It's Time for Apple to Disclose Apple Watch Sales

Apple Watch is a resounding success, and it's time for Apple to make it official by providing quarterly sales data. The question of whether Apple should disclose Apple Watch sales has never had a simple "yes" or "no" answer. Instead, the positives and negatives found with disclosure have to be weighed against each other. There is now more upside found in Apple disclosing quarterly Apple Watch sales than in keeping them private and just providing sales clues.

The Initial Decision

In late 2014, six months before Apple Watch went on sale, Apple announced that it would not be disclosing quarterly Apple Watch revenue and unit sales. The company would include Apple Watch in a new financial line item. The category, called "Other Products," would serve as a catch basin for a variety of products including iPod, Beats, Apple TV, other Apple accessories, and a range of third-party accessories sold through Apple Retail.

Apple's decision to withhold Apple Watch sales was a controversial one. Apple Watch represented Apple's first genuine new product category in the Tim Cook / Jony Ive era. Expectations were high as observers positioned Apple Watch as a litmus test for Apple's ability to innovate following iPhone and iPad. The lack of disclosure meant analysts would have to back into Apple Watch sales estimates using their own earnings models. This process guaranteed there would be a discrepancy when it came to Apple Watch estimates.

A number of theories were put forth regarding why Apple made the initial decision to lump Apple Watch in with Other Products. The official reasoning according to Apple management was that given how Apple Watch was a new product with no revenue, it made sense to lump the product with other products. In addition, the lack of disclosure was said to make it difficult for competitors to assess Apple Watch demand and market trends. The much simpler explanation was that Apple just didn't stand to benefit from disclosing Apple Watch sales out of the gate. Apple faced a number of benefits associated with keeping Apple Watch sales hidden, such as:

- Keeping competitors in the dark.

- Avoiding negative press coverage focused on the wide discrepancy between Apple Watch and iPhone sales.

- Avoiding investor and analyst disappointment if Apple Watch sales missed very high expectations.

- Moving the Apple narrative on Wall Street beyond unit sales growth.

Meanwhile, the downsides associated with keeping Apple Watch sales hidden included:

- Portraying a lack of confidence in Apple Watch.

- Being unable to control the Apple Watch narrative in the press.

In early 2015, there was very little upside for Apple found with disclosing Apple Watch sales. While management was confident that Apple Watch would become a hit product, there was no reliable way of converting that optimism into multi-year sales projections. The product had an unknown adoption curve, and Apple did not have a recent product to use as a proxy to estimate adoption. The iPad was released five years earlier, but the product had proven to be a sales outlier by riding the iPhone's coattails. In addition, management knew initial Apple Watch sales would pale in comparison to iPhone sales, potentially leading to negative stories in the press. Apple made the correct decision to keep initial Apple Watch sales hidden.

Sales Clues

On the surface, Apple's decision to withhold quarterly Apple Watch sales data would make it difficult to assess performance. As seen in Exhibit 1, Other Products revenue, which includes Apple Watch sales, doesn't provide many clues regarding Apple Watch demand. If anything, the most likely takeaway is that Apple Watch sales haven't been impressive. However, this assessment is grossly inaccurate.

Exhibit 1: Apple "Other Products" Revenue

In what came as a surprise, soon after Apple Watch launched, Apple management began to provide clues regarding Apple Watch sales. The sales clues have now become so helpful at reaching Apple Watch sales estimates, management appears to be systematically undermining its initial decision to withhold sales data. Some of the more noteworthy sales clues over the past two-and-a-half years include:

- Apple Watch revenue accounted for "well over 100% of the growth" in Other Products in 3Q15 (two months of sales). In addition, Apple Watch sell-through was higher in 3Q15 than in the comparable launch periods for iPhone and iPad.

- Apple Watch unit sales were up sequentially in 4Q15 and once again in 1Q16.

- Apple Watch unit sales exceeded sales of iPhone during its first year. Apple Watch was the second best-selling watch brand in CY2015 (revenue).

- Apple Watch experienced a unit sales and revenue record in FY1Q17. Apple Watch sales "nearly doubled year over year" in 2Q17 and have been up "over 50%" in 3Q17 and 4Q17.

- Apple Watch was the best-selling watch brand over the twelve months ending in June 2017 (revenue).

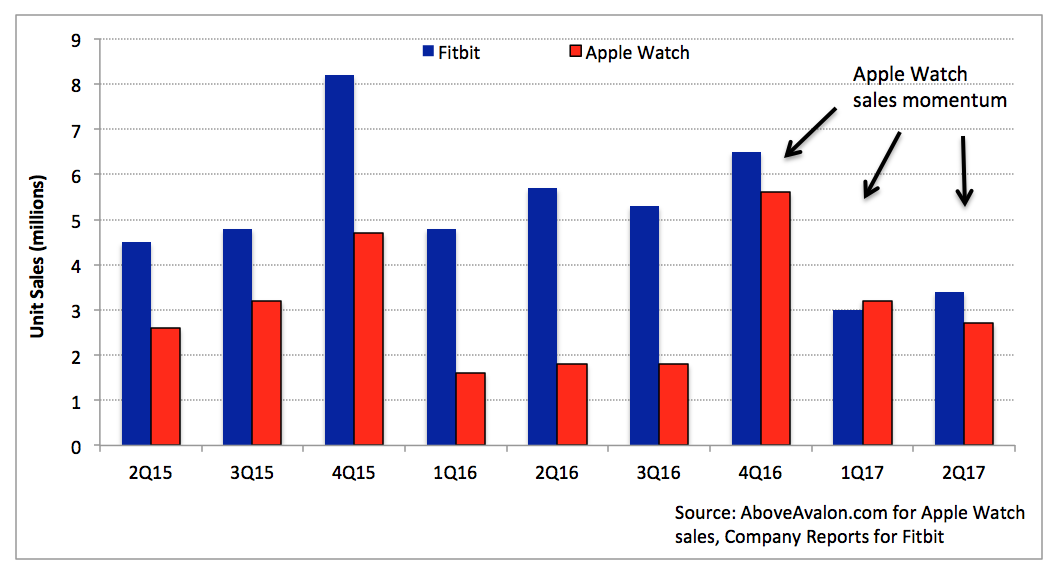

Taking the preceding clues into consideration and adding them to my Apple financial model leads to the Apple Watch unit sales estimates found in Exhibit 2. Apple has sold 30M Apple Watches to date. More detail on the size of the Apple Watch installed base and user base is available for Above Avalon members here.

Exhibit 2: Apple Watch Unit Sales (Above Avalon Estimates)

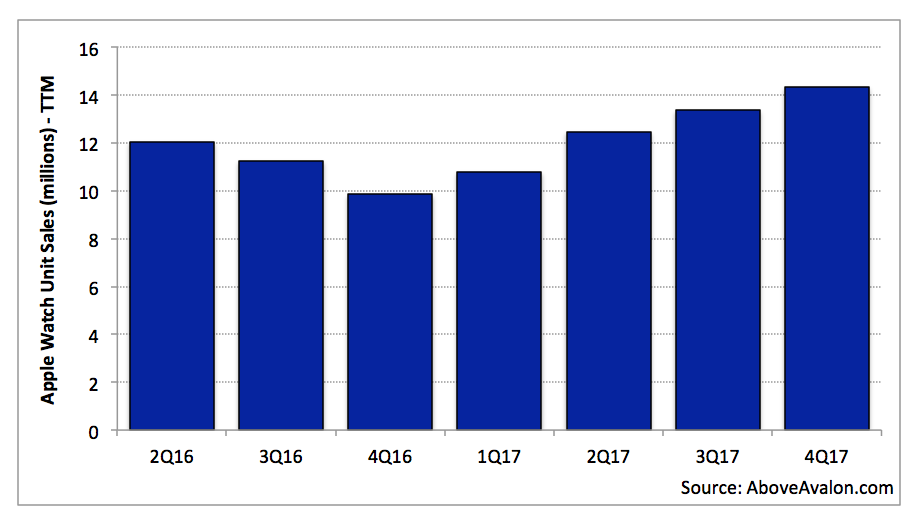

In order to remove the seasonality found with Apple Watch (sales are concentrated in the holiday quarters - 1Q16 and 1Q17), Exhibit 3 shows Apple Watch sales on a trailing twelve month basis. Apple Watch momentum becomes much easier to observe. Apple Watch unit sales have been steadily increasing over the past year with unit sales up nearly 50% year-over-year on a trailing twelve month basis.

Exhibit 3: Apple Watch Unit Sales - TTM (Above Avalon Estimates)

Time for Change

Four major changes have swung the disclosure debate in favor of Apple providing Apple Watch data on a quarterly basis.

- There is no smartwatch market. After more than two-and-a-half years of competition, it is clear that Apple Watch doesn't have much genuine competition. Instead of there being a smartwatch market, there is just an Apple Watch market. In the beginning, some thought low-cost, dedicated health and fitness trackers would pose a major long-term sales risk to higher-priced, multipurpose wearable devices like Apple Watch. This has proven to be incorrect. Apple Watch is seeing growing sales momentum while dedicated fitness trackers are quickly fading in the marketplace. Samsung, Garmin, Fossil are the only companies selling at least 100,000 smartwatches per quarter on a regular basis. The rationale for withholding Apple Watch sales data "due to competitive reasons" is getting weaker as time goes on. In addition, competitors already have a very good idea of how Apple Watch is performing in the marketplace thanks to the sales clues provided by Apple. (In addition, I have been providing Apple Watch sales estimates to Above Avalon members for years.)

