Netflix Isn't Invincible

Netflix has been on a roll. The company is adding approximately two million paying subscribers per month while its original content portfolio grows by leaps and bounds. However, calls suggesting Netflix has won the paid video streaming war are grossly premature. In fact, the battle hasn’t even begun. We are still in the early stages of what will likely become a brutal stretch for many players as competition for paying subscribers and our time intensifies. New players, including Disney and Apple, are about to enter the scene as different direct-to-consumer business models are put to the test. Many prevailing assumptions about the paid video streaming industry will end up being proven wrong.

Netflix Growth

It’s easy to see why Netflix has been a Wall Street darling. The company has seen years of sustained paid subscriber growth in an intriguing new market. While a few disappointing earnings reports, including 2Q18 results, have led to sporadic bouts of investor jitters, Wall Street has rewarded Netflix’s paid subscriber growth with a market cap roughly equal to that of Disney. Instead of judging Netflix on profitability or sales, Wall Street has only cared about one metric: the number of paid subscribers.

Exhibit 1 highlights both Netflix’s steady increase in the total number of paid subscribers and robust growth in the international segment offsetting slowing U.S. subscriber growth.

Exhibit 1: Netflix Paid Subscribers

As depicted in Exhibit 2, year-over-year growth in the number of paid Netflix subscribers on an absolute basis stands at an all-time high. In 2Q18, Netflix saw a 25M year-over-year increase in paid subscribers. This is roughly equal to the number of Hulu subscribers. Netflix now has close to 125 million paying subscribers, and the company’s momentum seems unbeatable.

Exhibit 2: Netflix Paid Subscriber Growth

Netflix Keys to Success

A few factors explain Netflix’s strong momentum over the years:

Original video content. Netflix’s decision to bet on original content has been a game changer, helping to maintain paid subscriber momentum from the early 2010s. Shows like House of Cards and Stranger Things have single-handily helped boost Netflix’s paid subscriber tally.

Low pricing. Compared to the price of a large cable bundle, Netflix’s low monthly subscription pricing is viewed as attractive by consumers. Netflix is also running with low pricing options in international markets.

Superior user experience. Consumers want to decide when to watch their favorite shows instead of being told when to tune in.

Netflix’s business model is ultimately dependent on the number of hours subscribers spend watching Netflix content. As long as subscribers are watching an increasing amount of content, the Netflix model works marvelously. Strong paid subscriber and engagement trends give management the green light to spend an increasing amount on original content, which then contributes to additional user and engagement momentum. This produces a positive feedback loop, as shown in Exhibit 3.

Exhibit 3: Netflix Feedback Loop

Netflix Competition

Competition has been a recurring theme on Netflix’s quarterly earnings calls. Management’s response has included a carefully-crafted, cautious tone, although the takeaway has been consistent: Instead of spending time worrying about the competition, Netflix remains focused on coming up with a better user experience. The aim isn’t to deny that Netflix faces competition, but rather to claim that Netflix doesn't look at the competition to figure out what to do next.

