The Apple Services Machine

Apple's services business is remarkably strong yet surprisingly mysterious. A closer look at Apple Services reveals an apparatus, which can easily qualify as a Fortune 100 company, that isn't what it seems from the outside. Apple isn't becoming a services company focused on coming up with a myriad of ways to milk existing users. Instead, Apple's services strategy primarily reflects the company's long-held ambition of becoming a leading content distribution platform.

Momentum

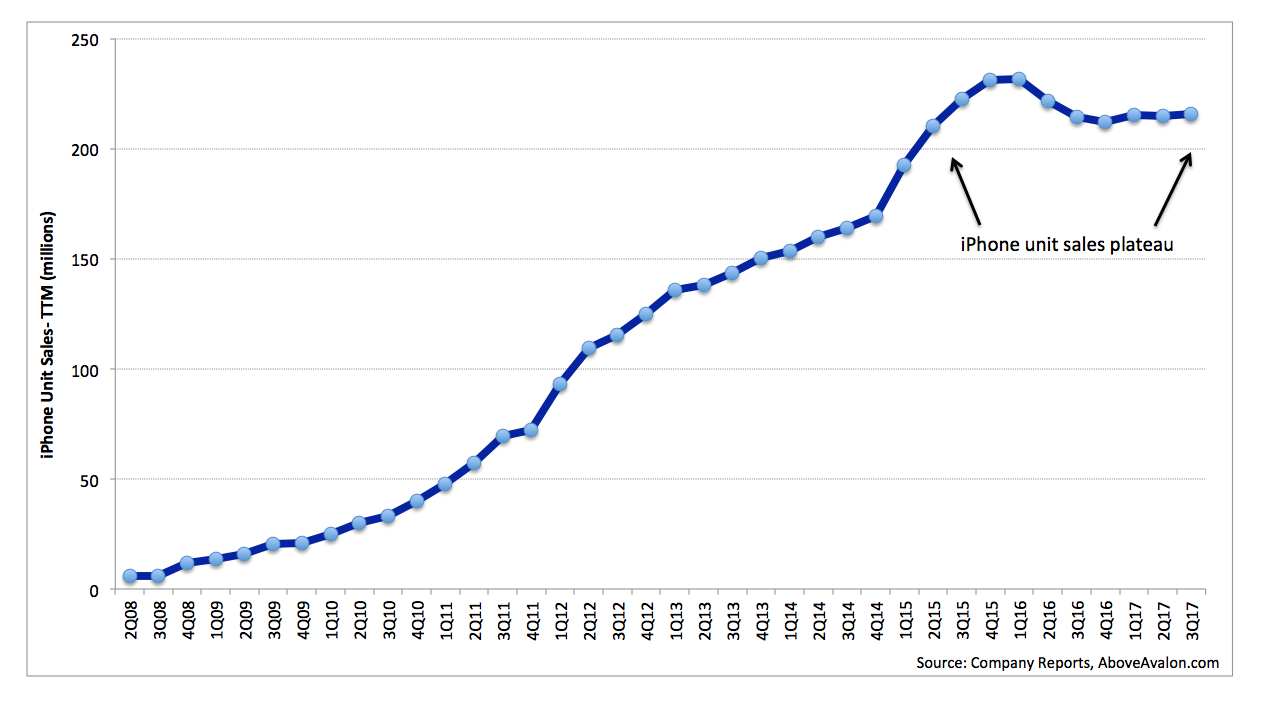

Services represent Apple's second-largest revenue source behind iPhone. In 2017, Apple reported $31 billion of Services revenue, which represented 13% of overall revenue. As seen in Exhibit 1, Apple Services revenue has experienced steady growth for years.

Exhibit 1: Apple Services Revenue (TTM)

In recent quarters, Apple's services business has seen renewed momentum. As shown in Exhibit 2, Services revenue growth began accelerating in late 2015 and is now at multi-year highs. The growth likely coincided with very strong new user trends for the iPhone business. An acceleration in growth despite Apple's already large Services revenue base is that much more impressive.