- Additional Apple Watch sales data. Apple has a much better handle on Apple Watch demand trends given 10 quarters of Apple Watch sales data. Management is well aware of the seasonality found with Apple Watch sales. In addition, much of the unknown found with the quarterly swings in Apple Watch sales has been removed. Year-over-year growth projections for Apple Watch now serve as a more reliable way of forecasting sales.

- Low Apple Watch expectations. Wall Street no longer has high expectations for Apple Watch sales. Accordingly, Apple is no longer facing the same level of risk of missing Apple Watch sales expectations.

- New Wall Street focus. There is evidence of Wall Street focusing much less on Apple's unit sales growth. Instead, Wall Street is increasingly focused on Apple's balance sheet. The result is an environment in which Apple doesn't have to worry as much about slowing Apple Watch unit sales posing a threat on Wall Street.

Apple has been trying to play both sides of the Apple Watch disclosure debate. On one hand, the company still doesn't want to face the pressure and scrutiny found with disclosing Apple Watch revenue on a quarterly basis. However, management is providing increasingly detailed sales clues in an effort to tell the world that Apple Watch is selling well and gaining momentum.

Apple now stands to benefit more from disclosing Apple Watch sales than keeping them hidden. What were once incentives for not disclosing Watch sales have reversed and now represent reasons to provide sales data.

- Apple is missing positive press coverage associated with strong Apple Watch sales figures.

- Apple can improve its Wall Street narrative by talking up Apple Watch as a primary computing platform. Sales data will help Apple in such efforts.

The recurring theme found with Apple's disclosure philosophy is providing numbers when doing so benefits the company. A few recent examples include Apple beginning to disclose the number of paid subscriptions across the various App Stores and more detailed numbers related to Apple Retail traffic. The paid subscriptions disclosure goes a long way in painting Apple as having the best ecosystem for paid third-party services. Meanwhile, the Apple Retail and online store traffic disclosure paints a picture of an expanding Apple ecosystem in China and emerging markets.

Best of Both Worlds

Since Apple won't be required to disclose Apple Watch sales in the near-term given their small percentage of overall revenue, there is a way for management to have the best of both worlds when it comes to Apple Watch disclosure. Management can begin disclosing quarterly Apple Watch unit sales while keeping revenue lumped in with "Other Products." By disclosing unit sales, Apple is able to receive all of the upside found with Apple Watch disclosure. However, by not disclosing revenue, management would be able to keep Apple Watch average selling price (ASP) data hidden for competitive reasons. While the world would know how many Apple Watches are sold every quarter, estimating would still be required to assess which Apple Watch models are selling well. Apple has done something similar in the past with Apple TV when the company periodically disclosed unit sales without breaking out revenue.

By providing just Apple Watch unit sales on a quarterly basis, Apple can beginning taking back the Apple Watch narrative. As of today, there is still a remarkable amount of skepticism pointed toward Apple Watch. Since there is no rational reason for such skepticism to exist given management's Apple Watch sales clues, the lack of official Apple Watch unit sales data is likely a contributing factor. Official Apple Watch unit sales would go a long way in positioning Apple Watch as a compelling computing platform. Some consumers may become interested in Apple Watch once knowing how many other people are buying and wearing the product. Compared to the lack of sales disclosure from companies like Amazon, Google, and Samsung, providing quarterly Apple Watch unit sales would garner much more positive press for Apple Watch.

Meanwhile, there is a declining number of downsides and risks found in disclosing Apple Watch unit sales. Apple Watch has significant momentum in the marketplace, and Apple's engineering and design teams are running as fast as they can with the product category. Apple is leading the market with a cellular Apple Watch and being able to apply fashion/luxury attributes to design and technology. These items will very likely continue to fuel sales momentum for Apple Watch. No other company is close to Apple when it comes to selling multipurpose computers on the wrist at volume.

Financial Disclosure

Apple will eventually have no choice but to disclose Apple Watch revenue. Once "Other Products" begins to account for 10% to 15% of Apple's overall revenue, pressure will build for management to break up the line item to make it easier for analysts to model. Other Products currently accounts for 6% of Apple's overall revenue. The iPad represented close to 15% of Apple's overall revenue immediately after going on sale. Apple likely had no choice but to break out iPad sales. Meanwhile, Apple stopped reporting iPod sales once it declined to 1% of overall sales.

The Other Products line item has been effective up to now since it represents a small fraction of overall Apple revenue. This was the primary motivation behind Apple creating the category in the first place - to serve as a catch basin for products bringing in a small percentage of overall revenue. If Apple Watch continues to see significant revenue growth, pressure will build for Apple to rearrange its financial disclosure in order to break out Apple Watch revenue. While this scenario won't happen in the near term, a few more years of strong Apple Watch sales growth will make it a very real possibility.

Holiday Quarter

Apple's next earnings report marks a great opportunity for Apple to begin disclosing Apple Watch unit sales. Apple will likely sell more than 9M Apple Watches during the holiday quarter, which would represent a sales record and exceed Mac sales by a wide margin. Looking ahead, Apple Watch is on track to reach a 25M unit sales per year pace in 2018. It's time for Apple to begin disclosing Apple Watch unit sales data and become much more vocal in telling the Apple Watch story.

Receive my analysis and perspective on Apple throughout the week via exclusive daily emails (2-3 stories a day, 10-12 stories a week). To sign up, visit the membership page.

iPhone X

After 10 years, the iPhone business is displaying signs of maturity. The days of significant sales growth are in the rearview mirror. The upgrade cycle is getting longer as it becomes that much harder to get people to upgrade their iPhones.

Apple was faced with a choice: Stick with the familiar and milk the iPhone business for all it’s worth, or throw familiarity out the window to pave a new iPhone journey for the next 10 years. Apple chose the latter, and iPhone X is the byproduct.

I’ve been using an iPhone X since Monday. Accordingly, this is not a comprehensive review. Instead, the focus is on my initial impressions and thoughts from using the device. My expectation is for additional iPhone X observations to materialize over the coming days and weeks.

iPhone X is without question an inflection point for the iPhone business. This new iPhone era won’t necessarily materialize in the form of stronger iPhone sales growth. Instead, the iPhone user experience is now on a different trajectory. In some ways, iPhone X places iPhone firmly in the direction of the original vision Jony Ive and Apple’s industrial designers had for iPhone when it was still an R&D project 12 years ago. Apple wants iPhone hardware to melt away, leaving just the user interacting with software.

Not Your Typical Update

The first thing that becomes apparent after using iPhone X is that this isn’t just any iPhone update. (Most people will probably call it iPhone “ex” instead of “ten” – I doubt Apple cares too much since people are going to buy this device in droves).

Historically, Apple has strived to have two or three marque features for each iPhone release. These features have to be substantial enough to frame a marketing campaign around. Some of these features, such as larger screens and fingerprint readers, have been hardware-related while other features, such as Portrait Mode and the dual camera system, have been a combination of software and hardware. In addition, new case colors have become a reliable way of enticing some iPhone users to upgrade. A few of the more noteworthy updates over the years include:

- iPhone 5: Larger 4-inch screen

- iPhone 5s: Touch ID / Gold finish

- iPhone 6 / 6 Plus: Larger 4.7-inch and 5.5-inch screens / Apple Pay

- iPhone 6s / 6s Plus: 3D Touch / Live Photos / Rose Gold finish

- iPhone 7 / 7 Plus: Dual camera system (Portrait Mode) / Jet Black finish

- iPhone 8 / 8 Plus: Glass back / Gold finish

When looking at the preceding list, no one feature jumps out as single-handily changing the way we use iPhone. Instead, each feature played a supporting role in a much bigger production. Apple’s broader goal has been to improve the iPhone experience ever so slightly with each new iPhone. Management has seen more success in reaching that goal in some years than in other years.

With iPhone X, two design changes stand out: the removal of the front-facing home button and Face ID replacing Touch ID. The changes amount to nothing short of an entirely new iPhone experience. The best way to describe the feeling found when using iPhone X is that it’s the closest thing to using an iPhone from an alternative universe. There is this fresh, or reinvigorating, feeling to it – as if the home button was holding the iPhone experience back, representing a barrier to interacting with software. No other iPhone update has been able to elicit such a strong feeling. It is also easy to see where Apple wants to take iPhone over the next ten years (more on this shortly).

Learning Curve

Much to my surprise, there really isn’t much of a learning curve with iPhone X. While it will take a few minutes to get used to not having a home button, the memory reflex adjusts incredibly quickly. I was expecting to keep pressing the bottom of the screen as if there was still a dedicated home button, but it just never occurred.

The remarkable thing about this is that considering how engrained the home button has been in our lives, to just move on after a few minutes says something about the intuitive user interface found with iPhone X. The home button wasn’t just a way to unlock our iPhone the dozens of times throughout the day or to get back to the home screen. Instead, the home button represented familiarity and safety. In case of trouble, a quick tap would drop us back into the comfort found with the home screen. In case of an extra sticky situation, a quick double tap would bring up the multitasking window as a form of escape.

With iPhone X, the swiping gesture has replaced home button pressing, and it feels more natural than a home button ever felt. A swipe up from the bottom of the screen in both a horizontal and vertical position brings you back to the home screen. Control panel is a swipe from the upper right corner.

Why No Home Button?

There is a rather straightforward question to ask about iPhone X: Why did Apple remove the iPhone home button in the first place? It’s all about coming up with a different way to interact with technology – removing extra bezel to just leave you and the screen. A byproduct of this is that Apple is able to fit more screen in the same form factor. iPhone X has a little bit less screen real estate (in terms of area) than iPhone Plus. The 5.8-inch screen has a more vertical element than its iPhone Plus sibling.

