Above Avalon Podcast Episode 129: Giants on Wall Street

A select group of corporate giants have been gaining influence and investor dollars on Wall Street. Episode 129 is dedicated to discussing today's corporate giants (Apple, Amazon, Alphabet, Microsoft, and Facebook) including the key differences and similarities between the five. The second half of the episode goes over why I think odds are good that today's giants won't be tomorrow's giants. The episode concludes with a closer look at Apple's quest to do the seemingly impossible - remain relevant.

To listen to episode 129, go here.

The complete Above Avalon podcast episode archive is available here.

The Race to a Trillion

An arbitrary race that many have been following on Wall Street is, which company will be the first to reach a trillion dollar market capitalization? Currently, there are four legitimate contenders: Apple, Amazon, Alphabet, and Microsoft. However, the race to a trillion dollars ends up hiding a much more interesting development that has been unfolding on Wall Street.

A select group of corporate giants continue to gain influence and investor dollars. Their rise is drawing into question whether or not this time is different. Have these companies found a way to remain at the top indefinitely? Are we seeing the rise of a new breed of corporate giant?

Today's Giants

There are currently five giants on Wall Street:

- Apple: $924B

- Amazon: $848B

- Alphabet: $814B

- Microsoft: $782B

- Facebook: $587B

Combined, the five preceding companies total $4.0 trillion of market cap, representing 16.5% of the entire S&P 500. This development has raised concerns that we may be in some kind of tech bubble or, worse, that today's giants are gaining too much power over the broader market.

History offers a different viewpoint. Wall Street has been no stranger to corporate giants. In fact, power was much more centralized at the top in the 1960s and 1970s when the top five companies made up more than 20% of the S&P 500.

Exhibit 1: Market Capitalization of Top Five Companies in S&P 500 (% of Total S&P 500)

During the 1960s and 1970s, the largest company represented 7% to 9% of the overall S&P 500. Today, Apple represents approximately 4% of the S&P 500. As seen in Exhibit 2, no company has been immune from the eventual fall from the top. It seems like the surest way to not be the largest company in the future is to be the largest company today.

Exhibit 2: Market Capitalization of Largest Company in S&P 500 (% of Total S&P 500)

Diversification

Historically, there has been diversification among the largest public companies. For decades, the top five companies have included representatives from different segments of the economy such as the tech, industrial, energy, and financial sectors. Many have looked at today's giants and concluded such diversification has disappeared. However, upon closer examination, a different picture comes into focus. There is still diversity at the top:

- Apple is a design company selling tools that empower people.

- Amazon is a retailer intently focused on offering the best retail experience imaginable.

- Microsoft is an enterprise-focused services company focused on helping people get work done.

- Google is a services company aimed at delivering data-capturing tools to as many people as possible.

- Facebook is a services company providing curated versions of the web (Facebook and Instagram).

The preceding five companies rely on different business models to form unique customer relationships. More impressively, each company has gotten to where it is today without interrupting the others' business models. We see some skirmishes at the edges. (Facebook and Google are both offering prime real estate for advertisers while Amazon has entered Google's search territory.) However, things have remained shockingly benign when it comes to all-out wars among giants.

Narratives

The five giants aren't treated and viewed equally on Wall Street. Along with having different business models, each also possesses unique narratives with some stronger than others. Amazon currently has one of the strongest narratives. Out of the five giants, Amazon is viewed as having the most defensible business model with the company positioning itself as a type of utility that will eventually own the most cost efficient and effective way goods are transferred from merchants to people's homes. One way to verify this strong narrative is to look at the market's reaction to Amazon announcing M&A activity. News of Amazon entering a new industry (grocery and now pharmacy) is accompanied by significant market cap losses among that industry's existing players.

Meanwhile, Facebook and Google are viewed as being more susceptible to competition grabbing users' attention with different kinds of data-capturing services. Nevertheless, the market is still rewarding the two companies for their seemingly more predictable services revenue streams based on delivering ads.

Apple is viewed as the most susceptible of the group. There continues to be a significant amount of doubt regarding Apple's ability to keep coming up with new products that people love. This skepticism has surrounded Apple for decades and is used by the company as a factor motivating employees to surprise the world.

Valuation multiples afforded to each company reflect these different narratives. Amazon shares trade at the highest multiples among the group with Apple bringing up the rear, trading at a 10% discount to the overall market (according to forward P/E multiples).

The following valuation metric is operating cash flow yields (operating cash flow / market cap). The lower the yield, the higher the valuation metric. For example, the market is currently willing to pay 3x more for a dollar of Amazon operating cash flow (and Amazon's future cash flow stream) versus a dollar of Apple operating cash flow.

- Apple: 7%

- Microsoft: 5%

- Alphabet: 5%

- Facebook: 4%

- Amazon: 2%

Software

The five largest public U.S. companies do have one thing in common: software prowess. Three of the five were able to harness the power found with software in the mobile era to achieve a type of scale that was once unimaginable. All five relied on software advancements to come up with new customer experiences. Facebook and Alphabet cater to more than two billion customers each. Microsoft and Apple have more than a billion customers each.

Some market observers are wondering if the combination of software prowess and sheer scale has resulted in a different kind of corporate giant. Have today's largest companies gained so much power thanks to their capabilities and loyal customer bases that they will be able to avoid the inevitable fall from grace? Similar questions have been pointed towards non-U.S. companies as well, including Tencent and Alibaba.

Defining Power

Today's corporate giants hold considerable power in two ways:

- Cash

- Data

Four of the five largest public U.S. companies have remarkably strong balance sheets. The following totals reflect net cash (excludes debt) positions as of the end of March 2018:

- Apple: $145B

- Alphabet: $100B

- Microsoft: $55B

- Facebook: $44B

- Amazon: $6B

More impressively, each company is kicking off significant amounts of cash flow. The following totals reflect operating cash flow for FY2017:

- Apple: $64B

- Microsoft: $40B

- Alphabet: $37B

- Facebook: $24B

- Amazon: $18B

Strong balance sheets and superior cash flows provide management teams flexibility to fund and pursue ambitious ideas. Each company has seen a dramatic rise in R&D expense in recent years. Apple, historically known for its R&D expense frugality, will spend more on R&D in 2018 than it did from 1998 to 2011. The following totals are R&D expense in FY2017.

- Alphabet: $17B

- Microsoft: $13B

- Apple: $12B

- Amazon: $12B*

- Facebook: $8B

*Estimated as Amazon includes R&D within its "technology and content" line item.

Add topics like AI and machine learning into the discussion, and some think these giants derive value not from just having many users, but also from users' data. There is a growing number of market observers and pundits that see a new breed of monopoly being born, a "data monopoly." This group views data, or the lack thereof, as a formidable barrier to entry, preventing others from competing with today's giants. In such a scenario, government regulation would be the only thing capable of slowing down the giants.

Nothing Lasts Forever

This may be a controversial statement, but odds are good that today's giants won't be tomorrow's giants. Despite some companies being viewed as more defensible than others, each is fragile. New companies, some of which haven't been founded yet, will rise up and compete with today's leaders for market supremacy. Critics will argue this thinking is too old-school and that today's companies simply hold too much power (via cash and user data) to one day be disrupted. I disagree.

It is easy to think that today's giants are where they are today because of a particular product, feature, or core competency. However, this isn't the case. Instead, each company has developed a culture and process to create value for customers. It is this process, and the sheer level of difficulty found with changing such a process, that will serve as a roadblock for today's giants.

Over time, new forces will rise that will challenge existing processes and require giants to come up with new ways of thinking. The degree to which management teams can respond and adjust to these new forces will determine the amount of success in staying at the top. There is nothing inherently found with today's giants that prevents new companies from leveraging technologies to deliver customer value in new ways. Instead of there being some kind of innovation black hole where advancements can only come from the five giants, tomorrow's giants will likely use today's leaders as stepping stones to reach new heights. An example of this development would be the way companies have used smartphones to rethink transportation via ride sharing.

Start-ups will be able to innovate in the areas of A.I. and machine learning despite not having access to the quantity of data that the giants possess. In essence, too many people are positioning data and scale as moats that will protect today's giants. Neither will prove true.

The five giants are keenly aware of their fragility. No one wants to miss the next big thing and be left behind. Consider the following actions when it comes to avoiding irrelevancy:

- Apple is sprinting into wearables while continuing to embrace additional vertical integration by owning the core technologies powering its devices. Apple is mapping a post-iPhone path forward.

- Google's Alphabet reorganization was designed to better manage the various bets the company had placed. While the reorg doesn't appear to be going terribly well from a management / leadership perspective, Alphabet has become more financially-disciplined when it comes to its long-term bets.

- Facebook's annual developers conference has seen Mark Zuckerberg position different initiatives as the company's future. In 2016, VR was said to be Facebook's future. The implication is that the world will increasingly move beyond just text and photos. In 2017, AR was Facebook's future. Today, Facebook finds itself dialing things back to put more resources in cameras and video.

- Microsoft's shift away from consumer markets symbolized management's acceptance of missing the mobile revolution and instead staking out a differentiated path forward.

- Amazon's vertical integration into product and delivery is upending nearly every part of the legacy retail complex.

While the giants have become more ambitious and willing to take on challenges, there has been very little change to their cultures or processes.

Case Study: Apple

Apple management is well aware that they are trying to do the seemingly impossible - remain relevant. Aside from a few luxury brands, very few companies have been able to avoid what appears to be the inevitable fall from grace.

Apple's future won't be determined by the iPhone, Apple Watch, or Services. Instead, Apple's future will be based on the company's ability to come up with valuable tools for people. This reality is dependent on a few ingredients:

- Deep collaboration among teams within Apple.

- An intense focus on design (i.e. how Apple products are used).

- Correct market positioning and timing (Arguably, these attributes end up being a design offshoot as they relate to how people will use Apple tools.).

Tim Cook is misunderstood as Apple CEO. Many have been grading Cook as if he is Apple's product visionary. Instead, Cook is tasked with managing something more important than any one product. Cook is looking over the process used to develop products. He has overseen major changes to the way Apple is managed on a day-to-day basis while doubling down on positioning Apple's Industrial Design group as purveyors for the experience found with using Apple products.

As we move into the AI / ML era, it isn't a coincidence that Apple has been making internal changes to foster deeper collaboration between industrial designers (who oversee Apple's product vision) and other teams on the frontline of new technologies. The recent hiring of John Giannandrea as Chief of Machine Learning and AI Strategy emphasizes this last point. Apple's new headquarters house a design studio fostering a greater level of idea dissemination versus what was possible at Apple's old headquarters.

We also see Apple moving deeper into owning core technologies - a bet that will likely give the company a competitive advantage measured in decades. Not only is Apple working on developing the required technologies for new product categories, but management is also waiting for the correct market timing. The transportation industry isn't quite ripe for a company like Apple to enter. However, given the significant amount of change unfolding in the space, an Apple move into transportation is inevitable. Such a move may be associated with Apple relying on different processes to monetize premium experiences. It is this embrace of change that gives Apple the best chance of continuing to build tools for people. Waiting for the right time to move is a freedom that Apple never had twenty years ago.

A Trillion Dollar Reminder

Barring some kind of global slowdown in economic activity, there will likely be at least one trillion dollar company among today's giants. Over the next few years, it is certainly possible that there will be multiple trillion dollar companies.

Instead of this milestone representing the start of a new chapter for these giants, it should serve as a reminder of these companies' fragility and the never-ending supply of new companies coming up with new processes for delivering experiences and value to the world.

While many think there will be growing competition or wars between today's giants, such a scenario is unlikely. Instead, the competition will come from other directions, including new entrants possessing dramatically different business models and processes.

The strongest opponents in the giants' battle to remain relevant end up being themselves. The natural aversion to change will simply be too strong for most giants. Strong balance sheets, billions of users, and access to seemingly unlimited user data will all prove futile in their bids to remain relevant.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on memberships, visit the membership page.

