an uprising against Apple. In this pursuit, Epic also tried to use the press more than any other company that came before it in going after the App Store.

These corporations are ultimately after the same goal – to weaken Apple’s ironclad grip over the App Store. While many independent developers are simply focused on finding financial sustainability for their families, the multi-nationals are more interested in pulling iOS from under Apple’s control in order to gain power at the expense of Apple.

Why the App Store?

Apple is pulling away from the competition like never before. A revised product strategy (pull to push), and a broader consumer technology landscape that is swinging and missing on bet after bet, are the two primary factors behind Apple’s momentum. However, the App Store plays a vital role in setting Apple devices apart from the competition.

Accordingly, the App Store may seem like an unusual target for Apple competitors. The digital storefront is very popular with users (based on usage trends) and developers. (Most developers don’t pay Apple anything beyond a nominal developer fee to transact business through the App Store.)

No one is questioning the App Store’s success or popularity. Instead, competitors see a way to turn that success into a weakness. Due to extensive lobbying efforts, most of which were driven by Apple competitors, governments and regulatory bodies from around the world are investigating the claim that Apple is relying on monopolistic behavior to achieve App Store success.

Competitors see these regulatory investigations as a potential vulnerability in Apple’s armor. Breaking up or watering down the App Store would allow competitors to leverage the iOS ecosystem to their advantage. In essence, Apple would lose control over app distribution in its own ecosystem. Competitors would no longer be subject to revenue share arrangements with Apple. In addition, they would be able to establish their own digital storefronts to go direct to customers.

Guerrilla Warfare

Companies like Epic don't want there to be a genuine debate about the App Store. If the debate were to boil down to one’s experience using the App Store, Epic and other App Store critics would lose.

However, the goal is to change the narrative and position the App Store as being fundamentally broken with the only remedy being alternative app stores free from Apple oversight. This sentiment is summarized in the following tweet from Epic Games founder and CEO Tim Sweeney:

“At the most basic level, we’re fighting for the freedom of people who bought smartphones to install apps from sources of their choosing, the freedom for creators of apps to distribute them as they choose, and the freedom of both groups to do business directly.”

We are witnessing a guerrilla war that is being waged by Apple’s competitors. This campaign includes companies and CEOs trying to win the moral high ground by appealing to consumers’ and developers’ emotions. Other goals include trying to distract and tire Apple with relentless App Store attacks coming from all directions and using the press to do much of the heavy anti-App Store lifting.

Nearly every article written about Apple’s latest App Store controversy and battle inevitably includes paragraphs of boilerplate language regarding the App Store’s growing list of regulatory issues around the world. Meanwhile, no space is dedicated to the holes and hypocrisy found in competitors’ claims and allegations against the App Store. This is a classic example of a PR guerrilla warfare tactic utilized by competitors in an attempt to sway the discussion and public opinion.

There are then companies running to the press to paint Apple as the evil behemoth going after small business owners during the pandemic. Facebook, Airbnb, and ClassPass have relied on such shady tactics to attack Apple. Portraying Apple as a small business killer is a new low.

True Intentions

To a certain extent, companies like Epic have been successful in quelling App Store debate. Allegations that Apple is milking developers in order to drive revenue and profit growth are passed around with no supporting evidence or numbers. (My financial estimates for App Store profitability on both a net and gross basis are found here.) Pointing out that the App Store isn’t as profitable as consensus assumes is now met with backlash. None of this was the case just 12 months ago.

The lack of perspective coming from customers is also glaring. Consumers, not Apple, are the group who ultimately ends up supporting tens of millions of developers financially. However, most of the commentary written about the App Store has come from the perspective of competitors with pending lawsuits against Apple.

Hijacking what had been a genuine debate regarding the App Store’s treatment of independent developers in order to prop up their own ambition, companies like Epic are revealing their true intentions. These companies aren’t going after the App Store with the interest of independent developers or users in mind. Advocating for an alternative app store is not pro-developer or pro-consumer. Instead, it’s just a way for these companies to make more money.