Exhibit 2: Apple Services Revenue (TTM) Growth

The Services Machine

Services is a financial catch basin for Apple's non-hardware revenue. As disclosed in Apple's financial filings, Services consists of five categories: digital content, iCloud, AppleCare, Apple Pay, and licensing.

Exhibit 3: The Apple Services Machine

Digital content. This includes revenue from Apple's various content stores, including the App Store and iTunes. Apple Music is also included in this category. While Apple doesn't disclose the total amount of revenue associated with selling digital content, the company has provided the amount paid to app developers on an annual basis. This data point makes it possible to derive the total amount of App Store revenue. In addition, Apple regularly discloses the number of paid Apple Music subscribers, which can be used to derive Apple Music revenue.

iCloud. Apple offers three tiers of additional iCloud storage (50GB, 200GB, and 2TB). Prices vary depending on the geography. The 200GB and 2TB storage tiers are eligible for family sharing. While Apple has not disclosed the number of users on a paid iCloud storage plan, management recently disclosed that iCloud revenue was up over 50% year-over-year to a record high, which implies good new user growth.

AppleCare. Apple sells a number of service and support options for its products.

Apple Pay. Apple earns a small percentage of every amount transacted through Apple Pay. Initial reports pegged this percentage at 0.15% for U.S. transactions. For every $100 of Apple Pay purchases in the U.S., Apple earns 15 cents. However, in the UK, Apple reportedly receives a smaller fee. Given Apple Pay's prominence outside the U.S., a safe assumption is that Apple earns on average less than 0.15% of every Apple Pay transaction.

Licensing and other services. Apple earns revenue from third parties for offering their services as default options on Apple devices. One of the more well-known examples is Apple's contract to have Google be the default search provider for Safari on Mac and iOS. Apple recently expanded its Google relationship to include Google for web searches via Siri and YouTube for video searches. Microsoft Bing remains the option for Siri image searches.

Estimating Services Revenue

Apple doesn't disclose the amount of revenue generated by each Services category. However, after sifting through years of earnings call transcripts as well as recent news releases involving the App Store and Apple Music, it is possible to put together a few pieces of the Apple Services puzzle.

According to my estimates, Apple earns a majority of its Services revenue from delivering content to nearly a billion people using more than 1.3 billion Apple devices. In 2017, Apple earned an estimated $21 billion from selling digital content ranging from apps (especially games) to music and movies.

Back in January, Apple disclosed that it paid $26.5 billion to app developers in 2017. Apple keeps either 15% or 30% of app revenue, depending on the app and whether it is a subscription. This suggests that overall App Store revenue was approximately $37 billion. Since Apple reports App Store revenue on a net basis, recognizing only the commission it retains, the full $37 billion of App Store revenue is not reflected under Services. Instead, Apple reports just its $11 billion share of the revenue.

The remaining portion of Apple's digital content revenue came from iTunes and Apple Music. Apple reports Apple Music revenue and some digital content sold through iTunes on a gross basis. This results in iTunes and Apple Music representing a large portion of Services revenue despite bringing in significantly less revenue than the App Store. In fact, iTunes and Apple Music likely contribute close to the same amount of Services revenue as the App Store.

Exhibit 4: Apple Services Revenue Mix (2017)