While the iPhone Plus has been gaining sales momentum in recent years, culminating with iPhone 8 Plus outselling its smaller iPhone 8 sibling, the form factor is a bit large for a certain portion of the iPhone user base. Apple went with the iPhone X’s particular form factor because it felt the best in hand. Of course, Apple will likely sell different iPhone X sizes over time, but the company had specific reasons for going with the current iPhone X form factor.

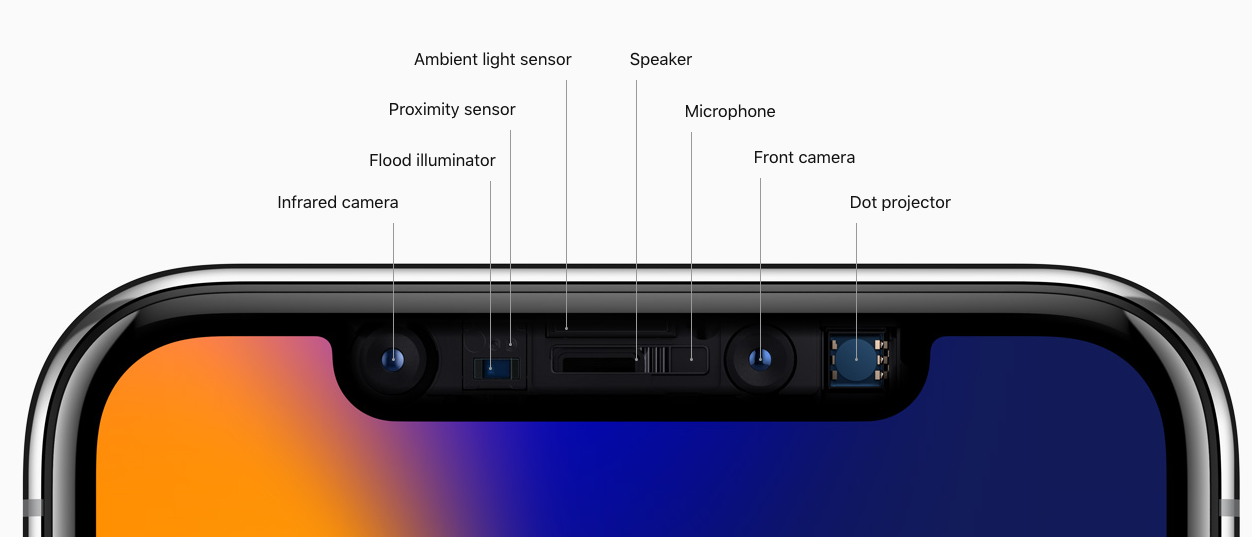

Face ID

Touch ID is a thing of the past. If it wasn’t for needing to use Touch ID on my iPad Pro, I doubt I will give the fingerprint recognition technology much thought going forward.

The Apple rumor cottage industry had a wild 2017 when it came to Touch ID and iPhone X. Many Apple rumor finders and reporters were extremely confident that Apple actually wanted to put Touch ID under the screen and due to technological roadblocks had to settle for Face ID. While it would not be surprising for Apple to investigate trying to put fingerprint recognition under a screen (why wouldn’t they kick the tires?), Apple is no way settling with Face ID. In addition, the claim that Face ID is in some way a stop gap is just wrong. Instead, Face ID represents the next reiteration of Apple’s quest to push biometric authentication forward.

Face ID set-up is ridiculously smooth, easy, and quick. We can probably throw the word magical into the mix as well – it would qualify. While Touch ID signup has improved over the years, Face ID blows it out of the window in terms of simplicity and intuitiveness.

There are a few notable drawbacks to Face ID – which do seem like low-hanging fruit for Apple to address down the road. (These drawbacks were discussed in my accompanying iPhone X initial impressions video.)

- You need to look at the iPhone X TrueDepth camera system basically directly on for Face ID to work. The days of laying your iPhone on the desk and just reaching over and pressing the home button are over (for now). Instead, you will either need to shift so that your face is directly over the TrueDepth camera system, or you have to lift up the iPhone from the flat surface. You can just tap the screen to see notifications.

- Face ID requires access to your eyes, nose, and mouth. For some people, this will limit Face ID availability. It is important to point out that Touch ID has its fair share of issues as well including wet fingers.

- In my initial tests, Face ID on iPhone X was slower than Touch ID on an iPhone 8 Plus when used to get to the home screen.

All in all, Face ID is impressive. It’s not a perfect replacement for Touch ID but it’s more than adequate. iPhone X will place Face ID as the first genuine technology that will make facial recognition go mainstream in a smartphone.

The Screen

A few hours with the screen is all you need to begin understanding why Apple chose to remove as much bezel as possible. The way Apple wraps the iPhone X screen around the TrueDepth camera system (a.k.a the notch) has been a polarizing topic in the run up to this week’s launch. Some people think the notch is bad design. This camp argues Apple shouldn’t have included a visual gap in the screen. Renderings showing various iPhone X apps in portrait mode, which clearly look odd at first, have given this camp a decent number of supporters.

However, in what likely isn’t a coincidence, the “notch is bad design” camp has been quiet when it comes to offering or suggesting better alternatives. Including extra bezel to the left and right of the TrueDepth camera system, like every other smartphone manufacturer currently does with their front-facing camera, isn’t a better solution. One wouldn’t be able to use that space to display information such the date, time, battery indicator, carrier signal, etc. In addition, the whole point of iPhone X is to get rid of as much bezel as possible.

Much like the home button, the “notch” will be quickly forgotten. It just melts away after a few hours of use. Let’s not beat around the bush – an iPhone X without any notch would obviously be the closest representation to Apple’s vision of hardware melting away to just leave the user interacting with software. However, the technology for such a feat just isn’t available today (although Apple R&D suggests the company is working at it). But Apple sure comes close to that perfection, even when taking into account the notch.

I don’t think it’s fair to say that the way Apple wraps the screen around the TrueDepth camera system was some kind of major compromise. Instead of Apple redesigning iPhone to remove the notch next year or the following year, there is a much higher likelihood of Samsung and other smartphone manufacturers embracing some version of the notch as the extra bezel found on Galaxy S8 or Pixel 2 XL really does stand out in a negative way when positioned next to iPhone X.

The debate over the notch is not about whether Apple should have included a notch or not with iPhone X. Instead, the debate comes down to screen real estate. Along those lines, the notch comes out ahead. Regardless of the pros and cons found with the notch, Apple is fully embracing it. In fact, the notch replaces the home button as a defining characteristic of the device – a way for the phone to stand out from competitors. The notch ends up being iPhone X branding.

Thoughts on Sales

Beginning Friday, Apple will be selling three new iPhones simultaneously for the first time (iPhone X, iPhone 8, and iPhone 8 Plus). After using both an iPhone 8 Plus and iPhone X, I don’t think it’s completely right to label each as Apple’s flagship iPhone. Instead, iPhone X has the exclusive rights to that title.

While iPhone X shares some similarities with iPhone 8 and 8 Plus, the differences are just too much to place the three phones on the same plane. However, it would be a mistake to cast iPhone 8 and 8 Plus as the forgotten iPhones.

Conventional wisdom positions iPhone X as targeting iPhone users focused on the latest and greatest technology. Meanwhile, everyone else is thought to be interested in the lower-cost iPhone 6s, 7, or 8. After using iPhone X and taking into consideration how most consumers buy iPhones, I’m not sure such a generalization is correct.

The question of how an iPhone user will choose between an iPhone X and a different kind of iPhone (most existing iPhone users will stick with iPhone for their next smartphone) won’t come down to one’s desire for the latest and greatest technology. Instead, it will likely come down to one’s comfort level with change and the desire for familiarity.

For a portion of the 800M iPhone users in the wild, iPhone X will represent change that isn’t essential at this time. This isn’t to say anything about iPhone X not appealing to the mass market or the device not being intuitive enough. Instead, the iPhone user base is increasingly heterogeneous when it comes to views and thoughts regarding technology and iPhone. For many people, iPhone 8 and 8 Plus are worthy upgrades to their existing iPhones. A very strong case can be made that iPhone 8 and 8 Plus will sell just fine next to iPhone X. In subsequent years, these users will eventually be in a better position to embrace the design changes found with iPhone X as Apple extends that design language to different screen sizes.

Approximately 80% of iPhone sales in the U.S. occur through mobile carriers. This means that for many iPhone users, the purchase decision between iPhone 8 and iPhone X may come down to how each iPhone looks next to each other in a Verizon or AT&T store. The iPhone X would probably win if it were a beauty contest – the screen just can’t be beat. However, the home button may give iPhone 8 and 8 Plus some points with a portion of consumers. At the end of the day, sales may end up a draw, which would be a big win for iPhone X considering its higher price.

Speaking of iPhone X pricing - which will likely go down as the most talked about Apple topic of the year – concerns of iPhone X pricing being too high are misplaced. This phone is going to sell well in U.S. and China. In fact, iPhone X will sell well in all of Apple’s established markets. Emerging markets will likely be a different story, which explains Apple’s consumer segmentation strategy for iPhone pricing. The iPhone SE, 6, and 6s are clearly targeting emerging markets where pricing is a much bigger sticking point.

Apple’s Goal

In many ways, iPhone X is the kind of product you would expect from Apple. Instead of settling with the existing iPhone paradigm and watching iPhone sales and profit gradually decline over time, Apple is determined to move on to the next thing. iPhone X is that the next thing. We are seeing the foundation for the next ten years of iPhone. All iPhones will eventually look and feel like iPhone X.

There are a few rough items around the edges. Face ID has some drawbacks when compared to Touch ID, although these are pretty much offset by its positives. In addition, some iPhone Plus users may be left a bit unsatisfied with iPhone X screen real estate (I would be interested in trying an iPhone X in the size of an iPhone Plus).