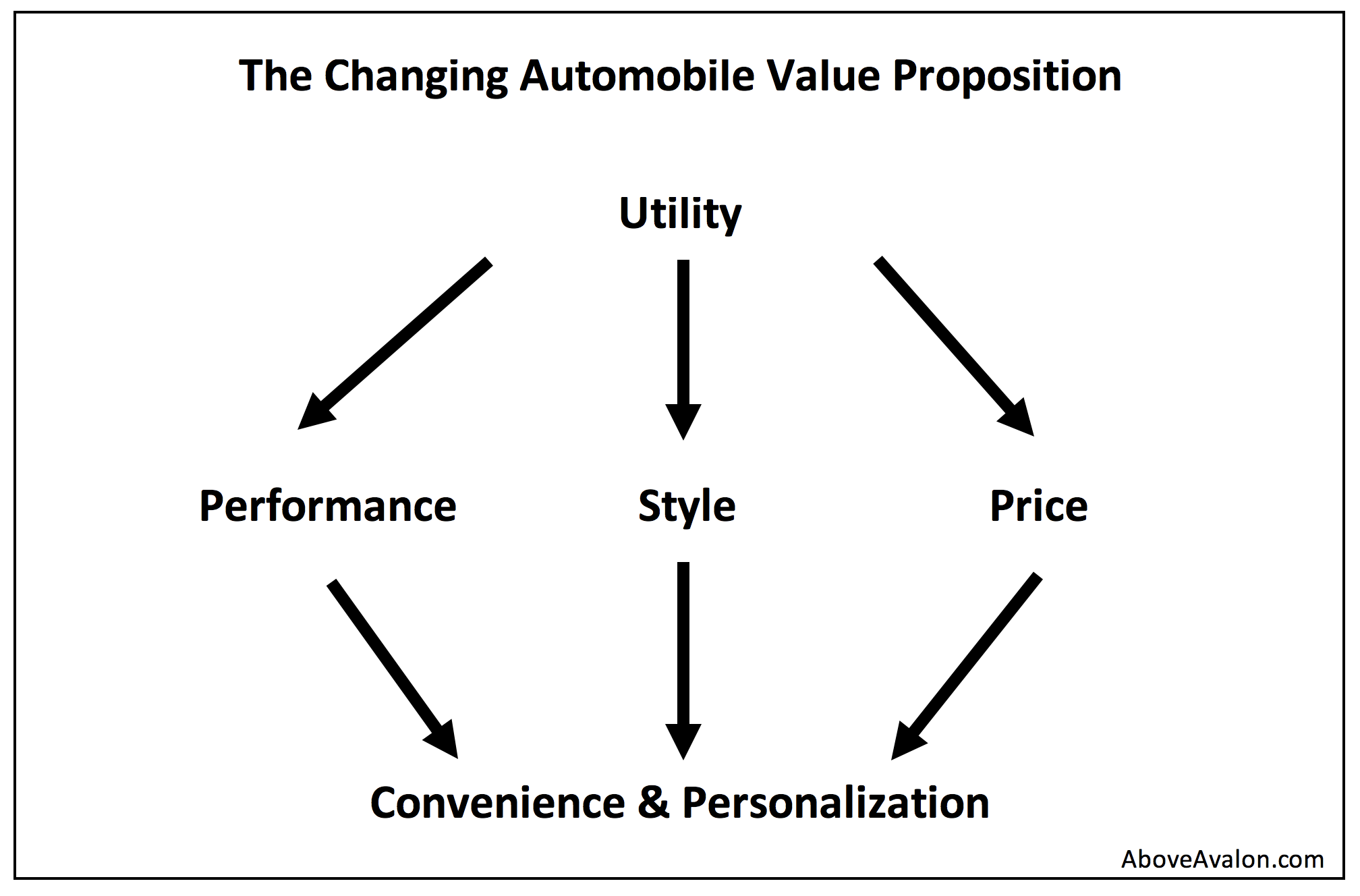

Up to now, Netflix has faced two primary competitors: legacy cable and our time. Netflix is a media company selling a video bundle to consumers. The company has seen much success in going up against the traditional cable bundle given innovation surrounding distribution. The way we consume video is undergoing a sea change, and Netflix has been able to ride the wave while legacy video struggles to stay afloat.

As shown in Exhibit 4, ESPN’s subscriber count, which serves as a proxy for the health of the large cable bundle, has declined by about 11% from the peak. Given how a growing number of slimmed-down cable bundles include ESPN, the large cable bundle has likely experienced even steeper subscriber declines.

Exhibit 4: ESPN Subscribers

Netflix’s fight against our time has been the more intriguing competitive battle. Netflix’s success is directly related to the amount of time users spend on the platform. Accordingly, the more Netflix video is consumed, the brighter Netflix’s prospects look. Given the finite amount of time available each day, Netflix ends up competing against everyday tasks for our time and attention. This battle has placed Netflix up against work, chores, errands, and even sleep. The battle for our time, not Amazon or even YouTube, has proven to be Netflix’s most formidable competitor to date.

New Battles

While it may seem like Netflix already has quite the nuanced battle on its hands going up against the clock, competition will only intensify. Up to now, Netflix has been running away with the ball with little to no competitive response from other paid video streaming players. When it comes to paid services other than Netflix, the list isn’t long with Amazon, HBO, and Hulu possessing the most mindshare. Things are about to change in a big way. In fact, we haven’t even seen a genuine battle yet in the paid video streaming space.