Monopolies

At the heart of Epic’s fight against the App Store is the need to have both developers and users on its side. There is a simple reason for such a goal. Epic’s underlying arguments against Apple regarding antitrust are fundamentally weak.

In a 62-page lawsuit filed against Apple, Epic alleges the company holds a monopoly in iOS app distribution and iOS in-app payment processing. There is one problem with such claims: Apple doesn’t have monopolies in any particular product device category. Meanwhile, claiming Apple has a monopoly on what goes on in the App Store is equivalent to claiming Apple has a monopoly on a premium experience.

In what is an ironic twist, Epic ends up demonstrating Apple’s lack of a monopoly in mobile gaming and app distribution. According to Epic, two-thirds of Fortnite users play the game on non-Apple hardware. If Apple held a monopoly on mobile app distribution, Apple’s decision to remove Fortnite from the App Store would have been a lights out moment for the game. Gamers have alternatives if they want to use them.

Need for Debate

It’s time for these guerrilla warfare tactics against the App Store to be called out in an effort to have a genuine debate about the App Store. Such a debate is sorely needed. It wouldn’t be about revenue share percentages, alternative app stores, or items like sideloading. Instead, the discussion is found with how Apple should balance customer and developer interests.

Some iOS developers feel like Apple is treating them like second-class citizens in its ecosystem. These developers want to know why Apple doesn’t go out of its way to make sure they are making as much money as possible. Instead, they feel they are being constantly attacked by App Store review. It’s a valid concern that Apple needs to take seriously.

Are we seeing Apple erring more on the side of customers to the determinant of developers? It may be an uncomfortable question to ask within Apple, but it deserves to be investigated.

Apple positions its customers, not profit, as the guiding light for everything it does. This customer-first focus extends to the App Store as well. Management’s actions with the App Store can be traced to ensuring the store’s viability and vitality. Both are critical for maintaining the App Store as a benefit for consumers. If users are content and happy, developers end up benefitting as well. The two go hand in hand.

There are three things that can help keep the customer versus developer dynamic found with the App Store in proper balance:

1) Allow increased in-app communication between developers and customers. Letting developers communicate more freely with users in apps stands to be a positive development for both parties. Allowing developers to include language like “visit our website for additional ways of buying our service” wouldn’t hurt customers and would be viewed positively for developers. Odds are good that we will see Apple make some changes on this front given the European Commission’s review of App Store practices.

2) Give developers more say over App Store guideline enforcement. App Store guidelines can be thought of as laws with no direct mechanism (like voting) for getting revised or rewritten. The ability to bring cases before some kind of review panel would be a step in the right direction. If there were something like the Supreme Court for App Store guidelines, a panel of Apple executives could determine if certain App Store guidelines would end up harming the broader ecosystem. Last month, Apple announced something along this lines.

3) Come up with the next App Store. By spending time now coming up with tomorrow’s App Store, Apple can benefit both developers and customers. The lack of attention given to this topic is telling. While Apple competitors are eager to replace the App Store with their own mobile app stores, the entire app dynamic loses its relevancy when thinking about wearables. We are going to need a complete rethink of apps as we proceed further into the wearables era.

Dragged Through the Mud

It’s difficult to envision any other product or feature other than the App Store that has done more in bringing such a wide variety of innovation to a billion users. It’s not an understatement to say that the App Store changed the world and is still doing so today.

By painting Apple as a monopolistic giant relying on App Store “tolls” and “taxes” to surpass a two trillion dollar market cap, competitors are dragging the App Store through the mud. Revenue share percentages and angst over App Store guidelines end up being distractions for what is ultimately a classic case of wanting more power. With Apple pulling away from the competition like never before, it’s not a mystery as to why competitors see urgency.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members in both written and audio forms. To sign up and for more information on membership, visit the membership page.