Apple is laying the foundation for a new user interface paradigm in which we rely much less on multi-touch to control our iPhones. Instead, we will rely on glances and looks. With wearables increasingly positioned as Apple’s product priority, an iPhone that serves as an augmented reality navigator controlled by glances is the future. The technology underpinning such a product can then one day be applied to other wearables controlled by glances and looks: Apple glasses.

Receive my analysis and perspective on Apple throughout the week via exclusive daily emails (2-3 stories a day, 10-12 stories a week). To sign up, visit the membership page.

Apple Is Facing a Double Standard

Apple is a Silicon Valley and Wall Street leader. The company has the most profitable and best-selling smartphone, tablet, smartwatch, and wireless pair of headphones in the market. Apple has grown its user base by 10x over the past 10 years and is bringing in nearly more revenue than Amazon, Alphabet, and Facebook combined. This level of success places a bull's-eye on Apple’s back and rightly so. Leaders should be held to a higher standard.

However, a trend has developed where a number of tech companies are said to be outperforming Apple. Despite being cast as leaders, these companies aren't judged by the same high standards as Apple. Microsoft, Samsung, and Google are said to be one-upping Apple in core competencies like hardware and design. Yet, these companies don't face anywhere near the amount of criticism thrown at Apple.

Even when looking at companies that deserve to be put on a pedestal, such as Amazon, Tesla, and Tencent (WeChat), a double standard becomes apparent. While these companies are doing great things in terms of building promising customer relationships, none are exposed to the level of cynicism facing Apple. A company that is heralded in the press as surpassing Apple as a leader should face the same high standards used to judge Apple. Unfortunately, this never happens. The bull's-eye is never removed from Apple's back and given to another company.

Grading on a Curve

A massive curve is being used to grade companies not named Apple. The list of recent examples is extensive.

Samsung. Samsung released its Galaxy S8 flagship smartphone to near unanimous praise this past April. Tech media positioned the phone as a sign of Samsung taking the smartphone design baton from Apple. The phone was said to be an engineering marvel, standing apart from iPhone, and every other smartphone for that matter. YouTube vloggers, some with financial ties to Samsung, couldn’t say enough positive things about the phone. Samsung had beaten Apple to market with a smartphone lacking a dedicated home button and having reduced front bezels.

Only a few days after launch, Galaxy S8 problems began to appear. In what has become a perennial occurrence with Samsung, smartphone features that were positioned as key attributes of the device were shown to be gimmicks. Samsung’s facial recognition software was easily spoofed with pictures. The company was forced to backtrack in terms of positioning facial scanning as a secure biometrical identification method. These problems should have led many to reassess claims that Samsung was the smartphone design leader.

Due to the home button being removed, Samsung decided to move the Galaxy S8 fingerprint reader to the back of the phone. It quickly became apparent that the decision was a questionable one. Instead of being labeled as a major design compromise, many reviewers brushed off the awkwardly positioned fingerprint reader as just a Samsung quirk. If the same scenario happened to Apple, leadership would be questioned and the company's strategy would be put into doubt. For Samsung, it was business as usual.

Microsoft. Microsoft has enjoyed two years of unanimous media praise for its Surface products. The company is said to push the boundaries of personal computing forward with Surface. Unlike Apple, Microsoft is viewed as giving consumers something they want before they even know they want it. Microsoft’s Surface business is being graded on a curve. The product category is losing in the marketplace as consumers show little to no interest in tablet/laptop hybrids. Despite poor sales, there has been no discernible change to the Surface narrative in the press. The same kind of sales decline for iPad led many to question Apple's entire strategy and vision. The goal posts continue to move for Microsoft. Surface success is now said to be found with enterprise adoption despite Microsoft spending the better part of the past five years positioning Surface for consumers.

Amazon. No company is currently receiving more praise than Amazon. While some of this is justified, a strong case can be made that Amazon's product strategy is being graded on a curve. Stationary speakers powered by Alexa are positioned by many as the future of personal computing. The lack of retort or debate regarding this claim is astounding. The tech community has elevated Amazon Echo on one of the tallest product pedestals around. Boilerplate language referencing Echo's success and popularity are found in every smart home article despite Amazon providing very few clues as to how the devices are selling or being used. Newer Echo devices such as the Echo Show and Echo Look led some tech reviewers to bend over backwards in an attempt to avoid the appearance of not "getting it." This behavior stands out when compared to the sheer level of skepticism thrown at Apple's HomePod, a device that isn't even available for sale.

Google. The company is said to be getting better at hardware, and a few people are starting to declare Google the new design leader. Google Pixel is positioned by some as a sign of Google even beating Apple at hardware. In reality, there are a growing number of signs indicating Google continues to fumble forward when it comes to hardware. While Pixel's growing number of issues are well-covered in the press, the degree to which Google received the benefit of the doubt in the first place is something not afforded to Apple.

Tesla. While Tesla receives its fair share of criticism from Wall Street, the tech community rarely pushes back against the company. Tesla's growing manufacturing struggles and missed deadlines are written off as typical Elon Musk antics. Meanwhile, Apple's manufacturing struggles are viewed as a sign of bad decision-making.

Snap. One word: Spectacles. The sunglasses with camera was looked at as a sign of Snap innovating faster than Apple. Long lines in front of a Spectacles vending machine were said to demonstrate how Snap was grabbing just as much buzz and interest as Apple during one of its global product launches. Not surprisingly, Spectacles flopped in the marketplace.

Apple Watch

The stark difference in how Amazon Echo and Apple Watch have been portrayed in the press highlight the double standard facing Apple. Neither Amazon nor Apple officially disclose product sales for each respective product, although Apple provides many more helpful Apple Watch sales clues. This makes it interesting how Amazon Echo has been declared a resounding success while Apple Watch receives doubt and criticism.

Amazon Echo and Apple Watch were likely selling at roughly the same pace during the first half of 2017. When considering Apple Watch sells at average selling price that is more than 5x that of Echo's, it's clear Apple Watch has been the revenue winner. In addition, given how some people have purchased four or five Echo devices, Apple Watch likely has wider user adoption.

Why is Apple Watch momentum and sales success not reported while Amazon Echo is positioned as the next big computing platform? Amazon doesn't have the same kind of bull's-eye placed on its back compared to Apple. Amazon Echo doesn't receive any where near as much criticism or cynicism as Apple Watch does.

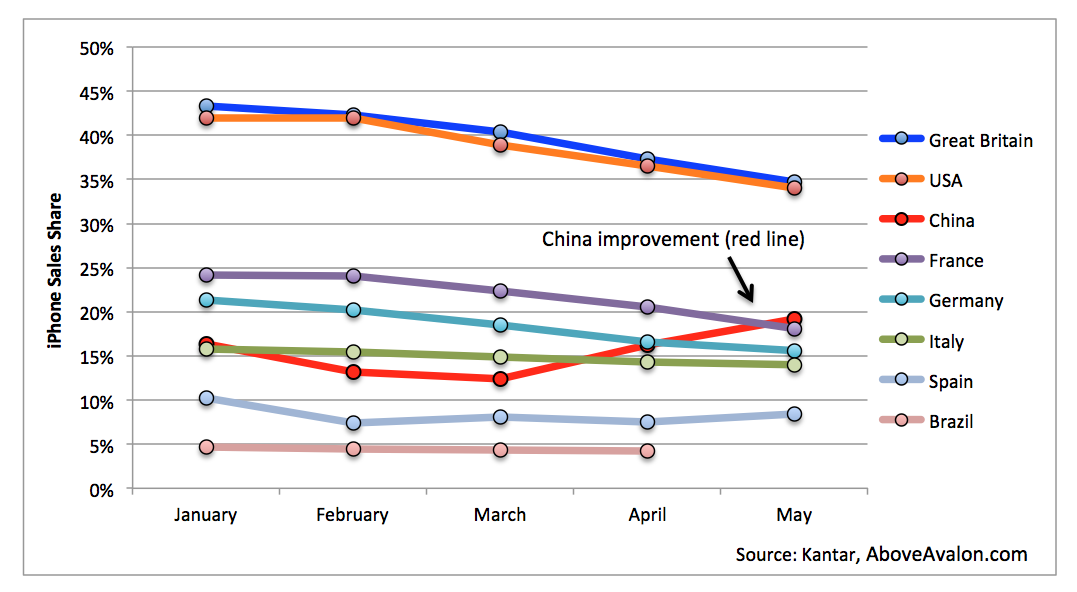

China

Nowhere is the double standard Apple faces on display more than when China is discussed. Apple is the best-selling western brand in China. The company will bring in $45B of revenue this year in Greater China, selling upwards of 50M iPhones. According to Apple management commentary, Apple is seeing solid sales growth through its App Store in China. In addition, the iPad and Mac continue to sell well. Apple Retail store traffic and sales are also up year-over-year. However, judging by the press, Apple is one step away from implosion in China. Whether it is competition from the low-end, which is not new or unique to China, or services companies like Tencent (WeChat) stealing Apple users, a narrative with lots of holes, Apple’s strategy in China is being severely questioned.

While Apple has clearly experienced trouble in China, which likely played a role in Apple appointing Isabel Ge Mahe as VP of Greater China, the lack of criticism facing other companies regarding China is noteworthy. Amazon, Facebook, and Netflix, three companies considered to be among the most innovative entities today, have little to no presence in China. In some cases, it’s not a stretch to say these companies will never have a presence in the country. Yet, this reality is not viewed as a problem or hindrance for these companies. Instead, China is positioned as a wildcard opportunity containing just upside and little to no downside. For Apple, China is viewed in the exact opposite way, representing a lot risk with little to no upside opportunity.