Above Avalon Podcast Episode 128: Figuring Out What's Next

One of the major takeaways from this year's WWDC keynote was found with something not announced on stage. Apple finds itself announcing new technologies that make more sense on form factors that don't yet exist. Episode 128 includes a discussion of this year's WWDC, which demonstrated how Apple is figuring out what comes next. After quickly recapping the major WWDC 2018 announcements, Neil discusses how Apple is setting the stage for smart glasses. The second half of the episode goes over Apple's motivation for looking beyond current success to figure out what's next.

To listen to Episode 128, go here.

Apple Is Figuring Out What's Next

"If you do something and it turns out pretty good, then you should go do something else wonderful, not dwell on it for too long. Just figure out what's next." - Steve Jobs

Apple used this year's WWDC to demonstrate a number of areas in which it is playing offense. This isn't a company content with letting others control the user experience found with its devices. However, one of the major takeaways from the WWDC keynote was found with something not announced on stage. Apple finds itself announcing new technologies that make more sense on form factors that don't yet exist. Management is increasingly focused on what comes next, and the answer is smart glasses.

WWDC 2018

The features and software unveiled at WWDC 2018 could be split into two categories. The first group included items targeting the way we use and consume content on Apple devices. This included everything from empowering users with information regarding how devices are used to improving the way we consume content via:

- An updated Apple News app.

- Apple Podcasts on Apple Watch.

- A completely redesigned Stocks app.

- A revamped (and rebranded) Apple Books.

Apple knows it holds a lot of power when it comes to content distribution given a user base of a billion people and 1.4 billion devices.

The other group of announcements was related to new technologies designed to make the cameras and screens in our life smarter.

- ARKit 2 introduces new ways of transforming smartphone and tablet cameras into smart eyes.

- Siri Shortcuts continue Apple's efforts to customize Siri to better suit a user's lifestyle.

- New machine learning (ML) capabilities are powering Memoji and various other applications made possible by smarter cameras.

There is a drawback found with most of the cameras and screens that stand to benefit from these new technologies: We still have to hold them. While AR makes for a cool on-stage demo, having to hold an iPhone or iPad up as an AR viewfinder for long periods of time isn't ideal. Items like Siri Shortcuts and Siri Suggestions are interesting on iPhone and iPad although they are incredibly more appealing on mobile displays worn on our bodies. ML applications on iPhone and iPad are useful, but the predictive and proactive nature of the technology can work wonders when combined with mobile cameras and screens that we don't have to hold. Apple is announcing new technologies that make more sense on form factors that currently don't exist.

My full WWDC 2018 review is available for subscribers here (major themes) and here (full notes).

What's Next?

While Apple management will never admit it, the company has been thinking and looking beyond iPhone for years. The Apple Watch's ongoing march to iPhone independency is clear evidence of this post-iPhone thinking. This isn't to say that the iPhone will lose its spot as the most valuable computer in hundreds of millions of lives anytime soon. In addition, the iPhone will likely remain Apple's top revenue-generating product for some time. However, those realities don't determine Apple's post-iPhone product strategy. Management isn't driven by the goal to come up with something that is more profitable than iPhone. Instead, the focus is on coming up with something that makes technology more personal and handling new workflows that were never able to be handled by iPhone.

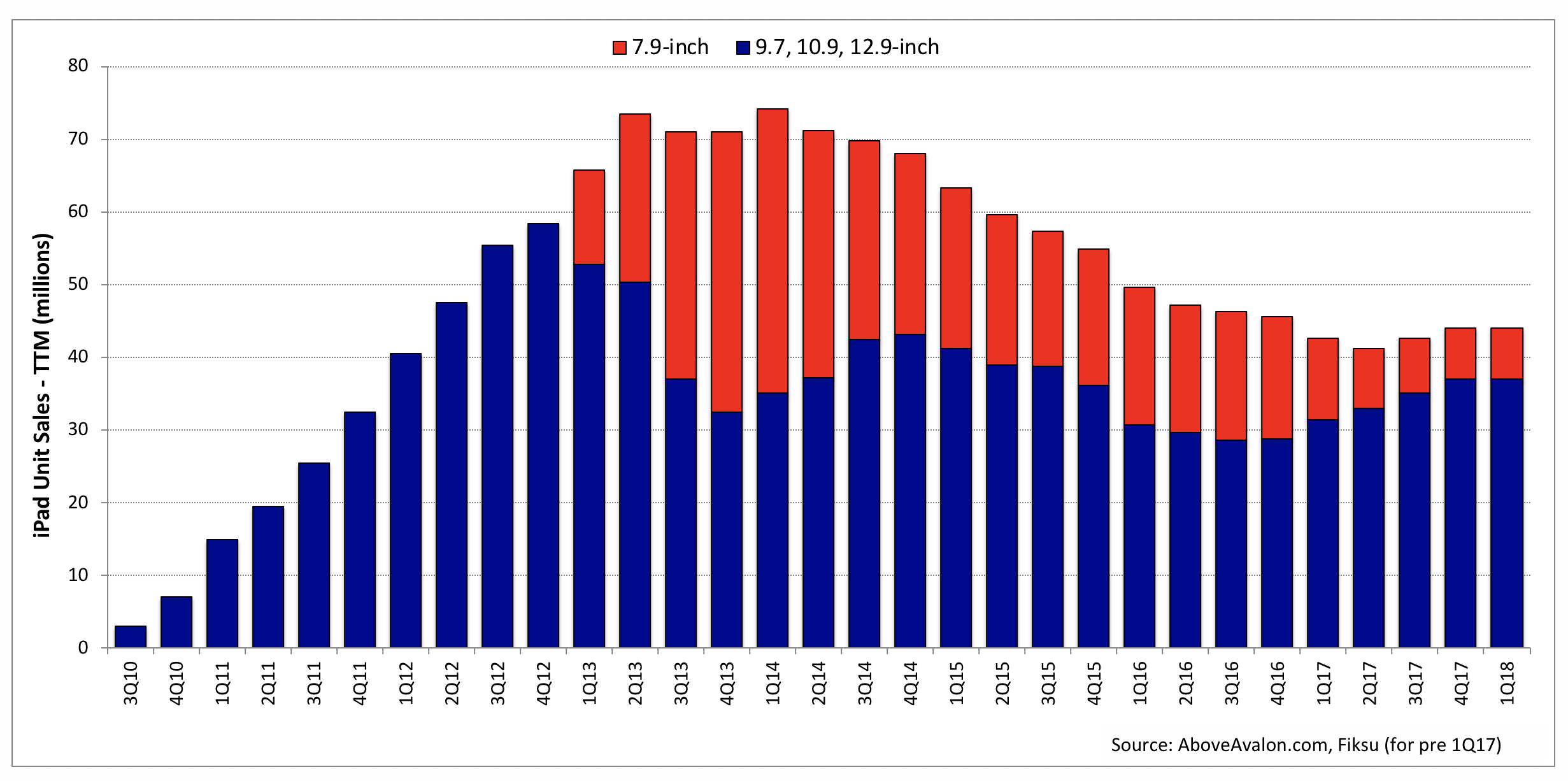

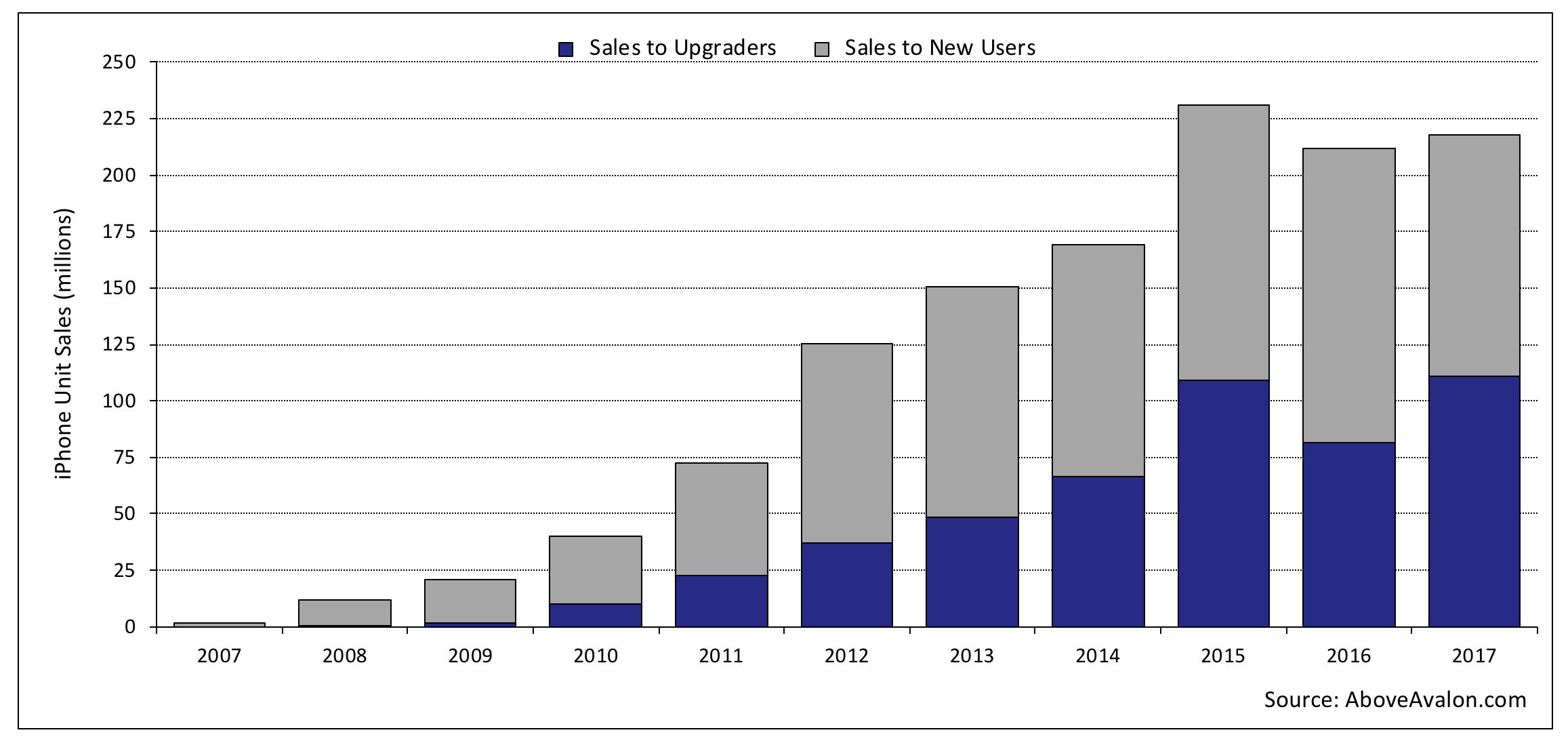

Last month, Mary Meeker presented the latest edition of her Internet Trends presentation. Narrowing 294 slides into one major takeaway isn't easy, but such a task was possible this year - the smartphone industry is mature, and it's time to figure out what's next. Smartphone sales are flat as the average consumer is OK with holding on to his or her smartphone for longer before upgrading.