Introducing the Above Avalon Daily Podcast

Over the past five years, 2,000-word written daily updates have served as the cornerstone of Above Avalon membership. With more than 1,000 updates published to date (the archive is found here), the emails have become widely read and influential in the world of Apple.

In an effort to make it easier to consume the daily updates in new and different ways, I am excited to announce a new daily podcast called Above Avalon Daily.

Designed as an add-on feature that can be attached to an existing membership, Above Avalon Daily allows written daily updates to be accessible beyond screens. Members now have the ability to consume the daily updates around the house, on a walk, or in the car.

Podcasting

I am a big believer in podcasts as demonstrated with 172 episodes and counting of the Above Avalon podcast produced over the past six years. Not only does the podcast medium offer a different consumption experience compared to written content, but the two supplement each other. Based on feedback over the years, many AboveAvalon.com readers also listen to the Above Avalon podcast and vice versa. My expectation is that this dynamic will now be found with written and audio versions of the Above Avalon daily updates.

Some may want to listen to Above Avalon Daily first and then read the episode’s “transcript” via the corresponding written daily update. This is especially true for various financial topics covered in the updates. Others will want to read the updates first and then listen to the updates at a later time while driving, at the gym, or doing anything that may limit screen access.

Episode Details

Above Avalon Daily episodes closely follow that day’s written update. Episodes revolve around the following topics:

Apple business and strategy analysis.

My perspective and observations on current news and Apple competitors.

My Apple financial estimates.

Full coverage of Apple earnings, product events, and keynotes.

It became clear early on when creating Above Avalon Daily that one cannot simply take the written daily updates and recite or dictate them word for word. There are too many quoted passages, numbers, exhibits, charts, and data points. Accordingly, each episode includes some curation, new transitions, and commentary that help convert written daily updates into an enjoyable audio format.

Two sample episodes are found below:

Each episode is approximately 15 minutes. Earnings and event episodes will run longer. As with the written daily update schedule, there are four new podcast episodes a week, which works out to a little under 200 episodes a year.

New episodes are released after that day’s daily update is published. Since I am based in the Eastern time zone, new episodes are published in the evening time frame. This makes it possible for new episodes to be listened to first thing the following morning in most regions. New episodes will come out in the AM in Asia and Australia as well. Of course, you can listen to new episodes as soon as they are published.

How to Listen

Transistor is handling the behind-the-scenes mechanics of Above Avalon Daily, a private podcast that can be listened to with various podcast players including Apple Podcasts and Overcast (both of which work great with Above Avalon Daily).

Above Avalon Daily relies on private RSS feeds. This makes it possible for new Above Avalon Daily episodes to show up only for members who have purchased the podcast add-on.

The set-up process for listening to Above Avalon Daily is very simple:

Upon purchasing the podcast add-on, you will receive an email (from “Neil Cybart via Transistor”) that directs you to a sign-up page listing various podcast players that can be used to listen to the podcast. Open the page on an iPhone, and you will see various iOS podcast players. Open the page on a Mac, and you will see options for listening to the podcast on a Mac. A screenshot of that page is found below.

After you select your preferred podcast player, previously-published Above Avalon Daily episodes will automatically appear in your podcast feed. There are already three hours worth of daily updates available. New episodes will appear as they are published.

That’s it. There is no need to create a separate login, password, or Transistor profile. In the vast majority of cases, there is no need to even copy or paste a link or RSS feed.

Pricing and Signing Up

The Above Avalon Daily podcast is available as an add-on ($10 per month or $100 per year) that is attached to an Above Avalon membership.

If you are currently an Above Avalon member, fill out this form to get the podcast add-on. To become an Above Avalon member and purchase the podcast add-on at signup, use the following forms:

Payment is hosted and secured by MoonClerk and Stripe. Apple Pay is accepted. You will receive a confirmation email that includes a link allowing you to update your payment information and membership status at any time.