Theories

Why is a double standard applied to Apple? Why are competitors being graded on a curve? I have a few theories:

1) People like underdogs. It's not that people necessary want to see Apple fall, but rather people want to get behind the underdog. It makes for a good story. A recent example of this is found with Andy Rubin's Essential getting into the smartphone market. Despite Essential's smartphone being positioned right next to iPhone, there was a notable lack of skepticism and proper analysis facing both the company and smartphone. Essential should never have been positioned as a genuine iPhone threat. Microsoft Surface's battle against Mac and iPad represents another underdog story that some people just don't seem to get enough of. In reality, there isn't much of a battle when looking at sales. Similar underdog stories are found with Amazon's Alexa outpacing Siri, Samsung beating iPhone in terms of design, Google matching up with Apple hardware, and Tesla grabbing more buzz than Apple.

2) Founder bias. There is a tendency for people to give companies run by founders the benefit of the doubt, while companies like Apple have a much higher bar to jump over. Few have made much out of Mark Zuckerberg's growing list of bad product bets and lack of vision. Zuckerberg's fascination with VR is at worst merely laughed off. Larry Page's and Sergey Brin's lack of focus are widely known and mentioned, but rarely questioned in terms of Alphabet's grand vision. Jeff Bezos can do no wrong, despite plenty of examples of Amazon making mistakes. Tesla has become all about Elon Musk's vision with few discussing the company's strategic blunders and holes. Meanwhile, each step Tim Cook and Jony Ive take is questioned more than the previous step. The only difference between these companies: Facebook, Alphabet, Amazon, and Tesla are led by founders, while Apple isn't.

3) Apple is misunderstood. Apple lacks a strong narrative in Silicon Valley and Wall Street. While much of this is due to Apple's own doing, the situation leads to unknown regarding how to judge Apple's performance. Many still view and grade Apple as if it is a technology company. In reality, Apple is a design company. This likely contributes to an elevated amount of skepticism and cynicism being applied to Apple's actions.

Solutions

The high standards applied to Apple should not be lowered in an effort to remove the double standard applied to the company. Leaders should receive an outsized amount of attention and criticism. Instead, the bar needs to be raised for companies not named Apple. If a company is said to be outpacing Apple, that company deserves to have a bull's-eye placed on its back. When it comes to the underdogs, stories should not romanticize David slaying Goliath, but detail the challenges and risks found in going up against Apple. Once problems and issue emerge, which they undoubtedly will, they should be covered as closely as the initial stories filled with optimism.

Apple is a polarizing company. This guarantees that the company will continue to face an outsized amount of skepticism and cynicism going forward. It's time that the same level of criticism be given to companies said to be giving Apple a run for its money as a Silicon Valley and Wall Street leader.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.

Apple's Grand Vision

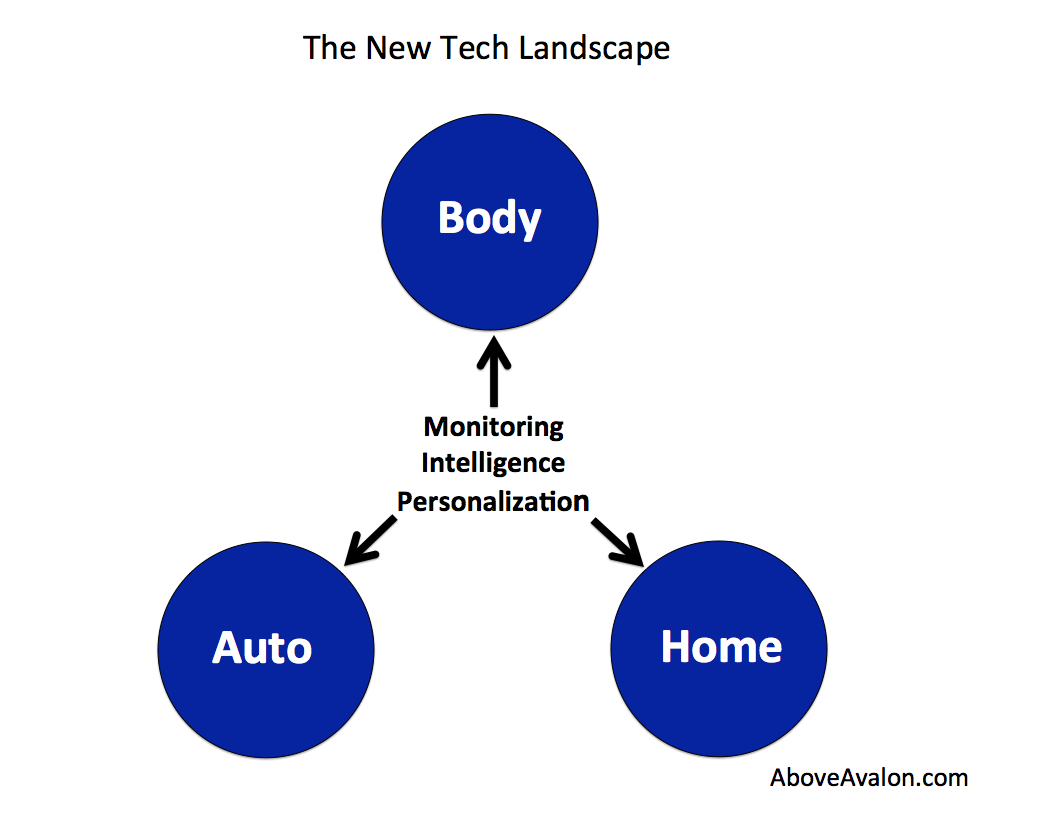

Apple's product strategy has been receiving more attention lately as voice-first and AI-first become buzzwords in Silicon Valley. Questions regarding whether Apple even has a coherent product vision are on the rise. While Apple is no stranger to receiving skepticism and cynicism, the degree to which people are discounting Apple's product strategy is noteworthy. There is mounting evidence that Apple's industrial designers are following a product vision based on using design to make technology more personal. It is becoming clear that such a vision extends well beyond just selling personal gadgets.

Product Strategy

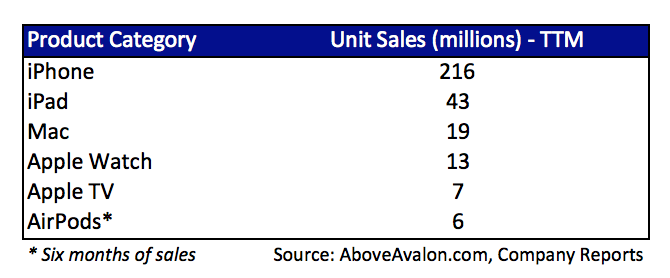

Apple's financials paint a picture of a company following an iPhone as Hub product strategy in which iPhone is the sun and every other product revolves around iPhone. Apple generated $140B of revenue and approximately $60B of gross profit from iPhone over the past year. These totals amounted to 60% and 70% of Apple's overall revenue and gross profit, respectively. As seen in Exhibit 1, over the past year, Apple sold 2.5x more iPhones than iPads, Macs, Apple Watches, Apple TVs, and AirPods combined.

Exhibit 1: Apple Product Unit Sales

Upon closer examination, Apple is not following an iPhone as Hub strategy. In fact, the company has never followed such a product strategy. Apple is instead following a strategy based on selling a range of tools containing varying levels of personal technology. Management is placing big bets on four product categories: Mac, iPad, iPhone, and Apple Watch.

Apple leaves it up to the consumer to determine the amount of personal technology that fits best in his or her life. For hundreds of millions of people, iPhone is the device that has just the right mix of power and functionality in a convenient form factor. This plays a major role in explaining the iPhone's oversized impact on Apple's financials. When looking at the number of new users entering each product category, it becomes clear that iPhone is Apple's best tool for gaining new customers. (The math behind Exhibit 2 is available for Above Avalon members here, here, and here.)

Exhibit 2: Growth in Installed Base

In addition to the four primary product categories, Apple also sells a line of accessories. HomePod, AirPods, Beats, and Apple TV are positioned to add value to Apple's primary computing platforms. The bulk of these accessories are designed to control sound. AirPods and Beats handle sound on the go while HomePod is tasked with controlling sound in the home. Apple TV is unique because it is given the job of controlling both sound and video on the largest piece of glass in the home. This uniqueness is also evident with Apple launching the tvOS platform for third-party developers.

The Grand Unified Theory of Apple Products

While Apple's four primary product categories share a few obvious attributes such as possessing screens, there is a more important connection. Each is designed to be an alternative to the next most powerful device as detailed in The Grand Unified Theory of Apple Products (shown below).

Apple's quest to make technology more personal involves using design to remove barriers preventing people from getting the most out of technology. Instead of positioning new products as replacements for older ones, Apple is focused on coming up with alternatives. One way to accomplish this goal is to take complicated tasks and break them down into more granular tasks, which can then be handled by smaller and simpler devices.

- iPad is given the job of being powerful and capable enough to serve as a Mac alternative.

- iPhone is given the job of handling tasks that may have otherwise gone to iPad.

- Apple Watch is tasked with doing enough things on the wrist that it can serve as an iPhone alternative.

Multitouch computing represented a giant leap in Apple's quest to make technology more personal. Based on unit sales, it's fair to say hundreds of millions of people think iPhone and iPad are adequate Mac alternatives. In a similar vein, Apple Watch isn't designed to replace iPhone. Instead, Apple Watch is given the job at handling some of the tasks given to iPhone. The ability to put digital voice assistants on the wrist represents Apple's latest personal technology breakthrough.