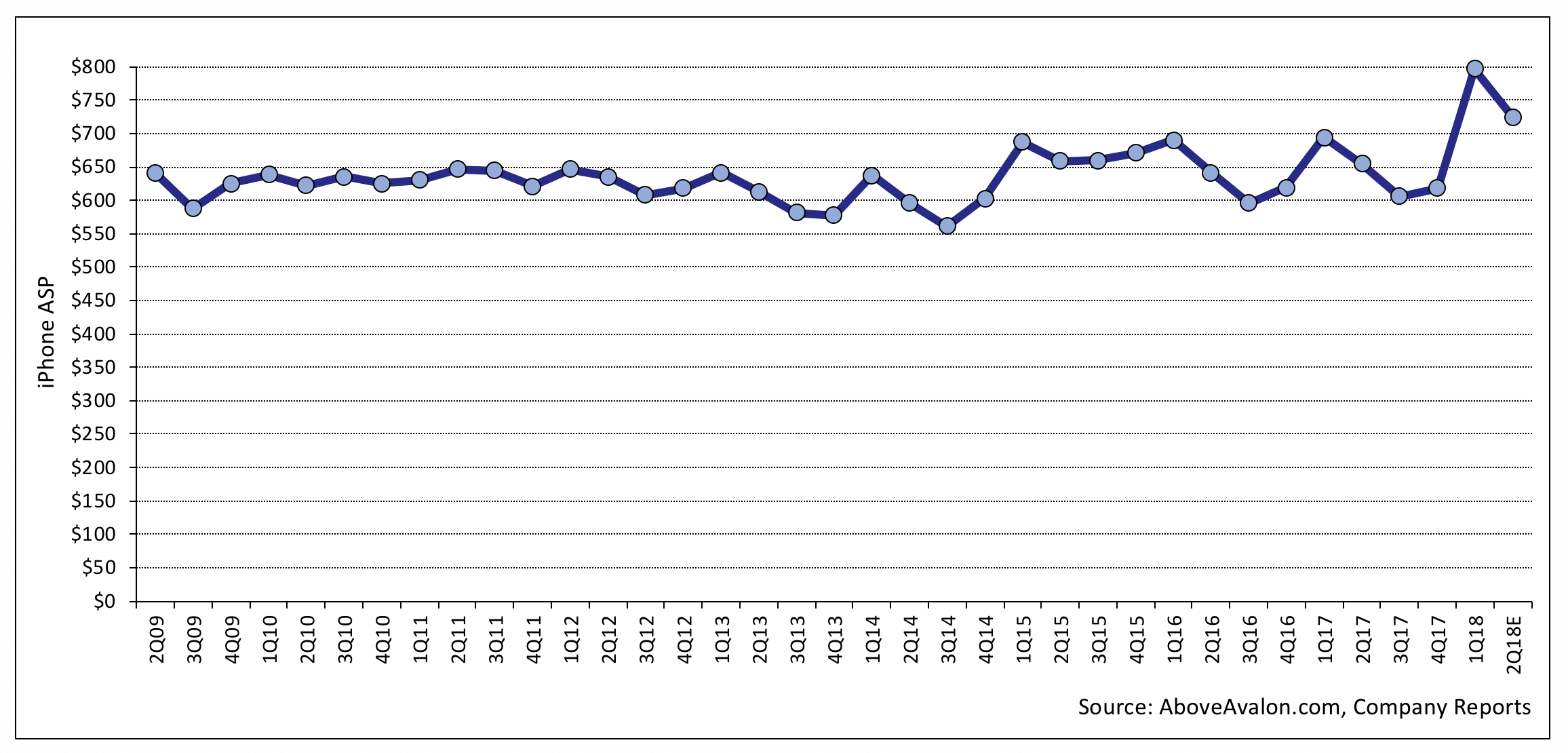

As seen in the chart below, Apple hasn't been immune to this trend as iPhone sales have plateaued. Apple is currently selling approximately 215 million iPhones per year, and sales are likely to remain in that ballpark in the near term.