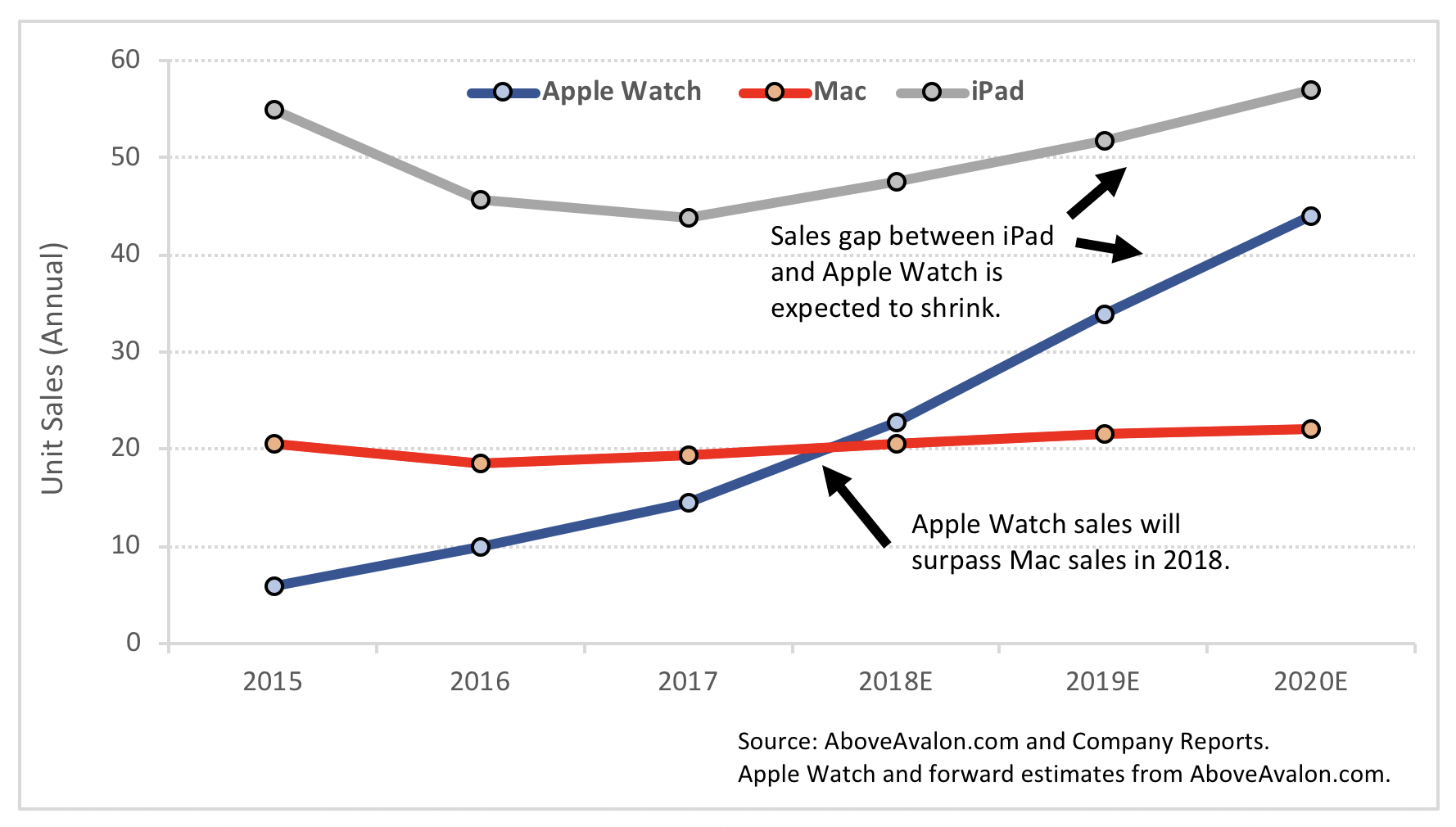

To put the preceding revenue totals in context, Apple Watch generated $6.5B of revenue in 2017.