Evolving Product Priorities

While Apple designers and engineers have shown the willingness to push Apple's four primary product categories forward, change is in the air. Apple Watch and the broader wearables category represent Apple's best chance to make technology more personal. One of the highlights from Apple's inaugural event last month at Steve Jobs Theater was a cellular Apple Watch. In fact, the Apple Watch portion of the event was the strongest part of Apple's presentation. After spending the past two years refining its Apple Watch messaging, Apple now has a more appealing and convincing Watch sales pitch for consumers.

It's becoming clear that Apple's product priorities are shifting.

- Release an Apple Watch that is fully independent of iPhone.

- Position Apple Watch to handle more tasks currently given to iPhone.

- Release accessories that complement Apple's expanding wearables strategy.

- Position iPhone as an AR navigation device.

- Position iPad as a genuine Mac alternative.

- Position Mac as a VR/AR content creation machine.

Combining the six preceding priorities into one cohesive product strategy leads to the following diagram.

Resources and attention are flowing to the devices at the right end of the spectrum, the products most capable of making technology more personal. A cellular Apple Watch Series 3 is the latest step in Apple's journey to an Apple Watch that is completely independent from iPhone. Such a product will represent a watershed moment for Apple Watch as it would more than triple the product's addressable market. When it comes to Apple Watch serving as a genuine iPhone alternative, the addition of a selfie camera one day and an increased role played by Siri intelligence will go a long way in allowing Apple Watch to handle additional tasks formerly given to iPhone.

Grand Vision

There is a grand vision behind Apple's product strategy of selling a range of personal devices. Apple believes design is the ingredient that allows people to get the most out of technology. Even though Apple's industrial designers oversee this vision, the entire company ranging from engineers and product designers, to Apple retail specalists believe in focusing on the user experience. Apple views core technologies not as products in of themselves, but as ingredients for something else. Instead of copying other companies and chasing after technology's raw capability, Apple is more interested in technology's functionality as it relates to the user experience.

It is easy to look at Apple's current product line of personal devices and wonder where the company will turn next. Additional wearable devices like AR glasses are inevitable and fit within a product line of personal gadgets. On the other hand, Apple's growing interest in transportation has been a head scratcher for many observers as a car doesn't seem to fit within Apple's product strategy. This has led some to wonder if Apple is getting away from its mission or vision in an attempt to chase revenue or users.

Instead of assuming a self-driving car would be tacked onto the end of Apple's product line next to Apple Watch, the much more likely scenario is that transportation would represent a brand new product paradigm for Apple. The same idea applies to Apple's growing interest in architecture and construction.

As shown below, Apple would have multiple product paradigms, each comprised of a range of products. This is the primary reason why Project Titan shouldn't be thought of as just a self-driving car initiative, but rather Apple building a foundation for its transportation ambition.

In essence, Apple's transportation strategy would begin with a self-driving car but then eventually lead to the company developing more personal modes of transportation based on new user interfaces, fewer wheels, and different seating arrangements. This process would be equivalent to Apple starting with Mac and then using new user interfaces, technology, design, and manufacturing techniques to create products capable of making technology more personal. Apple would take a self-driving car and strip away capabilities in order to improve functionality. The same goal can occur with architecture and the broader concept of smart homes. It's difficult to see homes becoming truly smart until Silicon Valley begins building housing. The major takeaway is that Apple's quest to make technology more personal doesn't just apply to personal devices. Instead, there is a role for design to play in entirely new industries such as transportation and construction.

Issues

Apple has run into its fair share of issues and roadblocks following its grand vision. As resources and attention flow to devices most capable of making technology more personal, Apple has made some questionable design decisions. The Mac Pro and Apple's overall approach to pro Mac users has not fared well in recent years. This serves as the basis for my "The Mac is Turning into Apple's Achilles' Heel" article earlier this year. Management was forced to back track in order to stem growing backlash within the pro Mac community. Even today, the amount of criticism pointed at the Mac, some of which is genuine, is trending at multi-year highs.

The Mac debacle also ends up revealing some of the downsides associated with Apple's functional organizational structure. The company practices a focus mantra when it comes to product development, which may result in certain products getting left behind or not getting as much attention as they may need. This may make the jump into new product paradigms like transportation that much harder for Apple.

While Apple's product line is still incredibly focused for a $825B company, there is no denying that additional models and SKUs have led to an expanding product line over the years. Apple's entire product line is shown below. Apple relies on a consumer segmentation strategy to target as broad of a market as possible for each of its four primary product categories. Apple has learned a lesson or two from the dark days in the 1990s. A byproduct of this strategy has been complexity being added to the product mix in recent years.

Inevitable Path

Apple puts much effort, care, and deliberation into marketing. This makes one of the animated videos found on Apple's website so intriguing. As shown in the screenshots below, the animated video is meant to highlight HomePod's spatial awareness capability. The only two Apple products shown in the room are HomePod on a table and the two individuals wearing Apple Watches. There is no iPhone, iPad, or Mac in sight. For some companies, this can be brushed off as a simple oversight, but not for Apple. It's intentional.

Apple looks at Apple Watch as the natural evolution of personal computing. Having Siri intelligence on the wrist throughout the day, in addition to receiving and consuming information via a screen, is powerful. Meanwhile, HomePod is positioned as an Apple Watch accessory capable of delivering sound in a way that just isn't feasible for a device worn on the wrist. While some companies are advocating new product strategies such as voice-first or AI-first, Apple is taking a different path with a product strategy evolving into one based on wearables. Voice and AI are then positioned as core technologies powering these wearable devices. To a certain degree, this is the inevitable path Apple has been on for the past 40 years. Going forward, the largest opportunity for Apple will be found in using its product vision to create personal technology paths in new industries.

Receive my analysis and perspective on Apple throughout the week via exclusive daily emails (2-3 stories a day, 10-12 stories a week). To sign up, visit the membership page.

iPhone Courage

iPhone pricing has garnered more attention in recent months than any other Apple topic. However, pricing is not the most important variable impacting the iPhone business. With iPhone X, Apple is taking what previously worked with iPhone and throwing it away in an effort to create a better user experience. For Apple to take this much risk with the product responsible for the vast majority of its cash generation and new user growth is noteworthy.

iPhone X

During its inaugural event at Steve Jobs Theater last month, Apple unveiled three flagship iPhones. Management dedicated 20 minutes of stage time to iPhone 8 and 8 Plus, models clearly positioned within the existing iPhone paradigm. Attention then turned to iPhone X, which garnered nearly twice as much stage time. While the "X" stands for ten, it could have very well stood for extreme. iPhone X will be the most radical iPhone Apple has sold to date. The home button has been removed to fit a larger screen in a smaller form factor. This change, which was years in the making, ushers in a completely new iPhone experience. Users will have to retrain their finger reflex to not press the bottom of the screen and instead, get used to swipes. In addition, the removal of fingerprint recognition in favor of facial recognition represents a very big change in how we will use iPhone. A strong argument can be made that removing the home button is the single-biggest change Apple has made to iPhone. The sheer amount of risk found in the move is being grossly underestimated.

iPhone Strategy

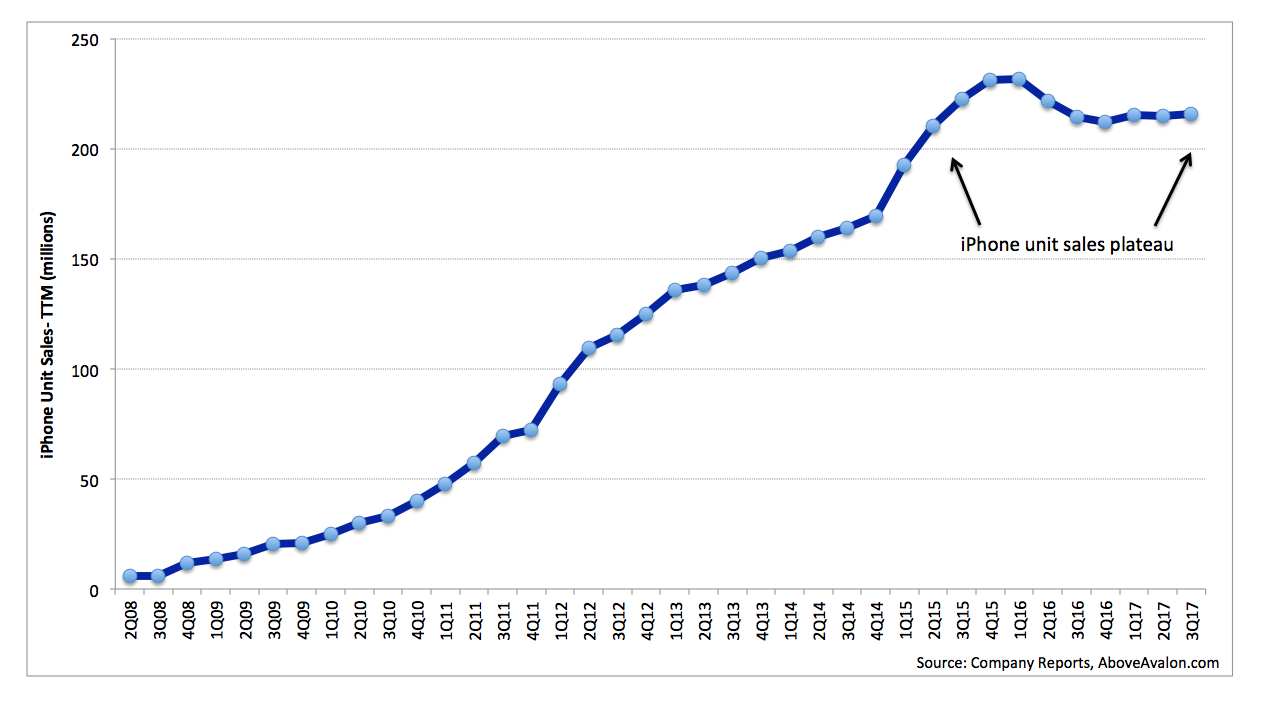

Apple is launching iPhone X at a critical juncture for the iPhone business. A slowing upgrade rate among existing iPhone users has led to overall unit sales plateauing, as highlighted in Exhibit 1.