In addition to being the first podcast exclusive for members, Above Avalon Daily marks the start of members being able to customize their membership to better suit their lifestyle and background. To those members who have already become listeners, thank you for your support. To those of you considering Above Avalon Daily, I am confident you will find the podcast a valuable addition to your daily routine.

Above Avalon Podcast Episode 172: Hidden Acceleration

Apple’s underlying ecosystem strength has been gaining momentum for years - it’s just been masked by people holding on to their iPhones for longer before upgrading. In episode 172, Neil quantifies how much Apple’s ecosystem is growing. Additional topics include the problem found with using overall revenue trends to analyze Apple growth, the Apple Services myth, and why non-iPhone revenue growth matters so much.

To listen to episode 172, go here.

The complete Above Avalon podcast episode archive is available here.

Apple's Ecosystem Growth Is Accelerating

The two most recent Above Avalon articles took a look at how and why Apple’s ecosystem is giving the company a major advantage against the competition.

With Apple reporting 3Q20 earnings two weeks ago, there is value in quantifying how much Apple’s ecosystem is growing. The data should startle the competition. Apple is seeing a clear acceleration in its ecosystem growth as hundreds of millions of iPhone-only users move deeper into the Apple fold by subscribing to various services and buying additional products.

Measuring Ecosystem Growth

There are a number of ways one can attempt to track or measure Apple’s ecosystem growth.

Number of devices per user

Number of paid subscriptions per user

In covering Apple’s business from a financial perspective, my modeling work includes keeping up-to-date estimates for most of the preceding data points. However, there is one metric missing from the list that may come as a surprise: overall revenue. Considering Apple provides this data point every three months, such an exclusion may seem peculiar. Wouldn’t Apple revenue shed light on how the Apple ecosystem is performing?

Relying on overall revenue for analyzing Apple’s ecosystem growth will lead to faulty conclusions. In Exhibit 1, Apple’s revenue is graphed on a trailing twelve months (TTM) basis. This is done to smooth out the seasonality found in Apple’s business (i.e. sales are concentrated around the holidays). The takeaway from the exhibit is that higher revenue demonstrates Apple’s ecosystem continues to grow although the rate of growth has slowed dramatically.

There is one problem with such a takeaway: It’s wrong.

Exhibit 1: Apple Revenue (TTM)

Click / tap exhibit to enlarge.

Overall revenue trends are masking what is actually occurring with Apple’s ecosystem. In FY2019, the iPhone was responsible for 55% of Apple’s overall revenue. On its own, that’s not an issue for Apple. The iPhone is part of Apple’s ecosystem after all. However, Apple has become increasingly dependent on existing users upgrading their devices to generate iPhone revenue. This has resulted in Apple’s overall revenue being heavily influenced by iPhone upgrading trends.

During periods of robust iPhone upgrading, Apple’s overall revenue shows stronger growth. When iPhone upgrading slows, overall revenue growth also slows to the point that Apple’s ecosystem may appear to be plateauing or even contracting (as seen in Exhibit 1). This was a major issue at the end of 2018 and early 2019 as slowing iPhone upgrades led many to conclude that Apple was in big trouble in China and other geographies.

Since iPhone upgrading trends have little to no direct impact on Apple ecosystem viability or strength, a better approach to get insights on Apple’s ecosystem growth is to divide Apple’s revenue into two categories:

iPhone

non-iPhone (Services, Mac, iPad, Wearables, Home, and Accessories)

As seen in Exhibit 2, breaking Apple’s overall revenue into iPhone and non-iPhone revenue leads to a completely different view of Apple’s growth trajectory. Non-iPhone revenue (the red line) continues to demonstrate very strong momentum while iPhone revenue (the blue line) is trending at the same level that it was in 2015.

Exhibit 2: Revenue (iPhone vs. Non-iPhone) - TTM

Click / tap exhibit to enlarge.