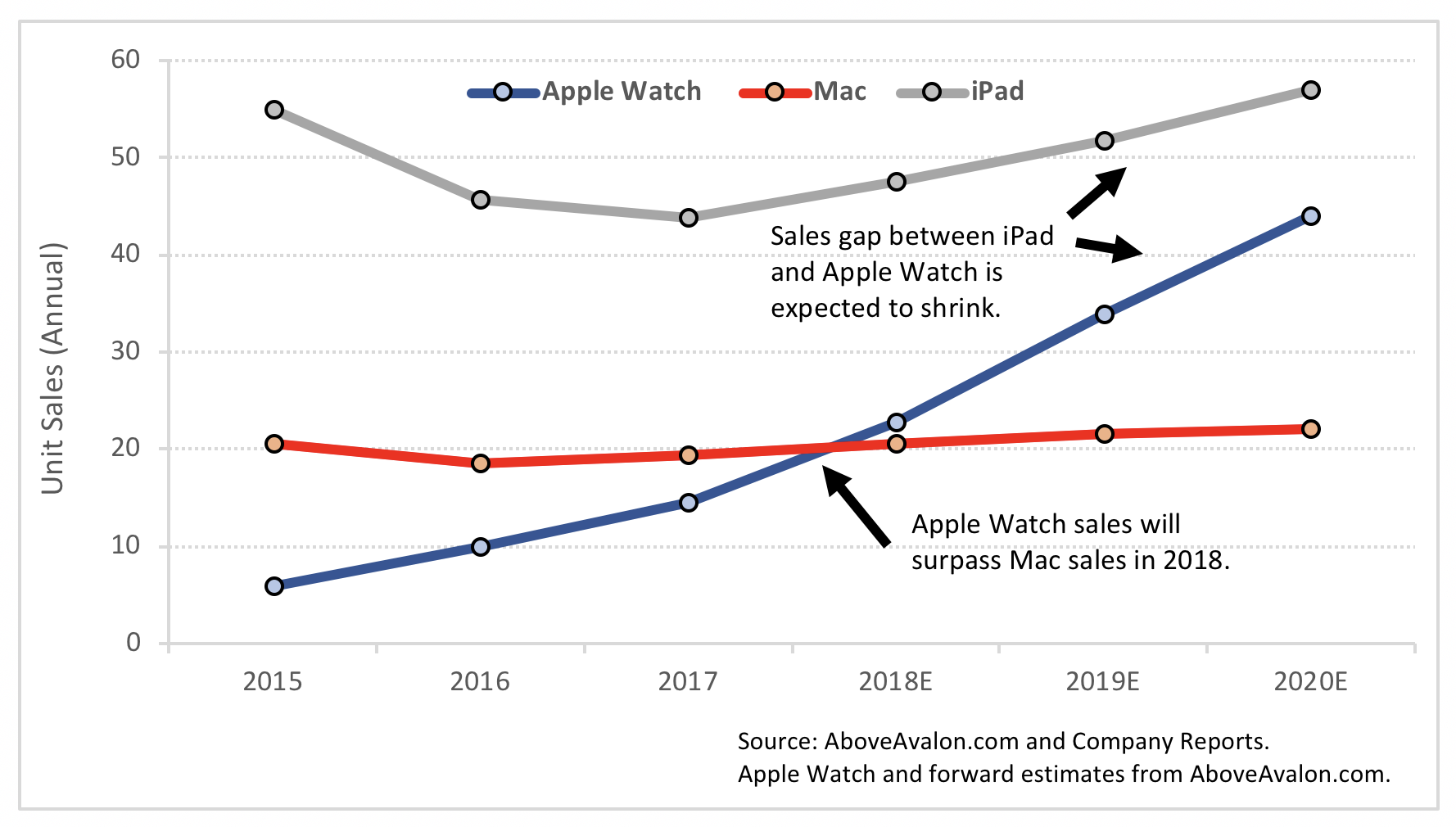

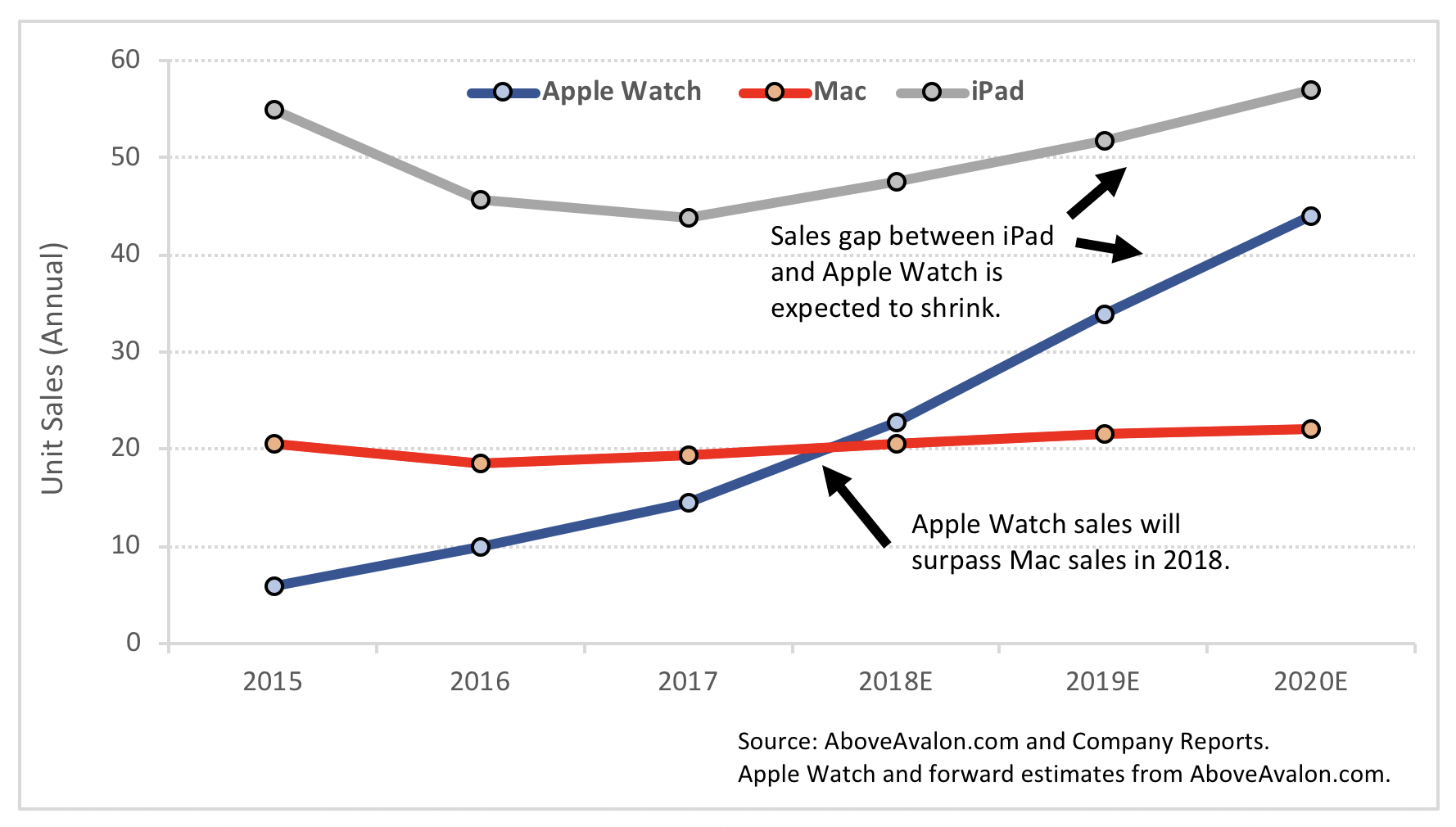

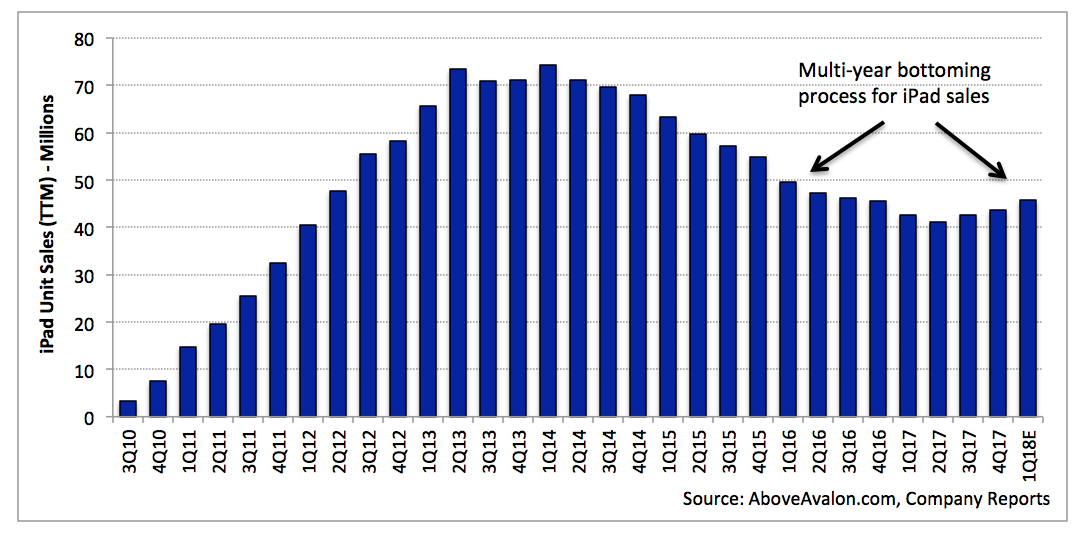

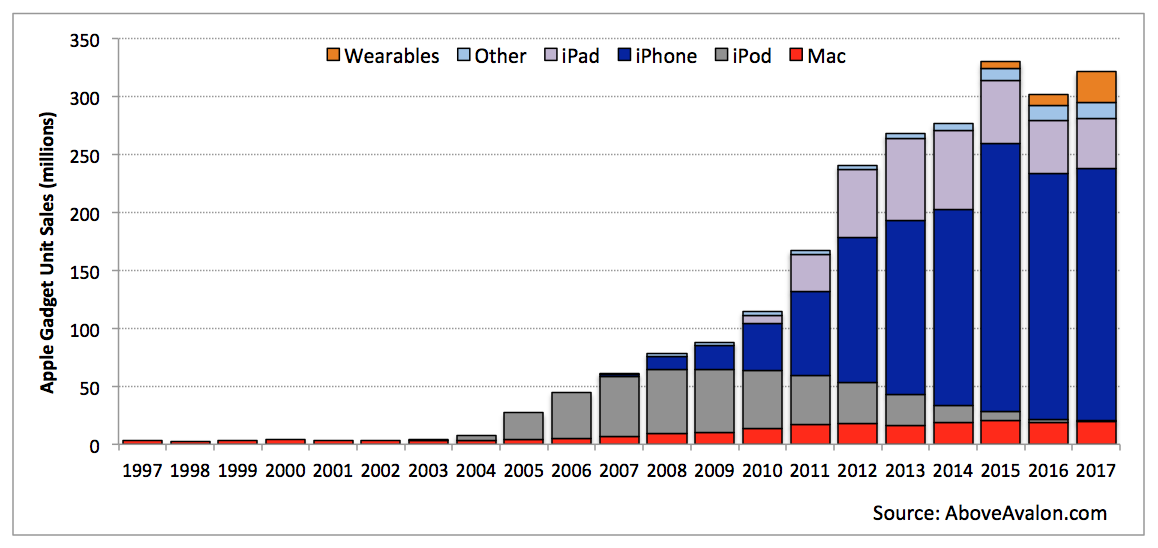

When thinking about what comes next, it's difficult to miss the rising yellow line in the preceding chart. Apple is seeing significant sales momentum in its battle for our wrists with Apple Watch and our ears with AirPods. These new form factors are successful in making technology more personal for tens of millions of people. When combining Apple Watch and AirPods sales, Apple's wearables segment will soon outsell iPad in terms of unit sales.

The next wearables battle will be for our eyes. This battle will revolve around a product that benefits from technologies currently found with ARKit, Siri, and Apple's ML efforts. Apple is setting the stage for smart glasses. A pair of smart glasses will essentially boil down to an ML playground cool looking and light enough to wear throughout the day. There's one problem for Apple: The world isn't quite ready for such a product. As Jony Ive put it a few months ago, "there are certain ideas that we have, and we're waiting for the technology to catch up."

Biding Time?

It's easy to think that Apple may simply be biding its time until the world is ready for AR glasses. However, WWDC gave us a glimpse of how Apple is busy behind the scenes, preparing for what comes next. With ARKit, Apple is using hundreds of millions of iPhone and iPads to inspire 20 million developers with the potentials found with AR. A similar dynamic is at play in getting customers comfortable with items like Animoji and Memoji - items that will likely one day be available via a pair of smart glasses.

In many ways, Apple is doing more than any other company to prepare the world for AR. Startups like Magic Leap have positioned themselves as being ambitious for wanting to control everything needed to develop a pair of mass-market AR glasses. However, Magic Leap is missing a few crucial ingredients needed for success. Unlike Apple, Magic Leap doesn't have a few hundred million devices for seeding early technologies that will eventually power a pair of smart glasses. Instead, Magic Leap is forced to conduct a portion of its R&D in public, releasing early prototype versions of AR goggles in an attempt to capture AR mind share that is increasingly flowing to Apple.

Another item that Magic Leap doesn't have, but which will prove to be incredibly useful for AR glasses, is Apple Watch. Apple has learned a significant amount about how personal technology can be worn on the body by having nearly 40 million people wear an Apple Watch on any given day. In addition, Apple Watch serves as a test bed for learning about proactive digital assistants. However, the most important aspect of Apple Watch is how the device will likely end up playing a key role in serving as a place to put tech on the body that will help power smart glasses. In fact, an argument can be made that Apple Watch will become more instrumental to Apple Glasses' success than any other Apple product.

Apple's Game to Lose

We see Apple pulling away from the competition when it comes to grabbing real estate on our wrists and ears. The company has a good shot at doing the same in the battle for our eyes. Consider the various ways Apple is well-positioned for AR glasses:

- Hardware and software integration. Apple has a few decades worth of experience while competitors have only recently realized that hardware/software integration is essential when it comes wearables.

- Controlling core technology. Apple's silicon efforts and broader ambition to control the core technologies powering its devices are giving the company a head start that will likely be measured in decades.

- Wearables manufacturing. Apple is learning a great deal about miniaturization with Apple Watch and AirPods. No other company is close to Apple in this area.

- AR technology. In just over a year, Apple has announced two major versions of its AR platform with hundreds of millions of supported devices. Years of extensive M&A activity in the AR arena is beginning to pay dividends.

- Developers. Apple has 20 million iOS developers focused on coming up with new experiences for a billion people. Companies like Magic Leap and Microsoft lack this critical piece of the equation.

- Fashion and luxury. Apple has learned a great deal about selling fashion with Apple Watch.

- Health/Medical. What may have started as an interest for Apple is turning into a strategic mission. A pair of smart glasses stand to improve the well-being of hundreds of millions of people as one of the key use cases for such a device is enhanced vision.

- Retail demoes. Apple has 502 retail stores around the world with plenty of space for glasses demoes.

There's an elephant in the AR room. This is Apple's game to lose.

Creating Tools

Five years ago, Apple management was facing growing pressure to announce something new. Wall Street and Silicon Valley were eager to see Apple unveil a new product category in the post-Steve Jobs era. To this group, the lack of a new product category from Apple meant that management was either struggling with innovation, or worse, suffering from a lack of imagination. The intense pressure to come up with something new likely played a role in Apple giving Apple Watch a huge product unveiling in September 2014.

Fast forward a few years, and Apple faces a dramatically different environment. There aren't as many calls for Apple to come up with something new following Apple Watch. Instead, Apple's ability to monetize the iPhone experience beyond hardware sales has made people think Apple is a different kind of company - one that is more focused on monetizing existing users instead of dreaming about what's next. In a way, many market observers are the ones now suffering from a lack of imagination when it comes to Apple.

Apple is a design company focused on creating tools for people. While some of those new tools may be positioned as accessories to existing products, other tools will be capable of ushering in paradigm shifts. The only way for Apple to remain relevant in the future is to disrupt itself by coming up with new tools consisting of a combination of hardware, software, and services. Such groundbreaking tools won't likely be released every two or three years. In fact, Apple may go more like five, six, or even seven years between announcing major new product categories. The point is that such paradigm shifts are needed.

Steve Jobs' quote calling for figuring out what's next and not dwelling on current success for too long was from a 2006 interview in which Jobs was asked where he sees himself within history's famous thinkers and inventors. Jobs was describing where the motivation for coming up with so many new products originated. For Apple, Jobs' quote serves as inspiration for not resting on its laurels and instead coming up with the next "pretty good" thing.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates. To sign up, visit the subscription page.

Above Avalon Subscriptions Turn Three

Last week, I celebrated the third anniversary of launching Above Avalon subscriptions. Those who signed up on May 13th, 2015 began their fourth year as Above Avalon subscribers. In an environment where online publishing is being questioned and doubted like never before, Above Avalon subscriptions are working. Above Avalon is an independent source of Apple analysis, 100% supported by subscriptions. The lack of dependency on ads, sponsors, or other revenue streams has played a large role in what Above Avalon has become over the past few years. In addition, Above Avalon has given me a front-row seat for watching the changing Apple news industry.

Strategy

Above Avalon embraces a subscription model in which subscribers pay for access to my full analysis and perspective on Apple. Two subscription options are available: $20 per month or $200 per year. Along with publishing weekly articles and podcast episodes, which are available to everyone, I publish a daily email available exclusively to subscribers. These emails go over everything that I think matters in the world of Apple. On any given week, I will cover 10 to 12 topics, one of which is discussed in the weekly article and podcast. The remaining topics are covered in email.

Subscribers receive other benefits that include receiving the weekly Above Avalon article via email, accessing the subscriber forum in Slack (more on this down below), and utilizing an archive consisting of approximately 600 emails previously sent to subscribers.

Above Avalon is unique as a paid subscription site that focuses on analyzing one company. I am unable to name another paid subscription site that has the same objective. Most subscription sites focus on broader topics such as certain genres or entire industries. In an interesting development, the other paid subscription niche popping up has been in the sports world as writers and analysts launch sites focused on specific sports teams.

The paid subscription model for analysis is not new. Its pioneers can be traced back to the financial world in which publications sent monthly and quarterly correspondence to paid subscribers via postal mail. However, the major change that has taken place more recently is a diversification in the way we consume news and analysis. A number of independent sites, often run by one person or a small team of people, have been able to grab an increasing amount of mind share from larger, more traditional news publications and multinational research firms. This market dislocation was one reason that led me to leave Wall Street and launch Above Avalon in 2014. The harsh economics of online publishing, combined with social media and tools for accepting online payments, sending emails, etc., have made it possible for one-person operations to find their audience (i.e. sustainability) in a sea of giants.

Paid subscriptions afford me the ability to focus on quality, not quantity, when it comes to readership. There is no financial incentive for me to publish sensational articles as the primary byproduct is a temporary jump in page views. Instead, my incentive is aligned with my desire to write articles that inform, enlighten, and provide an alternate view of Apple and the world. This ends up producing trust and credibility with readers, which are important drivers for attracting new subscribers.

Over the years, I've received different versions of the same question: Why don't I expand my coverage to include companies other than Apple? There is a simple answer: As Above Avalon subscribers can attest, my coverage area is already large. Since Apple doesn't operate in a vacuum, there is a need to monitor and analyze Apple's various competitors and the industries in which the company plays. However, the difference between Above Avalon and other sites is that all of my analysis is positioned from the perspective of Apple. In my view, having it any other way tends to breed Apple cynicism given the company's unique attributes. This cynicism often leads to the conclusion that Apple's different way of approaching the world will lead to failure. In fact, unwarranted cynicism is one of the main characteristics that lead to faulty Apple analysis.

Highlights and Challenges

Highlights from the first three years of Above Avalon subscriptions include:

- Reaching sustainability. While there was a specific subscriber threshold that marked Above Avalon sustainability (reached in 2015), subsequent events over the years have served as milestones. For example, seeing the first wave of annual Above Avalon subscriptions renew back in May 2016 further validated the business model.

- Online community. One thing that I didn't necessarily expect to happen was an online community to develop around Above Avalon. The Above Avalon subscriber forum in Slack continues to see an increasing amount of interaction and discussion. Subscribers currently reside in 55 countries and hold a diverse range of backgrounds and occupations. They include Silicon Valley executives and investors, the largest Apple shareholders, and the leading Apple journalists and writers in the business.

- Member meet-ups. There have been three member-meets (two in San Francisco and one in San Jose). The fourth is scheduled for next month during WWDC. Each has been memorable as I've been able to meet subscribers and put faces to what were previously just names in email, on Twitter, or in the forum.

- Subscriber support. Since launching Above Avalon subscriptions, I've experienced quite a few life changes. My wife and I welcomed two boys into this world. Each time, the outpouring of well-wishes from subscribers has been great. However, there have also been difficult times, such as my mother's recent passing. Subscribers were there with condolences. I even received condolences via postal mail from subscribers. It may seem like a small thing, but it's something I will never forget.

The biggest challenges have been:

- New things. I'm self-taught when it comes to the world of online publishing, podcasting and videography. In my prior career, I was a Wall Street analyst. While it hasn't been easy, YouTube and Twitter have been great tools for finding answers to questions.