Exhibit 1: iPhone Unit Sales (Trailing Twelve Months)

Despite weakening sales growth trends, Apple is still selling more than 200M iPhones per year, bringing in $140B of revenue and $60B of gross profit. In addition, the iPhone installed base grew by approximately 110 million users in 2017. iPhone remains Apple's most effective tool for grabbing new users.

Apple's iPhone strategy can be broken into three parts:

- Pricing

- Product marketing

- Design

While much of the attention has been focused on Apple's move at the high-end of the iPhone pricing spectrum, the company is making just as interesting of a change at the low-end. Apple is following a consumer segmentation strategy. Management is cutting iPhone pricing at the low-end to improve accessibility. The $399 iPhone price floor that had been in existence for years was shattered last month. A $350 iPhone SE is the lowest-priced "new" iPhone Apple has sold to date. Management's decision to continue selling iPhone 6s and 6s Plus, and even iPhone 6 in select markets, positions additional SKUs for customers focused on value and price. Meanwhile, at the other end of the pricing spectrum, Apple is running with higher-priced models targeting consumers who value the latest and greatest technology.

Underlying this pricing dynamic is a product marketing strategy focused on positioning the iPhone as the best camera people have ever owned. The dual-camera system found in iPhone 7 Plus is one of the more noteworthy iPhone features in years. With iPhone 8 Plus and iPhone X, Apple introduced Portrait Lighting, which adds a new element to Portrait mode. Apple then went further to include Portrait mode and Portrait Lighting on the iPhone X front-facing camera.

Apple saw how cameras are becoming much more than memory capture tools. Cameras are turning into smart eyes powering the dawn of the augmented reality era. Apple spent years dedicating resources to the effort and is now at the point where iPhone cameras are being powered by Apple silicon. This provides Apple's cameras additional differentiation and the ability to stand out from peers.

Apple has seen quite a bit of success with its iPhone pricing and product marketing strategy over the years. However, these two variables are not the most important items impacting iPhone's evolution. Design, or the way consumers use the product, has a much larger impact on iPhone's future, and Apple is making big changes to how we will use iPhone going forward.

The Headphone Jack

iPhone X demonstrates how Apple is willing to move beyond legacy design constraints and thinking. The home button has come to represent safety for hundreds of millions of people. In just a few years, Touch ID and fingerprint recognition became universally accepted because of their connection with the convenient iPhone home button. Apple is taking this familiar design and throwing it out the window in an attempt to push the iPhone experience forward. Although Apple is confident consumers will embrace the changes, the confidence sure isn't a result of consumers demanding or wishing for these changes. Instead, Apple designers and engineers are throwing away legacy thinking in order come up with something new. Upon closer examination, Apple has previously demonstrated this willingness to let go of legacy design.

In September 2016, Apple unveiled iPhone 7 and 7 Plus. The two flagship models contained the typical assortment of new features and upgrades. However, one change stood out from the others. Apple removed the dedicated headphone jack despite no one having asked for such a move. Instead of including the traditional pair of EarPods in the box, Apple unveiled a new pair of EarPods that used the Lightning connector. In addition, Apple included a small adapter so that older headphones would connect with Lightning.

When explaining Apple's decision, Phil Schiller, Apple SVP worldwide marketing, said "it really comes down to one word: courage. The courage to move on, do something new that betters all of us."

To say that removing the headphone jack was a controversial decision would be an understatement. The mere thought of removing the dedicated headphone jack from smartphones drove the tech community up a wall with some declaring the move as "user hostile" and "stupid." Schiller's explanation for the removal did not sit well with many. Some referred to it as tone-deaf, and others used arrogance and greed to describe the situation. There were then some who thought Schiller should have said "courage of convictions" in order to better encapsulate his meaning.

In reality, Schiller was right in calling Apple's decision to remove the dedicated headphone jack courage. As it turns out, Apple displayed additional courage last month by removing the home button from iPhone X.

Courageous

The reason these iPhone design choices can be called courageous is that Apple is not afraid to risk sales in order to make technology more personal. It is not easy to take a product that is bringing in more than $140B of revenue per year and change the way people fundamentally use the device. While this situation may seem too self-centered to deserve being called courageous, iPhone is used by 800 million people. (The math behind my iPhone user base estimate is available for Above Avalon members here.) A design decision capable of improving or advancing the iPhone experience will have a tangible impact on many lives. It's not an exaggeration to say that society as a whole can benefit from these iPhone design choices. We are empowered by having a mobile computer in our pockets, and additional power will flow to users as smartphones evolve into augmented reality devices.

The headphone jack is one of a handful of examples of Apple displaying courage by taking what seemed to be working fine and throwing it away to improve the iPhone user experience.

- 30-pin dock connector removal

- Headphone jack removal

- Home button removal

These design choices share a few common traits:

- Deliberate. Apple doesn't make changes for the sake of making changes. Instead, the company is deliberate with its choices. A headphone jack is not removed in order to merely have iPhone 7 stand out from iPhone 6s. Instead, the move is an early step in Apple's long-term mission to remove wires from our lives. Schiller's inability to discuss the long-term goal found in removing the dedicated headphone jack is one reason his courageous comments came off as tone-deaf. A number of years and iPhone versions often have to pass before the motivation behind some of Apple's design decisions becomes clear.

- Decisive. Apple doesn't sit on the fence when it comes to design. One should not bet on a dedicated headphone jack returning to iPhone. In what is still a raw and polarizing topic for some, dedicated home buttons with fingerprint readers are on their way out over the coming years. Dedicated home buttons don't have a future at Apple.

- Design. All of these significant iPhone changes are made with design in mind. By removing the dedicated headphone jack and home button, Apple is changing the way we interact with iPhone. While some of these changes occur through a new user interface, other changes involve how we use iPhone in relation to other products. While the user experience change is less clear with some changes, such as Apple swapping the 30-pin dock connector with Lightning, other examples, like the home button removal, are much more apparent.

It's All About Design

Avoiding change out of fear of angering users or customers can cripple an otherwise successful product and company. Fear of throwing away design artifacts and legacy tendencies represents one of the biggest risks facing iPhone today. This is why design, and not pricing or product marketing, is the most important variable when thinking about iPhone's future.

Fear of embracing change would make it impossible for Apple to accomplish its long-term goal of making technology more personal. When it comes to iPhone, this goal manifests itself in a design that blends hardware and software. Apple's willingness to take big design bets allows iPhone to evolve over time. As buttons and ports are removed to make room for the latest camera, battery, and screen technology, iPhone morphs from a multi-touch computer into an augmented reality navigator controlled by glances and looks.

This behavior of killing off features, components, ports, and technology in an effort to push the user experience forward is a carryover of Apple's approach with the Mac. The difference this time around is that Apple is making these changes to a product that is used by 8x more users.

Samsung vs. Apple

Apple is not alone in pushing smartphone changes like removing a front-facing home button or dedicated headphone jack. In fact, making changes for the sake of change is relatively easy in the smartphone industry. The difficult part is leveraging these changes to push the user experience forward.

Samsung was able to beat Apple to market with an OLED smartphone lacking a front-facing home button. However, the difference in how Samsung and Apple leveraged these design changes is noteworthy. By removing the home button, both companies had to come up with an alternative to having a fingerprint reader positioned in a convenient location. Samsung chose to place the reader in a much more awkward location on the back of the device. Meanwhile, the company's facial recognition alternative ended up being a bust as it quickly became apparent it just wasn't as good as fingerprint recognition. It is tough to argue that the Samsung Galaxy user experience was improved with such changes. Instead, Samsung serves as an example of making changes for the sake of change.

Meanwhile, Apple is positioning Face ID as the alternative to having Touch ID and the home button. If done correctly, Apple will be the company to bring facial recognition as a form of biometric authentication to the masses. Based on the company's success with Touch ID, Apple deserves the benefit of the doubt that Face ID can follow suit and see massive customer acceptance. In fact, Apple's removal of the home button and embrace of Face ID will likely kick off a new era at the company involving facial recognition. It is only a matter of time before every Apple product with a camera has the TrueDepth camera system. Such a development may seem trivial, but it will lead to a new era of health monitoring to which we haven't even contemplated the implications yet.

TrueDepth camera system in iPhone X.

The other implication found with Apple taking design risks is that unlike every other smartphone manufacturer, Apple sells very few smartphone models. The company does not have the benefit of taking risks with a much less popular model and only then bringing new features to the mass market once market adoption has been proven. Instead, Apple spends years and multiple iPhone versions systemically preparing for a major design change included in a flagship model.

Putting Fear Aside

The amount of risk Apple is taking with iPhone X should not be underestimated. There is a reason why management is positioning iPhone X as a glimpse of the next 10 years of iPhone. The model is dramatically different to iPhone 8 and 8 Plus. While Apple is confident that consumers will embrace these changes, it sure isn't due to consumers demanding or wishing for these changes. Instead, Apple designers, engineers, and marketers are showing a willingness to break down legacy thinking in order to come up with something new. By not letting fear of change and customer rejection dictate iPhone design decisions, Apple is displaying courage. While Apple stands to benefit financially from these design changes, iPhone users also stand to benefit. iPhone is empowering hundreds of millions of people in ways that were never before imagined. Courage is putting fear aside and taking bold risks in order to empower others.