A different way of looking at this data is to consider revenue growth rates. Using the revenue figures from Exhibit 2, we are able to create Exhibit 3, which displays year-over-year change in revenue for both iPhone and non-iPhone.

Non-iPhone revenue growth (the red line) has outpaced iPhone revenue growth (the blue line) for the past seven quarters. The higher growth rates for iPhone revenue in 2018 were due to higher iPhone ASPs caused by Apple unveiling the iPhone X. Excluding those quarters, non-iPhone revenue growth has been trending stronger than iPhone growth since 2016. This is a sign that Apple’s underlying ecosystem strength has been gaining momentum for years - it’s just been masked by people holding on to their iPhones for longer before upgrading.

Exhibit 3: Revenue Growth YOY (iPhone vs. Non-iPhone) - TTM

Click / tap exhibit to enlarge.

What is driving the non-iPhone revenue strength shown in Exhibits 2 and 3? The answer is found in the strong iPhone revenue trends from a few years ago. Years of strong new user growth driven by the iPhone is now contributing to hundreds of millions of iPhone-only users moving deeper into the Apple ecosystem. This trend began in earnest around the beginning of 2017.

The Services Myth

Some may look at the preceding exhibits and say that the data is still incomplete. Apple Services include a number of recurring revenue streams such as iCloud, Apple Music, and various paid subscriptions. Given the recurring nature of something like paid iCloud storage, it ends up being easier for Apple to report year-over-year Services growth. Apple’s Services business accounts for 40% of non-iPhone revenue. There is a different dynamic found with hardware revenue. Since hardware isn’t a recurring revenue stream, year-over-year growth ends up being that much harder to achieve as Apple is in effect needing to replace every dollar of revenue with new sales.

(One can argue something like the iPhone Upgrade Program is a recurring revenue stream for hardware. However, that ends up being a stretch. The Upgrade Program is a loan with a built-in upgrade optionality after the 12th payment. That is very different than something like an iCloud or Apple Music subscription.)

To address this issue, non-iPhone revenue can be broken out into Services and Products (excluding iPhone). In what will come as a shock to many people, Exhibits 4 and 5 show how Products revenue excluding iPhone (i.e. iPad, Mac, Wearables, Home, and Accessories) is now growing at nearly the same pace as Services. This represents a major narrative violation as consensus spent years positioning Services as Apple’s growth engine.

Exhibit 4: Revenue (Apple Services vs. Apple Products Excluding iPhone) - TTM

Click / tap exhibit to enlarge.

Exhibit 5: Revenue Growth YOY (Apple Services vs. Apple Products Excluding iPhone) - TTM

Click / tap exhibit to enlarge.

Based on Apple management commentary, we know that upgrading is not impacting the iPad, Mac, and wearables as much as the iPhone. Approximately half of people buying iPads and Macs are new to the product categories. For Apple Watch, the percentage is more than 75%. The new user percentage for iPhone sales is a fraction of those percentages. This tells us that iPad, Mac, and wearables sales are a very good indicator of Apple ecosystem strength.

Tying It All Together

One way of thinking about the Apple ecosystem is to view it as a pie. There are two ways for Apple to expand the pie: Bring in more customers and have existing customers spend more on services and products in the ecosystem (higher ARPU).

New users entering the ecosystem - The iPhone SE should not be underestimated as a successful tool for bringing Android users into the Apple fold.

Existing users moving deeper into the ecosystem - iPhone users are buying iPads, Macs, and wearables as well as subscribing to various Apple services.

Apple currently finds itself in an ecosystem expansion phase. Hundreds of millions of people with only one Apple device - an iPhone - are embarking on a search for more Apple experiences. We see this with non-iPhone revenue growing by 14% in 3Q20 on a TTM basis, which is higher than growth rates seen in the mid-2010s, as seen in Exhibit 6.

Exhibit 6: Apple Non-iPhone Revenue Growth Projection

Click / tap exhibit to enlarge.