- Hesitancy to publish. As Above Avalon has grown in terms of readers, listeners, and subscribers, I've become more hesitant to publish on topics when my views on them are still in their fragile state. This hesitation has resulted in certain articles and podcast episodes taking a shockingly long amount of time to write and produce.

Requirements

Above Avalon is an example of a paid subscription site working. However, when it comes to the model being replicated, I don't think there is a particular recipe or path for success with paid subscriptions. While some will find success literally overnight, others may find success only after a number of years.

There are three requirements needed for paid subscription sites to work:

- A strong voice. The recurring theme found in every successful independent site, email, or podcast is that it contains a strong voice. Wishy-washy stances on positions won't go far. The strongest voices have an ability to support their opinions with facts.

- Perspective. Above Avalon subscribers aren't interested in simply reading about news events and topics that matter to Apple. Instead, subscribers want to know my perspective on those news events and topics. By having perspective, one possesses a certain kind of philosophy that transcends any particular topic or news event.

- Be the best. While "best" is subjective, in my view, being the best entails having a deep understanding of the subject matter at hand. In nearly every example of a successful subscription-based site, the founders / writers are experts in their coverage areas.

The Apple News World

Above Avalon has given me a front-row seat to the changing Apple rumors and news world, also known as the Apple blogosphere. There are three buckets:

- News / Rumor Aggregators. MacRumors, iMore, 9to5Mac, and AppleInsider are the most well-known. Others such as Cult of Mac, MacDailyNews, and MacSurfer have also been around for some time. The largest sites are characterized by having a team of writers and a business model consisting of various revenue streams (ads, sponsors, affiliate links, different forms of memberships). Many have moved into video, podcasts, and email newsletters. A vibrant online community in the form of active message boards and forums play a big role in these sites' sustainability.

- News Publications. These include Financial Times, The Wall Street Journal, The New York Times, Fast Company, CNBC, Recode, Bloomberg, Wired, The Independent, BuzzFeed, The Verge, and *insert your favorite news publication that covers Apple news here*. Most of these sites have one or two correspondents who write about Apple. However, it is becoming rare for news publications to have Apple-exclusive writers. Business models vary in this group but have increasingly been moving towards paid subscriptions. Only a select number of these sites have vibrant online communities.

- Curators / Analysis / Research. Above Avalon, Daring Fireball, Asymco, Stratechery, MacStories, Tech.pinions, Six Colors, The Loop, Apple 3.0, TidBITS, Wall Street sell-side firms, podcast-only ventures, YouTubers, industry research firms, VC firms, and popular Twitter personalities are included in this category. There is much diversity in this group. Some write exclusively about Apple while others write and talk about Apple from time to time. Meanwhile, others use Apple as a way to analyze broader business and disruption theories. Business models run the gamut and include everything from ads and sponsors to paid subscriptions, donations, and affiliate links. Other sites and accounts are run strictly for marketing purposes. Communities tend to play a major role in these sites.

While some sites have tried to play in more than one bucket, few have found success. News and rumor sites have made few inroads in terms of analysis and research while analysis sites have generally stayed away from the tough business of breaking news and scoops.

Over the years, there have been a number of major changes in the Apple blogosphere:

News / rumor aggregators have grown up and gained legitimacy. After years of rocky relations, Apple basically treats the leading Apple news and rumor aggregators like any other news organization. Aggregators have achieved sustainability by broadening coverage to include pretty much everything that is in some way connected to Apple or the large iOS ecosystem. In addition, each runs with super lean operating budgets. The stories themselves likely don't pay the bills. Instead, it's the repeat visitors that are interested in the comment sections and forums. Each publication relies on podcasts and video as ways to maintain mindshare in each respective news medium.

Apple rumor / scoop industry has dried up and consolidated. Ten years ago, there were a number of news publications that were in a legitimate position to break the next Apple scoop (some of which were likely controlled leaks from Apple). Today, there are only two or three sites that even publish Apple scoops. The consolidation in Apple scoops has been driven by Apple ramping up the amount of secrecy regarding unannounced projects. In addition, Apple "scoops" have increasingly come from research firms paying for confidential information coming out of Apple's supply chain. One byproduct of this rumor consolidation has been a relatively high degree of turnover among Apple reporters.

Ad-supported business models are struggling. It is becoming more difficult to find ad-supported business models on the web. While there are likely a few reasons for this change, one includes ad dollars being funneled away from blogs and into podcasts and videos. This explains what appears to be an exodus of resources away from written blogs and into podcasts and video-focused efforts. Unfortunately, my suspicion is this won't end well for many as increased competition in the podcast and video space will tend to push sponsors to those with the largest followings. Such an environment would make it increasingly difficult for independent ventures to find sustainability by chasing scale.

Paid news sites boost independents. Most news publications have embraced paid subscriptions as another way of boosting revenues. While a paid subscription to a multinational news organization may make sense for many readers, the value / price tradeoff becomes murky for readers interested in specific topics and niches. For example, the average news publications will only write about Apple once a week (if that much). This environment provides an even greater amount of oxygen to independent sites that can give the time and attention to niche subjects.

Donation / support route isn't promising. The transition from ad-supported business models to subscription-based models hasn't been easy for many independent sites. Going from a scenario in which all content was public to one in which only a fraction of content is public can be jarring. Most sites have handled this transition by keeping content free and instead giving paid subscribers a very marginal amount of exclusive content. In essence, sites are treating subscriptions and memberships like donations. This is not sustainable for or attractive to subscription-based models.

Exciting Times

It's never been easier to start a paid subscription site. This reality has made it harder than ever to get a paid subscription site off the ground. While barriers to entry have been lowered in many content-focused genres, including blogs, YouTube, and podcasting, discovering your audience is becoming more challenging. At the same time, competition is intensifying. It's not realistic to assume the average consumer will subscribe to dozens of paid sites. However, there is no such thing as an "average" consumer. Instead, every consumer will subscribe to a different portfolio of paid sites. As an independent, the job is to earn a spot in some of those portfolios.

As I enter the fourth year of paid subscriptions, a big thank you goes out to Above Avalon subscribers. The past three years have been great and I'm looking forward to many more. I don't think there has been a better time to examine Apple.

To become an Above Avalon subscriber, visit the subscription page.

The Apple Services Machine

Apple's services business is remarkably strong yet surprisingly mysterious. A closer look at Apple Services reveals an apparatus, which can easily qualify as a Fortune 100 company, that isn't what it seems from the outside. Apple isn't becoming a services company focused on coming up with a myriad of ways to milk existing users. Instead, Apple's services strategy primarily reflects the company's long-held ambition of becoming a leading content distribution platform.

Momentum

Services represent Apple's second-largest revenue source behind iPhone. In 2017, Apple reported $31 billion of Services revenue, which represented 13% of overall revenue. As seen in Exhibit 1, Apple Services revenue has experienced steady growth for years.

Exhibit 1: Apple Services Revenue (TTM)

In recent quarters, Apple's services business has seen renewed momentum. As shown in Exhibit 2, Services revenue growth began accelerating in late 2015 and is now at multi-year highs. The growth likely coincided with very strong new user trends for the iPhone business. An acceleration in growth despite Apple's already large Services revenue base is that much more impressive.

Exhibit 2: Apple Services Revenue (TTM) Growth

The Services Machine

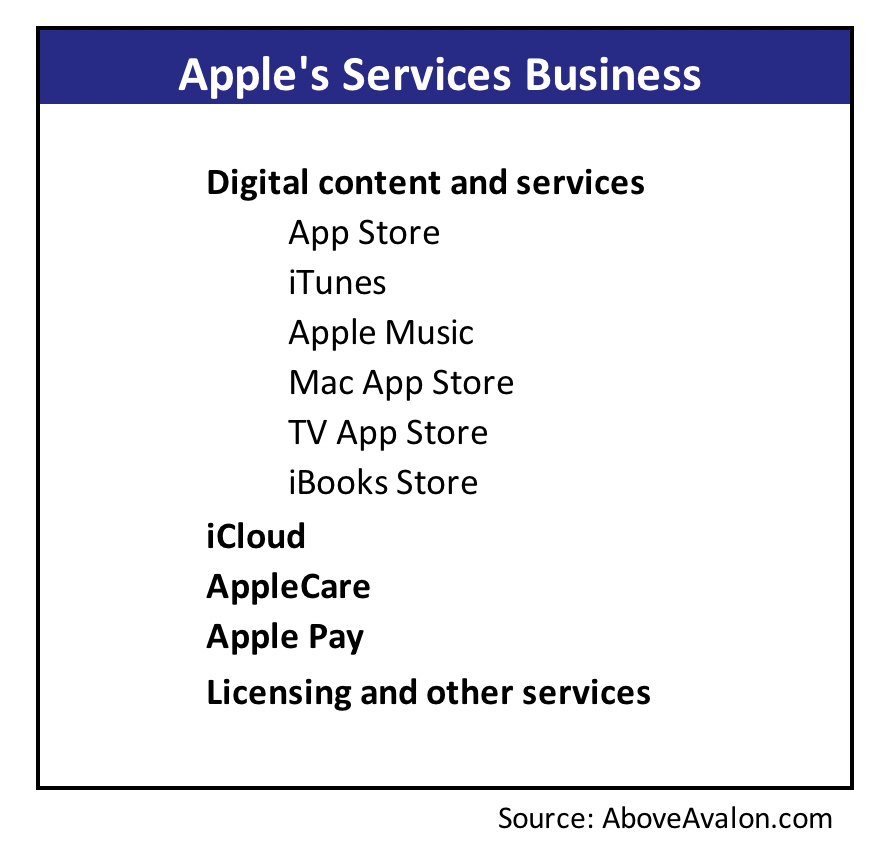

Services is a financial catch basin for Apple's non-hardware revenue. As disclosed in Apple's financial filings, Services consists of five categories: digital content, iCloud, AppleCare, Apple Pay, and licensing.

Exhibit 3: The Apple Services Machine

Digital content. This includes revenue from Apple's various content stores, including the App Store and iTunes. Apple Music is also included in this category. While Apple doesn't disclose the total amount of revenue associated with selling digital content, the company has provided the amount paid to app developers on an annual basis. This data point makes it possible to derive the total amount of App Store revenue. In addition, Apple regularly discloses the number of paid Apple Music subscribers, which can be used to derive Apple Music revenue.

iCloud. Apple offers three tiers of additional iCloud storage (50GB, 200GB, and 2TB). Prices vary depending on the geography. The 200GB and 2TB storage tiers are eligible for family sharing. While Apple has not disclosed the number of users on a paid iCloud storage plan, management recently disclosed that iCloud revenue was up over 50% year-over-year to a record high, which implies good new user growth.

AppleCare. Apple sells a number of service and support options for its products.

Apple Pay. Apple earns a small percentage of every amount transacted through Apple Pay. Initial reports pegged this percentage at 0.15% for U.S. transactions. For every $100 of Apple Pay purchases in the U.S., Apple earns 15 cents. However, in the UK, Apple reportedly receives a smaller fee. Given Apple Pay's prominence outside the U.S., a safe assumption is that Apple earns on average less than 0.15% of every Apple Pay transaction.

Licensing and other services. Apple earns revenue from third parties for offering their services as default options on Apple devices. One of the more well-known examples is Apple's contract to have Google be the default search provider for Safari on Mac and iOS. Apple recently expanded its Google relationship to include Google for web searches via Siri and YouTube for video searches. Microsoft Bing remains the option for Siri image searches.

Estimating Services Revenue

Apple doesn't disclose the amount of revenue generated by each Services category. However, after sifting through years of earnings call transcripts as well as recent news releases involving the App Store and Apple Music, it is possible to put together a few pieces of the Apple Services puzzle.

According to my estimates, Apple earns a majority of its Services revenue from delivering content to nearly a billion people using more than 1.3 billion Apple devices. In 2017, Apple earned an estimated $21 billion from selling digital content ranging from apps (especially games) to music and movies.