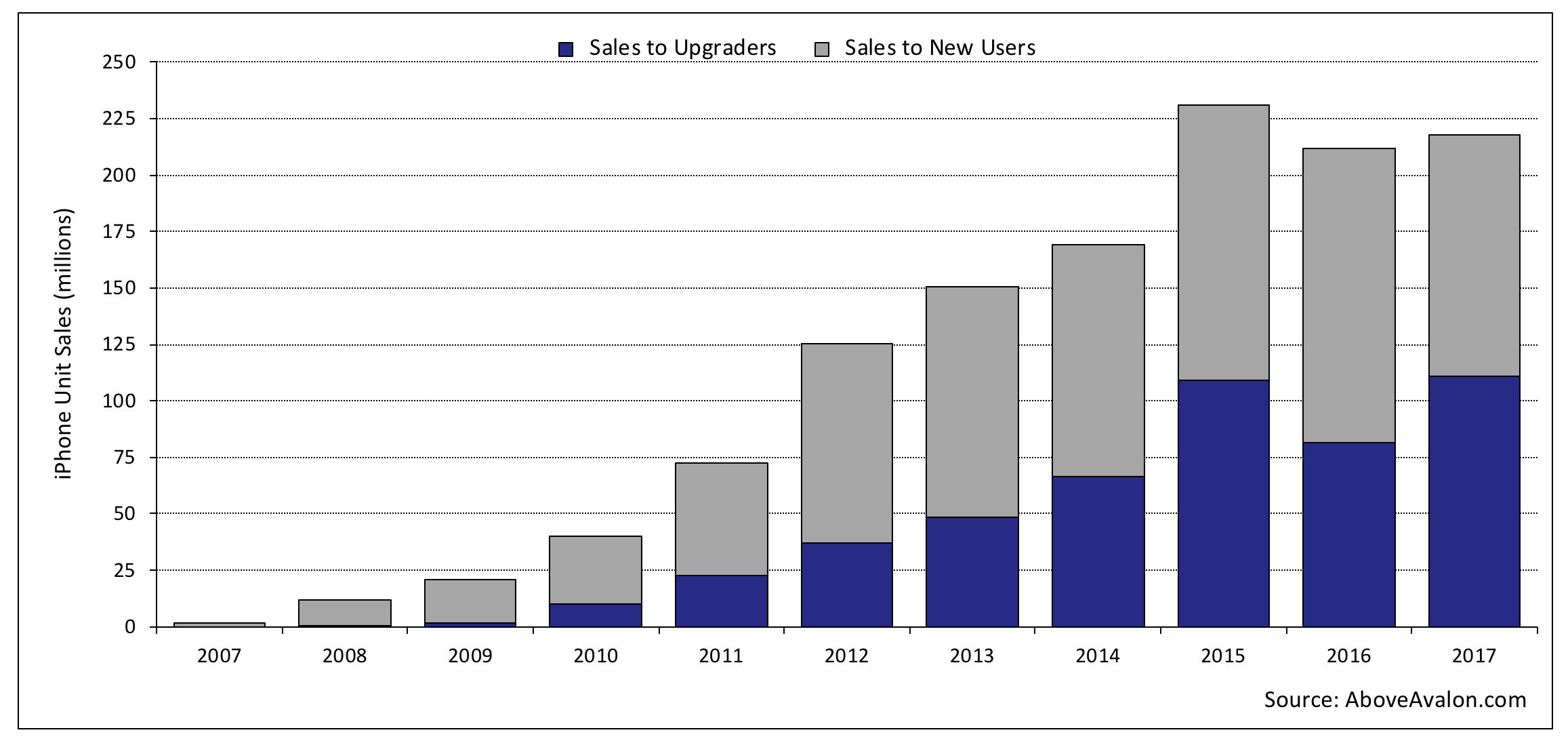

The primary reason Apple has experienced accelerating Services revenue growth since late 2015 is that the company has seen a dramatic increase in the number of people accessing its various content stores. The iPhone installed base grew by more than 100 million people each year from 2013 through 2017. These new users are spending an increasing amount of money buying various forms of content through Apple's stores.

One of the more interesting revelations from my estimated Apple Services revenue mix is the degree to which licensing is a key revenue driver. My estimate has Apple earning $4 billion per year from licensing. While Apple doesn't discuss its licensing business, recent reports of Google paying much higher TAC (traffic acquisition costs) suggests Apple has seen strong growth in its licensing revenue. The growth is a result of iOS gaining power at the premium end of the smartphone market. Companies like Google increasingly need access to iPhone users in order to feed their free data capturing services. According to my estimates, the $4 billion of revenue associated with licensing is roughly the same amount of revenue generated by AppleCare.