Looking ahead, my estimates have non-iPhone revenue accelerating from 14% growth to 20% growth in the coming quarters. iPad, Mac, and wearables are a major source of that growth acceleration. Considering how Apple is working off of a much larger revenue base, for revenue growth percentages to actually increase this far along in the process is intriguing. The takeaway is that Apple’s ecosystem is gaining momentum at a pace that should frighten the competition.

Hundreds of millions of people will be buying their first Apple wearable device in the coming years. Given the inherent nature of wearable devices - new form factors designed to make technology more personal - it is very likely that one Apple wearable purchase will eventually lead to additional Apple wearable purchases. Apple can then leverage high-margin Services to run with more aggressive pricing on wearables (and other Apple devices) which only ends up boosting demand.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members in both written and audio forms. To sign up and for more information on membership, visit the membership page.

For additional discussion on this topic, check out the Above Avalon daily update from August 13th.

Above Avalon Podcast Episode 171: The Apple Ecosystem

Apple’s ecosystem ends up being about more than just a collection of devices or services. Apple has been quietly building something much larger, and it’s still flying under the radar. In episode 171, Neil examines what Apple’s ecosystem derives its power from and why loyalty and satisfaction rates increase as customers move deeper in the Apple ecosystem. Additional topics include The Grand Unified Theory of Apple Products, Apple as a design company, how non-Apple hardware can serve as a Trojan horse for Apple, and how Apple’s ecosystem can evolve.

To listen to episode 171, go here.

The complete Above Avalon podcast episode archive is available here.

The Secret to Apple's Ecosystem

Apple’s ecosystem remains misunderstood. While consensus has come around to accepting the sheer size of Apple’s ecosystem (a billion users and nearly 1.6 billion devices), there is still much unknown as to what makes the ecosystem tick. From what does Apple’s ecosystem derive its power? Why do loyalty and satisfaction rates increase as customers move deeper into the ecosystem? Apple’s ecosystem ends up being about more than just a collection of devices or services. Apple has been quietly building something much larger, and it’s still flying under the radar.

Products

No company is able to match Apple in offering a cohesive and strategically forward-looking product line. Computers small and light enough to be worn on the body are sold next to computers so large that built-in handles are required. More impressively, all of these products are designed to work seamlessly together.

The Grand Unified Theory of Apple Products outlines how each of Apple’s major product categories is designed to help make technology more personal - to reduce the barriers that exist between technology and the user.

Products are designed to handle tasks once handled by more powerful siblings. New form factors are then able to handle new tasks in unique and different ways. It is the pursuit of making technology more personal that ends up being responsible for devices like Apple Watch and AirPods. The same dynamic is also paving the way for Apple to eventually sell wearables for the face in the form of smart glasses. (More on The Grand Unified Theory of Apple Products is found in the Above Avalon Report, “Product Vision: How Apple Thinks About the World,” available here for Above Avalon members.)

With 1.6 billion devices in use, it may be natural to conclude that devices are the source of Apple’s ecosystem power. This has led some to position the iPhone as the sun in Apple’s ecosystem with other products being the planets revolving around the sun. However, this is a misread of the role Apple devices are actually playing in the ecosystem. Just because the iPhone is used by more people than any other Apple device, it is incorrect to assume that will always be the case, or more importantly, that other devices are in some way inferior to the iPhone when it comes to handling workflows. There is something much larger at play here than just a billion users enjoying Apple hardware.

Services

With a $55 billion revenue annual run rate and 518 million paid subscriptions across its platforms, there is no longer a debate as to Apple’s ability to succeed with services. However, there is still a lack of consensus as to what role services play in Apple’s ecosystem. Decisions like bringing Apple Music to third-party speakers and the Apple TV app to third-party TV sets have confused many with some going so far as to conclude that Apple’s future is one of a services company.