Back in January, Apple disclosed that it paid $26.5 billion to app developers in 2017. Apple keeps either 15% or 30% of app revenue, depending on the app and whether it is a subscription. This suggests that overall App Store revenue was approximately $37 billion. Since Apple reports App Store revenue on a net basis, recognizing only the commission it retains, the full $37 billion of App Store revenue is not reflected under Services. Instead, Apple reports just its $11 billion share of the revenue.

The remaining portion of Apple's digital content revenue came from iTunes and Apple Music. Apple reports Apple Music revenue and some digital content sold through iTunes on a gross basis. This results in iTunes and Apple Music representing a large portion of Services revenue despite bringing in significantly less revenue than the App Store. In fact, iTunes and Apple Music likely contribute close to the same amount of Services revenue as the App Store.

Exhibit 4: Apple Services Revenue Mix (2017)

To put the preceding revenue totals in context, Apple Watch generated $6.5B of revenue in 2017.

The primary reason Apple has experienced accelerating Services revenue growth since late 2015 is that the company has seen a dramatic increase in the number of people accessing its various content stores. The iPhone installed base grew by more than 100 million people each year from 2013 through 2017. These new users are spending an increasing amount of money buying various forms of content through Apple's stores.

One of the more interesting revelations from my estimated Apple Services revenue mix is the degree to which licensing is a key revenue driver. My estimate has Apple earning $4 billion per year from licensing. While Apple doesn't discuss its licensing business, recent reports of Google paying much higher TAC (traffic acquisition costs) suggests Apple has seen strong growth in its licensing revenue. The growth is a result of iOS gaining power at the premium end of the smartphone market. Companies like Google increasingly need access to iPhone users in order to feed their free data capturing services. According to my estimates, the $4 billion of revenue associated with licensing is roughly the same amount of revenue generated by AppleCare.

While Apple has built new services revenue streams in the form of iCloud and Apple Pay, neither come close to matching the revenue associated with content distribution. Given the economics surrounding Apple Pay, it's not likely the service will be a significant revenue driver for Apple in the near term. For every $1 trillion transacted through Apple Pay, Apple would generate just $1.5 billion. As for iCloud, while management boasts about record revenue, the total likely pales in comparison to content distribution.

Estimating Services Gross Margin

In addition to not breaking out Services revenue by category, Apple management has kept Services margins under wraps. We know from management commentary that Services end up boosting Apple's overall gross margins. This is a major clue suggesting Services gross margin exceeds 40%. One way of reaching a more specific Services margin estimate is to look at each revenue driver.

Exhibit 5: Apple Services Gross Margin Mix (2017)

As shown in Exhibit 5, each Services category has a different gross margin. Licensing is likely the most profitable for Apple, followed by Apple Pay and iCloud. Extended warranties, such as AppleCare, are also highly profitable. The fact that Apple reports some iTunes revenue and Apple Music revenue on a gross basis weighs on digital content gross margins. Overall, my estimate is that Apple's services business has a 55% gross margin.

The Services Strategy

Apple's services strategy is misunderstood. Many have looked at Apple's services momentum and concluded that Apple is turning into a services company. In addition, a growing number of people are positioning services as Apple's future. Neither viewpoint is true.

Apple has been pursuing two goals with services:

Deliver Content. Apple has a long-standing ambition of leveraging its platforms in order to become a leading content distributor for apps, music, books, podcasts, and video. To claim that Apple has only recently begun to focus on earning revenue from delivering content is incorrect.

Increase Hardware Value and Functionality. Management looks at services as a key differentiator that increases the value found in using Apple hardware and software. Services like AppleCare, iCloud storage, and Apple Pay are designed to improve the experience found in using Apple hardware and software.

A recurring theme found with Apple Services is hardware dependency. Apple's ambition to be a content distributor is intertwined with its hardware capabilities. Without more than 1.3 billion devices in the wild, Apple's digital content revenue would be a fraction of its current size.

In addition, AppleCare, Apple Pay, iCloud, and licensing are also heavily dependent on the number of Apple devices in the wild. It is this hardware dependency that makes it impossible to look at Apple Services as a stand-alone business. The relationship between services and hardware is one reason why an Apple Services narrative on Wall Street hasn't been able to stick. The Services narrative isn't compelling if it excludes Apple hardware from the equation.

Apple's future isn't about selling services. Rather, it's about developing tools for people. These tools will consist of a combination of hardware, software, and services.

Looking Ahead

Apple management recently reiterated its goal of reaching approximately $50 billion of Services revenue by 2020. The most likely way Apple will reach this goal is by growing the amount of revenue associated with digital content distribution. App Store revenue has been growing by approximately 30% per year. Assuming Apple Music revenue growth more than offsets a decline in paid music downloads, Apple stands to grow its digital content revenue by at least $15 billion over the next two years. This will push Apple very close to its $50 billion Services revenue goal by 2020. These calculations don't take into consideration any new content subscription offerings from Apple.

Apple currently has more than 270 million paid subscriptions across its services, up over 100 million year-over-year. My suspicion is that a good portion of those subscriptions are content subscriptions. Apple is currently developing two new paid services for delivering content: Apple Video and a paid tier to Apple News. Each service will likely be given a long-term target of having at least 100 million paying users. In addition, Apple is in a good position to benefit from growing momentum for video streaming services including Netflix, HBO, and Hulu. It is not a stretch to claim that Apple will one day have 500 million paid subscriptions across its services.

Apple isn't becoming a services company. Instead, Apple is building a leading paid content distribution platform.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

Apple 2Q18 Earnings Expectations

Wall Street has major jitters when it comes to Apple's upcoming earnings release. Sentiment has decidedly swung toward the negative as questions swirl around iPhone X demand. Despite the dramatic downturn in expectations, Apple's stock price has held up remarkably well. While many eyes will be on iPhone sales tomorrow, my suspicion is that the data point won't have as much influence as consensus assumes. Instead, Apple's capital return update has the potential to be the major takeaway from 2Q18 earnings.

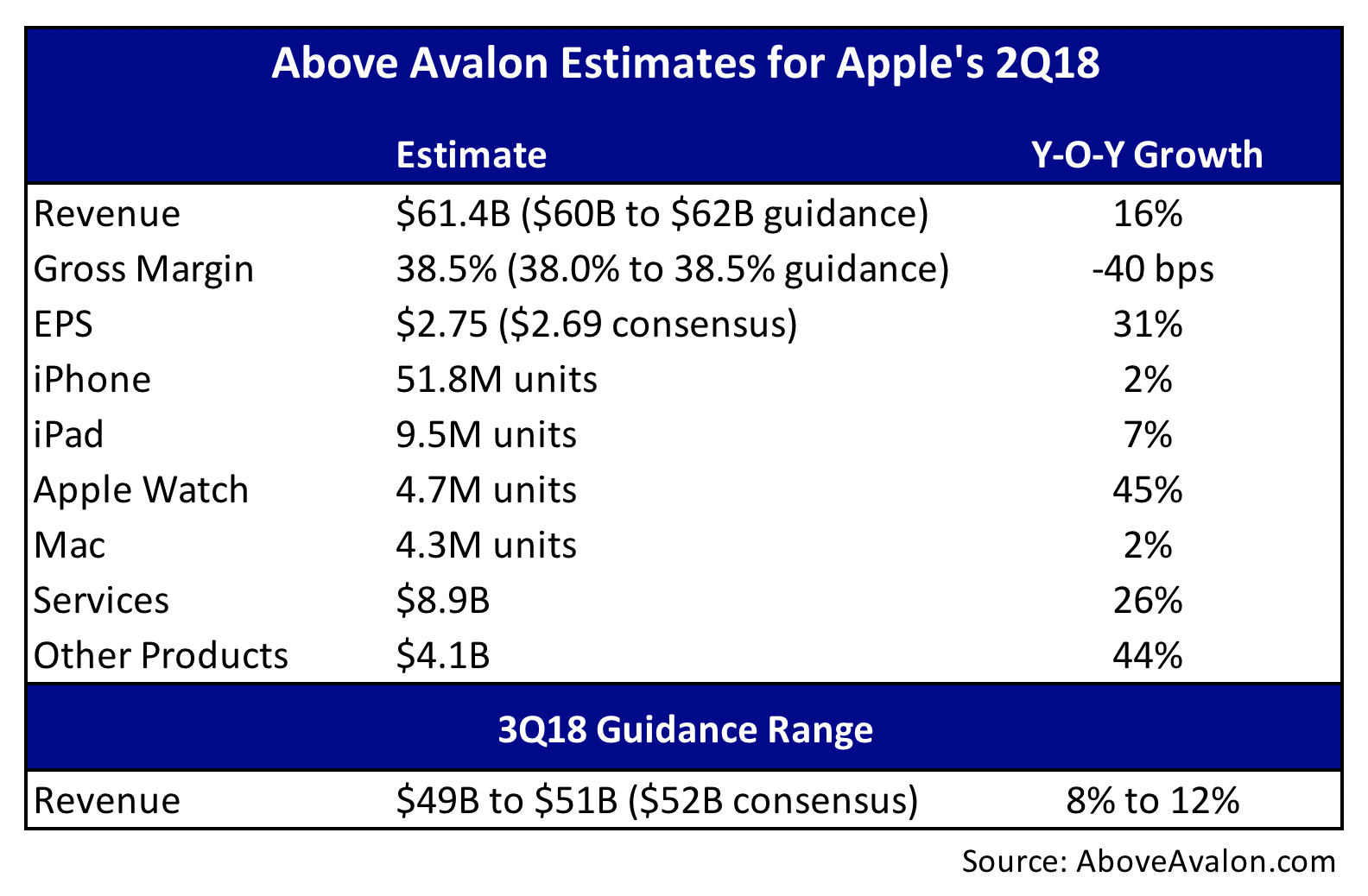

The following table contains my Apple 2Q18 estimates. The ingredients are in place for Apple to report a slight EPS beat to consensus although 3Q18 revenue guidance will likely come in below consensus.

My full perspective and commentary behind these estimates are available to Above Avalon subscribers. (Become a subscriber to access my full 5,000-word Apple 2Q18 earnings preview available here. To sign up, visit the subscription page.)

Items Worth Watching

Here are the five variables worth watching when Apple releases earnings on Tuesday:

iPhone Channel Inventory. Given prior management commentary, iPhone unit sell-through growth and iPhone average selling price don't represent the major wildcards for 2Q18 earnings. Instead, the big unknown is found with iPhone channel inventory. A significant channel inventory drawdown will result in Apple reporting iPhone unit sales closer to 50M units. Vice versa, a relatively minor decline in iPhone channel inventory may lead to Apple reporting iPhone sales slightly ahead of my 52M unit expectation.

iPad ASP. The days of dramatic iPad unit sales declines are over. Accordingly, instead of unit sales, average selling price (ASP) stands to provide much more information regarding the latest iPad trends. A weaker-than-expected iPad ASP may support the view that the 9.7-inch iPad at the low end of the line is likely gaining momentum at the expense of the higher-end iPad Pro options.

Other Products. Apple's "Other Products" category has the sales momentum. The line item includes various products such as Apple Watch, AirPods, HomePod, Beats headphones, iPod touch, and Apple-branded and third-party accessories.

3Q18 Guidance. Apple's 3Q18 revenue guidance will likely provide a few clues as to how iPhone demand has been trending. One complicating factor when it comes to revenue guidance is that Apple's non-iPhone part of the business is seeing major momentum. iPhone weakness will be partially offset by strength in Other Products and Services.

Capital Return. Apple will announce changes to its capital return program. My expectations are for a $100 billion increase to share buyback authorization and a 20% increase to the quarterly cash dividend. Management commentary regarding timing associated with share repurchases will be closely monitored.