While Apple has built new services revenue streams in the form of iCloud and Apple Pay, neither come close to matching the revenue associated with content distribution. Given the economics surrounding Apple Pay, it's not likely the service will be a significant revenue driver for Apple in the near term. For every $1 trillion transacted through Apple Pay, Apple would generate just $1.5 billion. As for iCloud, while management boasts about record revenue, the total likely pales in comparison to content distribution.

Estimating Services Gross Margin

In addition to not breaking out Services revenue by category, Apple management has kept Services margins under wraps. We know from management commentary that Services end up boosting Apple's overall gross margins. This is a major clue suggesting Services gross margin exceeds 40%. One way of reaching a more specific Services margin estimate is to look at each revenue driver.

Exhibit 5: Apple Services Gross Margin Mix (2017)

As shown in Exhibit 5, each Services category has a different gross margin. Licensing is likely the most profitable for Apple, followed by Apple Pay and iCloud. Extended warranties, such as AppleCare, are also highly profitable. The fact that Apple reports some iTunes revenue and Apple Music revenue on a gross basis weighs on digital content gross margins. Overall, my estimate is that Apple's services business has a 55% gross margin.

The Services Strategy

Apple's services strategy is misunderstood. Many have looked at Apple's services momentum and concluded that Apple is turning into a services company. In addition, a growing number of people are positioning services as Apple's future. Neither viewpoint is true.

Apple has been pursuing two goals with services:

Deliver Content. Apple has a long-standing ambition of leveraging its platforms in order to become a leading content distributor for apps, music, books, podcasts, and video. To claim that Apple has only recently begun to focus on earning revenue from delivering content is incorrect.

Increase Hardware Value and Functionality. Management looks at services as a key differentiator that increases the value found in using Apple hardware and software. Services like AppleCare, iCloud storage, and Apple Pay are designed to improve the experience found in using Apple hardware and software.

A recurring theme found with Apple Services is hardware dependency. Apple's ambition to be a content distributor is intertwined with its hardware capabilities. Without more than 1.3 billion devices in the wild, Apple's digital content revenue would be a fraction of its current size.

In addition, AppleCare, Apple Pay, iCloud, and licensing are also heavily dependent on the number of Apple devices in the wild. It is this hardware dependency that makes it impossible to look at Apple Services as a stand-alone business. The relationship between services and hardware is one reason why an Apple Services narrative on Wall Street hasn't been able to stick. The Services narrative isn't compelling if it excludes Apple hardware from the equation.

Apple's future isn't about selling services. Rather, it's about developing tools for people. These tools will consist of a combination of hardware, software, and services.

Looking Ahead

Apple management recently reiterated its goal of reaching approximately $50 billion of Services revenue by 2020. The most likely way Apple will reach this goal is by growing the amount of revenue associated with digital content distribution. App Store revenue has been growing by approximately 30% per year. Assuming Apple Music revenue growth more than offsets a decline in paid music downloads, Apple stands to grow its digital content revenue by at least $15 billion over the next two years. This will push Apple very close to its $50 billion Services revenue goal by 2020. These calculations don't take into consideration any new content subscription offerings from Apple.

Apple currently has more than 270 million paid subscriptions across its services, up over 100 million year-over-year. My suspicion is that a good portion of those subscriptions are content subscriptions. Apple is currently developing two new paid services for delivering content: Apple Video and a paid tier to Apple News. Each service will likely be given a long-term target of having at least 100 million paying users. In addition, Apple is in a good position to benefit from growing momentum for video streaming services including Netflix, HBO, and Hulu. It is not a stretch to claim that Apple will one day have 500 million paid subscriptions across its services.

Apple isn't becoming a services company. Instead, Apple is building a leading paid content distribution platform.

Receive my analysis and perspective on Apple throughout the week via exclusive daily updates (2-3 stories per day, 10-12 stories per week). Available to Above Avalon members. To sign up and for more information on membership, visit the membership page.