In such a world, Apple devices lose much of their value to cheap third-party hardware. This school of thought is responsible for claims that Apple gave up selling accessories like the Apple TV box and HomePod because customers can access Apple content distribution services on cheaper non-Apple hardware. It’s difficult to think of a bigger misread of how Apple thinks and operates as a company than to claim that Apple’s future is one of a services company.

There are now others who look at Apple’s financial success with services as a negative - a sign of Apple milking existing users of as much profit as possible. This school of thought positions paid services as a long-term liability to the Apple ecosystem.

A Toolmaker

While consensus credits products (hardware) as the source of Apple’s ecosystem power, services are increasingly viewed as a hidden risk factor that can crack holes in the ecosystem. Neither are true. Nearly a billion people are not using iPhones simply because they enjoy the hardware. Vice-versa, having 518 million paid subscriptions is not a sign of Apple users needing to pay some kind of tax or bounty to remain in Apple’s ecosystem.

From where then does Apple’s ecosystem derive its power? What makes a customer want to move deeper into the Apple ecosystem?

To answer these questions, we need to step back from any one product or service and instead look at Apple as a company. It is still common for people to call Apple by whatever is its best-selling or most popular product at any one time. This also applies to whatever product is responsible for revenue growth. As a result, we hear all too often phrases like Apple is an iPhone company, a services company, or even a wearables company. The problem is that Apple shouldn’t be defined by any one product, but rather the process that led to Apple having an ecosystem of products and services.

Apple is a design company selling tools that can improve people’s lives. These aren’t just any tools either. Instead, Apple is very selective in selling tools that are able to foster experiences that people are willing to pay for - something that has become increasingly rare in the consumer tech space. By having a design-led culture, Apple is able to put the user experience front-and-center during product development.

This experiences mandate ends up being responsible for Apple’s high loyalty and satisfaction rates. The 975 million people with an iPhone aren’t likely to remain iPhone users because of stellar hardware or compelling software powering that hardware. Instead, loyalty is driven by the experiences associated with using an iPhone.

An Experiences Ecosystem

The secret to Apple’s ecosystem is that instead of selling products or services, Apple ends up selling experiences made possible by controlling hardware, software, and services.

Instead of thinking of Apple’s ecosystem in terms of the number of people or devices, a different approach is to consider the number of experiences Apple is offering. This is where Apple’s true ambitions become visible. By using an iPhone, a customer doesn’t just receive one experience per day. Instead, nearly everything that is consumed on the device has the potential of leading to a good (or bad) experience. This is why Apple’s control of hardware, software, and services plays such a crucial role. Apple’s ecosystem likely consists of tens, if not hundreds of billions, of experiences in a single day.

Having an ecosystem of experiences ultimately represents the biggest challenge to Apple competitors. Coming up with an iPhone alternative isn’t good enough for enticing users to jump from the Apple ship. Instead, competitors need to come up with even better experiences than those found in the Apple ecosystem. As a user moves deeper into the Apple ecosystem - in pursuit of additional premium experiences - competitors need to figure out a way of recreating that growing list of experiences. Can it even be done? When looking at the wearables industry, the answer as of today is “no.”

Non-Apple Hardware

One of the most intriguing aspects of Apple’s ecosystem is how nearly half of Apple users still only use just one Apple device: an iPhone. The idea that every Apple user owns a multitude of Apple devices and services is wrong. The implication is that Apple’s billion users own (and use) quite a bit of non-Apple hardware. Today, non-Apple hardware used by iPhone owners include TV sets, cheap stationary speakers, and CarPlay-equipped automobiles.

Since Apple’s product strategy and organizational structure rewards saying “no” more than “yes,” there will likely always be opportunities for other companies selling hardware to participate in the Apple ecosystem. This ends up being a Trojan Horse for Apple.

Instead of needing to have a new customer jump with both feet into the Apple ecosystem from Day 1, something that isn’t likely especially as the next marginal customer will be coming from the middle tier of the market, Apple merely needs this customer to buy or use one Apple tool.