2Q18 Expectation Meters

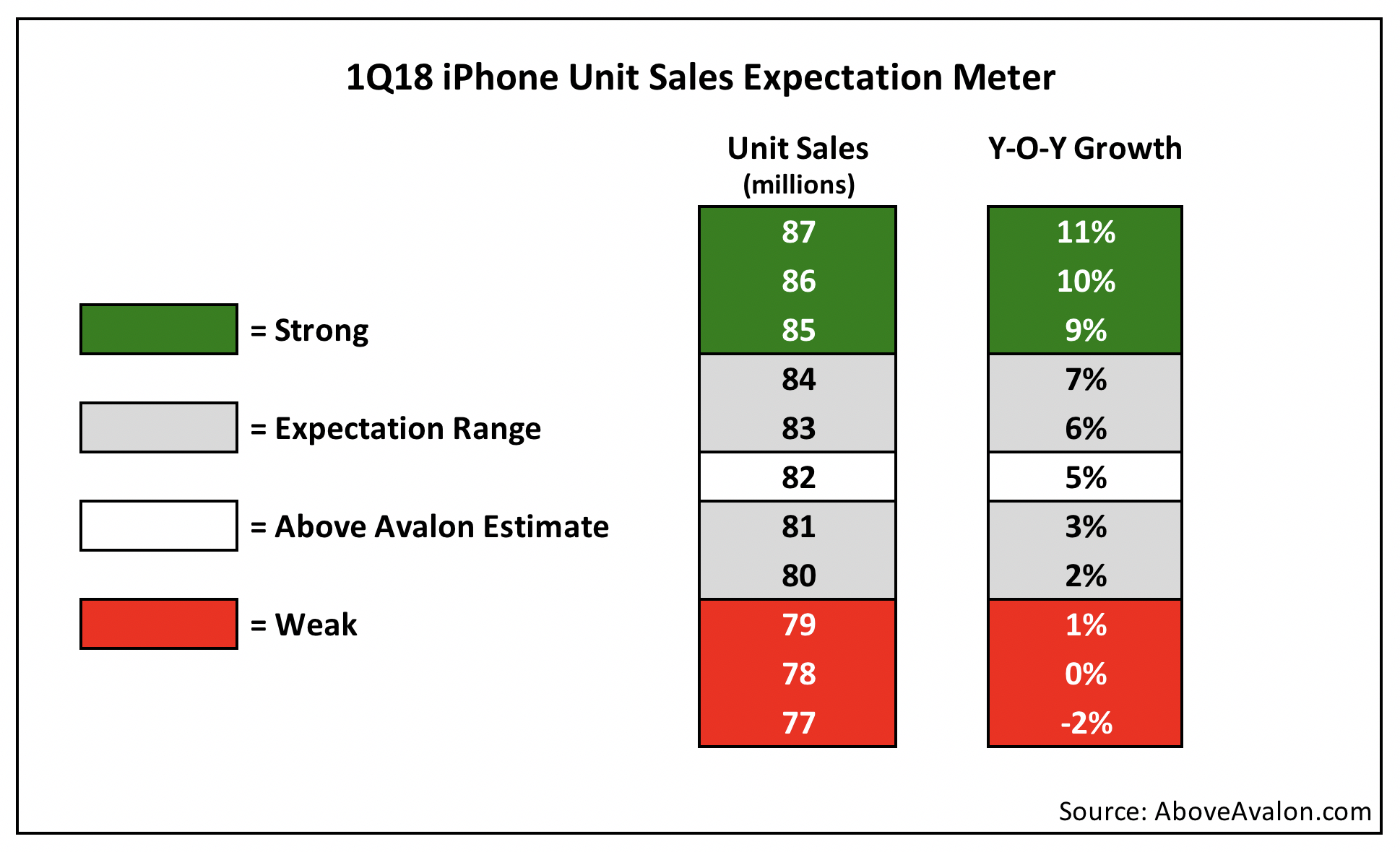

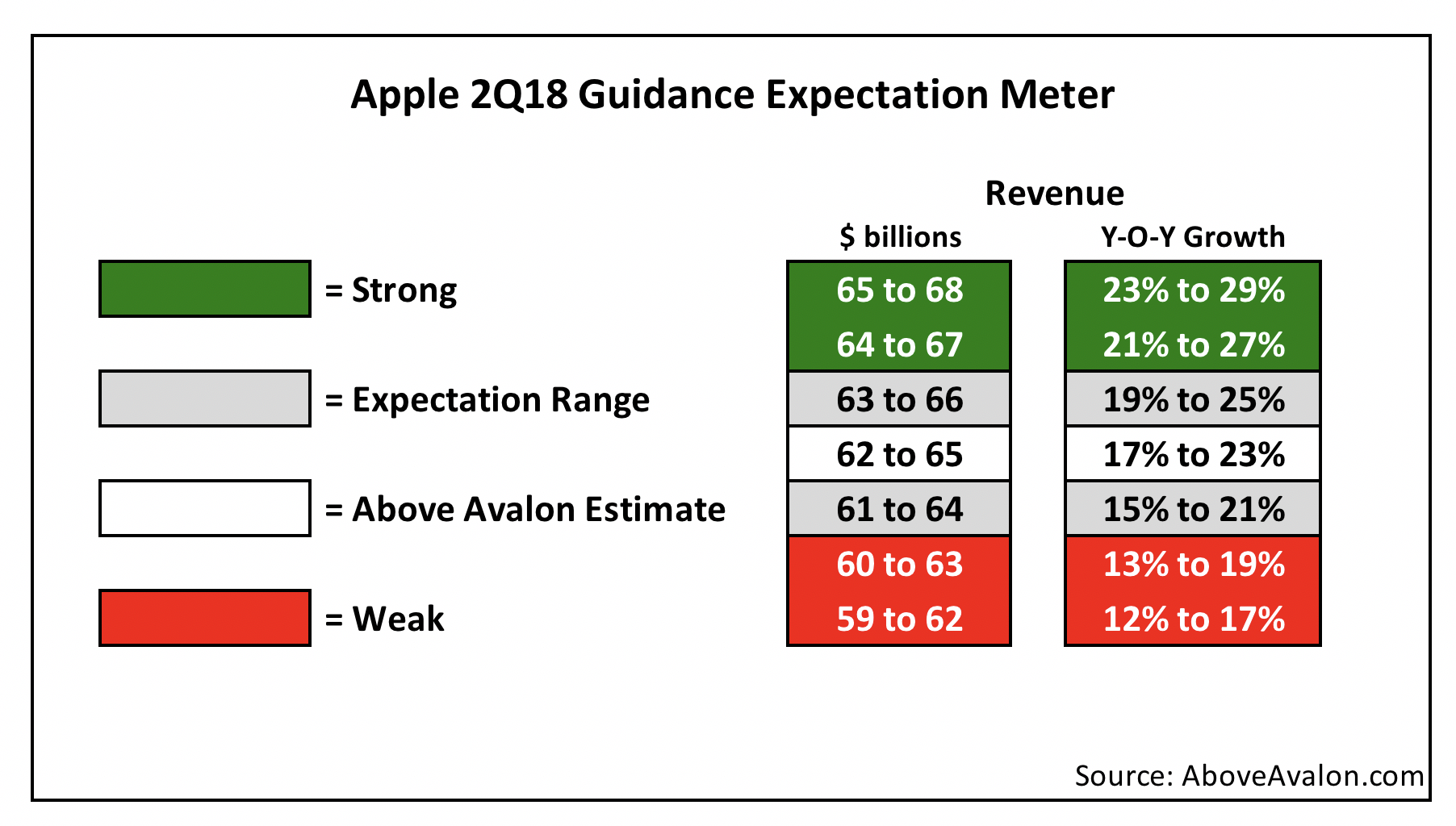

Each quarter, I publish expectation meters ahead of Apple's earnings release. Expectation meters turn single-point financial estimates into more useful ranges that aid in judging Apple's quarterly performance.

In each expectation meter, the grey shaded area is my expectation range. A result that falls within this range signifies that the product or variable being measured is performing as expected. A result in the green shaded area denotes strong performance and likely leads me to raise my assumptions and estimates going forward. Vice-versa, a result in the red shaded area has the opposite effect and leads me to reduce my assumptions.

I am publishing three expectations meters this quarter: iPhone unit sales, Other Products, and 3Q18 guidance.

My iPhone unit sales expectation range stretches from 50M to 54M iPhones. iPhone unit sales within this range would be labeled as expected. If Apple reports iPhone sales greater than 54M units, results would best be described as strong. A sub-50M iPhone result would lead me to reassess my sales expectations going forward.

For "Other Products," revenue that exceeds $4 billion would support the view that Apple Watch and AirPods were strong sellers during the quarter. HomePod sales will also likely contribute to the year-over-year growth in revenue.

Revenue guidance that exceeds $50 billion would likely be viewed positively while revenue closer to $45B would be viewed negatively. It is likely that Apple's 3Q18 revenue guidance will reflect a year-over-year revenue increase. The increase is due to momentum in Services and Other Products.

Above Avalon subscribers have access to my full 5,000-word Apple 2Q18 earnings preview (four parts):

- Setting the Stage

- iPhone Estimates

- iPad, Apple Watch, Mac, Services Estimates

- Revenue, EPS, Capital Return, 3Q18 Guidance

Subscribers will also receive my exclusive earnings reaction emails containing all of my thoughts and observations on Apple's 2Q18 earnings report and conference call. To read my Apple earnings preview and receive my earnings reaction notes, sign up at the subscription page.

Making the Case for Doubling Apple's Share Buyback Pace

Next week, Apple will provide an update to its capital return program. In what has become an annual tradition, the announcement will include a sizable increase to Apple's share repurchase authorization and a hike in the quarterly cash dividend. Given recent management commentary, Apple's overall thought process regarding capital allocation is already known. The only way Apple will be able to accomplish its capital return goals is by doubling the pace of share buyback from current levels.

Capital Return Update

For the past five years, Apple has used FY2Q earnings to announce updates to its capital return program. Here are the changes Apple announced to its share buyback authorization over the years:

2012: $10 billion buyback authorization

2013: $60 billion (increase of $50 billion)

2014: $90 billion (increase of $30 billion)

2015: $140 billion (increase of $50 billion)

2016: $175 billion (increase of $35 billion)

2017: $210 billion (increase of $35 billion)

In terms of the quarterly cash dividend, Apple has announced five increases over the years:

2012: $0.38 per share

2013: $0.44 (15% increase)

2014: $0.47 (8% increase)

2015: $0.52 (11% increase)

2016: $0.57 (10% increase)

2017: $0.63 (11% increase)

Excess Cash

In order to assess the most likely changes Apple will announce next week to its share buyback authorization and quarterly cash dividend strategy, we turn to recent comments from Apple CFO Luca Maestri:

"Tax reform will allow us to pursue a more optimal capital structure for our company. Our current net cash position is $163 billion. And given the increased financial and operational flexibility from the access to our foreign cash, we are targeting to become approximately net cash neutral over time."

Maestri's comments tell us three things:

Apple considers its current excess cash position to be $163 billion. After taking into account repatriation taxes, Apple's excess cash totals approximately $125 billion.

Apple wants to remove the vast majority of this excess cash from the balance sheet in order to reach "a more optimal capital structure." This isn't a management team that will sit on the excess cash indefinitely.

Apple's "net cash neutral" target implies management is okay with holding debt on the balance sheet. It's not likely that Apple will use excess cash to reduce its debt obligations significantly.

In addition to holding $125 billion of excess cash (after taxes), Apple is also kicking off significant amounts of cash. A successful capital return strategy needs to account for this ongoing cash flow generation. The company is currently generating approximately $50 billion of free cash flow per year. This total reflects approximately $60 billion of operating cash flow per year and between $10 billion and $15 billion spent on property, plant, & equipment. Over the next five years, it is conceivable that Apple will generate more than $200 billion of free cash flow. Management has been funneling nearly all of its free cash flow into capital return initiatives.

Combining Apple's $125 billion of excess cash currently on the balance sheet with its $200 billion of free cash flow generation, Apple is on track to have $325 billion of excess cash over the next five years. Without record-breaking increases to share buyback authorization and quarterly cash dividends, Apple will have trouble spending this excess cash prudently in a timely manner. Since 2012, Apple has spent just shy of $250 billion on capital return initiatives. Assuming Apple maintains its current share buyback pace and cash dividend payouts, it would take Apple close to ten years to spend $325 billion of excess cash. Big changes are needed in order for Apple to reach an optimal capital strategy in a reasonable amount of time.