Three notable competitors are about to enter the paid video streaming scene:

Disney. The company’s existing intellectual property portfolio, combined with assets acquired from 21st Century Fox, position Disney as a formidable force in the direct-to-consumer paid video streaming space. The company plans to have three video bundles: a Disney-branded bundle with family-friendly content, a Hulu bundle with content that isn’t as family friendly, and ESPN+. It is not a question of if Disney will succeed over the long run, but rather how aggressive Disney will be out of the gate in terms of grabbing paying subscribers.

Apple. The new kid on the block. We are seeing what it looks like for Apple to go all-in on developing its own video streaming service. There are still questions surrounding Apple’s video strategy. However, the stream of reports regarding new shows and movies points to Apple building a decent-sized (at least a dozen shows) portfolio out of the gate.

AT&T / Time Warner (HBO). After buying Time Warner for $85 billion, AT&T has a strong incentive to leverage its crown jewel, HBO, to gain a stronger footing in the direct-to-consumer paid video streaming landscape. AT&T seems interested in tinkering with HBO’s strategy of valuing quality over quantity. Such a content strategy is being questioned when compared to Netflix chasing both quality and quantity at the same time.

The three preceding companies will likely unleash a brutal paid video streaming war over the next five years. There will be intense bidding wars for the best ideas and shows. Talent will become even more scarce. Consumers will have more in the way of choice when it comes to watching high-quality shows. This battle will be so intense, free video streaming players, like YouTube, will likely be pulled into the mix. The significant momentum found with the paid video space is a direct threat to ad-based video models. Google may feel pressure to wade even further into the paid video streaming space.

Netflix’s Problems

Netflix’s grip on the paid video streaming market is not as strong as it may appear. The company’s competitive advantages in the marketplace are being oversold.

Netflix’s video catalog is underwhelming. Aside from its one to two dozen original hit shows, Netflix’s broader content portfolio isn’t compelling. Much of the legacy content is stale while a surprising number of original movies feel off - as if they are low-budget despite having household stars. While Netflix’s growing efforts with original shows may be enough to keep viewers as monthly subscribers, more is needed on the content front if Netflix wants to grow viewer engagement.

Switching between video subscription services is easy. The idea that consumers will stick with one video streaming platform has not been fully thought out. While companies like Netflix are incentivized to keep viewers on their own platforms, attention is easily transferrable to other video streaming services. Apple’s TV app breaks down the barriers between video streaming services to the point of there not being any barriers at all. It is not surprising that companies like Netflix have little desire to fully participate in such a service.

Netflix’s technology advantage is misrepresented. As Ted Sarandos, Netflix’s chief content officer, discussed in a recent interview, gut represents around 70 percent of the equation when it comes to Netflix determining what makes great content. The narrative that Netflix is actually a technology company masquerading as a media company ends up being a stretch. Instead, Netflix is a media company that must continue to come up with popular hit shows.

Subsidized subscription pricing helps the competition. Netflix continues to subsidize paid memberships in order to grab as many users as possible. An unintended consequence of this practice is that Netflix ends up leveling the playing field for competitors by devaluing paid video content. By keeping pricing artificially low, Netflix makes it that much easier for new competitors to enter the market with pricing that isn’t too far off from that of Netflix. Disney has telegraphed that it will likely price its family-oriented video bundle at around $5 per month, which isn’t too much lower than Netflix’s pricing, despite Disney having a content portfolio that will be a fraction of the size of Netflix’s.

Business Models

Paid video streaming does not have the characteristics of a winner-take-all industry. No one company will have a monopoly on good, compelling video content. Netflix is not going to become “the new cable bundle.” Instead, it’s very likely that consumers will subscribe to multiple paid video streaming services. We may very well see a handful of video streaming services have more than 100M paying subscribers around the world. This reality is made that much more likely given the significant financial resources found with industry players including Disney, Apple, Amazon, AT&T, and Google.

There have been two primary business models in the paid video streaming space:

Direct subscription fees (Netflix, Hulu)

Larger entertainment bundle fees (Amazon)

The two business models haven’t been put to the test. Direct subscription fees continue to be subsidized in order for companies to grab users. It is very obvious that Netflix will have to raise its subscription pricing in a big way, especially if engagement hours plateau.