Management is confident that one tool will eventually turn into two tools and then three since humans gravitate toward premium experiences. As one’s Apple tool collection grows, the number of experiences made possible by those tools increases. This has the impact of increasing customer satisfaction and loyalty. And the flywheel continues to turn. In order to get this flywheel moving in the first place, Apple must build bridges allowing new customers to move deeper into the ecosystem. Decisions like making Apple Music available on non-Apple hardware and bringing the Apple TV app to Samsung TVs are examples of such bridges.

Evolution

When thinking about how Apple’s ecosystem will evolve, the focus shouldn’t be on which new devices or services Apple can come up with, but rather on how Apple can offer new experiences to its customers. The blueprint for creating such experiences is already known: leveraging control over hardware, software, and services.

Technology’s battle lines are currently being redrawn with the goal being to capture the most valuable real estate in our lives: our health, homes, and transportation. Bets on software that completely reimagines the way we approach these verticals will likely prove to be good bets. Timing remains the big unknown.

This raises a question: How will Apple approach new verticals and industries? Would Apple attempt to recreate entirely new device lineups for each industry? Will The Grand Unified Theory of Apple Products be torn apart?

Instead of selling a $80,000 electric car or moving head-first into selling a range of first-party smart home hardware, Apple’s current ecosystem provides clues as to how the company can approach these new industries.

The point of Apple entering transportation wouldn’t be to sell cars, mopeds, or bicycles. Instead, it would be to sell experiences that Apple customers can consume on the road.

The point of Apple moving deeper into smart homes wouldn’t be to sell a plethora of small home gadgets and trinkets, some of which may require an electrician to install. Instead, it would be to sell experiences that Apple customers can consume in the home.

Apple developing an autonomous car remains difficult for many to wrap their minds around. The idea of Apple one day getting into housing is still considered a fantasy by most. However, such ideas make a lot of sense when thinking about how we consume experiences during the day.

An autonomous car is nothing more than a room on wheels. A house is a series of rooms connected to each other. With each, Apple would be looking to create environments that can support new experiences.

This brings us back to Apple’s current suite of products and services. It is incorrect to assume that Apple entering new industries would result in the company throwing its current products out the window. Instead, those tools stand to play major roles in delivering experiences in new industries.

Apple’s interest with Project Titan isn’t to beat or copy Tesla, but rather to figure out a way to have personal gadgets provide compelling experiences on the road. Such experiences could include Apple Glasses being used to find the right autonomous Apple Car to enter while Apple Watches can be used as identification for entry. Once inside the vehicle, the digital assistant found on the wrist or in front of our eyes could then be used to convert the car’s hardware to suit our needs. A similar dynamic would be found with smart homes - relying on personal gadgets, especially wearables, to come up with premium experiences in the home. We are seeing the early stages of this with products like HomePod and the way the device can be seamlessly used with Apple Watch.

The idea that Apple would enter the transportation and housing industries simply to come up with more areas for its users to engage with wearables may seem preposterous today. However, the idea that a single company would be able to deliver hundreds of billions of experiences per day by selling tools consisting of hardware, software, and services was similarly once a fantasy.

Listen to the corresponding Above Avalon podcast episode for this article here.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members in both written and audio forms. To sign up and for more information on membership, visit the membership page.

For additional discussion on this topic, check out the Above Avalon daily update from July 23rd.

Above Avalon Podcast Episode 170: Pulling Away From the Competition

In episode 170, Neil examines how Apple is pulling away from the competition to a degree that we haven’t ever seen before. Given how we are just now entering the wearables era, implications of this shift will be measured in the coming decades, not years. Additional topics include WWDC 2020, Apple’s revised product strategy, the competitive landscape, and Apple’s lead in wearables.

To listen to episode 170, go here.

The complete Above Avalon podcast episode archive is available here.

Apple Is Pulling Away From the Competition