Changes

Apple has a number of options at its disposal when it comes to spending $325 billion of excess cash over the next five years. The company can utilize mechanisms like a Dutch auction tender offer to repurchase a significant number of shares in a very short amount of time. There are also various cash dividend strategies that management can follow involving special dividends. However, the odds of Apple utilizing such strategies are not high. Instead, Apple will likely follow its existing capital return strategy but at much higher levels. Such a strategy is realistic, achievable, and financially prudent for shareholders.

One possible path Apple can follow includes announcing the following changes next week:

Increase share buyback authorization by $100 billion (would represent a record increase).

Increase the quarterly cash dividend by 20% to $0.75 per share (would represent a record increase).

Buyback Changes

Apple is currently buying back approximately $30 billion of shares per year. While this is a significant amount for any company to spend on share repurchases, Apple will have to materially increase this buyback pace to spend its excess cash in a timely manner. At the same time, there are limits as to the number of shares Apple can realistically buy back before distorting the market. (My Apple stock buyback program primer is available for Above Avalon subscribers here.)

Increasing share buyback authorization by $100 billion would give Apple the best of both worlds: the ability to buy back substantially more shares over the next two years while avoiding much market dislocation. In fact, a $100 billion authorization would allow Apple to double its buyback pace to $60 billion per year. Given Apple's daily trading volume, a $60 billion annual share buyback pace amounts to about 10 days of AAPL buying pressure. In subsequent years, Apple could announce smaller increases to buyback authorization in the range of $50 billion to $75 billion. This would be done to maintain the $60 billion per year buyback pace.

As shown in Exhibit 1, Apple can continue to utilize both open market transactions and accelerated share repurchase arrangements (ASRs) to buy back shares. The ramp in buyback from 2017 to 2020 reflects the amount of time Apple will utilize to bring back foreign cash to U.S. subsidiaries.

Exhibit 1: Apple Share Buyback

In the above scenario, Apple will have spent $275 billion on share buyback over the next five years. While Apple could certainly announce a larger increase to share buyback authorization next week such as $125 billion or even $150 billion, it's not likely that such authorization would result in a significantly higher buyback pace as Apple must still back its foreign cash to U.S. subsidiaries. In addition, a significant higher pace of share buyback would begin to raise questions about market dislocation.

Dividend Changes

A scenario that includes doubling its share buyback pace will have a major impact on Apple's dividend strategy. The company has been following a dividend strategy of conservative year-over-year increases in dividend expense. Due to the share buyback program, Apple has been able to grow dividends per share by larger margins each year given the reduction in the number of shares outstanding. Whereas Apple's dividend expense has increased by 21% since 2013, Apple's quarterly cash dividend has increased 66% during the same time period.

By ramping share buyback to $60 billion per year and increasing dividend expense gradually to $16 billion per year in 2021 (from the current $13 billion a year), as shown in Exhibit 2, it is possible for Apple to increase its quarterly cash dividend per share by as much as 80% over the next five years. In this scenario, Apple's dividend expense would increase by only 25% during the same time period.

Exhibit 2: Apple Dividend Expense

In the above scenario, Apple will have spent close to $75 billion on dividend expense over the next five years. The exact magnitude of Apple's dividend increase will be dependent on the price at which the company buys back its shares in the coming years. However, there is no question that Apple's quarterly cash dividend stands to benefit from a large increase in share buyback pace. An 80% increase over five years would bring Apple's quarterly cash dividend to $1.10 per share by the end of 2022.

Summary

Apple's balance sheet objective is to reach an optimal capital structure by giving excess cash back to shareholders. This goal will be achieved via the continued use of share repurchases and quarterly cash dividends. Following U.S. corporate tax reform, and assuming continued robust free cash flow generation, Apple will possess as much as $325 billion of excess cash over the next five years.

As shown in Exhibit 3, a realistic and prudent way for Apple to remove this excess cash from the balance sheet is to double the pace of share buyback (from $30 billion to $60 billion) while gradually increasing the amount spent on dividend expense over time.

Exhibit 3: Apple's Capital Return Program

By spending $75 billion per year on capital return initiatives, up from the current $45 billion per year pace, Apple will be on track to spend more than $325 billion of excess cash in order to reach an optimal capital structure.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

Apple Found a Wall Street Narrative

After months of iPhone sales estimates being slashed by analysts, expectations have been reset. The iPhone mega upgrade cycle of 2018 that so many were calling for is not going to happen. One assumes such a reset would have been accompanied by a significant decline in Apple's stock price. Instead, Apple shares have outperformed the market and continue to trade near all-time highs. The resiliency in Apple's stock price reflects the company finally finding a narrative on Wall Street, and it's not centered on the iPhone. Apple has become a capital allocation story.

Narratives

Narratives matter on Wall Street. A compelling and easy to understand narrative allows companies to navigate rough waters such as a disappointing earnings report. Amazon and Netflix currently possess some of the strongest narratives on Wall Street. Amazon is all about coming up with the best retail experience for customers. Wall Street is OK with Amazon funneling a good portion of its operating cash flow back into the business with the intention of becoming a better retailer. Netflix is focused on delivering a superb entertainment experience in which subscriber dollars are used to fund additional video content. Profits are not as important as subscriber growth.

Apple has long struggled with Wall Street narratives. A good argument can be made that Apple has never had a true Wall Street narrative. Instead, the company was judged merely by unit sales growth of whatever its best-selling product was at the time. This posed a challenge as unit sales growth will inevitably slow. In addition, a narrative revolving around unit sales growth ignores attributes that make Apple's business model unique. Apple is viewed merely as a hardware company.

In early 2016, Apple management began disclosing new data points in an attempt to find a Wall Street narrative and in the process, get investors to think about the company differently.

Installed base related purchases. Instead of relying on the Services line item to denote the amount of revenue driven by Apple's installed base, management disclosed the amount of installed base related purchases. The much-higher total included revenue retained by third-party app developers and digital content owners.

Number of paid subscriptions. In an effort to demonstrate Apple's ability to monetize the iOS base beyond hardware sales, management began disclosing the number of paid subscriptions across Apple's various services. The data point also reinforced the idea of Apple possessing a stream of consistent revenue.

Number of devices in use. Apple disclosed the total number of devices in use to highlight the strength of its ecosystem.

While a narrative revolving around services or ecosystem strength seems attractive for Apple, the stories contain major holes. A significant portion of Apple's Services revenue is tied to growth in the iPhone installed base. According to my estimates, Apple has grown the iPhone installed base by more than 100 million users per year since 2013. Once this new user growth slows, which has already begun to occur, Apple's Services revenue growth will likely face a headwind.

A narrative involving the Apple ecosystem and the number of devices in use addresses some of the downsides found with a services narrative. Even in an environment of slowing product sales, the number of active devices in use could still increase. However, an ecosystem narrative lends itself to Apple being judged by growth rates in terms of the number of devices in the wild. Both narratives lack sustainability. In addition, neither is able to capture the attributes that make Apple unique.

Stock Price Outperformance

Evidence is building that Wall Street has begun looking at Apple differently. As shown in Exhibit 1, Apple's stock price began to outperform the market in 2017. Apple shares were up 48% in 2017, more than double that of the S&P 500. Apple has continued to outperform the broader market in 2018 despite a sharp increase in market volatility.

Exhibit 1: AAPL vs. S&P 500

Many look at Apple's recent stock price outperformance as a sign that Apple management's efforts to weave a new narrative are working. Wall Street must be paying more attention to Apple Services or the broader Apple ecosystem. In addition, lofty iPhone sales expectations leading up to the iPhone X launch were repeatedly cited in the press as driving Apple's stock price increase in 2017. None of these explanations for Apple's stock outperformance sit well with me. Instead, there's likely something else at play.

A New Narrative

In July 2017, two months before the iPhone 8, 8 Plus, and X were announced, I published "Wall Street Has Begun to Think About Apple In a New Way" with the following thesis:

"The iPhone no longer has the same kind of influence over Apple shares as it once did. Instead, Apple has turned into a balance sheet optimization story on Wall Street. Apple's growing net cash balance (now standing at an all-time high of $158 billion) has taken the place of iPhone unit sales growth as the most influential variable impacting Apple shares."

With no new evidence disproving my theory, it is time to expand on my thinking. Apple has found a narrative revolving around capital allocation. Instead of iPhone sales or Apple Services revenue gaining importance, Apple's balance sheet strategy is driving the company's new Wall Street narrative.

There are three core tenets to Apple's capital allocation narrative:

Superb cash flow generation. Apple's business model predisposes the company to superior cash flow generation. Apple is able to monetize premium experiences more effectively and efficiently than anyone else. Instead of chasing scale, Apple sells tools that management think people will want and are willing to pay for. Scale ends up being merely a byproduct of a successful strategy. Apple is generating more than $60 billion of operating cash flow per year.

Capital efficiency. Apple's business model is remarkably efficient in terms of the amount of capital required to generate these cash flows. Instead of owning a complex web of factories, Apple has built a network of third-party suppliers and assemblers that are second to none. In addition, the company remains focused when it comes to funding capital expenditures for organic growth. As a result of these actions, Apple reports more free cash flow than Alphabet, Facebook, and Amazon combined.

Returning excess capital to shareholders. Given such strong free cash flow generation, Apple is kicking off more cash than management needs to fund growth opportunities. Instead of sitting on the excess cash or spending the cash on unattractive projects, management has shown the willingness to return excess cash to shareholders via share repurchases and quarterly cash dividends.

Apple is a capital utilization machine spitting out more than $50 billion of free cash flow every year, nearly all of which will be used to fund the company's capital return program. This capital allocation narrative is not driven by any one product. Weaker iPhone sales won't derail the narrative. In addition, new revenue streams such as Apple Watch, AirPods, or growth in Apple Services don't represent holes in the narrative. Apple's new narrative is all about management's unique philosophy regarding how shareholder capital is used to generate future cash flows. Stronger product sales will lead to additional cash flows and consequently more cash for buyback and cash dividends. The opposite will be true as well with weaker product sales leading to a reduction in cash flow and less cash for share repurchases and cash dividends.

At its core, Apple's capital allocation narrative describes the company as a design-led organization tasked with developing tools for people. Apple doesn't develop products to drive revenue. Instead, many ideas are passed over to focus on a few really great ideas. Maintaining a focused product line and working closely with contract manufacturers on new processes to build products are key attributes of Apple's design culture. A narrative involving Apple's capital strategy rather than any story based on one particular product like iPhone or iPad ends up doing a better job of describing the company's design story.

Implications

There are a number of implications found with Apple possessing a capital allocation narrative on Wall Street.

Quarterly iPhone sales won't matter as much. While there will continue to be value in monitoring iPhone sales trends, Wall Street will increasingly not care about the quarterly gyrations in iPhone unit sales growth. This is my theory for why negative iPhone reports have simply been tossed aside by the market.

The level of free cash flow will gain influence. The emphasis won't be on any one particular product but rather on the collective result of new products such as Apple Watch, AirPods, HomePod, and new services contributing to Apple's overall cash flow picture. It is certainly possible that wearables and Services revenue growth will offset any weakness in the iPhone business.

Apple's capital return program will continue to matter. New disclosures related to Apple's share buyback and cash dividends have the potential to move the share price higher or lower depending on how new revelations compare to expectations.

New initiatives may be judged more strictly. Traditionally, Wall Street hasn't cared much about new Apple products and initiatives since they were financial rounding errors next to iPhone. However, with a capital allocation narrative, increased attention may be given to new strategies that have the potential to change Apple's thought process regarding capital and the balance sheet.

Apple's capital allocation narrative has also led to changes in the way the market is valuing Apple shares. As shown in Exhibit 2, Apple's stock price is up more than the percentage increase in market cap. This is likely due to two factors: The market is valuing Apple's future cash flows at a higher multiple, and Apple's cash on the balance sheet is being priced differently since the share buyback program was launched. Both developments are likely a result of Apple's capital allocation strategy taking hold.

Exhibit 2: AAPL vs. Apple Market Cap vs. Apple Enterprise Value

Nearly all of the increase in Apple's enterprise value over the past five years has come from the market attaching a higher valuation to Apple's future cash flows (i.e. a higher market capitalization). Apple shares are currently trading at a 13.5x forward price to earnings multiple. Two years ago, this multiple was closer to 10.5x. Apple has experienced a nearly 30% increase in valuation multiple.