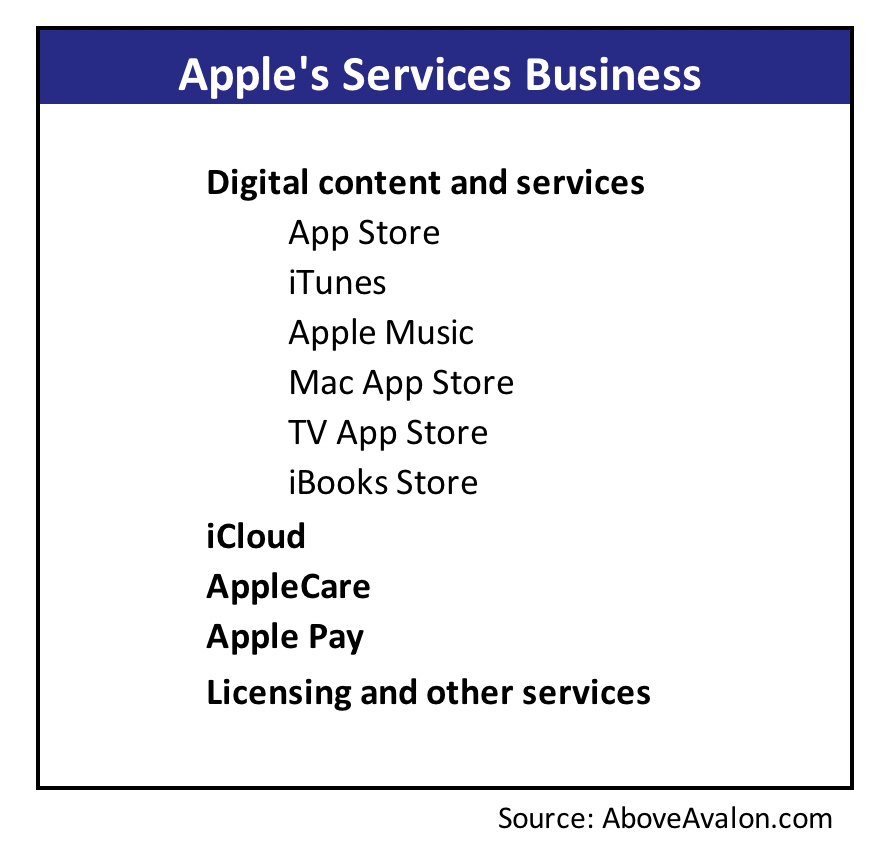

Meanwhile, companies that position video as merely one of a handful of services for subscribers don’t need to turn a profit with video streaming. By bundling video into Prime, Amazon doesn’t have to worry about video streaming pricing. Ultimately, this dynamic will pressure companies dependent on direct subscription fees. We haven’t seen what the video streaming industry looks like with another major player bundling video as part of a larger entertainment package. Apple is expected to offer a comprehensive entertainment package containing music, video, news, and even cloud storage.

Mindshare

Paid music streaming provides a sneak peak of what may unfold in the paid video streaming industry. In some ways, the music streaming industry is a few years ahead of the video streaming when it comes to having genuine competition.

There are key differences between the music and video streaming industries. With music, the same content is available on multiple paid streaming platforms. This has resulted in streaming companies positioning music discovery and the listening experience as the primary forms of differentiation. In what is a new development, hardware is also now being positioned as a differentiator with stand-alone stationary speakers, in addition to wearables, increasingly paying a role in how consumers pick between music streaming services.

Meanwhile, differentiation for video streaming comes in the form of original content. For example, Stranger Things is available only on Netflix and will likely remain so for the foreseeable future. Based on Netflix subscriber trends, original programming plays a major role in driving subscriber growth. This has led to a type of arms race when it comes to content budgets. Netflix is reportedly spending close to $10 billion per year on original content. Amazon is spending near $5 billion per year.

There are similarities between the two industries as well. Both music and video streaming began with a clear first-mover. Spotify was the undisputed leader in paid music streaming, similar to how Netflix now holds the same title in the paid video streaming space. This title gave each company significant mindshare, which corresponded to strong early momentum in terms of grabbing new users.