Receive my analysis and perspective on Apple throughout the week via exclusive daily emails (2-3 stories a day, 10-12 stories a week). To sign up, visit the membership page.

The Significance Behind Steve Jobs Theater

On paper, Steve Jobs Theater doesn’t make complete sense. The price tag would lead many to question the rationale in building a massive underground theater for unveiling products. It’s difficult to envision any other company wanting to undertake such a project. However, after I attended Apple’s inaugural event at Steve Jobs Theater, Apple’s motivation behind the building became crystal clear. Steve Jobs Theater is an Apple product, and a closer look at the building uncovers a side to Apple that few have seen before.

Initial Visit

Steve Jobs Theater is located in Cupertino and positioned in the southeast corner of Apple's new $5 billion Apple Park headquarters. The 167,000-square-foot building consists of a 921-seat underground theater and accompanying product demo room. Apple plans on utilizing Steve Jobs Theater for product unveilings and the periodic corporate event. Apple hired Norman Foster and his firm Foster + Partners as the project's architect although Apple Chief Design Officer Jony Ive and other Apple designers played a pivotal role.

Steve Jobs Theater. Photo credit: Apple

Most visitors arriving at Steve Jobs Theater for the first time will be impressed by its seclusion and allure. Unlike the 2.8-million-square-foot ring building, Steve Jobs Theater cannot be seen from nearby streets surrounding Apple Park. Instead, visitors must walk along a path that winds its way through a series of carefully landscaped hills. It soon becomes clear that this short walk is actually part of the broader experience Apple was trying to achieve.

The path empties out into a basin containing Steve Jobs Theater’s lobby. The 22-foot curved panes of glass create a strong first impression. To the right is an unobstructed view of the giant, circular ring building. The entire experience is reminiscent of Disney World as it becomes clear that someone has created this specific experience to be consumed at this particular location. The lobby, the only part of Steve Jobs Theater that is above ground, is massive, intriguing, and even magical. It doesn’t take long to notice the lack of walls or support structure. This leads to the inevitable question of how the 155-foot roof is being held up. (Spoiler: the glass supports the carbon fiber roof.) Additional questions are raised regarding how plumbing for the water sprinklers and electricity for the lights and speakers are piped to the roof. As it turns out, a little magic is indeed at work. As reported by Lance Ulanoff over at Mashable, all of the necessary plumbing and wiring is found in 20 of the narrow gaps between the large panes of glass.

Steve Jobs Theater floor plans.

The other item that stood out about Steve Jobs Theater was the two sets of stairs on either side of the lobby that are used by visitors to walk down to the theater. The intriguing use of Castagna stone and handrails hand-carved into the stone walls reminded me of a mix between an Egyptian structure and something from space. Photos and videos don't do them justice.

(My complete review of Apple's inaugural event at Steve Jobs Theater is available for Above Avalon members here.)

Not Perfect

Steve Jobs Theater is far from perfect. A strong argument can be made that Apple outgrew the theater before it even opened. Apple's prior two iPhone launches took place in a venue that fit 50% more people, which allowed Apple to invite many more Apple employees than they did to the inaugural event at Steve Jobs Theater.

Despite the building's large footprint, the exhibit space felt incredibly cramped. While Apple may like the visual of hundreds of people bumping into each other to get their hands on the latest products, it's not exactly the best experience to go through. My suspicion is that the exhibit space needs a few modifications to reflect the new era of reporters wanting to live stream.

The Steve Jobs Theater exhibit space was still packed after an hour of hands-on time.

In addition, there were a number of odd design decisions found at Steve Jobs Theater. These range from the awkward paper towel dispensers in the restroom to uneven temperature control in the lobby and doors that are unusually difficult to open. There was also a decent probability of getting a little wet from water dripping off the carbon fiber roof in the morning. However, the building's accomplishments end up vastly outweighing these minor oddities.

Observations

Much of the discussion regarding Steve Jobs Theater up to now has been superficial. Most people agree that the building is impressive and fits within Apple's broader design focus. However, upon closer examination, Steve Jobs Theater provides a fascinating look at today's Apple. A number of items stood out to me.

An Apple Product. Apple is no longer a company that just ships consumer hardware powered by differentiated software. The unveiling of Steve Jobs Theater is the latest sign of this reality. The theater is an Apple product, in the same vein as Apple's redesigned Retail stores. Apple approached Steve Jobs Theater and the broader Apple Park headquarters in the same way that it would any other product. Significant time and resources were spent on modeling and prototyping before construction. An identical process occurs for Apple products that eventually end up on our desks, in our pockets, and on our wrists.

One of the most significant takeaways from Steve Jobs Theater is that Apple is no longer a company content in just focusing on making well-designed electronics. Apple is moving into bigger and bolder initiatives. Jony Ive has hinted in various interviews about his never-ending drive to make technology more personal and create tools for people. While this goal will inevitably lead Apple further into wearables, including glasses, there is a very high likelihood that Apple will focus on bigger tools like self-driving cars. These bigger tools will require Apple to move much further into construction and architecture. Apple reportedly owns and leases a collection of heavy manufacturing facilities close to Apple Park that includes some of the last remaining open space in the San Jose vicinity. (A listing and map of these Apple buildings are available for Above Avalon members here). The day when Apple designers build their very own state-of-the-art transportation R&D center minutes away from Apple Park is no longer a fantasy. All of this puts the PR photos with Tim Cook and Jony wearing Apple hardhats into a new light.

Tim Cook and Jony Ive at Apple Park. Photo credit: The Telegraph

We have arrived at a weird point in time. Silicon Valley giants are gaining unfathomable amounts of power yet remaining remarkable aloof when it comes to manufacturing and construction. Apple is the notable exception. Apple is the company most eager to step outside its comfort zone and experiment in construction and architecture realms. Apple sees the gap between architecture and design starting to shrink. According to Jony, architecture is "a sort of product design; you can talk about it in terms of scale and function and materials, material types. I think the delineation is a much, much softer set of boundaries that mark our expertise."

Experience. There's a reason why Steve Jobs Theater and the overall Apple Park campus is reminiscent of Disney World. Both locations provide an unmatched experience to the visitor. When walking around the grounds surrounding Steve Jobs Theater, it truly felt as if the building is meant to represent Earth while the large circular ring building off in the distance is the Sun.

Steve Jobs Theater symbolizes how Apple is doubling down on extending the Apple experience beyond just iPhones in our pockets and Apple Watches on our wrists. As Apple's Retail store strategy shows, the idea of using architecture and physical spaces to explain the Apple story isn't new. However, Apple has taken the idea further to include its headquarters and even the theater at which it plans to unveil many of its future products.

Focus. It's easy to look at Steve Jobs Theater and forget the amount of work and resources that went into the building. Jony and Apple's Industrial Design team reportedly worked alongside Foster + Partners on nearly every aspect of the theater and the entire Apple Park campus. Apple management likes to use every opportunity to reiterate its goal of remaining focused and saying no to a lot of great ideas. The company's product line demonstrates such focus. Accordingly, there is logic in considering how much attention went into Apple Park over the past few years and where that attention is now being placed. This brings us to the most crucial takeaway regarding Steve Jobs Theater: Jony Ive.

Jony Ive

In May 2015, Jony was promoted to Chief Design Officer. The transition kicked off a debate regarding the underlying motivation behind the move. Many argued that the promotion marked the beginning of the end for Jony's time at Apple. Some observers argued Apple is setting the stage for Jony's eventual retirement by shifting day-to-day responsibilities to Richard Howarth and Alan Dye. The degree to which Jony then took a less visible presence in subsequent months (which was clearly telegraphed by Apple in announcing his promotion) added oxygen to the fire.

Others said Jony's Chief Design Officer title is mostly ceremonial with little-to-no responsibility and compared it to Steve Jobs giving the Chief Software Technology Officer title to Avie Tevanian in 2003. Tevanian ended up leaving Apple a few years later. In reality, such a comparison is so off base it could classify as intellectual dishonestly.

I've held a completely different view of Jony's promotion. The day after Jony's promotion was announced (via a Stephen Fry article), I wrote:

"With Howarth and Dye serving as Jony's two lieutenants in terms of managing day-to-day aspects of Apple design, what would such a dynamic look like and where would Jony fit into the picture? I consider Jony's new role to be much more about leadership while Howarth and Dye handle the more corporate side of things - the actual management of teams. The amount of additional time and attention that Jony can spend on entirely new projects, while leaning on his two right hands to make sure that schedules are being met and projects are receiving all of the resources they need, goes a long way in describing Apple's strategy over the next few years.

I see an environment in which Jony's potential can be unleashed even more now than the world has already seen. Similar to how Steve Jobs was known to head down to Jony's design lab to hang out, I suspect in some ways, Jony wants to do the same - check out of the day-to-day executive grind and lose himself in research and design elements on whatever topic or subject he choses. By being positioned in more of a leadership role than a managerial role, Jony could maybe be more like Jony."

Two years later, and with Steve Jobs Theater officially open, it is clear Jony holds the role closest to the one held by Steve Jobs. The promotion to Chief Design Officer represented sustainability for Jony. It has been reported that Apple Watch development, in addition to overtaking leadership of human interface, took its toll on Jony. The entire Apple Park project represents much of Jony's focus in recent years. Jony reportedly was the one who carried Apple Park on his shoulders. Its completion now gives Jony the freedom to focus on new initiatives and projects at Apple.

A Design Company

"[O]ne of the ways that I believe people express their appreciation to the rest of humanity is to make something wonderful and put it out there." - Steve Jobs