However, with a genuine competitor in the music streaming market, Spotify’s mindshare has suffered. Exhibit 5 compares the growth in paid subscribers for Apple Music and Spotify. While each company continues to benefit from the music streaming pie getting larger, Spotify now has to share the stage with Apple for mindshare.

Based on company disclosures, Apple Music’s new user growth is indeed accelerating as time goes on. In what is likely a worrying development for Spotify, Apple Music is now said to have more paid users than Spotify in the U.S. Similar trends are unfolding in other developed markets.

Exhibit 5: Apple Music vs. Spotify

Meanwhile, Spotify’s stronghold appears to be in Brazil and emerging markets, locations in which Apple’s market penetration is low. This dynamic doesn’t give one confidence in Spotify’s long-term opportunity. Instead, Apple will continue to chip away at Spotify’s mindshare.

While Netflix is able to use original content as a way to set itself apart from the competition, the company hasn’t needed to share the paid video streaming stage with such household names as Disney and Apple.

The Key Variable

The number of paid subscribers is not the key variable to monitor with Netflix. Since the paid video streaming market faces a number of tailwinds, it is certainly possible that Netflix will continue to grow its subscriber count over time. The overall streaming pie will continue to grow. Instead, the Netflix item to watch is subscriber engagement.

Netflix’s business model is ultimately dependent on the number of hours subscribers spend watching Netflix content. As discussed up above with Netflix’s feedback loop, as long as subscribers consume an increasing amount of content, the Netflix model works marvelously.

Based on Netflix’s 2Q18 earnings commentary, viewing/engagement hours are still up year-over-year. What will happen to Netflix engagement once Disney and Apple launch their own video bundles? Questions surrounding future competition are legitimate for Netflix. While consumers may very well end up subscribing to multiple video bundles, there is only so much time that can be split among each bundle. Time spent watching Disney or Apple content will be time not spent watching Netflix content.

As shown in Exhibit 6, the hole in Netflix’s armor will likely be found with the item circled in red: engagement. Any sign of plateauing engagement could lead to a domino effect as Netflix loses pricing power and the ability to run with higher content budgets. Any slowdown in new original content could then begin to impact new user trends, especially in international markets. Less content could then lead to even lower engagement.

Exhibit 6: Netflix Feedback Loop (Potential Problem Circled in Red)

The Big Picture

Given how Netflix is viewed by many as unstoppable, it probably shouldn’t come as a surprise that consensus expectations remain muted for Disney and Apple in the paid video streaming space. This will likely end up being a mistake. Various publications have been solely focused on casting doubt on Apple’s video efforts instead of highlighting how the paid video streaming market remains attractive for a company like Apple. The cynicism surrounding Apple Video brings back memories of the doubt facing Apple Music in the early years.

Tim Cook and Eddy Cue are reportedly taking a very hands-on approach with Apple’s video initiative, highlighting the service’s importance to Apple. Video will end up being a key ingredient of an Apple entertainment bundle containing various services. The company ends up building not just a video streaming service, but a Hollywood arm. Meanwhile, Disney has the strongest intellectual property out of any video player. The company’s problem up to now has been found with distribution. Those problems are now being addressed.

As for Netflix’s future, management appears to be well-aware of the risks found with being just a paid video streaming company. Netflix management will likely focus on two items in particular:

Acquire or build a strong portfolio of intellectual property. It would not be surprising to see Netflix embrace M&A (the company has only acquired one company - Millarworld) in an effort to beef up its intellectual property.

Expand beyond video content. Netflix reportedly considered buying a chain of movie theaters. Recent reports have Netflix moving into radio as well. These efforts are designed to move Netflix beyond being just a paid video streaming company.

Disney and Apple don’t have to go toe-to-toe with Netflix to do well in the video streaming space. Instead, each company is ultimately focused on grabbing viewer attention with compelling content. The ingredients are in place for both Disney and Apple to do very well.

Receive Neil’s analysis and perspective on Apple throughout the week via exclusive daily updates. The updates, which have become widely read and influential in the world of Apple, provide timely analysis of news impacting Apple and its competitors. Neil also publishes exclusive reports on Apple business, product, and financial strategy. The daily updates and reports are available to Above Avalon members. To sign up and for more information on membership, visit the membership page.